Saving $300 a month is a great accomplishment. Although $300 might not be a huge deal, consistently saving it every single month will grow exponentially over time. I’m going to look more deeply into what saving $300 a month will do for you, but first, is saving $300 a month good?

Yes, saving $300 per month is good. Given an average 7% return per year, saving three hundred dollars per month for 35 years will end up being $500,000. However, with other strategies, you might reach 1 Million USD in 24 years by saving only $300 per month.

First of all, if you’re already saving $300 a month – congratulations! You’re better than most with your money.

If not, you should work on getting there. You can also read this other article if you’re closer to $100 a month: Is Saving $100 Per Month Good?

In the rest of this article, I’ll try to explain where $300 a month will get you, and what might happen to you if you stick with it for multiple years.

I’ll also give you a few different strategies as to how I would put those $300 to work (investing).

If you instead are trying to figure out how much you’re supposed to save, check out this article: How Much Should YOU Save Per Year?

Disclaimer: None of this is financial advice. I’m not a financial advisor, and all of this stuff is just informational and my opinion. Also, keep in mind that extrapolation is speculative by nature.

Will Saving $300 Per Month Make You Rich?

This depends on a few factors: Your time horizon and what “rich” means.

Let’s get one thing straight: You will not become a millionaire in a few years from saving $300 a month.

Let’s define “rich” as having a $500,000 net worth and a time horizon of a few decades.

You might not agree that $500,000 makes you rich, but in this context, the specific definition is not that important.

First of all, I assume you’re saving your money in a passive index fund. Basically, saving is equal to investing in the rest of the text. I assume index fund because it’s the best way to invest for “retail” investors like you and me. (source)

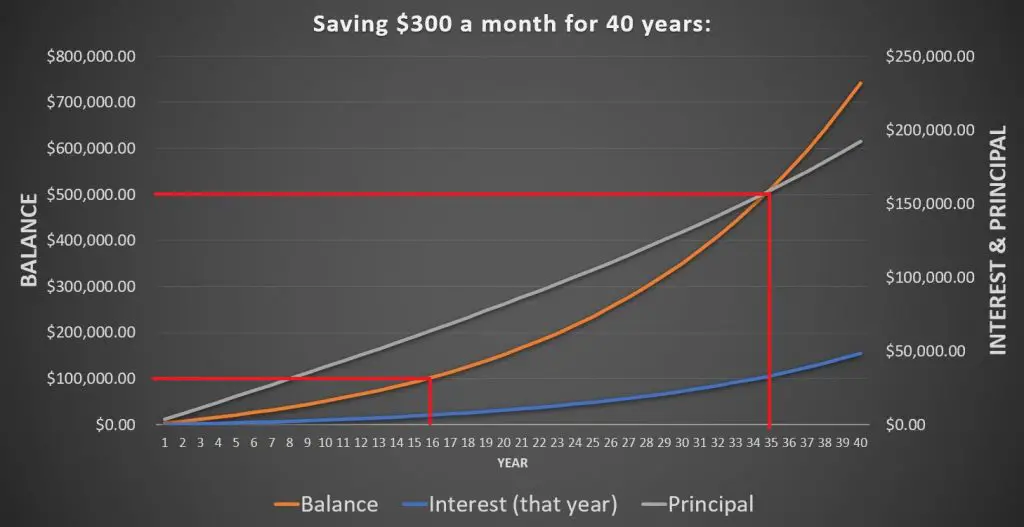

Given a 7% annual return on our money (from saving in a passive index fund) the numbers turn out like this:

We see that saving $300 per month turns into $500,000 in 35 years, as shown by the upper red line.

After only 16 years of saving $300/month, you’ll have $100,000 saved up.

Conclusion:

Yes, you can become rich by saving $300 a month. Rich, in this case, means having $500,000. It will take you 35 years, given a return of 7% per year.

Suggested reading: Is Saving $500 Per Month Good?

Saving $300 per month, with a $20,000 starting point:

What if you already have some money saved up, and wonder where you’ll be in the next 40 years if you continue saving $300 per month?

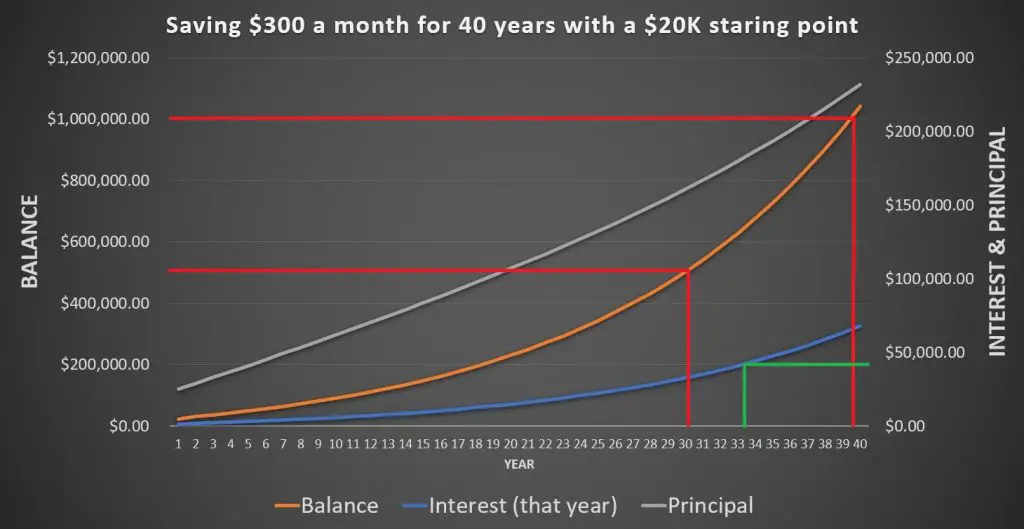

Let’s run the numbers again, with an initial investment of $20,000 and a continued $300 per month investment over 40 years:

Results from saving $300 a month with a $20K starting point:

- In 30 years you’ll have a balance of $500K

- You’ll be a millionare after 40 years

- After 33 years, you’ll have a passive income from your portfolio of over $50,000 per year.

The blue line on the chart above tells you the interest, or ROI, each year. It can be looked at as “the passive income generated by your portfolio each year”. That’s why saving $300 a month for 33 years creates a passive income of over $50K a year.

Is It Possible To Save $300 Per Month?

A lot of people I talk to think saving $300 per month is unrealistic.

“three hundred bucks just way too much to put away every single month!”

“Sure, every once in a while I’m able to do it, but not consistently over many years!”

However, this is not the case. It’s highly possible to save $300 per month. It’s actually not that hard to achieve if you make the right moves.

What you need to do in order to make saving three hundred dollars a month possible:

- Cut down your housing expenses. Housing is by far the biggest expense for most people. If you can cut down on this one, you’ll be able to save a lot more money every month. For example, if you spend $1000 per month on housing, but you’re able to cut that down by 33%, you’ve got $333 per month already – more than what you need!

- Cut down on commute related expenses. This is often the next biggest expense people have. If you can cut this one down, you’re left with a big chunk of money to save every month.

Pro tip: Move closer to work, in a cheaper house/apartment. This cuts down on your housing expenses and makes getting to work cheaper and faster. It saves you both money and time, making it possible to save $300 a month easily!

Most people think that it’s about cutting down on the “small stuff” like the Netflix subscription or the occasional Starbucks coffee. This couldn’t be further from the truth…

Small things have a small impact. Big things have a big impact!

If you’re able to cut down on the big things like housing expenses and commuting expenses, you’ll be saving $300 a month in no time. The best part is that you can keep spending money on small luxuries like Netflix and Starbucks.

Suggested reading: Is Saving $1000 Per Month Good?

The Best Way To Save $300 Per Month (Investing):

As you know, saving money in a bank account is a terrible strategy. After building a safety net of a few thousand bucks, you should start investing the money you save.

The reason is that inflation decreases the value of your money every single year but 2-5% (exponentially).

In fact, bank accounts are like investments with a guaranteed negative return of up to 5% per year.

Money in a bank account is like a melting block of ice…

You need to put that money to work and invest it. This way, your wealth grows over time, instead of shrinking due to inflation.

“Sure, but how the heck should I invest it? I know nothing about investing!”

No worries, mate! I’ll help you get started:

The bread and butter of your investing strategy should in most cases be passive index funds. This is the easiest, and often best, strategy for the average guy/gal.

In the examples above, where saving $300 a month turned into hundreds of thousands of bucks, the money was invested in a passive index fund.

What you need to do is to set up an automatic savings plan. As soon as you get your paycheck, the bank should take $300 of that money and invest it in a passive index fund, without you having to lift a finger.

Pro tip: You should NOT wait until the end of the month to save “what’s left”. You should save at the beginning of the month and spend what’s left. You need to “pay yourself first”!

Ways to make higher returns when saving $300 a month:

Most people saving $300 per month should stick to investing in passive index funds, as they are easy to automate, carry low risk, and offer high returns.

However, some of us are hungry for more than 7% returns…

Personally, I’m deeply invested in the cryptocurrency market. In fact, this website started out as a pure cryptocurrency blog. It has now expanded into more general topics around saving money, early retirement, and other stuff I’m passionate about.

If you, like me, want to achieve higher returns than 7% per year, you can start to look into cryptocurrencies.

Know this:

If you’re able to put in the work and educate yourself about this amazing market, you can make mind-bending returns. The volatility and risk are much higher than with traditional investments like passive index funds, but so are the potential returns.

For example, in the first half of 2021, the cryptocurrency market surged. A lot of people, me included, made several-hundred-percent returns in a few months. Some investments even made several thousands of percent returns. After the surge, there was a 50% crash in two weeks, which was brutal…

Do you see how the crazy volatility offers unparalleled opportunity? Good luck finding another market where 250% gains in a few weeks are considered “pretty good” returns.

To learn more about crypto investing, you can read some of my articles on it. You can find a list of them here: cryptocurrency articles.

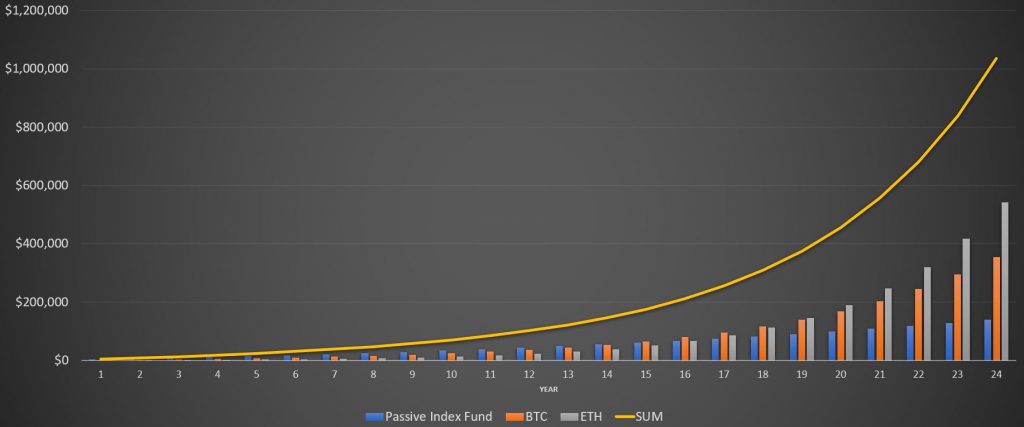

Let me give you a concrete example of how I personally would invest my saved $300 a month:

Investment strategy for saving $300 per month:

Let’s assume I know next to nothing about cryptocurrencies and don’t feel like spending 50 hours researching it. This is what I would do in that case:

- Save $200 in a passive index fund

- Save $75 in Bitcoin

- Save $25 in Ethereum

With (historically speaking) conservative assumptions on the future returns on Bitcoin and Ethereum, saving 300 bucks a month for 20 years would look like this:

After 24 years, I would in theory have over 1 million USD from saving three hundred dollars per month.

The returns assumed in this example are as follows:

- Passive Index fund: 7% per year

- Bitcoin: 20% per year (which is conservative. Historically it’s actually around 200% per year…)

- Ethereum: 30% per year (which is conservative as well, as ETH in general offers even higher returns than Bitcoin, historically speaking)

This last chart is highly speculative, as we don’t have the same amount of data on the returns of cryptocurrencies over long periods of time.

Conclusion: Yes, Saving $300/month Is Good

Saving three hundred dollars per month will eventually make you a millionaire if the money is invested properly, and the time frame is in the decades. With a seven percent return from index funds, your portfolio will reach $500,000 in 35 years.

Although some people find it hard, it is far from unrealistic to save $300 a month – even for low-income wage earners. The key is to cut down on housing and commuting expenses, not to cut out the small stuff like Netflix and Starbucks.