Saving anything more than 10% of your income is better than 2/3 of Americans. Saving as much as 30% of your income will put you leaps and bounds ahead. In today’s article, I’m looking at just how good saving 30% is, and where you’ll end up if you stick with it.

Here’s the short answer:

Yes, saving 30% of your income is good. It’s six times better than the average personal savings rate of 5%. Earning a median salary and saving 30% will make you a millionaire in 24 years.

In the rest of the article, we’ll look deeper into this, and figure out where saving 30% of different incomes will get you.

We’ll look at a few charts to get a visual representation of how powerful saving that much can be.

In addition, I’ll give you the hands-down best way to reach your goal of saving 30% (or more) of your annual income.

If you’re trying to figure out exactly how much to save, you should read this article instead: How Much Should YOU Save Per Year?

Saving 30% Of Your Income vs The Average Savings Rate

Let’s begin by looking at just how much better saving 30% is than the average “personal savings rate”.

How much the average guy saves from their income:

According to the U.S. Bureau of Economic Analysis, the average American saves only 5% of their income.

They measure this in their metric called “The personal savings rate”.

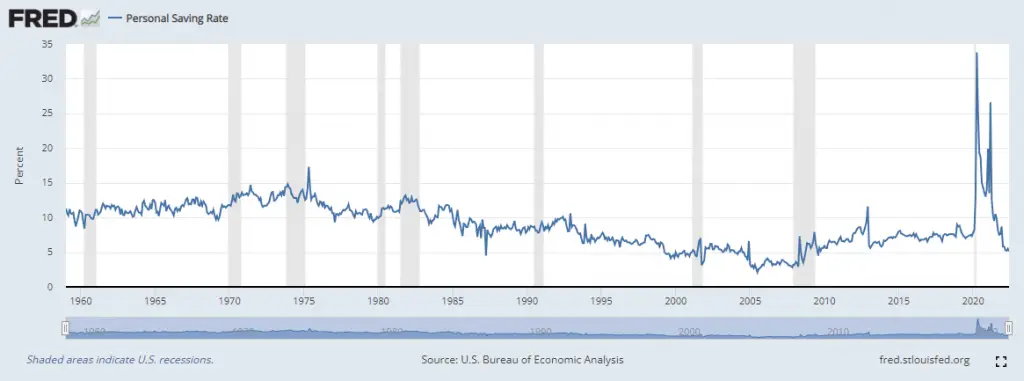

The personal saving rate is in a long-term downtrend. This means people, on average, save less and less, and currently only 5%:

In the 60′ and 70′, Americans used to save between 10% and 15%.

In the 80′, the average fell below the 10% threshold.

In the 90′, the downtrend continued.

In the 2000′, the personal savings rate went down to 3% at its worst. However, the trend seemed to reverse somewhere around 2005/2006.

In the pandemic, it shot up to 30% briefly but fell back to five percent in 2022.

No matter what the trend currently is, it is obvious that saving 30% of your income is way better than the average.

Let’s conclude with this:

Saving 30% of your income is currently six times better than the average American’s personal savings rate.

Saving 30% vs 5% of your income:

It’s obviously much better to save 30%, but how much better is it?

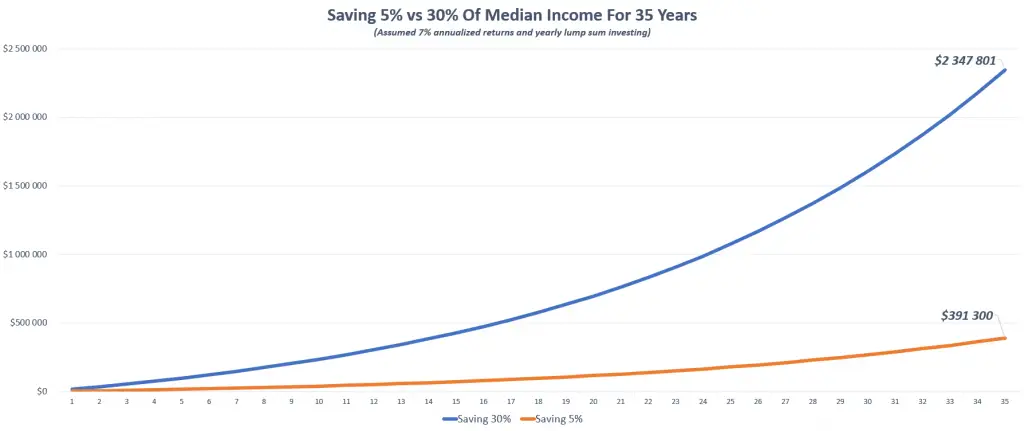

To get an idea of this, I’ve made a chart showing how much saving 30% compared to 5% of a median wage for 35 years turns into.

I’ve assumed a 7% annual return, and annual lump sum investing. I calculated the median income across all states in the United States in 2021 to be $56,613 for single people. (data used)

Check it out:

Saving 30% turns into $2,347,801, while saving 5% turns into $391,300.

If you were to retire on those sums, here’s what your income would be with a 4% safe withdrawal rate:

| Savings | Safe Annual Withdrawl |

|---|---|

| $2,347,801 | $93,912 |

| $391,300 | $15,652 |

That’s a huge difference…

Let’s conclude this discussion with the following:

Saving 30% of your income is six times better than the average American. Given a median annual income, saving 30% over 35 years will turn into over $2,3 million while saving 5% will turn into less than $400,000.

A Closer Look: Saving 30% of the median income for 35 years

Saving 30% of that is equivalent to saving $16,984 annually, or $1,415 monthly.

Below you see another chart showing how that money might grow over 35 years:

- By saving 30% of a median salary for 25 years, you’ll be a millionaire.

- In 33 years, you’ll have over two million dollars.

- If you stopped saving after 35 years, your portfolio would still grow by $164,000 the next year.

If you’re making more than the median income of $56,613 per year, the numbers are even crazier…

If you think saving 30% is too easy, you can check out one of these two articles:

If you don’t think you can save 30%, you should check out one of these articles:

Is Saving 20% Of Your Income Enough?

Is Saving 25% Of Your Income Good?

Next, I’ll let you in on some of the most powerful financial moves you can make. This will greatly help you reach your savings goal of 30% of your income.

How To Save 30% Of Your Income:

Saving 30% of your income is difficult. According to Forbs, the median balance for checking and savings combined is a modest $5,300. (source)

And even if you manage to break above the average, and finally reach 30%, the real challenge is to stay there. To keep saving 30% year after year.

But don’t you worry! I’ll give you the keys to accomplish this. By following three simple steps, you’re going to get a lot closer to saving 30% of your income.

To get a complete guide on saving more money, check out this article instead: The 4 Steps To Save A Lot Of Money Fast

Three steps to save 30% of your income:

Let me give you my basic philosophy first:

Small things make a small impact. Big things make a big impact.

Let me explain…

Most people think that it’s all about cutting down on small luxuries like Netflix and Starbucks.

I think that’s dumb, at least for saving BIG bucks.

The main principle that enabled me to save 30% of my income, and more, was the following:

Do NOT focus on the small, variable expenses. Focus on the big, fixed expenses.

This is essential for two reasons:

You save big money by cutting down on big stuff, and by focusing on fixed expenses you’ll save that money consistently every month/year.

To reach your goal, here’s what you must do:

- Cut down on housing expenses. Housing is by far the biggest expense for most people. If you can cut down on this one, you’ll be able to save a lot more money every month. For example, if you spend $20,000 per month on housing, but you’re able to cut that down by 40%, you’ve already got $8,000 per month!

- Cut down on commute-related expenses. This is often the second largest expense people have. If you can cut this one down, you’re left with a big chunk of money to save every year.

- Shop for insurance and utilities. Insurance and utilities stack up fast. Once every year you should go through it all and “shop around” for better alternatives. Big bucks can be saved on this.

The best move you can make to save BIG money:

Based on the principle and philosophy formulated above, here is the hands-down best thing you can do for your finances:

Move closer to work, in a cheaper house/apartment.

This move cuts down on your housing expenses and makes the number one transportation cost, getting to work, cheaper. It’s likely that you’re saving on utilities as well.

In fact, if you’re able to move close enough, you might consider biking or walking to work, almost eliminating your transportation costs entirely.

If you need more on saving more money, check out this article: Can’t Save Money Because of Bills? Here’s What I Did

Anyways, my point is this:

Cutting down on big fixed expenses like housing and transportation is how to save 30% of your expenses.

In addition, the saving will be consistent because you cut down on “fixed” expenses.

Examples Of Saving 30% Of Your Income For 30 Years:

Below you’ll see a table showing what saving 30% of different incomes turn into over a 30-year period.

In addition, I’ve included the “Safe Withdrawl”, which basically means how much you can take out from your savings every year, without depleting your savings. This is generally agreed upon to be 4%, meaning that you can withdraw 4% of your savings per year.

| Annual Income | Saved 30% For 30 Years | Safe Withdrawl |

|---|---|---|

| $25,000 | $708,500 | $28,350 |

| $35,000 | $1,075,000 | $39,675 |

| $40,000 | $1,135,000 | $45,350 |

| $45,000 | $1,375,000 | $51,000 |

| $50,000 | $1,530,000 | $56,675 |

| $55,000 | $1,685,000 | $62,350 |

| $60,000 | $1,835,000 | $68,000 |

| $65,000 | $1,990,000 | $73,675 |

| $70,000 | $2,143,000 | $79,350 |

| $75,000 | $2,296,000 | $85,000 |

| $80,000 | $2,450,000 | $90,500 |

| $85,000 | $2,600,000 | $96,350 |

| $90,000 | $2,755,000 | $102,000 |

| $100,000 | $3,060,000 | $113,500 |

| $125,000 | $3,825,000 | $141,700 |

| $150,000 | $4,593,000 | $170,000 |

| $200,000 | $6,125,000 | $226,750 |

I hope you find your own annual income on the list above, or at least something close to it.

Conclusion: Yes, Saving 30% Of Your Income Is Good

If you’re saving 30% of your income you’re leaps and bounds ahead of most people. In fact, you’re saving six times more than the average.

For median wage earners, saving 30% of your income for 35 years will turn into roughly $2,350,000. You’ll be a millionaire after 24 years.

The best way to accomplish your savings goal of 30% is to cut down on big fixed expenses like housing and transportation. The number one move you can make is to downsize into a cheaper apartment/house closer to work.

Hope you found it helpful and interesting!

– Oskar