Saving 40% of your income is an incredible feat. It takes a true financial mutant to do that. Today, I’ll tell you how I did it, and also where it might take you in the future if you stick with it.

Here’s the short answer:

Yes, saving 40% of your income is good. It’s eight times better than the average personal savings rate of 5%. Earning a median salary and saving 40% will make you a millionaire in 21 years.

In the rest of the article, we’ll look deeper into this, and figure out where saving 40% of several different incomes will get you.

I’ll give you examples with charts of what you can expect to happen if you save 40% of different incomes ranging from $40K/year to $200K/year income over 30 years.

In addition, I’ll give you the hands-down best way to reach your goal of saving 40% (or more) of your annual income.

If you’re trying to figure out exactly how much to save, you should read this article instead: How Much Should YOU Save Per Year?

So, How Good Is Saving 40% Of Your Income?

Before looking at where you’ll end up if you save 40% for years and years, let’s quickly look at what “the average guy” does.

How much “most people” save from their income:

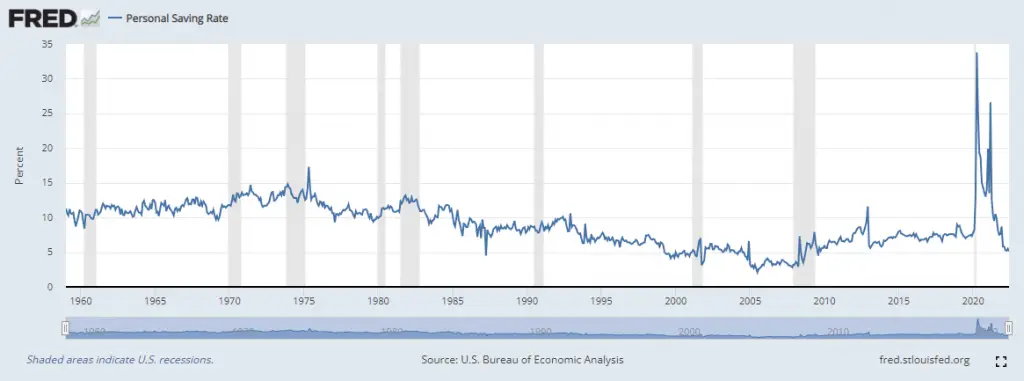

The U.S. Bureau of Economic Analysis tracks how much people, on average, save. They call this metric “The personal savings rate”.

It is presented as a percentage of income.

The personal saving rate is currently 5% (in 2022). This means people, on average, only save 5% of their income:

Looking at the chart above, we see that people used to save ten to fifteen percent of their income in the 60′ and 70′.

Somewhere in the 80′, people slacked on their savings, slowly decreasing to less than five percent.

In the pandemic, it shot up to 30% briefly but fell back to five percent in 2022.

You don’t need to be a mathematician to see that the personal savings rate is far below your target of 40%.

Let’s conclude with this:

Saving 40% of your income is currently eight times better than the average American. At no point since at least 1960, likely ever, has the average personal savings rate even been close to 40% for a significant length of time.

In other words, if you manage to save 40% of your income, you’re a financial mutant!

Saving 40% of the median annual income for 30 years:

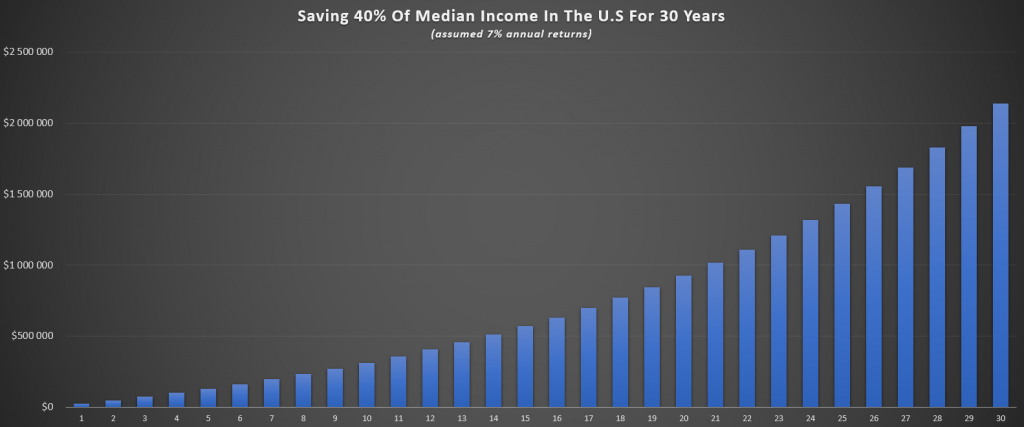

I calculated the median income across all states in the United States in 2021 to be $56,613 for single people. (data used)

Saving 40% of that is equivalent to saving $22,645 per year, or $1,887 every month.

Below you see just how much that’ll turn into in 30 years:

- By saving 40% of a median salary for 21 years, you’ll be a millionaire.

- In 30 years, you’ll have over two million dollars.

- If you stopped saving after 30 years, your portfolio would still grow by $150,000 the next year.

That’s some serious money! I’ll come back with some more examples and charts later in the article, but let us first look at how to save 40% of your income:

How To Save 40% Of Your Income Every Year:

Most people are unable (or unwilling) to save as much as 40% of their income. As you saw, the average is a modest 5%.

And even if they manage to get up to 40%, few can stick with it for several years.

I’ll give you three actionable steps to save 40% (or more) of your income. And best of all, following these steps will ensure you stick to that savings rate for years and years.

To get a complete guide on saving more money, check out this article instead: The 4 Steps To Save A Lot Of Money Fast

The best way to save more money and stick with it for years:

Let me give you my basic philosophy when it comes to personal finance:

Small things make a small impact. Big things make a big impact.

Let me explain:

Most people think that it’s all about cutting down on small luxuries like Netflix and Starbucks.

This couldn’t be further from the truth…

The number one principle that enabled me to save 40% of my income was this:

Do NOT focus on the small, variable expenses. Focus on the big, fixed expenses.

This is key for two reasons:

You save big money by cutting down on big stuff, and by focusing on fixed expenses you’ll save that money consistently over long periods of time.

To reach your goal of saving 40% of your annual income, here’s what you must do:

- Cut down on housing expenses. Housing is by far the biggest expense for most people. If you can cut down on this one, you’ll be able to save a lot more money every month. For example, if you spend $2,000 per month on housing, but you’re able to cut that down by 40%, you’ve already got $800 per month!

- Cut down on commute-related expenses. This is often the second largest expense people have. If you can cut this one down, you’re left with a big chunk of money to save every month.

The best move you can make to save BIG money consistently:

Based on the principle and philosophy formulated above, here’s the hands-down best thing you can do for your finances:

Move closer to work, in a cheaper house/apartment.

This move cuts down on your housing expenses and makes the number one transportation cost, getting to work, cheaper. In fact, if you’re able to move close enough, you might consider biking or walking to work, almost eliminating your transportation costs entirely.

If you need more on saving more money, check out this article: Can’t Save Money Because of Bills? Here’s What I Did

If you think saving 40% is out of reach, you can check out one of these articles:

Is Saving 20% Of Your Income Enough?

Is Saving 25% Of Your Income Good?

Is Saving 30% Of Your Income Good?

If you’re a financial mutant and think 40% is too easy, try to save half of your annual income.

Anyways, my point is this:

Cutting down on big fixed expenses like housing and transportation is how to save 40% of your expenses.

In addition, the saving will be consistent because you cut down on “fixed” expenses.

Examples: Saving 40% Of Various Incomes For 30 Years

I now want to show a few examples of different salaries and where saving 40% of that will take you.

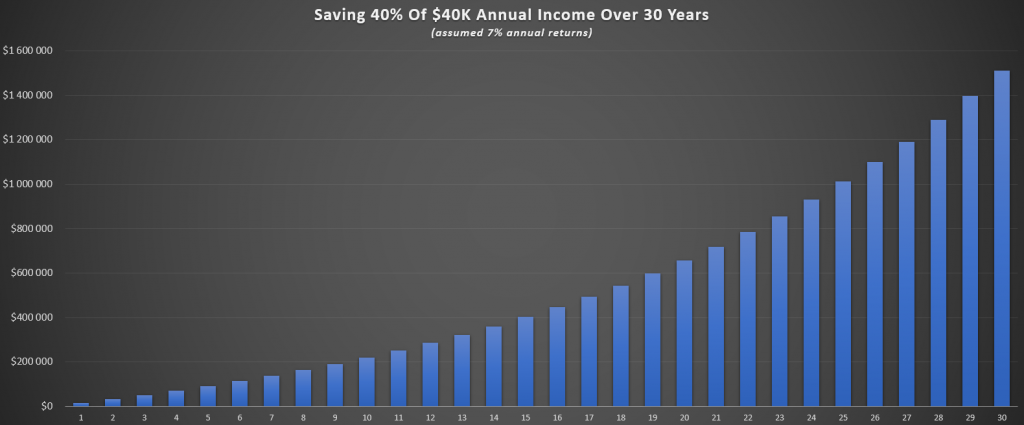

Saving 40% of $40K for 30 years: $1,500,000

Saving 40% of $40K is the same as saving $16K annually. Here are some quick observations made from the chart above:

- You’ll be a millionaire in 25 years.

- After 10 years, you’ll have $200,000

- After 15 years, you’ll have $400,000

Earning $40K per year is below the median, and this should therefore be realistic for most people. If you’re learning $40K per year, and want to save 40% of that, you’ll need to live on $2,000 monthly or less. Here’s an article showing you how you can do just that:

Yes, You Can Live On $2,000 A Month! Here’s How & Where

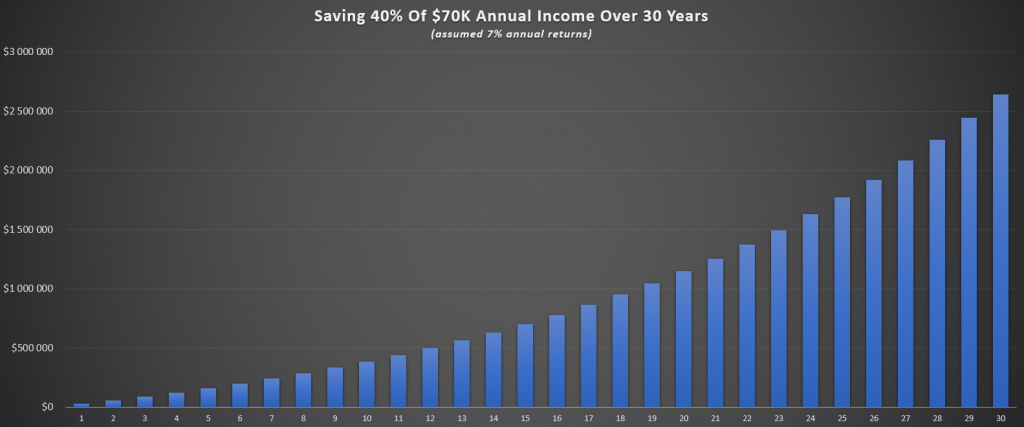

Saving 40% of $70K for 30 years: $2,650,000

Saving 40% of $70K is the same as saving $28K annually. Here are some quick observations made from the chart above:

- You’ll be a millionaire in 19 years.

- After 10 years, you’ll have $385,000

- After 15 years, you’ll have $700,000

- After 27 years you’ll have more than two million dollars.

Lots of people are earning $70K per year. In addition, looking at household income instead of single-person income, this is actually below the median in most states of America.

To save 40% when earning $70,000 annually, you must live on $3,500 a month or less. You can check out the following article to aim for $3,000:

Living On $3,000 A Month – It’s Possible!

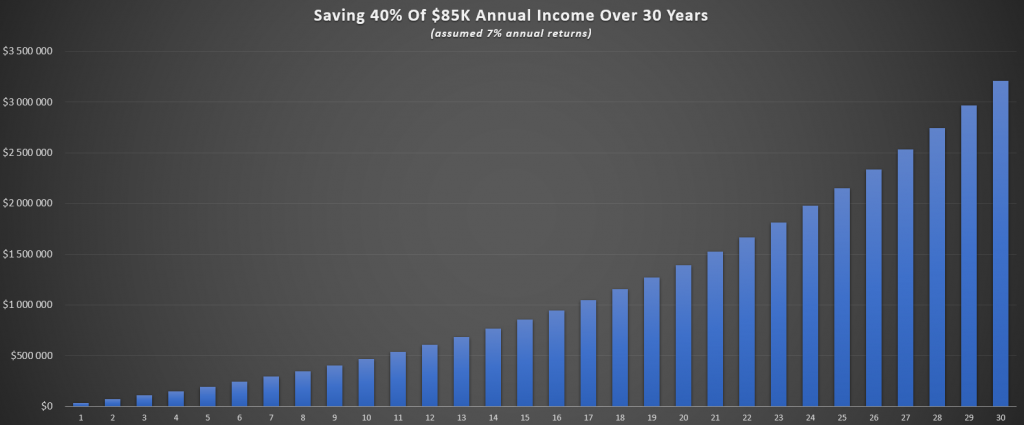

Saving 40% of $85K for 30 years: $3,200,000

Saving 40% of $85K is the same as saving $34K annually. Here are some quick observations made from the chart above:

- You’ll be a millionaire in 17 years.

- After 10 years, you’ll have $470,000

- After 15 years, you’ll have $850,000

- After 25 years you’ll have more than two million dollars.

Rather few people earn $85K per year. But again, looking at household income instead of single-person income, this is actually a common thing. Two people living together only need to make $42,500 each.

To save 40% when earning $85,000 annually, you must live on $4,250 a month or less. You can check out the following article to aim for $4,000:

Can You Live On $4,000 Per Month? (Single and family of four)

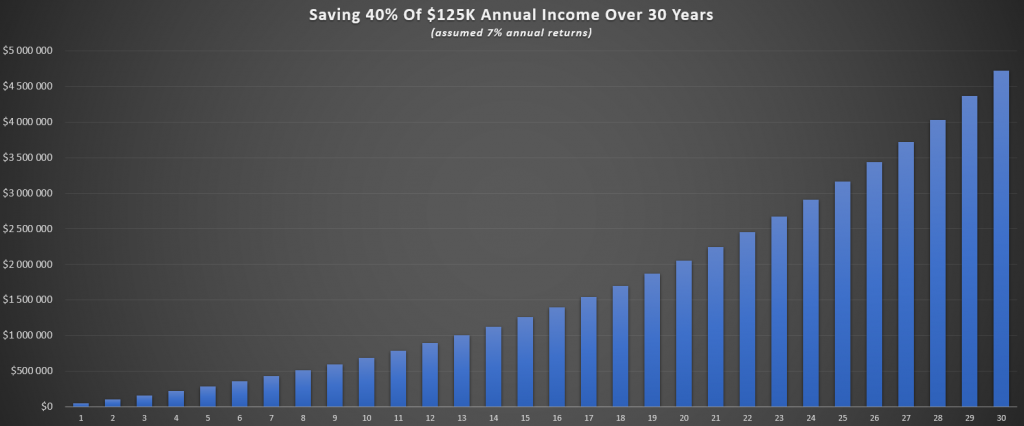

Saving 40% of $125K for 30 years: $4,750,000

Saving 40% of $125K is the same as saving $50K annually. Here are some quick observations made from the chart above:

- You’ll be a millionaire in 13 years.

- After 10 years, you’ll have $690,000

- After 15 years, you’ll have $1,250,000

- After 20 years, you’ll have more than two million dollars.

- After 25 years, you’ll have more than three million dollars.

- After 28 years, you’ll have more than four million dollars.

Extremely few people earn $125K per year. But as a household income is not that rare. Two people living together only need to make $62,500 each, which is slightly higher than the median annual income in The U.S.

To save 40% when earning $125,000 annually, you must live on $6,250 a month or less.

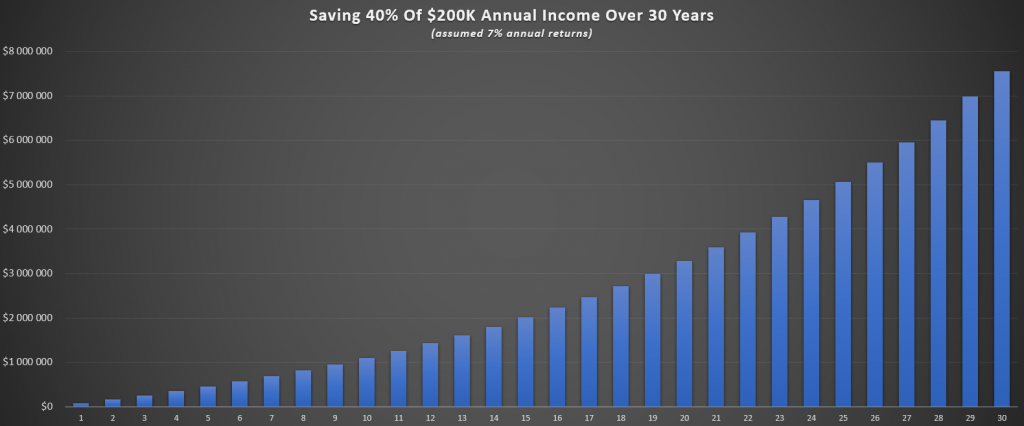

Saving 40% of $200K for 30 years: $7,500,000

Saving 40% of $200K is the same as saving $80K annually. Here are some quick observations made from the chart above:

- You’ll be a millionaire in 10 years.

- After 5 years, you’ll have almost $300,000.

- After 15 years, you’ll have $2,000,000.

- You’ll have more than three million dollars in less than 20 years.

- In 23 years, you’ll have more than 4,250,000.

- After 25 years, you’ll have more than five million dollars.

- In the final year alone, the amount increases by $570,000

Almost no one earns $200K per year. But a few households with two $100K/year earners do. To learn more about what it’s like to earn $100K a year, read the following article:

Is $100K a Year Good? (For Single People and Families of 4)

Let’s stop the examples and go to the conclusion.

Conclusion: Yes, Saving 40% Of Your Income Is Good

Saving 40% of your income is great. You’ll have over two million dollars if you do it for 30 years with a median salary.

The best way to achieve it is to cut down on big fixed expenses like housing and transportation. Consider moving into a cheaper apartment/house closer to work.

The average savings rate in The U.S. is 5%. Therefore, saving 40% of your income is eight times as good as the average.