Stablecoins are versatile digital assets. Since they are tethered to external assets, like fiat currencies and other cryptocurrencies, they offer price stability while providing liquidity. Two of the most popular stablecoins operating on the Ethereum blockchain are USD Coin (USDC) and DAI, but which is better?

USDC is better than DAI because of lower volatility and a better-tested legal structure. DAI is decentralized while USDC is centralized which naturally makes DAI more risky as a consequence of innovation.

As an investor, USDC is the better stable coin because it’s backed by the US dollar, a traditionally stable asset, even though DAI, which is backed by other cryptocurrencies, is touted as decentralized. I am more comfortable with legacy finance settings (DAI has a high technical barrier to entry) and am not particularly worried about the centralization of USDC. The Centre Consortium, which operates the stablecoin, has developed a good track record and trust regarding transparency and accountability.

You can read more about the two biggest centralized stablecoin in this article: USDC vs USDT

BTW:

When investing in cryptocurrencies, there are easy ways to multiply your returns significantly. I’ve written about four of them and given them to you FOR FREE in this guide:

How Are USDC and DAI Similar?

- The Ethereum operating system powers both USDC and DAI.

- Both USDC and DAI are available on the best cryptocurrency exchanges

- Both USDC and DAI utilize smart contracts

- I can use both USDC and DAI as hedges against market volatility.

- Both stablecoins have interest generating and loan programs.

- Both USDC and DAI are asset-backed(collateralized)and valuated on a 1:1 conversion system, with each stablecoin redeemable by an equivalent dollar amount.

- Both USDC and DAI are regularly audited.

- Both USDC and DAI are open-source projects.

How Are USDC and DAI Different?

USDC and DAI are different in several key aspects, including:

- Ownership: DAI is not owned by anyone, while USDC is (kind of)

- Governance -Centralization/Decentralization: USDC is centrlized while DAI is decentralized.

- Stablecoin collateralization and ecosystem: USDC is backed 1:1 by USD while DAI is a bit more complex.

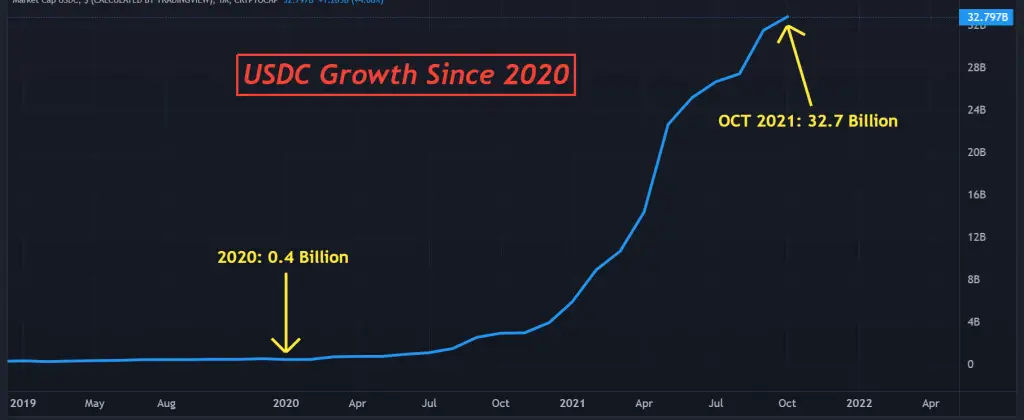

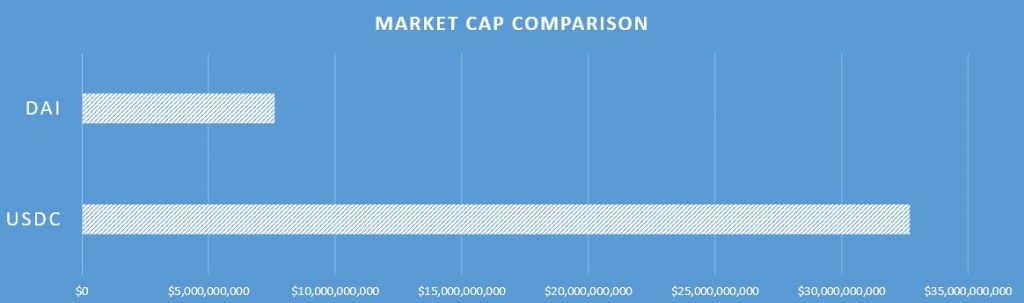

- Market capitalization: USDC is much bigger than DAI, as seen on the chart below:

Let’s get deeper into each of the points above!

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, etc. Also, I’ll give you helpful guides and reviews.

Get expert insights every week – Sign up for free below:

1. Ownership

Circle Ltd founded a consortium known as Centre, which manages USDC, which was launched in 2018. Centre includes members from Coinbase, a cryptocurrency exchange platform, and Bitmain, a Bitcoin mining company that invests in Circle. Centre provides standard governance for the stablecoin.

DAI, on the other hand, was launched in 2017 and is managed and maintained by MakerDAO. MakerDAO is a decentralized autonomous organization (DAO). This means it is represented by encoded rules maintained on the Ethereum blockchain that is transparent and not influenced by a central government.

MakerDAO comprises the owners of MKR, its governance token. These members can vote for reforms to some smart contracts parameters to ensure DAI is stable.

2. Governance – Centralization/Decentralization

USDC is a centralized fiat-backed stablecoin. This means that it is operated by one central entity, in this case, Centre. Centralization has always been a tricky issue in the cryptocurrency space. The user agreement of USDC gives the governing entity the right to freeze assets at its discretion.

Circle Ltd has frozen funds upon request by law enforcement. While I see this as sometimes necessary ethically, I believe it detracts from the ethos of power decentralization that pervades digital currencies.

As an investor, I need to trust that the governing entity backs its stablecoins with the stated equivalent in alternative assets. Fortunately, I, and many other traders and investors in the crypto space, have gained trust in the highly transparent auditing and funding processes of USDC.

MakerDAO’s smart contracts in the form of a decentralized application (DApp) facilitate the over-collateralization and repayment process that creates DAI. I consider DAI to be the first decentralized finance (DeFi)project to gain widespread adoption. In fact, it’s the standard currency for Ethereum’s DeFi ecosystem (fintech solutions developed and maintained by Ethereum’s tech stack).

DAI is a decentralized stablecoin, and through its smart contracts, I am assured that no central entity can freeze my assets. However, contrary to popular notions, I contend that DAI is not entirely decentralized since MakerDAO still controls certain aspects of the stablecoin, including smart contract parameters, accepted collateral, and DAI’s value.

3. Stablecoin Collateralization and Ecosystem

USDC is a fiat-collateralized stablecoin. USDC uses the US legal tender as its source of collateral for the issuance of tokens. USDC retains a 1:1 peg to the US dollar or other approved investments by holding an equivalent amount of the legal tender through reserves held by trusted third parties (established financial institutions and auditors).

The tokenization of the US fiat into USDC occurs in three steps: I can send a US dollar amount to the Centre (ERC20 token issuer) bank account. The Centre utilizes a USDC smart contract to create an equivalent amount of USDC. The newly minted USDC is sent to my account, and my substituted US dollar amount is held in reserve. If I want to redeem my USDC for US dollars, the process will be similar but in reserve.

DAI, on the other hand, is a crypto-collateralized stablecoin. Instead of being backed by legal tender, DAI holds other cryptocurrencies such as Ether (ETH) in escrow through Maker vaults for the issuance of new MKR tokens. With this operational model, I can mint and burn tokens without using a centralized third party. DAI lives completely on the blockchain, and its solvency isn’t reliant on any counterparties.

If I deposit ETH or other accepted cryptocurrencies, I can borrow against the value of my deposit and receive a newly created DAI. Another difference between DAI and USDC in this regard is that where USDC only needs to hold a 1:1 reserve in fiat, DAI and other crypto-collateralized stablecoins need over-collateralization to mitigate price volatility.

The collateralization ratio for DAI : Ether is set to 150% currently. This means that if I deposit $150 worth of ETH, I would be able to borrow up to 100 DAI (which is roughly equivalent to $100). If the collateral value dips below this ratio, the smart contracts can automatically liquidate the loan. Conversely, if the value of the collateral rises, I can borrow additional DAI.

By repaying a loan and the interest accrued, the returned DAI is burned automatically, and the collateral is available for withdrawal. The US dollar value of DAI is backed by the dollar value of the underlying collateral that MakerDAO’s smart contracts hold.

MakerDAO can control the circulating amount of DAI by controlling collateralization ratios, types of supported collateral, and the DAI borrowing and storing interest rates. This is how MakerDAO controls the value of DAI.

4. Market Capitalization

USDC has a market cap of $32.7 Billion USD with a roughly equivalent amount of coins in circulation. DAI has a market cap of $6.4 Billion USD with an equivalent amount of coins in circulation.

Keep in mind, this will have changed by the time you’re reading this, but it gives you an idea of the difference in size/adoption.

USDC is Safer Than DAI:

While DAI has decentralization going for it, USDC is the safer and better stablecoin because it is collateralized by US dollars and other traditionally stable assets held in reserves.

The operational model behind DAI means that the stablecoin can only exist as long as the MAKER token and Ether exist. This is a major potential risk with DAI since it doesn’t have all of its reserves in stable assets like the US dollar and other fiat currencies.

USDC is the better option since it is fiat-collateralized, meaning it is legally safer. This potential risk was brought to light back in March 2020, when Ethereum dropped in value by one-third, leaving DAI in a precarious state. At the time, MakerDAO briefly considered an emergency shutdown of the stablecoin.

If this had happened, as a DAI holder at the time, I would have been forced to redeem my coins for Ether. It was only after surviving this setback that MakerDAO decided to include USDC in its mix of reserves. It is for this reason that a large portion of the stablecoin is backed by USDC currently. This makes it evident that USDC is the safer stablecoin, especially if I want to trade or invest long-term.

I find that USDC has little price volatility compared to DAI and other cryptocurrencies. DAI has to keep a large amount of cryptocurrency in its reserves to cover market fluctuations, meaning the pegging ratio isn’t always 1:1. Error margins of up to 5 percent on either side occur now and then.

Fortunately, the error margins don’t last for more than a few days. Nonetheless, the stability of DAI is determined by the volatility of the collateral, thus requiring over-collateralization to absorb these value fluctuations. USDC is more stable, and its value doesn’t move from the actual value of the US dollar.

Compared to DAI, USDC has more credibility, and investors trust its operations due to a higher degree of transparency. Granted, DAI does have some degree of transparency superior to other stablecoins such as Tether (USDT), but it’s not on the same level as USDC.

USDC releases monthly publicly verifiable reports of audits conducted by Grant Thornton, one of the top accountancy firms globally, attesting that the stablecoin is indeed back 1:1 by USD reserves. The Circle consortium also complies with regulatory and prudential standards while governing the USDC ecosystem.

On the other hand, DAI is largely unregulated (although this may soon change), meaning it features less accountability. However, I have to give MakerDAO a thumbs up for conducting routine audits even though this is not a legal requirement in the stablecoin space. However, USDC transparency policies are more robust.

Should You Use USDC or DAI?

The use case will determine an investor’s choice between USDC and DAI. Personally, I go with USDC whenever possible. Decentralization isn’t everything. As an Investor, I must have confidence that my chosen stablecoin won’t be highly impacted by an unforeseen black swan event (like COVID-19).

USDC is superior to its US dollar backing. MakerDAO has among the most secure smart contracts, but traditional financial institutions like banks have better-understood risks and longer history.

Also, I feel more comfortable with legacy finance settings and find the DAI ecosystem to be a bit too complex for most traders and investors. For expert traders who don’t want a centralized entity to have control over their funds and transactions, I would recommend DAI in this case.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is NOT the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.