A light-bulb flashed over my head the first time I really understood the effects of the Bitcoin halving on the price of Bitcoin.

Knowing what the Bitcoin halving is and how it affects the price is essential for anyone seeking to understand Bitcoin.

The short answer:

The Bitcoin halving causes a shift in the supply/demand balance, leading to an exponential rise in the price of Bitcoin. This happens every four years and is the backbone of the value of Bitcoin. In addition, it also sparks a hype cycle, pushing the price even higher, eventually leading to a price crash of 80%-90%.

In my opinion, it is the backbone of Bitcoin’s value and the main reason why more and more people, institutions, and governments keep throwing money at it.

Simply put, the Bitcoin halving is an event happening every four years that decreases the reward that miners receive for hashing blocks and validating transactions.

Why does cutting the rewards miners receive in half every four years make Bitcoin more valuable? Why should you care about this?

Because it creates scarcity, exponentially increasing the value of Bitcoin.

We’ll go over all the necessary aspects of Bitcoin mining and Bitcoin fundamentals to give you a complete understanding of the Bitcoin halving. If you’re familiar with what the halving is, skip this part.

Bitcoin Mining – How it is Affected by The Bitcoin Halving

Bitcoin mining consists mainly of two things; validating transactions and hashing blocks.

Validating Transaction

Whenever someone transacts BTC, information about that transaction is double-checked by miners. The wallet address of the sender and receiver, the time and date, and the amount of BTC transacted.

The Bitcoin miners then decide if the transaction happened the way it was registered.

Then, Once the transaction is verified, it’s placed in a “block”. A block is basically a bunch of chunked-up information about a few thousand transactions.

So, miners double-check all BTC transactions, and place information about them in blocks.

The next step is to add this block to “the chain”, which is the public database everyone can check out.

For a block (information about a few thousand transactions) to be added to the chain (the public database), it first needs to be “hashed”.

Hashing Blocks

This is essentially a guessing game with up to trillions of possible answers:

Bitcoin miners are trying to find the correct “hash” – a string of numbers/characters unique to each block. The miner that finds the correct answer receives a reward in the form of BTC, called the “block reward”.

The difficulty of Bitcoin mining, specifically, the difficulty of the guessing game of hashing blocks, depends on the number of computers trying to guess it (total computing power of the network of miners).

If the number of miners goes up, the difficulty goes up. If the number of miners goes down, the difficulty goes down.

This ensures that each block takes approximately ten minutes to hash, no matter how much CPU you put into it.

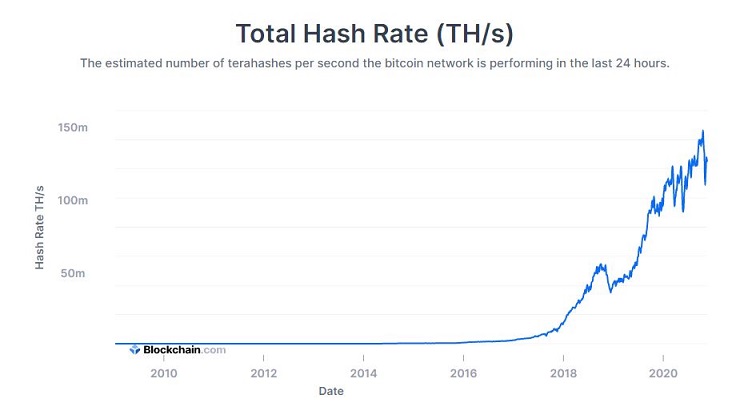

The chart below shows us the total computing power of the network measured in Terra Hashes/second. It’s safe to say that the 2017 bull run sparked a Bitcoin mining mania. (Source: Blockchain.com)

Now, where does the halving come in?

Remember, the halving is an event where the block rewards are cut in half. This means that hashing blocks produce half as much BTC as it used to.

If you find these things interesting, you need to read this article: Will Proof of Stake Kill Mining?

That sounds like a bad thing, but it’s actually the backbone of Bitcoin’s value.

Suggested reading: What is Blockchain Technology?

How The Bitcoin Halving Affects the Block Rewards

We established earlier that “block rewards” are the BTC that miners receive for hashing blocks.

Now, what the halving actually does is cut the block rewards in half.

Also, we have Bitcoin halvings every four years or so.

This means that the profitability of mining Bitcoin is exponentially decreasing, at least in terms of BTC.

Why then, is the total computing power of Bitcoin miners exponentially increasing?

Why do more and more people mine Bitcoin when the rewards are cut in half every four years?

The fact that the Bitcoin network’s computing power is only increasing tells us that miners have long-term faith in the price of Bitcoin.

This is why:

Even though the BTC reward is cut in half every four years, it doesn’t mean that the USD value of the received block reward is decreasing.

In other words, miners believe that the price of Bitcoin will more than double every four years. If they didn’t, it would be absurd to invest millions of dollars into mining equipment.

The halving of block rewards pushes the price of Bitcoin up:

Think about it, the only way to produce new Bitcoin is through mining, which is a big part of the selling pressure of the market.

Bitcoin miners create 50% less Bitcoin every four years, effectively cutting the supply (selling pressure) from miners in half.

Given a constant demand, the price must increase, given the laws of economics.

In fact, the halving is what started the last two bull markets, pushing the Bitcoin price up several thousand percent.

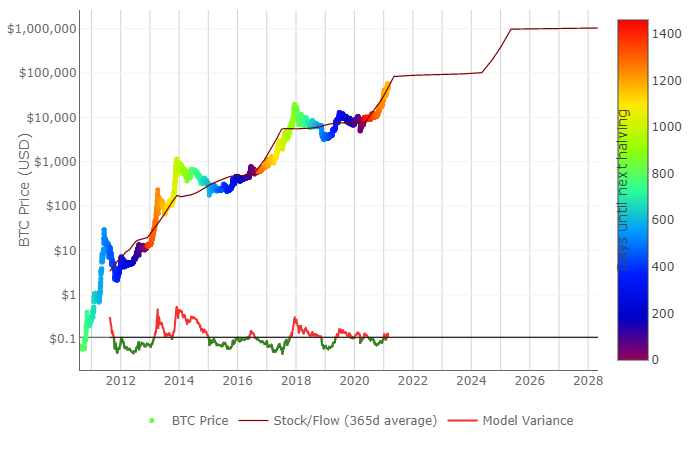

Below you see a chart of the Bitcoin price together with vertical lines representing the previous Bitcoin halvings:

As you can see, the price doesn’t react instantly to the halvings, but it starts increasing exponentially after some time.

It has to increase due to a lack of supply, given the constant/increasing demand.

Let’s take a closer look at them, one by one:

First Bitcoin Halvings Effect on Price

The first Bitcoin halving took place at the end of November 2012, cutting the block rewards from 50 BTC to 25 BTC.

This means that miners went from receiving 50 BTC per block hashed, to 25 BTC per block.

Let’s zoom in on the chart and look at what we can derive from it:

I’ve measured the price increase from the halving to the peak, as well as how long it took to get there. As you can see, Bitcoin gained 10 000% over 52 weeks. It went from a price of 11.5$ to 1148$ – approximately 100x in one year.

Second Bitcoin Halvings Effect on Price

The second Bitcoin halving took place in July 2016, cutting the block rewards from 25 BTC to 12.5 BTC.

Let’s zoom in on the chart and look at what we can derive from it:

The effect of the bitcoin halving was a price increase of 3000%, giving us 1/3 of the gains we got from the first halving. The time it took to reach the peak also increased, from 52 to 74 weeks – 22 weeks longer.

This indicates that the gains we receive are lower and slower.

The gains seem to be cut in thirds for each halving and take 5-6 months longer to reach the peak. This is highly speculative to suggest and is by no means “a fact”.

Third Bitcoin Halvings Effects on Price

The third Bitcoin halving took place in May 2020, cutting the block rewards from 12.5 BTC to 6.25 BTC.

Let’s zoom in on the chart and look at what we can derive from it:

I’ve theorized on what could happen if the gains decrease with 2/3 and take 22 weeks longer for each halving, and concluded:

The two previous halvings indicate that we will reach a Bitcoin price right around 100 000$ in 2022 – approximately 10x in 2 years.

As you can see above, the price has reacted to the halving, strengthening my belief that the halving, by necessity, increases the price of Bitcoin.

A guy who goes under the name “PlanB” tried to predict the price of Bitcoin after each halving, creating the legendary “Stock to Flow model”.

I’ll break down what “the stock to flow” means and show you the model:

The Stock to Flow of Bitcoin

The stock to flow of an asset tells us something about how much is produced vs. how much there already is of the given asset.

Specifically, it tells us how many years it would take to double the given asset’s supply at the current production rate.

In Bitcoin’s case, this means that a stock to flow of 10 would imply that miners need ten years to double the amount of Bitcoin in circulation at the current mining rate.

In other words, it’s a number that tells us how much Bitcoin is being mined relative to how much Bitcoin there already is.

A high stock to flow is good for price and stability and is often a sign of scarcity.

Currently, the stock to flow is 54.

This means that at the current speed of mining new BTC, miners need 54 years to double the supply of Bitcoin.

Now, this is why the halving is so fundamental to Bitcoin’s value:

The halving cuts block rewards in half, and therefore the production rate of Bitcoin in half, every four years.

This doubles the stock to flow every four years!

Stock to Flow and Price

When looking at precious metals, a higher stock to flow usually means a higher price. I made a chart showing the exponential relationship between stock to flow and market value.

Notice that the chart on the left shows a linear increase in stock to flow and the chart on the right shows an exponential increase in market value.

This tells us that a linear increase in stock to flow results in an exponential increase in price.

But here’s the thing: Bitcoin’s stock to flow doesn’t increase linearly, but exponentially! Think about that for a minute…

Gold is the metal with the highest stock to flow, which is the biggest reason it’s highly valued and acknowledged as a great store of value.

Now think about this:

After the next halving, Bitcoin will have a higher stock to flow than Gold!

Below you see the model created by PlanB, modeling the price of Bitcoin by the stock to flow. (Source: lookintobitcoin.com)

This model can be overwhelming, but stay with me.

Let’s go through it and see what we can learn about the bitcoin stock to flow and its relationship with the price:

Bitcoin Halving Effects on Price – Stock to Flow

We can see that the Bitcoin price has gone above the predicted price after both halvings we’ve had in the past. Remember, we had our first halving at the end of 2012, the second in the middle of 2016, and our last one in May of 2020.

The Stock to Flow model predicts that Bitcoin will, in this cycle, reach 100,000 USD. This strengthens our prediction by looking at the ROI from the previous halvings in the parts above.

We also see that we tend to overshoot the target and go far beyond the predicted price. This leads me to think that a price prediction of $100K is conservative, and $150K – $200K might be more realistic.

Effects of Bitcoin Halving – Conclusion

Again, the halving is the event happening every four years where the block reward miners receive for hashing blocks are cut in half.

This reduces the supply of Bitcoin and doubles the stock to flow.

After the next halving, the stock to flow of bitcoin will be greater than that of Gold.

We’ve seen how the historical effects of the Bitcoin halving have acted as a catalyst for the previous bull markets, and it seems like history is repeating itself.

Are you prepared for the bull market? Do you have a strategy for maximizing your returns?

Are YOU Ready?

I’ve created a guide on how to increase ROI (Return on investment). This metric is the most important factor when it comes to investing.

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is not the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on four easy ways to increase ROI.

I do all four of them myself, and know for a fact that they can increase ROI by up to hundreds of percent.