We all know we should save money, but how much should we save each year? In this article, I’ll help you figure out how much you should save annually. I’ll also give you a few examples with some cool charts and data tables.

But first, here’s the short answer:

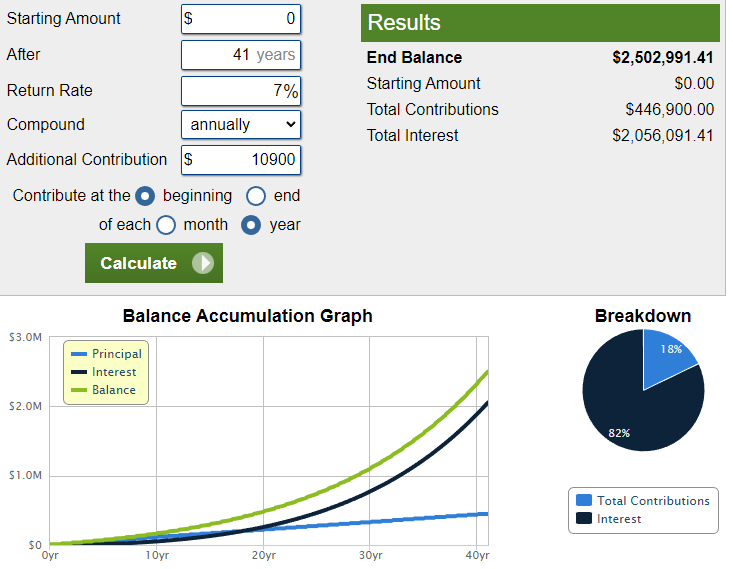

As a general rule, you should save 20% of your yearly income. More personally, you should save enough money every year to reach your long-term financial goals. For example, a 24-year-old wanting to retire with an annual income of $100,000 per year at age 65 needs to save/invest $10,900 per year, given an average return of 7% per year.

Most articles on this topic give generic advice on specific items you can save money on. Either that or they postulate that “saving 20% of your income” should be the goal for everyone, arbitrary as it is. In fact, I wrote an article about it you can check out: Is Saving 20% Of Your Income Enough?

In this article, you’re not getting advice on stuff to save money on, or random percentages of your income you should save… I’ll help you figure out what yearly savings target is right for you.

Today, we’re going to lay the foundation for your future financial success!

PS: I’ve also written about this on the daily timeframe. Check it out here: How Much Money Should You Save Per Day?

Calculate How Much YOU Should Save Per Year

Instead of throwing some generic advice at you, or telling you how much people “on average” are saving, I’ll help you figure out the annual saving that’s right for you.

To figure this out, we need to do the following:

- Formulate your financial goals.

- Calculate your yearly (after tax) income.

- Calculate your average yearly expenses.

- Make a budget to reach your goals.

The steps take some “good ol’ work”, but they are not complicated. I’ll guide you through each of them, and price examples as we go.

Suggested reading: Is Saving 40% Of Your Income Good?

Step 1: Formulate your financial goals

In his book “The 7 Habits of Highly Effective People”, Stephen Covey wrote about the habits of people that achieve outstanding success in business, and life in general. The second of those habits goes like this:

“Begin with the end in mind“

– Stephen Covey

What he means, is that you need first to figure out where you want to go. Only then, can you formulate a plan to get there.

It makes perfect sense. After all, it’s pretty much impossible to arrive somewhere if you don’t know where it is!

Based on this habit, beginning with the end in mind, the first step is to define your end destination.

Ask yourself questions like this:

- Is my current income something I could live on when I retire?

- How much do I want to have when I retire?

- Do I want a big house? If so, how big?

- Do I want a big family?

- Do I want to be single for the rest of my life?

- Do I want to live with a partner, but without kids?

- What kind of car do I see myself driving in 10 years?

- Do I ever want to start a business?

- How much do I want to work in the future?

- When would I like to retire? Earlier than normal? Later than normal?

More questions might pop into your head. Explore them, and reflect on your “gut reactions”.

All of the answers to questions like these affect how much money you should be saving per year.

For example, if you want to have five kids, your finances are going to be totally different from a single person living alone.

If you want a huge house, your finances are going to be totally different from a person living in an apartment.

Before moving on, you should have a clear view of four things: location, family, housing and transportation. You don’t have to figure out exact numbers, but you should try to estimate a “range” you want to be in.

Ask yourself these questions, and write down some answers:

- Where do you eventually want to live when you get older? This has a huge impact on your finances.

- Do you want a family? How many kids?

- How much “house” do you want? The number of bedrooms is a decent metric you can use. You should also decide between an apartment and a house. If you can guestimate the square feet you desire, that’s even better.

- What kind of car do you want? Do you want a high-end car like a BMW, Audi or Porsche? Or are you happy with a more affordable car like the Tesla Model 3? Maybe you’re on the frugal end of the spectrum, and go for a car like the Toyota Yaris? You don’t have to pick the exact car; try to figure out the “range” you want to be in. Luxury, normal or cheap.

After thinking about this a while, write down something like this:

“My wife and I have three kids. We live in a 5 bedroom house in the suburbs just outside of Kristiansand in Norway. We have two cars, one family-friendly and affordable car, and one high-end car.“

– Oskar From The Future

This gives me an idea of what the most significant, fixed expenses will be in the future.

You can continue to work on this and get into the details of your lifestyle. I’m not gonna do that here, but it’s a good idea to write that stuff down. It gives you clarity and concrete goals to aim for, and reaches far beyond finance.

By beginning with the end in mind, I can already say this:

- I’ll need a big house with five bedrooms. In the location I want to live in, houses like that currently go for $350,000.

- My transportation expenses will likely be rather high, as the two cars will be used a lot (with three kids) and the high end will probably have additional insurance costs etc.

- As a family of five, expenses like food, electricity and entertainment will be rather high.

Basically, I need to figure out how much the average family household spends per year, and add 20%-50% to take the large house and additional child into consideration.

The be clear, you’ll never be able to get an exact number by setting these goals. However, you will have a rough idea of the lifestyle you want to have in the future, which makes financial planning much more concrete and realistic.

In my situation, I think a household income of $100K a year will suffice. That estimation is based on another article I wrote about what kind of lifestyle and budget $100K affords for single people and families of four.

Based on that, I’ll formulate my goal like this:

I want an annual household income of $100,000 in retirement. According to “the 4% rule”, therefore, I need to have $100K divided by 0.04, which is $2.5 million in savings and investments by the age of 65.

The goal of having $2.5 million in savings is what’s relevant to this article. That’s what we’ll use later.

Basically, you need to figure out the desired annual household income and divide it by 0.04. That’ll give you your target for retirement savings.

For example, if my desired destination were living alone in a “cheap-ish” apartment, not owning a car, something like $40K a year would probably be more than enough. I would then need $40,000 / 0.04 = $1,000,000 in savings and investments by the time I retire.

Now that we have an idea of where we’re going, the next step is to figure out where we are.

The final step is to figure out how much you need to save every year in order to bridge your current position with your desired destination.

In this article, I use “save” and “invest” synonymously. Actually, saving money can’t make you rich; only investing can.

The first step to figuring out where you currently are, financially, is to calculate your income:

Step 2: Calculate your yearly (after tax) income

Income can be more than just your salary. For example, if you’re a student, you might get loans/stipends each month, which counts as income in this setting.

Also, if you get money gifts, for example, on your birthday or Christmas, you need to consider those.

Oh, and if you don’t know how much your after-tax salary is, you can use this calculator: Forbes Tax Calculator

If you’re married, or somewhat close to getting, you should use your combined household income in the calculation!

Below you’ll see an example of a single person’s annual income with random numbers in it:

| Source | Annual Income |

|---|---|

| Job (Salary after tax) | $42,500 |

| Side Hustle (Like this website) | $5,400 |

| Gifts Christmas and Birthday gifts combined divided by 12) | $300 |

| TOTAL YEARLY INCOME: | $48,200 |

I like to organize this info in tables. You can you Excel if you like. Or do it “old-school” and use pen and paper.

After getting this down on paper, or in an excel file (or whatever you prefer), it’s time for the next step.

Step 3: Calculate your average yearly expenses

If you already know your monthly expenses, just multiply the number by twelve you’ll have your annual expenses.

If you don’t know how much money you spend monthly, or annually, you’re not playing to win…

You should at least have an idea of how much, and where, you spend your money.

To get a great overview of your personal finances, I suggest you follow these six steps:

- Get a list of all your expenses for the last three months. We’ll take the average of three months because it varies a bit from month to month. Lists like this can often be found in your online bank account. If you don’t have any way of figuring this out, you should start tracking your spending by saving receipts and logging them weekly.

- Sort all the expenses into “categories”. By categories, I mean stuff like “housing”, “transportation”, “food”, etc. When budgeting, we’ll call these categories “items”.

- Add all the expenses in each category together. For example, if you had 10 different expenses of $14 each on the “transportation” category in the last three months, add it all together and write “$140” as your total expense for transportation. At the end of this, you should have the total amount spent in the last three months in all the different categories.

- Divide all the “total expenses” for each category by three. Remember, we got the expenses from the last three months. We need to divide it by three to get the average monthly expense.

- Add it all together. This will get you your average total monthly expenses from the last three months.

- Multiply it by twelve to estimate your annual expenses. This is the number we need to figure out how much you should save per year.

After completing the five steps listed above, you will know the following:

- How much money you spend every year, on average.

- What you spend your money on, and the average yearly amount you spend on each item.

Just like with your yearly income, you should sort the expenses in a table.

Here’s an example of a single person’s annual expenses (with random numbers):

| Items | Annual Expenses |

|---|---|

| Housing (rent, electricity, water, etc.) | $7,800 |

| Transportation (Car, bus, Uber, etc.) | $3,500 |

| Food (Groceries, eating out, beer, etc.) | $3,000 |

| Insurance (Health insurance, life insurance, etc.) | $2,400 |

| Clothes (Pants, jackets, shirts, etc.) | $900 |

| Personal care (Gym, makeup, supplements, etc. | $960 |

| Subscriptions (Netflix, Spotify, Disney+, phone subscription, etc.) | $480 |

| Hobbies (Guitar strings, wheels to longboard, books, etc.) | $600 |

| Entertainment (TV packs, bowling, football games, etc.) | $1,200 |

| Miscellaneous (Birthday parties, Christmas gifts, and “other stuff”) | $420 |

| Total | $21,260 |

If you’re a single person and have annual expenses above $24,000, I suggest you read this article and try to live on $2,000 a month.

If you’re a family and have annual expenses above $48,000, you should aim to lower your expenses and live on $4,000 a month or less.

With your current annual spending and income in place, it’s time for the final step!

Step 4: Make a budget to reach your goals

I’ll continue to use the examples from the previous steps:

- My goal is to have $2,500,000 in savings by the time I’m 65.

- My current annual income is $48,200

- My current annual expenses are $21,260

The question now is, how much do I need to save every year to reach my goal of having $2.5 million in savings and investments? And is my current income high enough? Are my annual expenses low enough?

This depends on your age. If you’re young, you don’t need to be as aggressive. You need to be highly aggressive in your savings if you’re older.

Let’s use this calculator. Below you see how much I, a 24-year-old guy, need to save every year to reach my goal of $2,500,000 by 65:

From the calculations above, I now know this:

If I save $10,900 every year until I retire, I’ll have $2.5 million in savings. By the 4% rule, I’ll have an annual income of $100,000 a year, which is enough to live my desired lifestyle as defined in step one.

Knowing this, I am in a position to make a budget.

Here’s the key: I will put in $10,900 in savings as an expense in my budget.

My budget would therefore look something like this:

| Source (Income and Expenses) | Amount |

|---|---|

| Housing | $7,800 |

| Transportation | $3,000 |

| Food | $3,500 |

| Insurance | $2,400 |

| Clothes | $900 |

| Personal care | $960 |

| Subscriptions | $480 |

| Hobbies | $600 |

| Entertainment | $1,200 |

| Miscellaneous | $420 |

| Retirement Savings | $10,900 |

| Total Expenses (including savings) | $32,160 |

| Salary (after tax) | $42,500 |

| Side Hustle | $5,400 |

| Gifts | $300 |

| Total Income | $48,200 |

| Income – Expenses | +$16,040 |

As you can see, I’ve got more than enough to reach my goal. In fact, I’ve got $16K left over every year.

This is mainly because my expenses (in this example), are low. The $16K will be spent on family stuff and cars and such over the coming year.

The important thing is that I keep my annual expenses (excluding the retirement savings), at least $10,900 below my annual income.

In my example, this means that I should not allow my annual expenses to exceed $48,200 – $10,900 = $37,300.

If I want to increase my expenses above $37,200, I first need to increase my income.

I’ll now provide a bunch of charts showing how much saving “X” per year will be in “Y” years. Let the math begin!

Suggested reading:

– How to Save $30,000 In One Year

– How To Save $8,000 In One Year

– How To Save $2,000 In One Year

Examples: How Much Saving “X” Per Year Turns Into

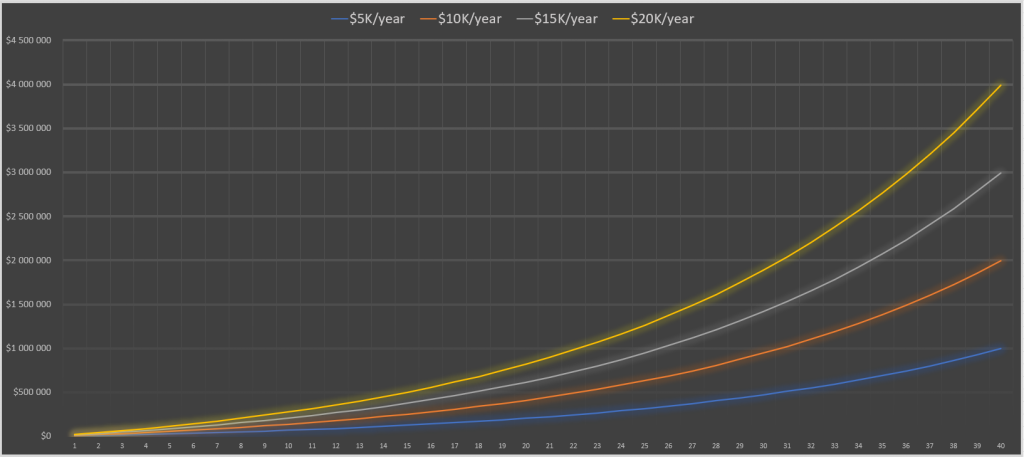

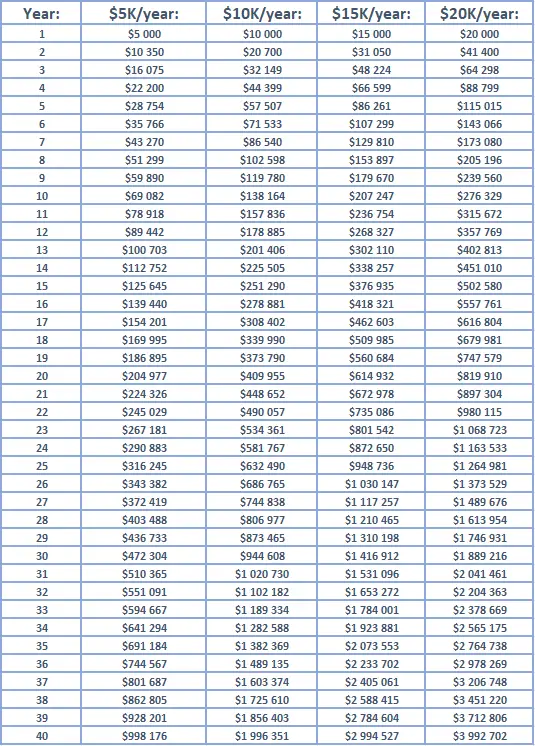

I’ll show you a chart with four examples. It shows how much saving $5K per year, $10K per year, $15K per year and $20K per year amounts to in up to 40 years.

The assumption is still that the average annual return is 7%. This is typical for broad index funds like The S&P 500.

Observations based on the chart above:

Saving $20,000 a year:

- Saving $20,000 every year for 22 years will make you a millionaire.

- If you save $20,000 a year for 40 years, you’ll have $4,000,000.

- Saving $20,000 a year for 33.5 years turns into $2,500,000. By the 4% rule, this is equivalent to retiring with an income of $100K a year.

Saving $15,000 a year:

- Saving $15,000 every year for 26 years will make you a millionaire.

- If you save $15,000 a year for 40 years, you’ll have $3,000,000.

- Saving $15,000 a year for 37.5 years turns into $2,500,000. By the 4% rule, this is equivalent to retiring with an income of $100K a year.

Saving $10,000 a year:

- Saving $10,000 every year for 22.5 years will turn into $500,000.

- Saving $10,000 every year for 30.5 years will make you a millionaire.

- If you save $10,000 a year for 40 years, you’ll have $2,000,000. By the 4% rule, this is equivalent to retiring with an income of $80K a year.

Saving $5,000 a year:

- Saving $5,000 every year for 30.5 years will turn into $500,000.

- Saving $5,000 every year for 40 years will make you a millionaire. By the 4% rule, this is equivalent to retiring with an income of $40K a year.

Exact numbers (data table):

Notice the difference between year 39 and year 40:

For the $20K/year example, the balance grows by roughly $280,000 in the last year alone. That’s more than saving $5K/year turns into in 23 years!

Conclusion: How Much You Should Save Per Year

To calculate how much you should save per year, follow these steps:

- Formulate your financial goals.

- Calculate your yearly (after tax) income.

- Calculate your average yearly expenses.

- Make a budget to reach your goals.

In my example, here’s what I did:

- Financial goal: have $2.5 million by age 65. My current age is 24.

- Yearly Income: $48,200

- Yearly Expenses: $21,260

- Leftover money every year: $48,200 – $21,260 = $26,940

- To reach $2.5 million by age 65, I need to put $10,900 of my leftover $26,940 into savings/investments.

I hope you found this article helpful!

– Oskar