I’m being bombarded with questions about this; What are the best ways to invest in altcoins for a beginner? How do I research altcoins? Where do I buy altcoins?

I’ve decided to write an article covering all your questions in detail, so that you can safely dip your greedy toes into the enriching sea of altcoins.

Atlcoins: What are they?

Basically, Altcoins are every cryptocurrency that exists excluding Bitcoin. “Alt” is short for alternative, as in alternative to Bitcoin.

As you know, Bitcoin is the cryptocurrency, and everything else is beneath it. For this reason, everything else is just called an altcoin.

Why Invest in Altcoins?

Why should beginners care about what the best altcoins to invest in are? After all, Bitcoin is the king, right?

Well, that’s true, but the gains you can make from altcoins are larger than the gains you can make with Bitcoin investing.

In other words:

You want to invest in altcoins to increase your returns.

This comes with added risk of course, as altcoin are more volatile. However, if you can pick the right ones, your returns will be insane.

Historical Gains in The Altcoin market:

Let’s take a look at the gains you would have made by investing in altcoins vs. investing in Bitcoin in 2017.

Below you see the gains Bitcoin had in 2017:

Bitcoin increased 2500% through 2017, which is a 26x. If you invested $10 000 dollars, you would have been sitting on $260 000 after one year.

That’s a great ROI, and an achievement few can brag about. Altcoins however, far outdid Bitcoin.

Below you see the gains of the general altcoin market in 2017. Brace yourself, it’s totally insane:

Thats right, Altcoins increased a whopping 66 342%! That’s more than a 650x. Investing $10 000 in the general altcoin market would have made you over $6 500 000. That’s 6.5 million bucks.

Now, the question is how to pick the right altcoins. What do we look for, and where do we find them?

What to look for in Altcoins

It’s hard for beginners to find good altcoins to invest in. There are thousands of them, and they all promise they will change the world and make you rich.

At the same time, lot’s of bad altcoins are begin “shilled”, which means “pushed” or “advertised” in a dishonest way.

Different people in the crypto space constantly push new “great” altcoins to their followers. These coins are often just “the flavor of the day” and disappears the next week, leaving investors with a loss.

How the heck are you supposed to orient your way through this mess?

You need a checklist. You need a standardized way to analytically go through an altcoin, and compare it to others. That’s hands down the best way to go about it.

The Altcoin Investing Checklist

When analyzing altcoins, you need to have a checklist. This is to make sure that you don’t act on your emotions, and that you have a legit way to compare them to each other.

This is what my checklist looks like:

I like to go through all the point on the list, and rate each on from 1-10. This gives me an overall idea of the altcoin I’m researching.

What you need to do is to pick a few altcoins you’ve heard of, and go through the list. After a while, you’ll find a few good ones.

Then, you need to look at the price, and the potential they have. Is now a good time to buy? Should you dollar cost average? Should you lump sum invest?

If you want to find the best strategy for investing in altcoins, read this article:

Crypto Investing Strategy For Beginners: Three Easy to Follow Strategies

Now that you’ve got a few altcoins you want to invest in, you need to figure out where to buy them.

Where to buy Altcoins

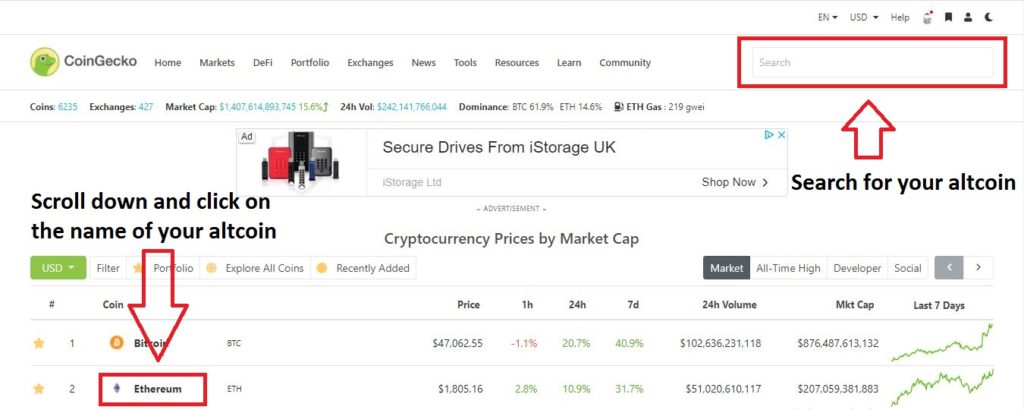

To find out where to buy altcoins, first you need to go to coingecko.com, or coinmarketcap.com.

In this example, I’ll be using coingecko.com to show you how you can figure it out.

I’ll pretend I do not know where to buy Ethereum, and show you how I would go about figuring it out, step by step:

STEP #1

Coingecko.com lists all cryptocurrencies ranked by market cap (total value of all the coins combined). On the first page you’ll see the top 100 coins, which is where you want to look if you’re a beginner.

You can also search for coins in the top left corner on the home-page. Be sure to search for the token/coin (ETH), not the name of the company/organization behind it (Ethereum).

Or, you can just scroll down and look for it.

What you need to do is to click on the altcoin that you want to figure out where to buy.

In my case, this is Ethereum, which is the number two coin, and therefore easy to spot right away. I therefore click on Ethereum.

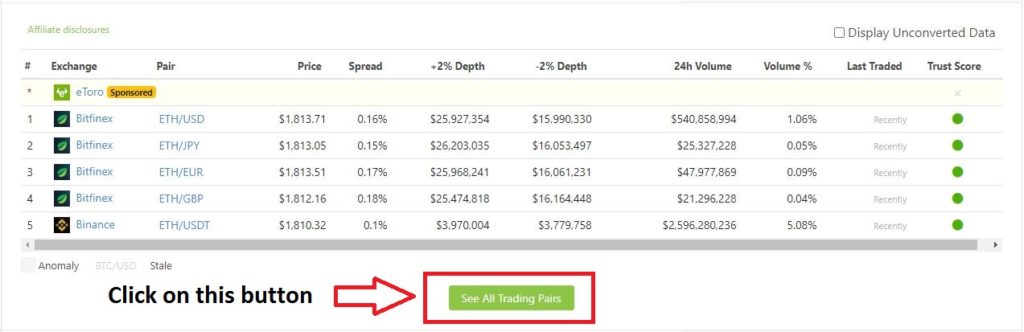

STEP #2

What you first see after clicking on your altcoin is the price. Scroll down, and you’ll see a chart. Scroll even further, and you’ll se this:

Click on the “See all Trading Pairs”

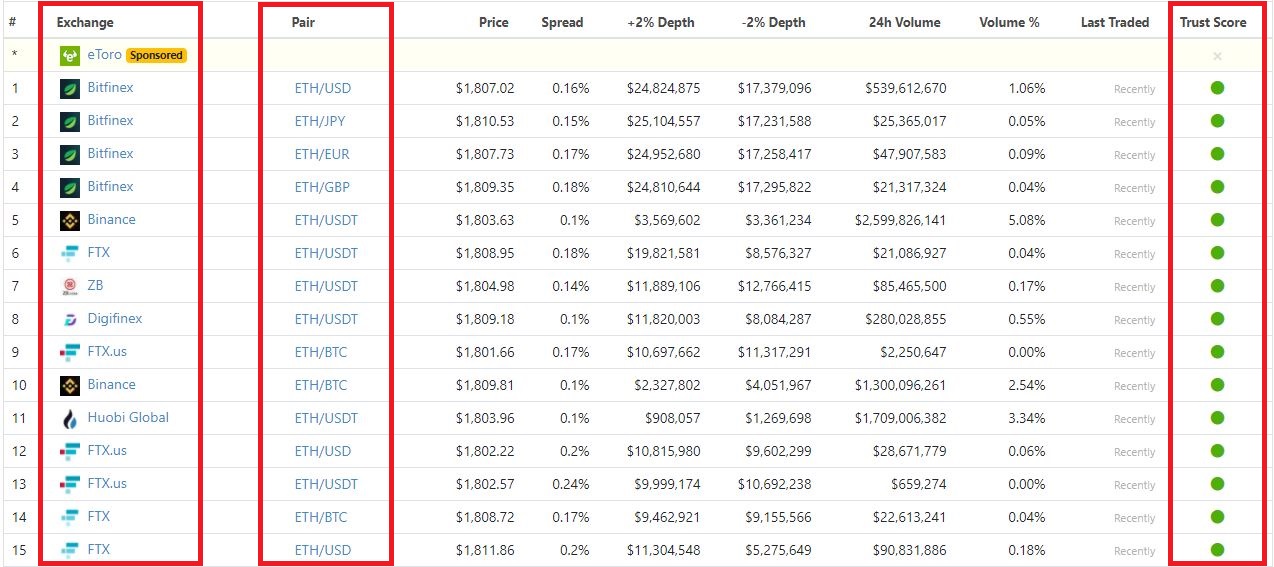

STEP #3

I know this looks intimidating if it’s your first time, but stay with me. What you’re seeing is the different “trading pairs” for your altcoin.

Trading pairs tell you what coins you can exchange for the given altcoin. Generally, most coins can be exchanged with BTC and/or ETH and/or stablecoins, which means that you’ll need to buy BTC, ETH or a stablecoin like USDT or USDC, and exchange that into the altcoin you want to buy.

All the information you need is now right in front of you. All the different trading pairs, and the different exchanges is on that list.

Let’s take a look at it:

On the far left side you see the name of the exchanges.

On the far right you see the “trust score”. Make sure it’s green!

On the second from the left, you’ll see the different trading pairs. Make sure that you’re able to make the exchange.

Most coins you’ll want to buy, you can find on Binance, Crypto.com, Bitfinex and Kraken. These are exchanges I have used my self, and trust.

RECAP:

1) Go to coingecko.com, search or scroll down to find the coin you’re researching and click on it.

2) Scroll down below the price chart and click on “All Trading Pairs”

3) Look at the different exchanges on the left side, and the trust score on the right. Decide where you want to buy the altcoin.

How Much Should You Invest in Altcoins?

This is a tricky one, as it depends on the investor in question. It all depends on how much risk you’re willing to take on.

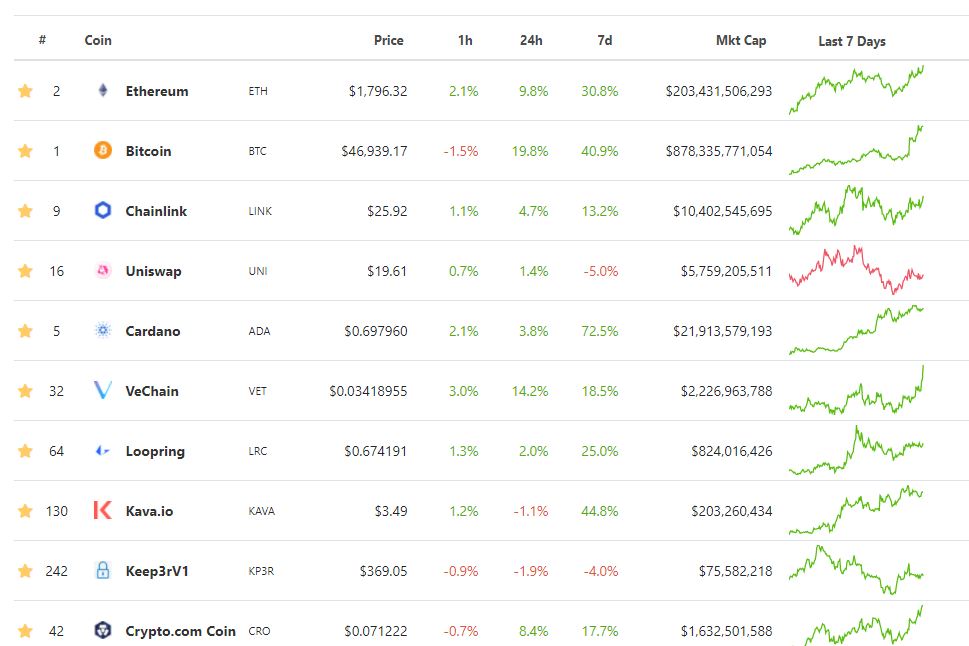

It also depends on the coin, as smaller coins carry more risk. I like to divide between big-caps, mid-caps and small-caps. Big-caps are projects with big market caps like Ethereum and Litecoin. Mid-caps are projects like Uniswap and Monera. Small-caps are projects like Enjin Coin and Matic Network.

Using CoinGecko, the top 10 coins are big-caps, 10-30 mid-caps and 30-120 small-caps. Below that you find the micro-caps. Stay away from them, unless you know what you’re doing.

The Bitcoin Dominance

The Bitcoin dominance is the most important metric to follow when investing in altcoins. It’s the percentage of the total cryptocurrency market that lies in Bitcoin.

The Bitcoin dominance tells you if altcoins are cheap or expensive, if you know how to read the chart.

If the Bitcoin dominance is 60%, it means that 60% of the total crypto market cap is in Bitcoin.

If the dominance is high, it means that altcoins are generally cheap. In the other hand, if it’s low, altcoins are expensive, relative to Bitcoin.

Looking at the chart of the Bitcoin dominance, we can try to predict if it’s going up or down in the future.

If it looks like the Bitcoin dominance is going down in the future, it’s implies that altcoins will outperform Bitcoin. If it looks like it’s going up, Bitcoin will outperform altcoins.

This is a prediction I sent out in my newsletter at the beginning of January:

This letter is from 04. of January 2021. It basically says that the Bitcoin dominance is likely to move down, and that altcoins will outperform Bitcoin in the short-mid term.

Since then, the altcoin market has doubled, with some of the altcoins we talk about in the letters surging with more than 300%.

I provide regular updates on this metric to my newsletter subscribers. It’s totally free, and without spam. Download my free guide to subscribe.

Click the button below to sign up, and claim my free guide:

What altcoins I have Invested in:

I’ll let you have a sneak peak into my personal portfolio. Remember, this is what I currently own, not necessarily what I own when you read this article.

Most of my positions are long term holds, but a few of them are short to mid term trades.

How To Master Altcoin Investing:

The secret to investing in altcoins is to stay ahead of the curve. Instead of putting endless hours into the bottomless void of altcoin research, let me do it for you!

Get exclusive information about market trends and predictions about altcoins like LINK, ADA, ETH and more; download my free guide, and subscribe to my newsletter for now:

Some of you might notice that I’ve got more Ethereum than Bitcoin at the moment. This is simply because I moved a lot of Bitcoin into Ethereum in December/early January, and the Ethereum price doubled right after, and has now tripled.

I did in fact talk about that in my newsletter as well. I notify my followers about all my moves, the good and the bad. I value transparency and openness.

Sign up and get my free guide to increase your ROI below:

Looking For the Best Investing Strategies?

I recently published an articles analyzing the three best Cryptocurrency investing strategies for beginners: