As a math student (and nerd) I spend a lot of my time looking at mathematical models predicting the future price of Bitcoin, and I always look for new Bitcoin models.

Well, I’ve taken it a step further:

I made two new Bitcoin models for 2021-2024, maybe even longer. One of them is a logarithmic band, similar to the logarithmic growth curves. The other model is based on the stock to flow of Bitcoin, gold, silver, platinum and palladium, and shows the fair value, what Bitcoin “should” be priced at, at any given time.

I’ll go through them in this article, and show you why I think they’re useful for Bitcoin investors. Let’s start with the “fair value” one:

The Fair Value S2F Model (Fair value of Bitcoin)

This one is a complete original. It’s inspired from the stock to flow model by PlanB, as the stock to flow plays a major role in this model.

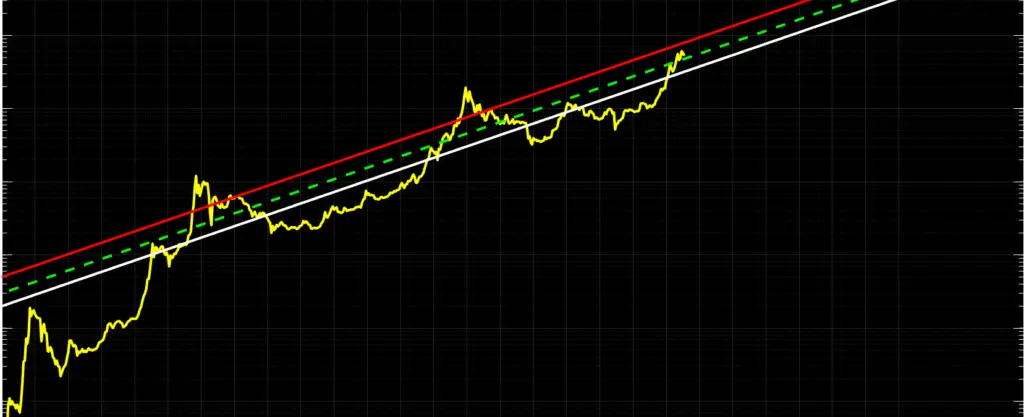

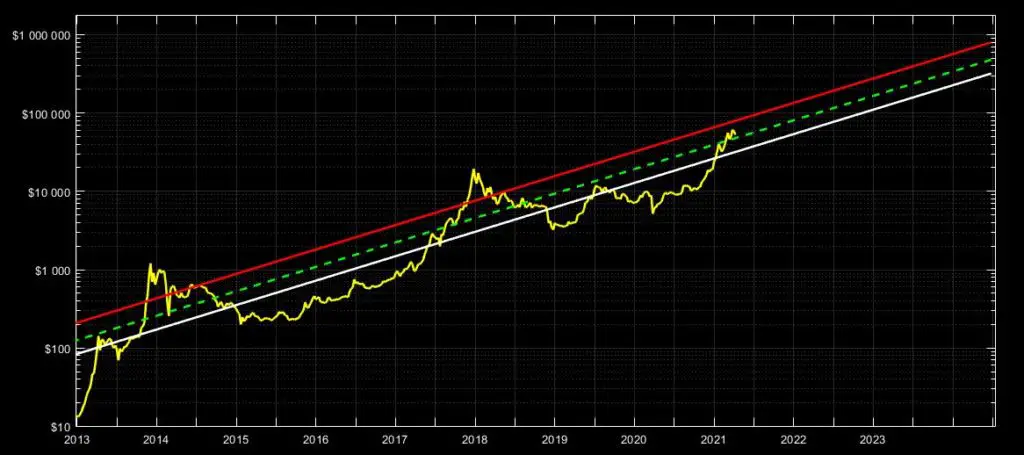

This is what it looks like:

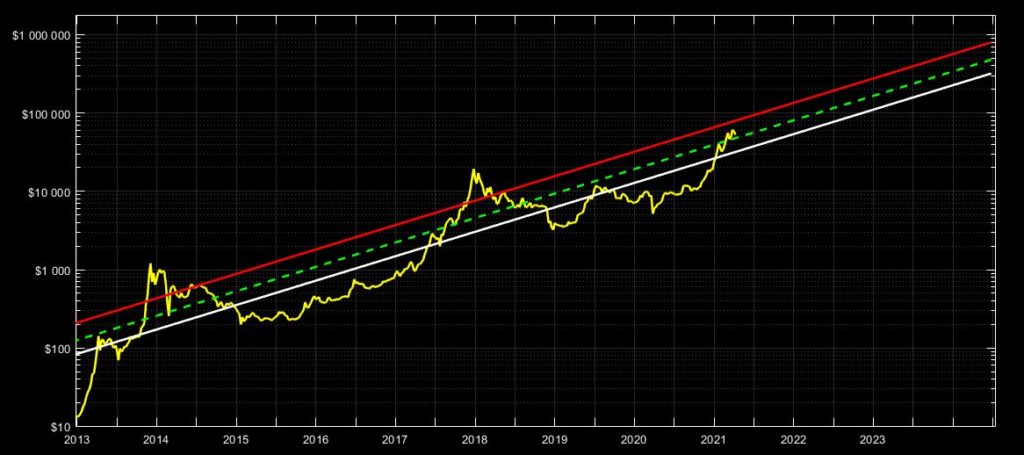

(You can see the price on the left vertical axis, notice that it’s on a logarithmic scale (every tick up is a 10x).)

How to Read This Model:

1) The green dashed line is the “fair value” of Bitcoin, or what the Bitcoin price should be in a rational market.

2) If the Bitcoin price is below the white line, Bitcoin is “cheap”, or “over-sold”

3) If the Bitcoin price is above the red line, it’s “expensive”, or “over-bought”

How I’m Using This Model:

1) If the price is within the red and white line, at it’s fair value, I will slowly accumulate, or hold, Bitcoin.

2) If the price is below the white line, I will aggressively accumulate Bitcoin.

3) If the price is above the red line, I will gradually sell Bitcoin.

It’s an easy-to-use model, even though the technical of how it’s made is complicated. All you need to do is check it from time to time, and invest according to the three points above.

It takes the guess-work out of the picture, and bases my investing on mathematics and historical data, which is much better than sticking your finger in the air or “betting” on a further price increase.

Why this is the fair value of Bitcoin:

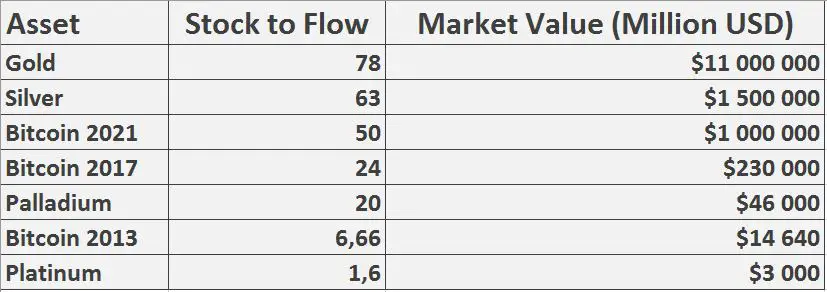

I gathered data about the supply (stock) and mining rate (flow) of several commodities, as well as historical numbers for Bitcoin, and made this data table together with the respective market value: (sources: Statista, coinworld, providentmetals, companiesmarketcap, Bitcoin.com, Metals/Medium, and a few others)

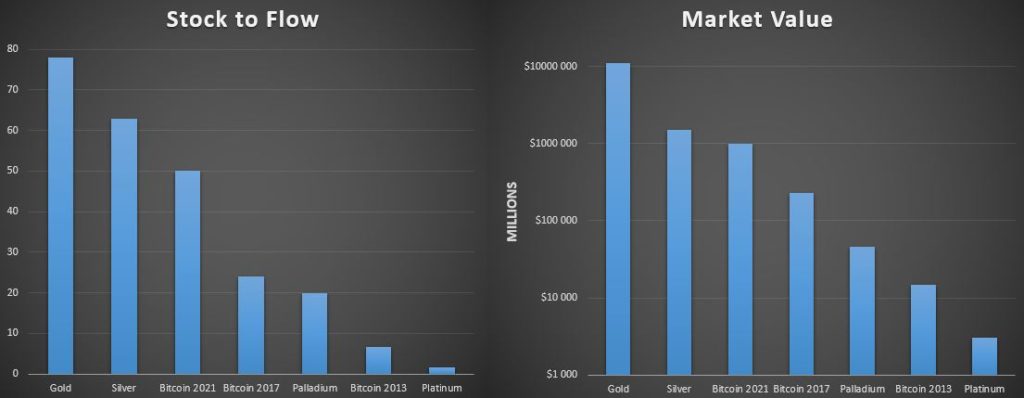

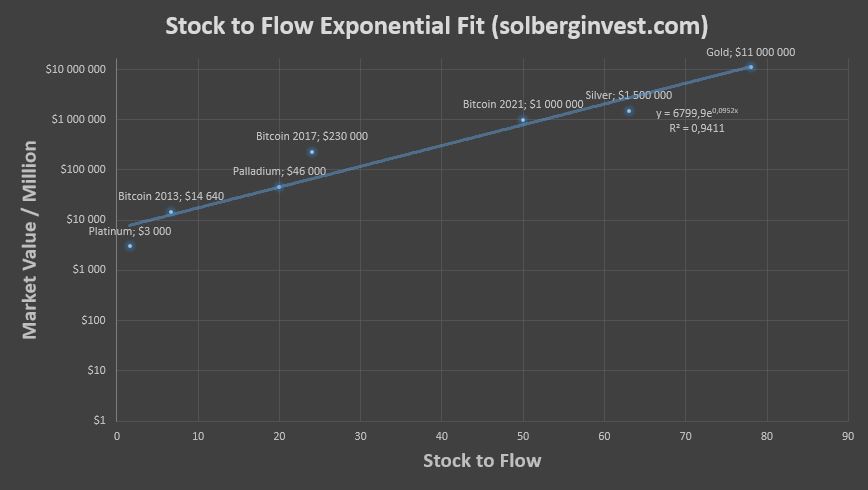

I used this data, and made this comparison of the stock to flow of each of them, side by side with a comparison of their market value. This is to basically just to point out the correlation between the stock to flow of and the market value an asset:

Notice how the height of each respective pillar is similar when looking at the stock to flow (left) and the market value (right)?

Another thing I should point out is that the market value chart (right) has it’s vertical axis, the axis showing the market value, increasing exponentially. Every tick up is a 10x.

This seems to indicate, like planB has showed, that the market value of an asset increases exponentially when the stock to flow increases.

Why do we care about this? Because the stock to flow of Bitcoin doubles every four years due to the halving.

the charts above indicate that the price will increase exponentially when the stock to flow increases, we can therefore assume that the price of Bitcoin will increase exponentially with each halving, like it has done in the past.

Using the same data as above, I made another chart. Notice how the time variable is replaced by the stock to flow:

The data points are the assets from the data table above. The blue line going between/through them is the fitted exponential trend line.

Beneath the line, at the end, you see the function that describes the trend line:

y = 6799e^0.0952x.

Usually, x is the time variable, but in this function x is the stock to flow.

In other words, the trend line shows how to calculate the market value of an asset as a function of its stock to flow.

I used this function, and adjusted it to fit the price of Bitcoin, as the chart above only shows the market cap of Bitcoin.

Also had to change back from stock to flow, to time, on the x-axis.

This works, because the stock to flow of Bitcoin is itself a function of time.

Summarized, this was my general idea:

To Use the function above, adjust it to predict the price instead of market cap, as well as perform a variable substitution from “stock to flow” to “time”, which works because the stock to flow of Bitcoin is itself a function of time. I also wanted it to be a continues, monotonically increasing and (of course) exponential function.

My work resulted in a model that shows the fair value of Bitcoin. I tells you when it’s cheap/expensive, as well as how cheap/expensive it is:

It’s More Useful Than The Stock to Flow Model

The fair value line on this model takes into consideration the next halving event. In the stock to flow model for example, the fair value of Bitcoin is more or less constant, but spikes at each halving.

Technically, that’s the right way to think about it, because the stock to flow of Bitcoin is more or less constant between the halvings. It doubles over a short period of time right after each halving, but goes back to stay constant until the next halving.

However, this seems to simple.

In my opinion, the fair value should price in the coming halving to some extent. After all, future halvings are a certainty.

The halvings are hard coded into Bitcoin, and will necessarily affect the price of Bitcoin in the future, due to a disrupt in the supply/demand and increased stock to flow. Therefore, we ought to price it in to some extent.

The Fair Value S2F Model does this.

The model takes the next halving, as well as how far away it is, into consideration when assigning the fair value.

This way, we get a more accurate and continues fair value, that is useful each and every week, not just every four years.

This model does not predict a specific Bitcoin price, as this is not it’s function nor purpose.

The purpose of this model is the get an idea of the risk of investing in Bitcoin at any given time. It’s supposed to tell you how cheap or expensive Bitcoin is right now.

It tells us something about the the probability of a price-plunge, or a price-surge, is.

I will use this model, together with others, to guide my Bitcoin investing in the coming years. I will sell gradually when the price ascends the red line, and accumulate aggressively whenever the price is below the white line.

Receive Updates on This Model Every Week

In my premium newsletter I send weekly updates on all my models, together with in depth technical analysis on Bitcoin, Ethereum, Cardano and Chainlink.

From time to time I also talk about other altcoins like Vechain, Uniswap and Polkadot.

You also get sneak peeks into my personal portfolio.