Lean FIRE is a variant of the FIRE movement that offers a quick path to retirement through saving enough for long-term sustenance. Unlike full FIRE, Lean FIRE requires a much smaller portfolio, making it ideal for low and medium-income earners.

To achieve Lean FIRE, you have to accumulate a portfolio that can support a frugal lifestyle. Generally, this is 25 times your estimated retirement expenses. For most people, a portfolio of $1,000,000 is enough to Lean FIRE.

This article is for you if you’re looking for a step-by-step guide on achieving Lean FIRE. It covers who can pursue Lean FIRE, how to evaluate your financial position before starting Lean FIRE, how to set your Lean FIRE goals, and how to create a plan for achieving them.

For a guide on FAT Fire, check out this article instead: The Ultimate Guide To Achieve FAT FIRE [2022]

Who Can Pursue Lean FIRE?

Lean Fire retirement requires a minimalist lifestyle, requiring you to reduce your current expenses by at least 10 to 20%. While some people can comfortably survive on the bare minimum, some can find it daunting and restraining. If you fall into the following categories of people, you fit in the Lean FIRE class.

Low to Moderate Income Earners

FIRE numbers can easily scare away people with low to moderate income because they have less disposable income. This means it might be challenging to save aggressively to achieve financial independence and retire early. But thanks to Lean FIRE, which requires accumulating a smaller portfolio suitable for all earning levels.

Single People

While living alone, it is easy to cut the clutter and simplify your life. However, when you have a family or kids, it might strain your already lean retirement budget. For instance, if your retirement annual earning is $40,000 and you have a family of 3, each person will have to survive on $1,100 per month, which is extremely frugal.

Step 1: Evaluating Your Financial Position for Lean FIRE

Most experts advise carrying out a financial health check before and after major decisions. It enables you to know where you stand financially and how you can restructure your budget to suit your needs.

A proper financial evaluation checks all facets of your finances, including your income, expenses, and debts, to reveal the dents and cracks that need fixing.

After completing this step, you should have an idea of your complete financial situation. You should know how much you’re earning monthly, where that money is coming from, your monthly expenses, and your assets and liabilities.

When assessing your financial situation, you should do the following:

Prepare Your Financial Report

A financial report summarizes all your income, expenses, assets, and liabilities. In a nutshell, it reveals your financial position and how much you’re worth. There are two types of statements you should prepare:

- Cash Flow Statement

- Balance Sheet

A cash flow statement records your cash inflows and cash outflows. Its purpose is to determine if you have a negative or positive cash flow. To calculate your net cash flow, you’ll deduct your total cash outflow from total inflows.

Cash inflows include your salary, dividends, interest income, and income gains. On the other hand, cash outflows cover expenses such as rent, utility bills, gas, and entertainment. A positive cash flow shows you have spent less than you earned in a period.

A balance sheet gives you your net value. It’s the difference between your assets and liabilities.

Assets are liquid and durable items you own, like a house, a car, saving and checking accounts, and investments.

Liabilities are the debts you owe, like mortgages, credit card balances, and current bills. If you have a negative net value, it may impair your ability to save for Lean FIRE. What you should do is reduce your cash outflow and liabilities.

Evaluate Your Debts

The purpose of evaluating your debts is to know how much of your income goes into debt repayment and to see how much debt you absorb every month. Though having a little debt doesn’t hurt, too much debt consumes your future or retirement income and impairs your ability to achieve financial goals.

Your debt-to-income level should be at or below 36%. To calculate it, add all your recurring debt payments, such as a mortgage, student loan, and credit card, and divide by monthly income. Whatever number you get, multiply it by 100 to get the percentage.

You should implement a debt payment strategy if it’s higher than 36%.

There are two debt repayment strategies:

- Avalanche method. Involves ranking your debts depending on the interest rates and paying the high-interest ones first.

- Snowball method. Involves listing your debts by their dollar amounts and clearing small debts first. Paying small debts acts as a motivation to pay bigger ones.

Mathematically, the avalanche method will get you out of debt the fastest as it will eliminate debts by order of interest rates, thus reducing the amount of interest you pay.

However, eliminating debts altogether can help motivate you to keep paying off your debts. Ultimately, you should pick the debt payoff strategy that works best for you.

Assess Your Emergency Fund

Life is often unpredictable, and you will likely fall sick, lose your job, or break your washing machine at some point. Having savings for unexpected expenses can save you from debts. Experts propose having enough to cover three to six months of your expenses.

If you have no emergency fund, you should start by building a sustainable emergency fund before paying off your debts or investing.

Review Your Income Sources

As many companies grow, most employees experience pay cuts or lose jobs due to redundancy. If you solely depend on a single income source, you may struggle to meet your monthly expenses and save for retirement.

To boost your income and achieve your financial goals faster, you should consider diversifying your income sources. Diversifying gives you financial stability should anything happen to one income source.

Step 2: Set Your Lean FIRE Goals

After evaluating your finances and taking the necessary steps to become stable, the next step is setting your Lean FIRE goals. First, you’ll have to determine your Lean FIRE number because it varies from one person to another.

Here are two different ways to calculate your Lean FIRE number:

- Lean FIRE number = Annual retirement expenses x 25

- Lean FIRE number = Annual retirement expenses / Safe Withdrawal Rate (SWR)

You should consider the factors below when setting your Lean FIRE number.

To get an in-depth guide to calculating your Lean FIRE number, read this article: THIS Is How Much Money You Need To LEAN FIRE: (3-step guide)

The Place You Want To Live

Lean FIRE supports a minimalist or frugal lifestyle. If you live in a place with a high cost of living, it might be wise to consider moving to the suburbs where you can live frugally. Examples of areas with a low cost of living include Mississippi, Oklahoma, Missouri, Tennessee, and Arkansas.

I took the time to calculate the median living expenses (including rent) in 20 different cities in the U.S. for single people and families of four. Use it to pick a location that suits your needs:

| Location | Median Expenses: (Single, Family) |

|---|---|

| New York, NY | $4,193, $7,934 |

| San Francisco, CA | $3,843, $7,471 |

| Oakland, CA | $3,403, $6,853 |

| Washington, DC | $3,113, $6,292 |

| Boston, MA | $3,268, $6,429 |

| Pittsburgh, PA | $2,178, $5,201 |

| Nashville, TN | $2,766, $5,740 |

| San Diego, CA | $3,118, $6,092 |

| Miami, FL | $3,086, $6,058 |

| Chicago, IL | $2,611, $5,506 |

| Philadephia, PA | $2,430, $5,307 |

| Los Angeles, CA | $3,044, $5,917 |

| Dallas, TX | $2,496, $5,286 |

| Atlanta, GA | $2,365, $5,117 |

| Las Vegas, NV | $2,130, $4,797 |

| Orlando, FL | $2,364, $4,979 |

| Austin, TX | $2,668, $5,264 |

| Huston, TX | $2,163, $4,762 |

| Tulsa, OK | $1,709, $4,115 |

| AVERAGE: | $2,834, $5,743 |

If you want to have an adventure, you can also relocate abroad to cheap countries such as Spain, Portugal, or Malaysia. Apart from a low cost of living, the place you choose should be secure, have a low tax rate, and have affordable healthcare services.

Your Retirement Expenses

Your expected monthly retirement expenses determine how much you should accumulate in your Lean FIRE goals. In this case, your costs will drastically reduce as you’ll be spending on the necessities such as food, travel, healthcare, and housing, and less on luxuries like fancy dinners and expensive holidays.

To estimate your retirement expenses roughly, you should track your current monthly spending and remove some costs you don’t wish to incur in retirement. You should also factor in your life expectancy to determine how many retirement years you should be saving for.

For instance, if you wish to retire at 50 and your life expectancy is 85, your savings should be enough to cover 35 years of retirement. You should also adjust your retirement budget for inflation and taxes.

How Much You Can Save Every Month

Setting a realistic and achievable Lean FIRE number that won’t strain your current life is essential. Your goal should correlate to your income. If your income is low, your savings rate shouldn’t be too aggressive.

However, the rules are flexible, and you can adjust your Lean FIRE number and your monthly savings when your income increases.

I’ve written a lot about saving money. Feel free to check some of these articles out:

- Is Saving 20% Of Your Income Enough?

- The 4 Steps To Save A Lot Of Money Fast:

- How to Save $30,000 In One Year

- Can’t Save Money Because of Bills? Here’s What I Did:

When You Want To Retire

The financial implication of retirement is always significant. Sacrificing your paycheck for a smaller retirement income can make you feel insecure. That’s why it’s essential to consider when you wish to retire to adjust your Lean FIRE number accordingly.

The sooner you want to retire, the higher your Lean FIRE number should be because you’ll have many retirement years. Also, your monthly savings will increase in this case.

If You Will Fully Retire

Lean FIRE offers a mild level of financial freedom. So, if you want to supplement your retirement income by partially working in your retirement, your Lean FIRE number should be average. However, if you want to retire fully, you should strive for a higher Lean FIRE number to avoid extreme frugality.

There’s nothing wrong with having a side hustle during your retirement years. Personally, I will probably never stop blogging about finance and other interests I have, which drastically lowers my required savings to Lean FIRE.

Summary of Step 2 – Your Lean FIRE Goals:

By now you should have a pretty good idea of what your retirement years are going to look like. This will help you set a goal. Your goal should be a specific dollar amount. As mentioned at the beginning of this section, estimate your annual retirement expenses and multiply them by 25. You’ll probably land somewhere around $1 million. If you’re closer to two, or even three million, you’re not looking to “Lean FIRE”, and should instead read my guide on achieving “Fat FIRE”.

Step 3: Strategies for Achieving Your Lean FIRE Number

Now that you have a specific Lean FIRE goal, it’s time to develop a strategy for achieving the goal. A solid saving plan removes the guesswork by giving you a roadmap to ensure you don’t miss out on opportunities that can grow your savings.

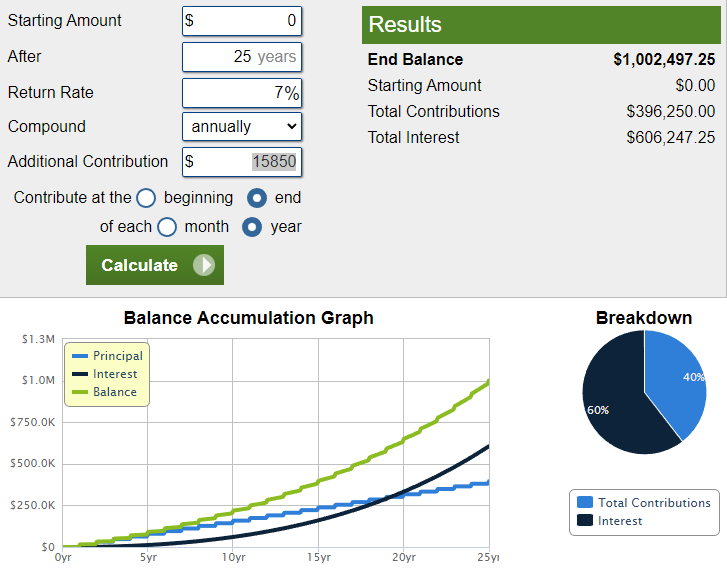

With your Lean FIRE goal, you can break it down to monthly or annual savings/investment targets. You can do this by using a calculator (like this one) and playing with the numbers until you reach your goal. For example, if my target is $1,000,000 and I want to retire in 25 years, the calculator tells me that investing/saving $15,850 annually is adequate:

If you want a detailed break-down of how much to save per year to reach your goal, read this article: How Much Should YOU Save Per Year? (Examples and Charts)

Below are some strategies to go from zero to Lean FIRE:

Self-Direct Your Retirement Investments

Most people are unaware they can invest in the stock market while using a retirement account with tax benefits. With a self-directed IRA, you can invest in alternative assets not allowed in traditional IRAs and directly manage your account. However, it’s the custodian who offers administrative services.

If you’d like to have checkbook control and not wait for the custodian to cut checks, you can invest through a Limited Liability Company (Self-directed IRA LLC). A self-directed IRA helps you reduce risk through diversification and increase your rate of return.

To open your self-directed IRA, all you’ll need to find a trustee or custodian of the account. You’ll be responsible for market research and finding brokers to purchase your investment.

Cash in High-Yield Saving Accounts

High-yield savings accounts are special savings accounts that pay over 20 times more than the average national rate on a conventional savings account. They provide a secure middle ground for savings by protecting your principal and offering federal insurance safety.

This is great for short and mid-term savings. For example, if you’re saving for a downpayment on a new house it’s often better to put your money in a high-yield savings account than in the stock market due to the short-term risk.

As banks shift from traditional banking to internet banking, the demand for these accounts has increased across the country, making saving rates skyrocket. And another benefit is you can hold your savings account and checking account in separate institutions and be able to transfer your funds electronically.

While saving a considerable balance on a high-yield savings account, you should consider the following:

- The initial deposit needed to open the account, and if you’re comfortable depositing it.

- The minimum balance needed to keep the account running.

- The interest rate.

- Maintenance fee charged on the account.

- Withdrawal options available.

Diversify Your Income Sources

While growth value matters in any investment, you should seek more. Instead of investing in just stocks, you should diversify to investment income that matches stock growth potential. Generating returns with investment gives you early access to your money which you can reinvest to grow your savings much faster.

Besides, you should also consider starting a passive income business. It’s ideal because it earns you income without demanding your time. Diversifying your income streams helps you spread risk and compensate for inevitable market and life fluctuations.

Create a Budget

Following a budget isn’t optional if you wish to achieve any significant financial goal. It keeps you from drifting through life aimlessly and tossing your money at any object that catches your eye. It helps you evaluate your expenses and cut off unnecessary costs, and direct the appropriate amount of money to your savings.

To create a budget, list all your expenses and the amount you spend on each. Then evaluate each item to see if it is a necessity or not. Creating a habit of budgeting keeps you away from spending more than you earn and credit card debts.

You can use the following budget as a template. The numbers in the template reflect the median household spending in The U.S.

| Item | Monthly Cost | Percentage of Budget |

|---|---|---|

| Housing (Rent or mortgage and utilities like electricity and water) | $1784 | 34.9% |

| Transportation (Car payments, gas, bus tickets, vehicle insurance etc.) | $819 | 16% |

| Food (Groceries and restaurants) | $640 | 12.3% |

| Insurance & Pensions (Personal insurance like life insurance, pension savings etc.) | $604 | 11.8% |

| Healthcare | $431 | 8.4% |

| Entertainment (Subscriptions, TV, Speakers, a new Phone etc.) | $243 | 4.7% |

| Savings | $190 | 3.7% |

| Apparel and Services | $120 | 2.3% |

| Education | $106 | 2.2% |

| Miscellaneous | $76 | 1.6% |

| Personal care | $54 | 1.2% |

| Other | $44 | 0.9% |

| TOTAL | $5,111 | 100% |

Using Excel, or a notebook, write down what YOU spend on each of the items. If you’re spending more than you’re earning, make the necessary cuts.

To learn how to live on less, check out one of these articles:

- Living On $1,800 A Month: Budget, Lifestyle And More

- Yes, You Can Live On $2,000 A Month! Here’s How & Where

- Living On $3,000 A Month – It’s Possible!

- Can You Live On $4,000 Per Month? (Single and family of four)

Automate Your Savings

When a portion of your paycheck goes directly to your savings account, you can’t spend it on other stuff. Automating your savings also ensures you receive only the amount you have budgeted for, helping you stick to the budget and achieve your financial goal sooner.

Mistakes You Should Avoid

Below you’ll find three common mistakes you should avoid.

Over Diversifying

While diversification reduces the risks by not putting all your eggs in one basket, going overboard can result in unnecessary complications and fees.

When there are too many investments, over-diversification occurs because the marginal advantage of lower risk is outweighed by the marginal loss of projected return.

The best way of knowing your inherent risk is by assessing the volatility levels of your investments. If your portfolio moves sharply with a slight market fluctuation, the risk is high. The modern portfolio theory shows that the optimal diversification is 20 uncorrelated assets. That is assets that respond differently to the market.

For example, buying 20 different tech stocks is not diversified because they are all correlated.

On the other hand, buying a few tech stocks, dividend stocks, some real estate assets, accumulating some Bitcoin, and having some cash in a high-yield savings account is highly diversified.

Starting out, pick three different sectors that are not correlated and build positions in these. Dividend stocks, real estate and crypto is my current focus. In the future I plan on building significant positions in index funds as well, and in specific tech stocks.

Deferring Too Much Tax

One advantage of retirement accounts is accumulating your savings tax-free until retirement. While this can grow your savings significantly, it can cost you when you retire early. A large nest egg can cause you to fall into a high tax class and pay more tax. While saving, you should strike a balance between current and future tax.

Anticipating Too Low Costs

The value of money today is not the value of money tomorrow. Soaring levels of inflation keep deteriorating the purchasing power of money. If you anticipate too low costs in retirement, you might outlive your savings. While preparing your retirement budget, it’s wise to increase the prices slightly just in case the economy changes unfavorably.

Don’t let inflation keep you from investing and saving money. It’s vital that you invest and save during inflaiton.

Best Ways of Investing for Lean FIRE

Below are some suggestions as to where you can put your savings to work. Since saving money can’t make you rich, it’s imperative to invest your money.

Index Funds

Unlike other mutual funds, index funds have passive management, which saves you from high operation fees and poor investment decisions. After investing, you pass other responsibilities to the manager, who looks to purchase and hold securities that correspond to the given index intending to match the index’s performance.

Index funds generally have the following benefits:

- High returns. It’s the nature of all stocks to fluctuate. However, index funds maintain a high average return of up to 7% over the past several decades.

- Diversification. You can own stock from various companies with a single purchase. For example, the Nasdaq fund exposes you to around 100 companies and S&P 500 to about 500 companies.

- Low management cost. Because of passive management, the index fund expense ratio is low, which boosts your return.

Real Estate

Real estate is a great long-term investment vehicle with the right skills and knowledge. It includes physical assets such as land, commercial, and residential properties, non-physical assets like Real Estate Investment Funds (REITs), and crowdfunding.

The benefits you get from real estate investment include:

- Diversification. Real estate negatively correlates with other assets like stock, ensuring you’ll be able to withstand market fluctuations.

- Dual income. Your investment earns dividend income and returns on capital which helps supplement your income.

- High returns. The returns vary depending on the properties’ theme. However, the average return ranges between 5 to 12%.

The easiest way to invest in real estate is to pay off your mortgage. But that’s not always the best decision. To learn more about it, check out this article: FIRE Movement: Should You Pay Off the Mortgage or Invest?

Individual Stocks

Individual stocks involve buying ownership of a company. You can make money through stock appreciation and dividends. Although most people invest in mutual funds, individual stocks have a higher appreciation potential and the following benefits:

- No management fee. You incur zero management fee to own individual stocks, which means more returns.

- Control over your investments. Individual stocks give you control over which assets you want to invest in and where and when to invest.

- Tax advantage. You pay no tax on stock appreciation until you sell it.

Cryptocurrency

This is riskier than the other suggestions but offers higher potential returns. Bitcoin, for instance, has delivered an annualized return of 200% for the last ten years. It’s not likely to continue performing that well, but personally, I believe it has its place in your portfolio.

For the tech-savvy, one can also look into other cryptocurrencies than Bitcoin, like Ethereum. There are thousands of others, but you should stick with the “blue-chips” like Bitcoin and Ethereum until you have spent roughly 100 hours learning about the technology and how the crypto market moves.

I’ve got tons of articles about crypto on this website. In fact, initially, this website was built as a crypto blog. Check them out here.

The general benefits of cryptocurrencies are as follows:

- Potentially extremely high returns

- Lots of innovative projects to learn about

- Can often be “staked” or blended out on dedicated platforms to generate a yield of 4% all the way up to 12% per year.

Final Thoughts

Lean FIRE offers a quicker route to early retirement. However, it only accounts for necessities such as food, housing, transport, and healthcare. Most people need roughly $1,000,000 to achieve Lean FIRE. For low and medium-income earners, this amount is enormous and requires evaluating your finances, setting realistic goals, and creating a strategy of saving your way up.