It took me three months to pull the trigger after I initially decided to invest in Bitcoin. I procrastinate, because I didn’t know how, where or when to invest in Bitcoin.

The main reasons I had for waiting to invest in Bitcoin was it’s complexity, and lack of legit guides.

The thing is that he crypto market waits for no one. It moves fast. For this reason I’ve created a simple, step-by-step guide on how to do it.

Bitcoin is probably one of the best investments you can make in 2021, so you better not commit the same mistake as I did!

How to Invest in Bitcoin – The Easiest and Best Ways

Back in the day, investing in Bitcoin used to be super complicated. Luckily, it’s easier than ever, and can be completed in 30 minutes.

How to Invest in Bitcoin – Step #1

There are tons of places to invest in Bitcoin. The most popular are Coinbase and Binance.

Coinbase is the easiest and most noob-friendly. Binance however, have much lower fees, and allow you to buy a bigger variety of coins.

If you don’t want to do research, and you just want to open an account to buy some damn Bitcoin – go with Coinbase.

To get the most bang for your buck by putting in some work, go with Binance.

If you pick Binance, be prepared to spend some time getting to know your way around the exchange and all the different parts.

Binance is not as noob-friendly as Coinbase.

The one I use myself, and the best one in my opinion, is crypto.com.

Yeah, their actually called “crypto.com”.

They are easy to use, have low fees, and a great supply of different coins.

What makes them the best, in my opinion, is the ecosystem built around the exchange.

Crypto.com Ecosystem:

1) Staking services

Gives you a weekly returns on you crypto assets, kind of like dividend stocks.

2) Lending services.

You need to put up crypto as security, and receive a loan – instantly!

3) Crypto visa card.

You receive it for staking their native token CRO for 6 months. They’ve got great bonuses like a cashback up to 8% as well as free spotify and netflix.

4) The Syndicate

A program where you’re able to get 25% – 50% discounts on Bitcoin, Ethereum and other currencies. Yeah, I know, it’s true.

I usually recommend crypto.com, as they score high on all the metrics. They are user friendly, have low fees, and have a great ecosystem built around them.

Sign up to Crypto.com to Invest in Bitcoin:

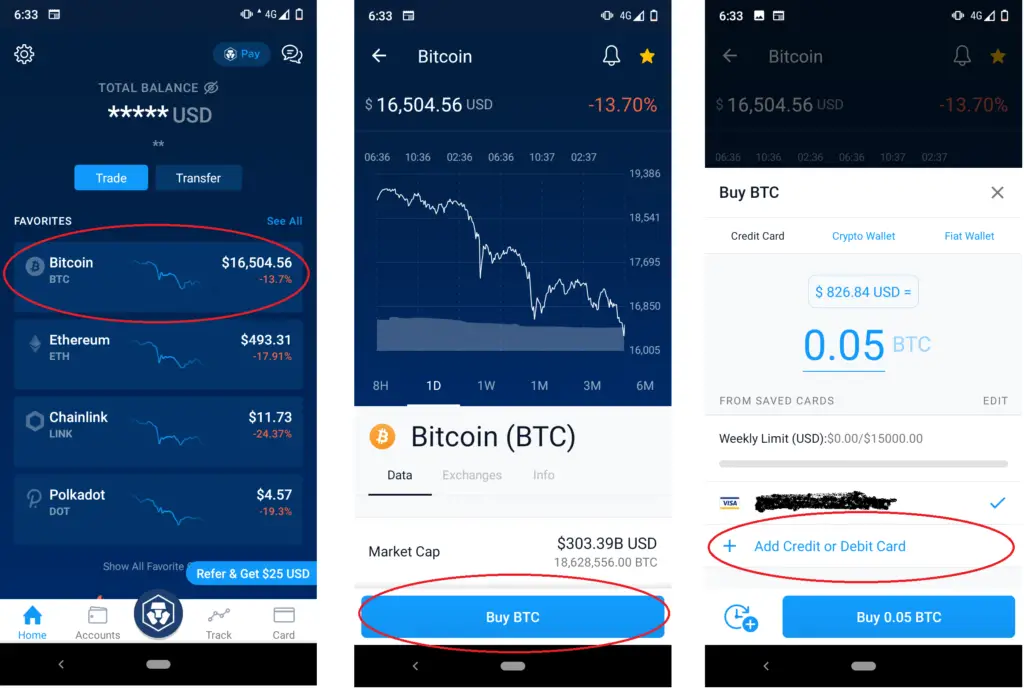

I highly recommend their app. Apps are way more intuitive to use than exchanges, and therefore better for beginners.

What You Need to Do:

1) Download their app “crypto.com” on your phone.

2) Sign up using my referral code:

Referal code: df6qegxu9q

Using my referral code, both of us will receive a reward after you sign up and start using them.

How to Invest in Bitcoin – Step #2

The next step is to actually invest in Bitcoin. You’ll have to choose between bank transfer of to buy with your credit/debit card.

The pros of bank transfer are lower fees, and that there’s a higher weekly limit to the amount of crypto you can buy.

In other words, if you’re planning to put hundreds of thousands in, do it by bank transfer.

The pros of using you card is that it’s easy and safe. You don’t risk sending money to the wrong place, as might happen when using bank transfer.

I usually recommend using your card if you’re just starting out.

What you need to do now:

You need to click on “Bitcoin”, then “Buy Bitcoin” and “Add Credit or Debit Card”

Finally, you only need to choose the amount you want to buy, and click the blue buy button below the add card button.

How to Invest in Bitcoin – Step #3

Now that you have your Bitcoin, you need to store it safely.

This is not an issue at first, but as you begin to accumulate assets of significant value, safety becomes a concern.

The most secure option is to buy a hard wallet, also known as a cold wallet.

A hard wallet is a place to store your crypto that’s not connected to the internet.

This way, you can’t be hacked. It’s kind of like a physically safe.

The hands down best hard wallets out there are delivered by Ledger. I usually recommend this one, as it’s the one I have myself.

If you’d like to keep you crypto safe, but not pay for the hard wallet, you can always go for a hot wallet.

Hot wallets are digital wallets kept as an application on your desktop, or online. These are locked with a password, preferably combined with something like google authenticator.

In other words, be sure to activate two step verification when using hot wallets to be safe.

I used a hot wallet for a long time. However, as my assets grew, I switched over to a cold one. It helps me sleep at night.

PS:

I have a free newsletter where I send out technical analysis on Bitcoin, Ethereum, Cardano and others. Also, you’ll get some free guides and reviews. Sign up for free below:

What now?

Now that you’ve invested in Bitcoin, and stored it in a safe manner, there’s only one thing left to do:

The last step is to HODL, meaning hold on for dear life.

It might sound like a joke, and it kind of is, but it’s really not.

A lot of people expect the market to treat them with mercy. Let me tell you; Bitcoin does what Bitcoin wants to do.

Even in bullmarkets we experience 20-40% drops in price.

Does this mean you should pack your bags and never look at Bitcoin ever again? Of course not!

We all know we should buy low, and sell high. Why then, do so many people do the opposite?

Why do so many people buy high and sell low?

It’s the fear that gets them. They buy high, in fear of missing out (FOMO), and sell low in fear of further depreciation (FUD).

Do not commit the same mistakes. Do not become the dumb money. Be part of the smart money. Hold on to your Bitcoin when the price drops.

After all, every single downturn we’ve had in a bull market so far, has been followed by an even greater upturn.

Be smart money. HODL.

Extra:

Only for serious investors

I’ve created a guide on how to increase ROI (Return on investment). This metric is the most important factor when it comes to investing.

When investing in traditional markets like stocks and bonds, there’s not too much you can do to significantly increase your ROI.

This is not the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on 4 easy ways to increase ROI.

I do all four of them my self, and know for a fact that they can increase ROI by up to hundreds of percent.