Lean FIRE is the shortest route to financial independence and early retirement. It requires you to cut off wasteful spending to focus on necessities. With such an arrangement, it is easier to achieve your FIRE number sooner, but how much exactly do you need to Lean FIRE?

Here’s the short answer:

You need 25 times your annual expected retirement expenses to achieve Lean FIRE. Given a frugal lifestyle, $1,000,000 or less is sufficient. This means annual expenditures of no more than $40,000, or $3,400 per month, assuming a 4% withdrawal rate.

This article explains how to calculate your Lean FIRE number. It covers defining your retirement goals, estimating your budget, and calculating your Lean FIRE number.

If you’re looking for a full guide to achieving Lean FIRE, read this article instead: The Ultimate Guide To Achieve LEAN FIRE: (Step-by-Step)

If you’re considering FAT Fire, check out this one: The Ultimate Guide To Achieve FAT FIRE [2022]

Step 1: Defining Your Retirement Goals

Everyone has a unique retirement dream, which explains why there’s no fixed Lean FIRE number. Before you start saving, it’s crucial to envision your retirement life to ensure your nest egg is sufficient and you cannot outlive it.

In this section, I don’t want you to think about money or expenses. Just try to envision a retirement lifestyle you’re comfortable with. We’ll estimate the costs of that lifestyle in the next section.

Below are some factors to consider:

Your Retirement Lifestyle

How do you want to retire? The retirement lifestyle you wish to have largely determines your Lean FIRE number. First, you’ll have to consider where you want to retire. If you’re going to retire within the US, your Lean FIRE might be lower than someone looking forward to retiring in a costlier country.

I have put together a table showing the median monthly cost of living in 20 different cities in the U.S. for single people and families of four. It includes rent. Use it to get an idea of where it’s cheap and where it’s expensive:

Again, the cost of living varies from place to place. Retiring in an area with a high cost of living would require a higher Lean FIRE number. Another thing to consider is travel. Usually, after retirement, most retirees like traveling. In this case, your Lean FIRE would be higher than that of someone willing to have a quiet life without movement.

Family Size

How many people are you saving for, and how old are they? While living minimally alone is easy, you might need to stretch your budget if you’re saving for more than one person. If you have kids, your expenses might be more as you’ll have to cover their education expenses.

On the other hand, if your savings cover your elderly parents, it’d be wise to target a higher Lean FIRE number as you might spend more money on medical bills. For instance, if you have a family of three and your target expenditure is $35,000 per year, each person would have to spend around $11,700.

Your Retirement Age

The age you want to retire has a significant impact on the size of your portfolio. The earlier you wish to retire, the higher your Lean FIRE number should be. This is because you’ll have more retirement years.

For example, assuming a life expectancy of 85, retiring at 40 means your savings should last you for 45 years while retiring at 50 requires your savings to last 35 years.

Also, your retirement age determines how much you should save each month to achieve your goal. If you have a few years to retire, you’d have to save more aggressively than a person with more years. You’ll get less help from compounded interest as well.

Your Health

Health is wealth. Health complications such as diabetes, asthma, and hypertension can cost a lot of money in hospitalizations, drugs, and special diets. So, your Lean FIRE number should be higher if you speculate that your health may deteriorate in the future.

If You’ll Continue To Work After Retirement

Early retirement doesn’t always mean leaving the workforce entirely. With other sources of income, you can supplement your retirement income. Conversely, if you decide to quit work altogether, you might need to target a higher Lean FIRE number or live a more frugal life in retirement to ensure you don’t outlive your savings.

Step 2: Estimating Your Retirement Expenses

After envisioning your retirement life, the next thing to do is to prepare your retirement budget. A budget is an invaluable tool that enables you to estimate your retirement expenses. Not only that, but it also allows you to:

- Eliminate unnecessary expenses. Lean FIRE requires a minimalistic lifestyle, and you might need to cut off most of your current costs in retirement. With a budget, it is possible to take a closer look at your spending habits and determine non-negotiable and optional expenses.

- Maintain your retirement expenses. With a budget, you can streamline your nest egg to last throughout your retirement days.

It’s challenging to accurately estimate your retirement expenses, given that the prices of goods and services are ever-changing. However, your current expenses, or the median expenses in your desired city, can act as a benchmark, and then you subtract the amounts depending on how frugal you wish to live.

The Median Living Expenses

If you find it hard to estimate your retirement expenses, you can use the median living expenses as a benchmark. I put together a table showing the median living expenses in twenty different cities for single people and families of four:

| Location | Median Expenses: (Single, Family) |

|---|---|

| New York, NY | $4,193, $7,934 |

| San Francisco, CA | $3,843, $7,471 |

| Oakland, CA | $3,403, $6,853 |

| Washington, DC | $3,113, $6,292 |

| Boston, MA | $3,268, $6,429 |

| Pittsburgh, PA | $2,178, $5,201 |

| Nashville, TN | $2,766, $5,740 |

| San Diego, CA | $3,118, $6,092 |

| Miami, FL | $3,086, $6,058 |

| Chicago, IL | $2,611, $5,506 |

| Philadephia, PA | $2,430, $5,307 |

| Los Angeles, CA | $3,044, $5,917 |

| Dallas, TX | $2,496, $5,286 |

| Atlanta, GA | $2,365, $5,117 |

| Las Vegas, NV | $2,130, $4,797 |

| Orlando, FL | $2,364, $4,979 |

| Austin, TX | $2,668, $5,264 |

| Huston, TX | $2,163, $4,762 |

| Tulsa, OK | $1,709, $4,115 |

| AVERAGE: | $2,834, $5,743 |

I generally believe a frugal person or family can live 40% below the median. In addition, most retirees live below the median anyways. Therefore, to estimate your retirement expenses, pick your desired city, and multiply it by 0.6 to get the estimated frugal living expenses in that city.

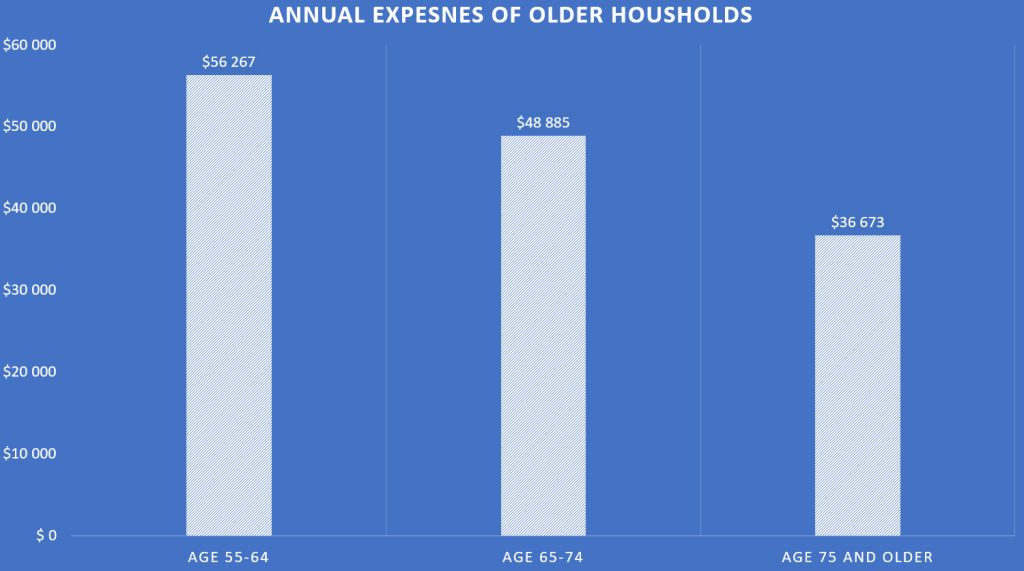

To get an idea of what older households spend annually, I made a chart based on data from U.S. BUREAU OF LABOR STATISTICS showing it by age:

This shows a decrease in annual expenses over time. That’s good news and indicates that it is easier to live on your Lean FIRE portfolio for longer. It is likely due to less traveling, debts being preyed off, and generally “doing less stuff”.

If you’re up for a challenge, you might want to check out one of these articles:

- Living On $1,800 A Month: Budget, Lifestyle And More

- Yes, You Can Live On $2,000 A Month! Here’s How & Where

- Living On $3,000 A Month – It’s Possible!

- Can You Live On $4,000 Per Month? (Single and family of four)

To get your personal estimate, you should do the steps suggested below:

Calculating Fixed Expenses

The most significant portion of your budget goes to your fixed expenses. They are costs that are less likely to fluctuate from period to period and so you can easily predict them confidently. While budgeting, you need to consider how often your expected fixed expenses recur. Some can recur weekly, monthly, or semi-annually.

Examples of fixed costs to budget for Lean FIRE include:

- Housing (mortgage or rent payment)

- Insurance premium (life or health insurance)

- Loan repayment

- School fees

- Subscriptions such as gym

Though it can be daunting, it is possible to reduce fixed expenses with time. For example, you can downsize or move to a cheaper place if your rent is high. You can also cancel some subscriptions that you can survive without.

Some people choose to pay off their mortgage early to decrease their expected retirement expenses. This might be the right move, but it depends on your specific situation. Read this article to learn more about it: FIRE Movement: Should You Pay Off the Mortgage or Invest?

In my opinion, fixed expenses offer the biggest opportunity to cut down on spending and save more money. The median household in The U.S. spends over 50% of their income on transportation and housing, which are largely fixed expenses. If you manage to cut down on those two you’re way better off already.

I personally did this by moving to a cheaper apartment closer to work. This cut down on housing, and almost eliminated transportation as I could walk to work. This enabled me to save 40% of my income. And since the cut expenses are fixed, the 40% was saved every single month, consistently, for years.

If you’re trying to save more money, you should read this article: The 4 Steps To Save A Lot Of Money Fast

Calculating Variable Costs

Unlike fixed costs, variable costs are hard to predict because they change over time. The more you use a commodity, the more you pay for it, and vice versa. Most variable expenses are discretionary, but some may be necessities. They’re the easiest expenses to eliminate or reduce.

Examples of variable costs include:

- Food

- Utility bills

- Gas

- Entertainment

- Travel

Cutting these are often easier than the fixed expenses, but not as impactful. My personal philosophy when it comes to finances is that “small things make a small impact and big things make a big impact”. Therefore, to make a big impact on your finances, you should cut down on the big things like housing and transportation. The variable items are the icing on the cake.

Accounting for Emergencies and Taxes

Life is always unpredictable, and you may have emergencies such as broken appliances or car repairs. Deducting such expenditures from your retirement income can cause you to strain your already frugal budget. Also, most retirement savings have tax deferment privileges, and you pay tax on the withdrawal.

On top of your total fixed and variable expenses, you should add 20% to account for emergencies and taxes.

Step 3: Calculating Your Lean FIRE Number

Once you have estimated your retirement expenses, the next thing to do is to calculate your Lean FIRE number. Lean FIRE number is the size of the portfolio you have to accumulate to live off your retirement, assuming a 4% withdrawal rate.

The formula to calculate it is:

Lean FIRE = Expected Annual Expenditure / Safe Withdrawal Rate (4%), or alternatively:

Lean FIRE = Expected Annual Expenditure x 25

The 4% and 25 x rules come from the Trinity Study. It states that once you achieve a portfolio equal to 25 times your annual retirement expenses, it can last throughout your retirement, assuming a 4% withdrawal rate.

If you’re scared that you might outlive your portfolio, consider decreasing the safe withdrawal rate to 3%. You then need to multiply the expenses by 33.333 or divide them by 0.03.

Practical Example

Assume you found your monthly fixed retirement expenses $1,700 and variable costs $1,000. What would be your Lean FIRE number?

- Find the total fixed and variable expenses.

Total Fixed and Variable expenses = ($1,700 + $1,000 = $2,700).

Remember to include 20% for tax and emergencies. Tax and Emergencies = (20% x $2,700 = $540). - Find the annual expenses.

Total monthly expenses = ($2,700 + $540 = $3,240)

Annual expenses = ($3,240 x 12 = $38,880) - Calculate the Lean FIRE number.

Lean FIRE number = Expected annual expenditure x 25 ($38,880 x 25 = $972,000) or by division:

Lean FIRE number = Expected annual expenditure / Safe Withdrawal Rate ( $38,880 / 0.04 = $972,000)

Once you accumulate savings of $972,000, you can withdraw $38,880 yearly for the rest of your retirement days. But, you must maintain the purchasing of the first amount you withdraw should inflation cause money to lose value.

Final Thoughts

Lean FIRE is the quickest way to achieve FIRE because it requires a small portfolio. It advocates for a frugal lifestyle below the average US household spending. The maximum Lean FIRE portfolio is $1,000,000. To calculate your Lean FIRE number, you first need to estimate your annual expenses and apply the 4% or 25x rules.