The cryptocurrency market shows no mercy. It will eat you alive if you’re not prepared. The only way to survive, and profit, is to have a well formulated crypto investing strategy. In this article, we will analyze three strategies to find the best crypto investing strategy for beginners.

Why You Need a Strategy

It’s simple, really. You need a strategy to prevent emotional behavior. It’s hard to act rational when the market is going crazy. In crypto, it’s even hard to stay rational on regular days, due to the extreme volatility.

A well formulated strategy, with clear actionable steps, can act as a guiding light when the fog of emotions block your vision. When you feel the FUD (fear, uncertainty and doubt) after a sudden crash, or FOMO (fear of missing out) after a surge, the strategy is like a father telling you “stay calm now, eyes on the price.”

Simply put, everyone, including beginners, need a crypto investing strategy to optimize two things: average buy-price and average sell-price.

You want to get in as low as possible, and get out as high as possible. That’s hard to do, but a strategy makes it much easier.

What a Good Strategy Looks Like

A good strategy consists of to things: Actionable, clear and unambiguous steps, and a specific, well formulated measurable goal.

“I’m gonna buy low, and sell high” is NOT a strategy. One might actually call that a goal, but it’s certainly not a strategy. There are no unambiguous, actionable steps. When is the price high? When is the price low?

To create a good strategy we need to start with setting a goal. This goal needs to be specific and measurable. “I want to be rich” is not specific and measurable. “I want to have a net worth of one million dollars” is better.

After we’ve set a goal, we need to plan actionable steps we can execute in order to reach the goal.

“I will buy low” is not a well formulated step. “I will buy when the price is below 50 000 USD” is better, but not good enough. “I will buy 100 USD worth of crypto every week the Bitcoin price is below 50 000 USD” is is what you want to aim for.

Now, the strategy that we’ve created in this example is example is:

GOAL :

1 000 000 USD Net worth

STEPS:

1) Buy 100 USD worth of Bitcoin every week the price is below 50 000 USD.

2) Hold until it’s worth 1 000 000 USD

This is not a complete strategy, but you get an idea of what a good strategy looks like. The goal is specific and measurable, and the steps are actionable and clear. To complete this strategy, we would need one more step; selling.

Let’s take a look at three crypto investing strategies for beginners and how you can implement them in your life. These strategies are popular and easy to follow.

Crypto Investing Strategy #1 – HODL

HODL means to hold on for dear life. This is probably the most common strategy for average people. However, HODL’ing is actually not a strategy, but a philosophy, as it lacks a clear goal.

What you need to do is to figure out what your goal is, like we did in the last part. Preferably a USD target you want your portfolio to reach.

Subscribing to the HODL philosophy, you want to dollar cost average (invest a specific number of USD every single week/month) no matter what the price does.

You dollar cost average until your portfolio reaches the seize that your goal specifies, and then you sell it.

Let’s look at an example of a crypto investing strategy that follows the HODL philosophy:

GOAL:

250 000 USD Net worth

STEPS:

1) Invest 1000 USD in Bitcoin every month

2) Sell when my portfolio reaches 250 000 USD

3) Reward myself with ice cream for following the strategy and executing the planed steps.

Is HODL’ing the Right Crypto Investing Strategy for YOU?

This strategy is by no means the best one, but it’s the simplest. HODL’ing is the ultimate “set it and forget it” strategy.

If you hate checking prices and keeping up with the news, this is the strategy for you. If you want to put in as little work as possible, but still reap a nice profit, you should HODL.

However, if you want to squeeze out some more gains, you should consider a more active approach. I would advice you not to HODL, but to follow one of the following strategies. Only HODL if you don’t want to put in any work what so ever.

let’s take a look at another popular crypto investing strategy for beginners:

Crypto Investing Strategy #2 – BTD

BTD means to “Buy the dip”. Buy the dip, means to invest when the price drops. This strategy is similar to the HODL strategy, but it’s slightly more active.

Remember, the HODL philosophy tells you to dollar cost average the same amount of USD into the market every single week/month no matter what the price does.

BTD however, tells you to invest more when the price is going down, and less when the price is moving up.

What you want to do is to start dollar cost averaging into the market every week/month, but change the amount you invest depending on the price change.

Has the price fallen since your last investment? Consider increase the amount. Has the price increased since your last investment? Consider decreaseing the amount.

Let’s look at an example of a crypto investing strategy build on the BTD principal:

GOAL:

250 000 USD Net worth

STEPS:

1) Invest in Bitcoin at the first of every month.

2) Invest 750 USD in Bitcoin if the price is higher than the previous month. Invest 1500 USD in Bitcoin if the price is lower than the previous month.

3) Sell when my portfolio reaches 250 000 USD

Is BTD the Right Crypto Investing Strategy for YOU?

BTD seems to perform better than HODL in the long run, as it gives a lower average buy-price. However, to acheive this you need to do two things:

1) Activly check prices and follow the market to some degree.

2) Decide how much you’re going to invest at the different price levels.

Some people find this exhausting, or just to complicated, and that’s alright. However, if you’re willing to put in the work, this strategy would be advantageous – giving you a higher ROI.

Crypto Investing Strategy #3 – ST

ST means “swing trading”, which is the most profitable strategy in this list by far. However, it requires some skill and effort.

A swing trader takes advantage of the long-term trends of the market. He accumulates during the downtrends, and sells during the uptrends. In other words; a swing trader buys and sells at strategical prices to maximize his ROI in the given time-frame.

It’s important to note that he trades the long-term trends, not the day-to-day movements. He typically establish a position, holds it for a few months, and start selling gradually over a few weeks.

Let’s look at an example of a crypto investing strategy based on swing trading:

GOAL:

250 000 USD Net worth

STEPS:

1) Invest 750 USD in Bitcoin per 5000 USD the Bitcoin price is below 50 000 USD.

2) Sell 750 USD of Bitcoin per 5000 USD the Bitcoin price is above 50 000 USD into cash or stablecoins.

3) Sell everything when the portfolio reaches 250 000 USD.

Is ST the Right Crypto Investing Strategy for YOU?

Successful swing trading by far outperforms the other two strategies. It produces high returns by consentrating buy-action during lower prices, and takes profits when the prices are high. The profits taken at high prices can be re-invested when the price comes down.

Swing trading is right for you if:

1) You’re willing to learn, and put in the necessary effort.

2) You’re able to stay rational when the price plunges.

This strategy is the most complicated of the three, and it’s the hardest one to follow. However, it’s not like you either succeed or fail – Swing trading has degrees of success and failure.

Therefore, you don’t have to be an expert to make outsized retuns swing trading. You only have to be decently efficient, and learn from your mistakes to improve over time.

Pros and Cons of Swing Trading

Swing trading is a double edged sword. Done right, it produces high returns, but there’s a risk that follows. There’s the risk of losing money, as well as the risk of missing out on making money.

A person that buys the dip (BTD), or holds on for dear life (HODL) only has the fist of those risks, but not the last one. They never risk not making money, or missing out on a market uptrend, as they do not trade the market in the same way as the swing trader.

Swing trading also takes some skill. One has to be able to read price charts, and follow a few metrics to know when to buy and when to sell. This can be hard, especially if you’re a beginner.

However, a successful swing trader can make amazing returns. Let’s look at just how much more money a swingtrader could make than the other two strategies in a practical example, through 2020:

SW vs. BTD vs. HODL – Simulating The Different Strategies

Let’s simulate three people using the three strategies through 2020 to approximate the difference in ROI between the three strategies.

First, let’s make a few assumtions:

1) Each person has 12 000 dollars to invest.

2) They execute their strategy reasonably well.

Results of HODL

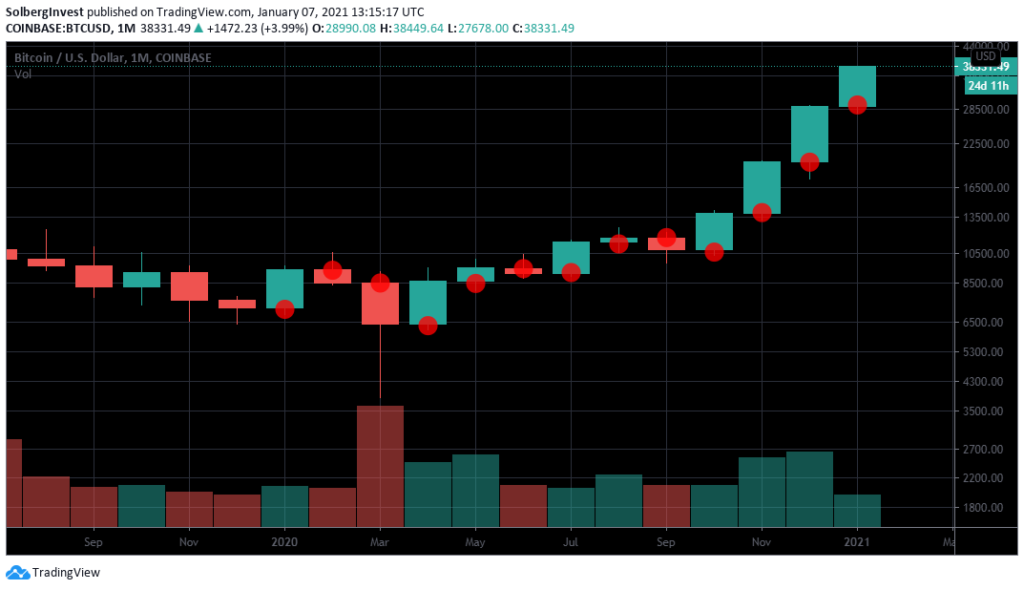

Below you see the Bitcoin price through 2020. Each candle represent one month of price action. The red dots represent the buying of the HODLer.

Since this guy is dollar cost averaging the same amount every month, the red dots represent a 1000 USD investment. They are all on the 1. of the month.

I’ve calculated the average amount of BTC accumulated in each buy, and it turns out to be 0.1032 BTC.

This gives him a bag of 1,2384 BTC at the end of the year.

This means that the average price the HOLD’er has payed for his Bitcoin is 9 689 USD.

Also, at the end of the year, his portfolio will be worth 35 832 USD, giving him an ROI of 2.98.

Results of Buy the Dip

The dip buyer invests different amounts at different prices. This makes it harder to simulate. We assume that he has a startingpoint of investing 750 USD, and 1500 USD whenever the price decreases from the previous month.

In other words; he’s investing 750 USD 01.01.2020, 750 USD 02.01.2020, 1500 USD 03.01.2020 etc. He will have invested the 12 000 USD within november, meaning he does not invest anyting in december.

The blue dots below represent his buying activity:

The average amount of BTC accumulated each month inculding December is 0.1070.

This gives him a bag of 1,2845 BTC at the end of the year.

This means that the average price the HOLDer has payed for his Bitcoin is 9 341 USD.

Also, at the end of the year, his portfolio will be worth 37 166 USD, giving him an ROI of 3.09.

Returns of Swing Trading

Let’s take a look at the typical buying pattern of a swing trader. The yellow dots represent 1000 USD investments:

As you can see, he does not dollar cost average in the same way as the other two strategies, but instead invests whenever he deems the price low.

No actual swing trader has the exact buying pattern as seen above, but it represents a typical, decent swing trader who has executed his strategy of taking advantage of the lower prices.

The average amount of BTC accumulated each month, inculding the months he didn’t invest, is 0.1191.

This gives him a bag of 1,4291 BTC at the end of the year.

This means that the average price the HOLDer has payed for his Bitcoin is 8 396 USD.

Also, at the end of the year, his portfolio will be worth 41 348 USD, giving him an ROI of 3.44

Comparing the ROI Of The Strategies

Through out 2020 the ROI of the different strategies:

HOLD: 2.98, BTD: 3.09, ST: 3.44.

It’s clear that the more complicated strategy pay of. If the extra effort and required skill is worth it is for you to decide.

Let’s calculate just how significant the difference in ROI is. We know that the formula for finding the difference looks like this:

Difference in ROI = ROI_1 / ROI_2.

Now, let’s go through them:

BTD vs. HODL:

3.09 / 2.98 = 1.037 = 3.7%.

This means that buying the dip gave an ROI 3.7% higher than HODL.

3.7% might not sound like a lot, but when the numbers get big, 3.7% is worth the minimal effort it takes to go from HODL to BTD. After all, the only difference is that the dip buyer lowers the inital sum, and doubles it every month that the price has decreased with repect to the previous month.

ST vs. BTD:

3.44 / 3.09 = 1.113 = 11.3%.

This means that swing trading gave an ROI 11.3% higher than buying the dip.

11.3% higher ROI is a big deal. However, the effort it takes to swing trade is much higher than the effort it takes to buy the dip. One has to activly check the markets, as well as make emotionally hard decisions to invest a lot of money when the markets are in the red.

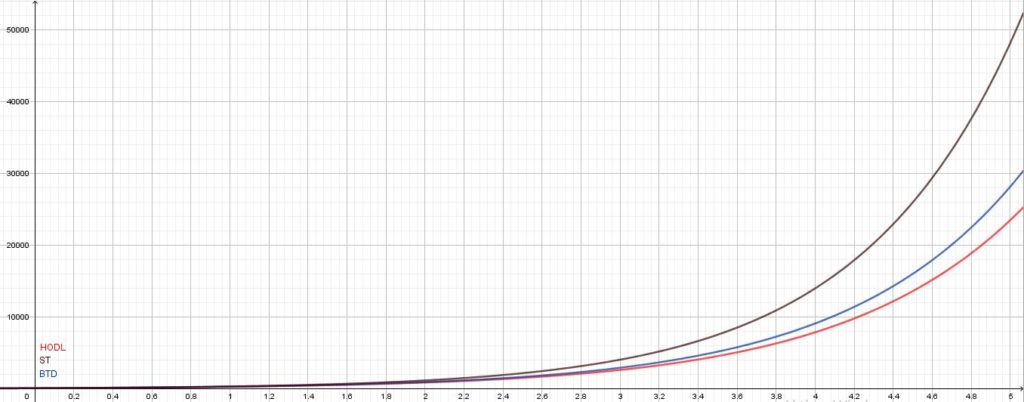

To illustrate the huge difference in ROI over time between the different crypto investing strategies for beginners, we can plot the ROI’s as functions of time, assuming that the difference in ROI remains constant.

Below you see three different functions representing the expected ROI of the three strategies over a five year period:

(The upper line represent the ROI of swing trading. The middle line represents buying the dip, and the bottom line represents HODL’ing)

We clearly see that one of the strategies outperform the others. Swing trading is the clear winner in terms of ROI.

HODL and BTD are fearly similar, but there is a significant advantage for BTD.

Conclusion

It seems to me that unless one finds investing an exchasting and dreadful activity, one should always follow BTD over HODL.

Buying the dip takes a tiny bit more effort, but increases the ROI significantly. Also, the increase in ROI will compound over the years, increasing the returns exponentially.

Swing trading is by far the best strategy in terms of ROI, but it takes effort and skill. For this reason, beginners might find it hard, or confusing. However, in the long-term, swing trading produces an exponentially higher ROI than both HODL and BTD.

Therefore I conclude with this:

Abosulte beginners should focus on buying the dip. If checking the market once per month is to much work, they should HODL. People with more experience, and a willingness to work, should consider swing trading, as it produces increased ROI.

Want to Increase Your ROI Even More?

There are other ways to increase your ROI than merely following the strategies discussed above.

I’ve written a free guide, showing four easy ways to increase ROI. I know that they work, as I’ve implemented them in my own strategy.

These Methodes Can Increase Your ROI with up to 400%:

Suggested Reads to Further Develop Your strategy:

Fundamental to all strategies are price predictions. Below you you find my price predictions for Bitcoin and Ethereum:

Also, when making a strategy you need to map out where we are in the Bitcoin cycle. The article linked to below shows you how to tell if Bitcoin is in a bullmarket: