I still remember when I finally managed to save $1000 or more per month consistently. I was thrilled and excited to see how fast my savings account and investments grew every single month. But after the initial excitement, the question arose: Is saving $1000 per good? Should I strive to save even more?

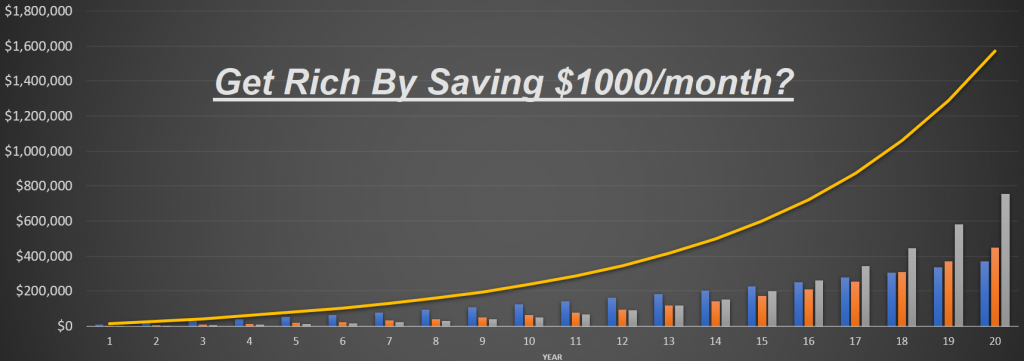

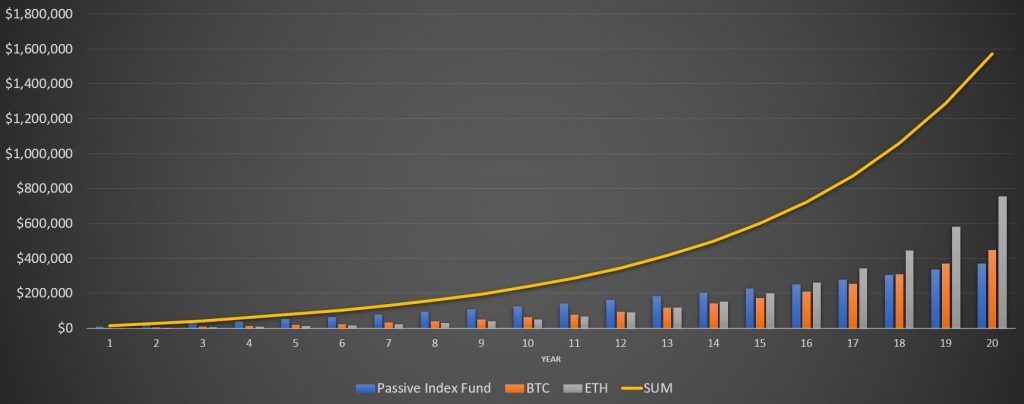

Yes, saving $1000 per month is good. Given an average 7% return per year, saving a thousand dollars per month for 20 years will end up being $500,000. However, with other strategies, you might reach 1.5 Million USD in 20 years by saving only $1000 per month.

I want to spell out where saving $1000 per month will take you, and how it might change your life. Personally, I think saving $1000 is a huge milestone for anyone, and a big step in the right direction.

If you want to figure out how much you should save per year, read this article instead: How Much Should YOU Save Per Year? (Examples and Charts)

There’ll be a short section about how to save $1000/month towards the end of the article. But if you’re looking for a complete guide on saving more money, I suggest this article: The 4 Steps To Save A Lot Of Money Fast

Will Saving $1000 Per Month Make You Rich?

This depends on a few factors: Your time horizon and what “rich” means…’

Let’s define “rich” as having a $500,000 net worth and a time horizon of 25 years. By doing some good ol’ math we can calculate the expected outcome:

First of all, I assume you’re saving your money in a passive index fund. Basically, saving is equal to investing in the rest of the text. I assume index fund because it’s the best way to invest for “retail” investors like you and me. (source)

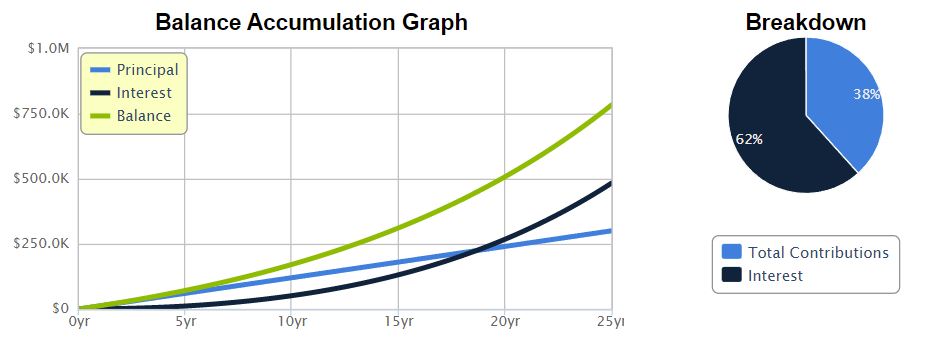

Given a 7% annual return on our money (from saving in a passive index fund) the numbers turn out like this:

We see that saving $1000 per month turns into $500,000 in roughly 20 years, which is well within our goals defined above.

Also, notice that the interest/returns you make on the money you save exceed the saved money by year 17. This means that you made more money from investing than you have saved in these 17 years.

In fact, the returns made from the savings are 62% of the total amount after 25 years, which shows the immense power of compound interest.

suggested reading: Is Saving $500 Per Month Good?

Saving $1000 per month, with $50,000 starting point:

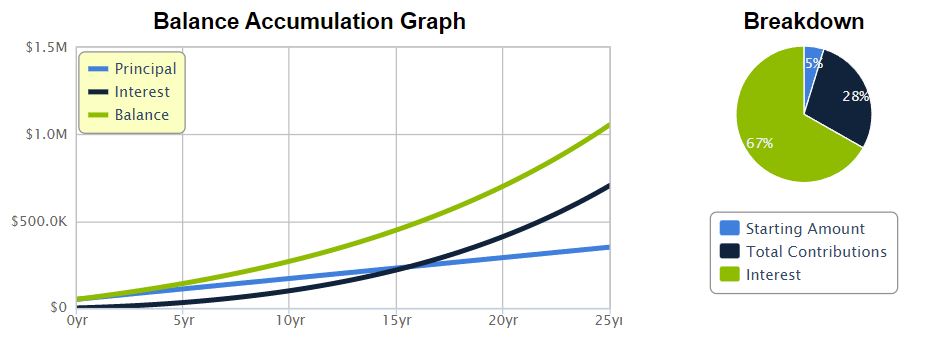

What if you already have some money saved up, and wonder where you’ll be in 25 years if you continue saving $1000 per month?

Let’s run the numbers again, with an initial investment of $50,000 and a continued $1000 per month investment over 25 years:

As you can see, this turns into over one million USD.

Saving $1000 per month, with a starting point of $50,000 will make you a millionaire in less than 25 years. (in theory!)

Suggested reading: Is Saving $10k Per Year Good?

Is It Possible To Save $1000 Per Month?

Many people I talk to think saving $1000 per month is unrealistic.

“One thousand bucks is way too much to put away every month!”

“Sure, I’m able to do it every once in a while, but not consistently over many years!”

However, this is not the case. It’s highly possible to save a thousand dollars per month. It’s actually not that hard to achieve if you make the right moves.

Of course, the difficulty of saving $1000/month depends on your salary.

Individuals earning $100K/year have several thousand left over every month after taxes and expenses. Read more about what it’s like to earn $100K in this article.

However, most of us don’t have such a high salary, so, here’s what we must do:

- Cut down housing expenses. Housing is by far the biggest expense for most people. If you can cut down on this one, you’ll be able to save a lot more money every month. For example, if you spend $1500 per month on housing, but you’re able to cut that down by 33%, you’ve already got $500 per month!

- Cut down on commute-related expenses. This is often the next biggest expense people have. If you can cut this one down, you’re left with a big chunk of money to save every month.

Pro tip: Move closer to work, in a cheaper house/apartment. This cuts down on your housing expenses and makes getting to work cheaper and faster. It saves you both money and time, making it easy to save $1000 a month!

Most people think that it’s about cutting down on the “small stuff” like the Netflix subscription or the occasional Starbucks coffee. This couldn’t be further from the truth…

Small things have a small impact. Big things have a big impact!

If you can cut down on the big things like housing and commuting expenses, you’ll be saving $1000 a month in no time. The best part is that you can keep spending money on small luxuries like Netflix and Starbucks.

suggested reading: Is Saving $300 Per Month Good?

The Best Way To Save $1000 Per Month (Investing):

As you know, saving money in a bank account is a terrible strategy. After building a safety net of a few thousand bucks, you should start investing the money you save.

The reason is that inflation decreases the value of your money every single year but 2-5%.

The right way to think about it is that bank accounts are like investments with a guaranteed negative return of up to 9% per year.

Money in a bank account is like a melting block of ice…

You need to put that money to work and invest it. This way, your wealth grows over time, instead of shrinking due to inflation.

“Sure, but how the heck should I invest it? I know nothing about investing!”

The bread and butter of your investing strategy should in most cases be passive index funds. This is the easiest, and often best, strategy for the average Joe.

In the examples above, where saving $1000 a month turned into $500,000 in 20 years, the money was invested in a passive index fund.

What you need to do is to set up an automatic savings plan. As soon as you get your paycheck, the bank should take $1000 of that money and invest it in a passive index fund, without you having to lift a finger.

Suggested reading: Why You Should Invest During Inflation

Ways to make higher returns when saving $1000 a month:

Most people saving $1000 per month should stick to investing passive index funds, as they are easy to automate, carry low risk, and offer high returns.

However, some of us are hungry for more than 7% returns…

Personally, I’m deeply invested in the cryptocurrency market. In fact, this website started out as a pure cryptocurrency blog. It has now expanded into more general topics around saving money, early retirement, and other stuff I’m passionate about.

If you, like me, want to achieve higher returns than 7% per year, you can start to look into cryptocurrencies.

Know this: If you’re able to put in the work, and educate yourself about this amazing market, you can make mind-bending returns. The volatility and risk are much higher than with traditional investments like passive index funds, but so are the potential returns.

For example, in the first half of 2021, the cryptocurrency market surged. A lot of people, me included, made several-hundred-percent returns in a few months. Some investments even made several thousands of percent returns. After the surge, there was a 50% correction, which was brutal…

Do you see how the crazy volatility offers unparalleled opportunity? Good luck finding another market where 250% gains in a few weeks are considered “pretty good” returns.

To learn more about crypto investing, you can read some of my articles on it. You can find a list of them here: cryptocurrency articles.

Let me give you a concrete example of how I personally would invest my saved $1000 a month:

Investment strategy for saving $1000 per month:

Let’s assume I know next to nothing about cryptocurrencies and don’t feel like spending 50 hours researching it. This is what I would do in that case:

- Save $700 in a passive index fund

- Save $200 in Bitcoin

- Save $100 in Ethereum

With conservative assumptions on the future returns on Bitcoin and Ethereum, saving a thousand bucks a month for 20 years would look like this:

After 20 years, I would in theory have over 1.5 million USD from saving a thousand dollars per month.

The returns assumed in this example are as follows:

- Passive Index fund: 7% per year

- Bitcoin: 20% per year (which is highly conservative. Historically it’s actually 200% per year…)

- Ethereum: 30% per year (which is conservative as well, as ETH in general offers even higher returns than Bitcoin, historically speaking)

Conclusion: Yes, Saving $1000/month Is Good

Saving a thousand dollars per month will eventually make you a millionaire if the money is invested properly, and the time frame is 20 years or more.

Although some people find it hard, it is far from unrealistic – even for low-income wage earners. The key is to cut down on housing and commuting expenses, not to cut out the small stuff like Netflix and Starbucks.

Suggested reading: Two Great Reasons to Save Money During Inflation: