If you’re a dip-buyer, DCA’er or swing trader you’re going to love this model:

It will take your investing to the next level, and decreasing your average buy-price, and increasing your average sell-price.

Basically, it tells you the risk of holding Bitcoin right now, on a scale from one to ten. Higher risk -higher chance of correction. Lower risk, lower chance of correction.

In this article I’ll go through how to use it, as well as why you should use it.

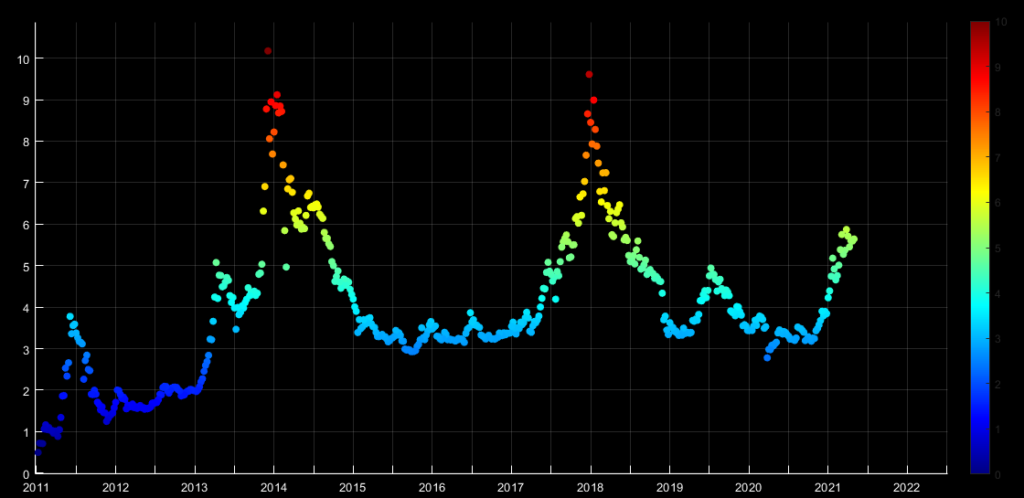

The Risk Model – Bitcoin

This models shows to the risk of investing/holding Bitcoin at any given time, but what does that mean?

1) On a scale from 1-10, it shows you how likely it is that right now is a good time to buy Bitcoin. Lower risk levels = better buying opportunities.

2) It also tells you how likely it is that Bitcoin will experience a major correction. If the risk is high, it’s more likely. If the risk is low, it’s less likely.

3) It also tells you when to sell, for maximum profit. High risk levels = best selling opportunities.

This is what it looks like:

The risk is shown on the left y-axis, and it’s also colorcoded. Dark blue = risk level 1, dark red = risk level 10.

We see that the peaks we had in 2013 and 2017 both reached a risk level above 9.

Right now, 12. of April 2021, we’re at a risk level of 5.7, giving us plenty of room to grow.

However, the risk level will shoot up like it did in 2017, if the Bitcoin rally continues.

You need an exit strategy. When Bitcoin crashes, it happens way faster than you think.

How You Should Use The Risk Model

This model is extremely useful for Bitcoin investors. One way of using it, is to “dynamically dollar cost average” according to the risk levels.

Let me explain:

Let’s say you investment strategy is dollar cost averaging. Every month, you invest $1000 into Bitcoin. That’s a decent strategy, but it could be improved a lot:

What you want to do is to get your “average buy-price” as low as possible, to increase ROI.

The way to do this, is to adjust the amount you invest every month, based on the risk level.

You want to invest more when the risk level is low, and less when the risk level is high.

A practical example of a strategy using The Risk Model:

| Risk Level: | Invested Amount: |

| 1 | Invest $4000 |

| 2 | Invest $2000 |

| 3 | Invest $1000 |

| 4 | Invest $500 |

| 5 | Invest $250 |

| 6 | Hold |

| 7 | Sell 5% of your BTC |

| 8 | Sell 15% of your BTC |

| 9 | Sell 30% of your BTC |

| 10 | Sell 60% of your BTC |

Do you see how useful this model is? It makes investing in Bitcoin so much easier.

You’re no longer relying on speculative price predictions, your gut feeling, or some random youtubers thoughts on the market.

Everything you need to do is to check this model, and invest/sell according to the risk level. Easy as that!

Receive Updates on This Model Every Week

In my newsletter I send weekly updates on all my models, together with in depth technical analysis on Bitcoin, Ethereum, Cardano and Chainlink.

From time to time I also talk about other altcoins like Vechain, Uniswap and Polkadot.

You also get sneak peeks into my personal portfolio.