USDC and USDT are the biggest and most adopted stablecoins. But which of them is best?

Here’s the short answer:

USDC is better than USDT in every aspect except for liquidity and the number of trading pairs. In terms of transparency, security, legal framework and interoperability, USDC is better than USDT.

Comparing USDC vs. USDT, I consider USDC to be the better stablecoin. I value transparency, and as such, I have more trust in USDC since it has a higher degree of transparency via its publicly verifiable attestations. While USDT has higher trading volume and liquidity, the gaps and controversies in its auditing and transparency make USDC the best stablecoin.

To learn more about USDC, and how it compares to the decentralized stablecoin DAI read this article: USDC vs DAI.

BTW:

When investing in cryptocurrencies, there are easy ways to multiply your returns significantly. I’ve written about four of them and given them to you FOR FREE in this guide:

How Are USDC and USDT Similar?

- Both USDC and USDT are fiat-collateralized, meaning they are backed by US dollars.

- Both USDC and USDT operate on a 1:1 conversion system as each stablecoin is redeemed by an equivalent dollar amount.

- Both USDC and USDT provide security to traders and investors in the volatile crypto market.

- I can purchase both stablecoins from the same platforms (cryptocurrency exchanges).

- Both USDC and USDT utilize the same hardware wallets.

- Both stablecoins have available interest products.

- USDC and USDT have available loans.

1. Fiat-Collateralization

USDC and USDT are both backed by fiat currency, the US dollar. Each stablecoin provides a 1:1 conversion redeemed by the US dollar. They are considered off-chain assets since the collateral isn’t another cryptocurrency.

The fiat collateral is retained in reserve with a financial institution or central issuer and remains proportionate to the stablecoin tokens in circulation (in theory…).

2. Security to Investors

Both stablecoins minimize price volatility, achieving a utility that’s entirely separate from the ownership of traditional cryptocurrencies. They are price-stable assets behaving like fiat while maintaining the utility and mobility of cryptocurrencies, making them a great hedge against the volatile crypto market.

3. Interest Products

There are numerous lucrative blockchain finance interest products on both USDC and USDT with very competitive rates compared to traditional finance. I can earn interest on my holdings of both stablecoins. Several centralized providers, including Celsius Network, Nexo, and Crypto.com, support interest accounts from both stablecoins.

Personally, I use Celsius to earn a passive income with my crypto. They offer interest rates of up to 12% on stablecoins. Read this article to learn more about Celsius, and how to make passive income with crypto.

4. Available Loans

I can obtain crypto loans in the form of both USDC and USDT. Both options feature flexible lockup terms, competitive APR rates, low minimum and high-maximum loan amounts, instant availability, and availability on major centralized crypto lending platforms.

Once again, I use Celsius to take loans with crypto as collateral. Read about the safety of using Celsius in this article.

5. Wallet Compatibility

Both USDC and USDT can transact on the Ethereum blockchain (ERC20 tokens). They have the same underlying technology and thus have similar wallet and storage compatibility. I can easily store both USDC and USDT in cold storage personal hardware wallets providing maximum security.

They have both evolved into beasts of multiple blockchains. You can now use them on several different chains like Binance smart chain, Tron, etc. USDT is notably more evolved in this sense, making it more versatile.

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, etc. Also, I’ll give you helpful guides and reviews.

Get expert insights every week – Sign up for free below:

How are USDC and USDT Different?

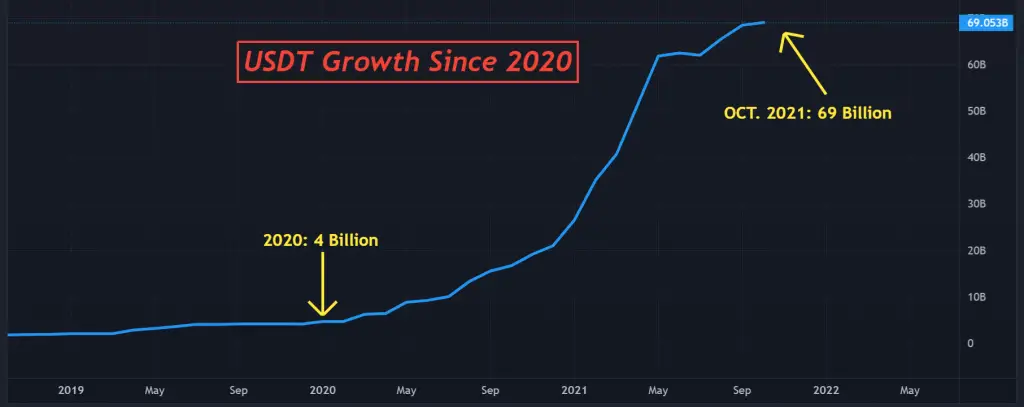

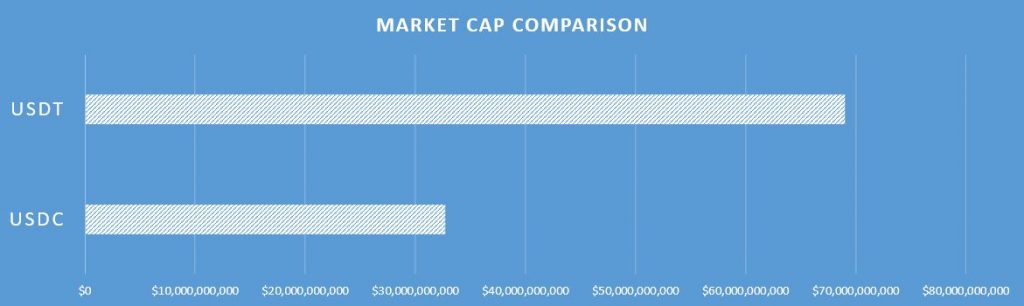

- Market Capitalization – USDC has a market cap of USD 32.7 Billion with 32.7 billion coins in circulation. USDT has a market cap of $69 Billion USD with 69 billion coins in circulation.

- Ownership – USDC was launched in 2018 and is issued and managed by a consortium called Centre. Circle Ltd and members from Coinbase founded Centre. USDT was launched in 2014 and is issued and managed by Tether Holdings, which Bitfinex controls.

- Trust and Transparency – Grant Thornton, one of the top consulting and accounting audit firms, inspects USDC. Circle, Ltd. Provides publicly verifiable audits indicating the stablecoin is backed by US dollars (1:1) in segregated bank accounts. Freeh Sporkin & Sullivan LLP, a law firm, inspects USDT. Tether Holdings doesn’t publish publicly verifiable audits indicating the backing of the stablecoin. It is unknown how often USDT audits their accounts.

- Supported Blockchains – USDC runs on Ethereum, Algorand, Stellar, Solana, Hedera Hashgraph, and Tron platforms. USDT runs on Ethereum, Solana, and Algorand platforms.

- Regulation and Licensure – USDC is regulated and fully licensed to provide services in its operational jurisdictions. There is considerable ambiguity on the regulation of USDT with an opaque operating structure.

- Trading Volume and Liquidity – I consider liquidity and trading volume an important factor as an investor. USDT has a higher trading volume and liquidity than USDC (highest global trading volume), available in nearly all crypto exchanges. USDC is only available on most cryptocurrency exchanges. USDT also has a much higher amount of trading pairs across crypto-asset types compared to USDC, which supports above-average trading pairs.

- Stable Coin Backing – USDC backing includes mostly cash and cash equivalents. USDT backing includes mostly assets of equivalent value.

- USDC has a more efficient and unrestrictive purchase and redemption process compared to USDT.

USDC is Safer Than USDT

In my opinion, stablecoin issuers must provide regular breakdowns of their reserve compositions to manage opaqueness in a dynamic crypto landscape. As an investor, a lack of transparency produces a high-risk environment.

USDC is safer than USDT since it provides more transparent auditing and funding processes than USDT.

The explosive growth that USDC has experienced in 2021 is a testament that I am not alone in this sentiment. USDC started the year with a market cap of just over $4 billion USD. It has since grown to a current market cap of $32.7 billion USD.

Two of the largest names in the cryptocurrency exchange and payment space are behind USDC. Circle and Coinbase have invested heavily in staying on the right track when it comes to global regulation, with the Centre consortium stating that regulated financial institutions back USDC.

USDC operates within US money transmission laws and utilizes established auditors and banks for true operational and financial transparency. USDT can not boast of the same heritage.

USDC is the safest stablecoin for three reasons:

- USBC prioritizes the highest levels of prudential and regulatory standards in the governing of its ecosystem.

- Circle provides assurances via the monthly reserve attestations that Grant Thornton issues. Grant Thornton is among the world’s leading accounting firms.

- The Centre consortium has built the primary economic activities underlying USDC within the perimeters of the US financial system.

The attestations assure me that USDC’s dollar collateralized assets can meet the stablecoin’s outstanding coins in circulation. USBC has consistently released publicly verifiable audits since it first entered circulation. I can personally access these reports on the Centre website. This consistency shows me that Circle Ltd. is committed to ensuring trust in the USDC ecosystem, making it safer than USDT.

I view USDC as an open digit asset that leverages the fundamental trust of the US fiat and the primary principles and oversight of the US financial system. When I contrast these aspects with the operational models of USDT, the disparity is evident.

Over the last few years, USDT has received widespread criticism for its opaque operational structure. Granted, public disclosure of reserves is not a regulatory requirement for privately issued virtual currencies or stablecoins as of now.

However, Tether Limited has regularly avoided third-party audits of its reserves, despite claiming that it maintains the 1:1 reserve for all their issued tokens. While USDC’s audits are not as extensive as full audits, they place Centre ahead of Tether Limited and other stablecoin operators in terms of safety and transparency.

I contend that USDC is far less controversial than USDT, and it has fewer concerning doubts over its reserves. Following a legal dispute with the New York Attorney General’s office in February 2021, Tether was required to pay an $18.5 million fine and submit quarterly transparency reports. I find it difficult to trust digital asset operators who have to be litigated to release transparency reports.

Questions about dollar reserves aren’t the only controversies I can find surrounding USDT either:

There have been allegations of price manipulation and a hacking incident in November 2017 where $31 million worth of tokens were stolen from Tether. USDC, on the other hand, has never been hacked since its inception in 2018.

Nonetheless, these two stablecoins are the same in terms of the underlying technology, so I can’t say USDC is inherently safer or more secure in this regard, but history isn’t on the side of USDT. Knowing the transparency and history of both stablecoin operators, I contend USDC to be a safer and better choice since they both have trading pairs with the most relevant cryptocurrencies.

Should You Use USDC or USDT?

The decision to purchase USD Coin (USDC)or Tether (USDT) will depend on specific needs, preferences, and investor profiles. Personally, I almost always go with USDC. While USDT does enjoy higher trading volume and liquidity, I believe the risks involved outweigh the benefits. USDC maintains a substantial trading volume, and I can access it across the major cryptocurrency exchanges.

There are only two cases that I can think of where I would opt to use USDT. The first is if I am seeking to execute short-term trades. In this case, the alternative stablecoin trading pairs (for USDC) may not exist. The second scenario is when I need to use advanced exchange features such as margin funding and futures trading. Both these use cases require an investor to be considerably experienced.

However, when I am looking to earn interest on my stablecoins, obtain a stablecoin cryptocurrency loan, hedge against crypto market volatility, exchange crypto assets to fiat or enter the crypto market with fiat, I would always choose to use USDC.

Overall, when I look at all the comparison parameters, USDC comes out on top in all categories except liquidity, which is not that important for me to overlook transparency.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is NOT the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.