Inflation sucks. We’re all slowly drowning, and there’s nothing to do about it… Or is there? In this article we’re looking at the current inflation, and how different assets have performed relative to inflation.

I will give you two reasons to invest during inflation, but first, here’s the short answer:

Historical evidence suggests that one should invest during inflation. Most major asset classes have outperformed inflation in recent years. And, in the major inflationary period from the mid-60s to the mid-80s, investing performed much better than saving.

Let me explain in more detail, with some numbers and graphs.

Suggested reading: Two Great Reasons to Save Money During Inflation

First Reason To Invest During Inflation: Keeping Up & Outpacing

Investing makes it possible to keep up with inflation. Picking the right assets, you might even beat inflation!

Let us take a look at the inflation between 2020 and 2022, and see if investing in different asset classes made you “keep up” with inflation:

Inflation from January 2020 – July 2022: 14.34%

There are many ways to measure inflation, but for this article, we’ll use the “Consumer Price Index For All Urban Consumers (CPI-U)”, as it best fits most people. (source)

In reality, I think that inflation is higher than the reported 14.34% on the chart above, but let’s just go with that…

Now, let’s look at the price movements of different asset classes in the same time frame, and compare how they performed relative to inflation!

Did Gold Beat Inflation?

Below you see the chart of Gold, pointing out that it increased in value by 5.91% from Jan 2020 to July 2022:

Given that inflation was over 14%, Gold’s shy 5.91% increase is not enough. Gold did NOT beat inflation!

Did Stocks Beat Inflation?

Below you see the chart of The S&P 500, pointing out that it increased in value by 22.35% from Jan 2020 to July 2022:

Given that inflation was over 14%, The S&P 500’s 22.35% increase is more than enough. Stocks beat inflation!

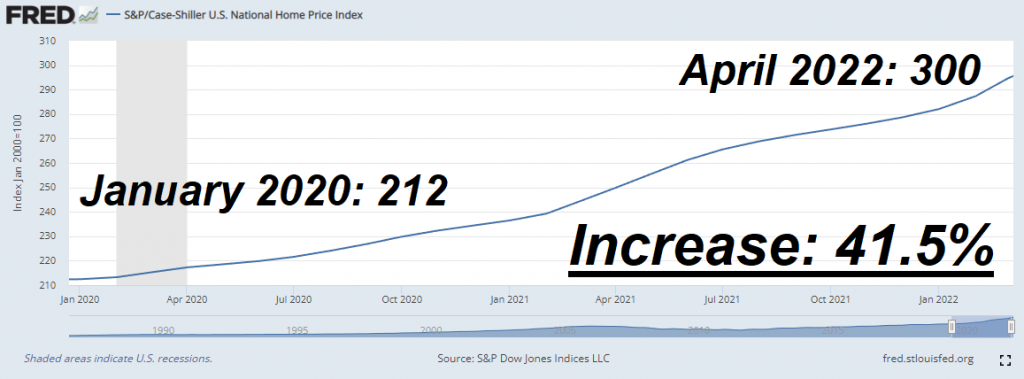

Did Real Estate Beat Inflation?

Below you see the chart of housing prices in The U.S, pointing out that it increased in value by 41.5% from Jan 2020 to April 2022 (I didn’t find reliable data stretching to July):

Given that inflation was over 14%, the increase of 41.5% in housing prices is more than enough. Real estate beat inflation!

In addition, it beats stocks (with a factor of two)!

Did Bitcoin Beat Inflation?

Below you see the chart of Bitcoin, pointing out that it increased in value by 148.31% from Jan 2020 to July 2022:

Given that inflation was over 14%, Bitcoin’s crazy increase of 148.31% crushes every other asset class, and beats inflation by miles!

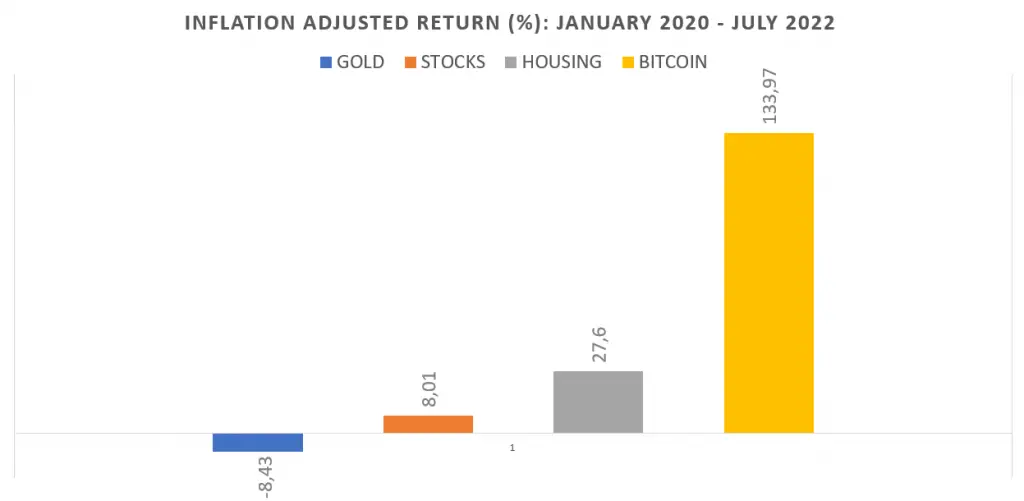

Summary: Three out of Four Investments Beat Inflation!

To summarize the four asset classes we’ve looked at, here’s a neat little table I put together:

| Increased in Value | Inflation Adjusted Increase in Value | |

| Gold | 5.91% | -8.43% |

| Stocks | 22.35% | 8.01% |

| Housing | 41.5% | 27.6% |

| Bitcoin | 148.31% | 133.97% |

Because I’m a nerd and a “math guy“, I also made a chart showing the different outcomes:

It’s clear to see that investing during inflation can be highly profitable. Even if you’re not willing to put money into Bitcoin, housing is the next best protection against inflation.

Some people think that one should “always” invest during inflation, but I think it’s more nuanced than that, as I get into in this article about investing vs saving during inflation.

Many will argue that housing is a better protector against inflation than Bitcoin, even though the inflation-adjusted returns have been way higher for Bitcoin in recent years.

The reason is that Bitcoin is still young. This trend of beating inflation might not last. Bitcoin itself might not last. Real estate will. We must always live somewhere, right? Housing will definitely be, at least for a few more decades, a scarce and desired asset, which is the key component to keeping up with, and even beating, inflation.

Suggested reading: Is Saving $300 Per Month Good? (Where You’ll Be In The Future)

Second Reason To Invest During Inflation: Lose Less

You can not always beat inflation. Sometimes you can’t even keep up. If your inflation-adjusted return is negative, it means you’re losing purchasing power, and effectively losing value. That sucks, but NOT investing can suck even more!

Understand, investing during times of high inflation might prove to be better than doing nothing!

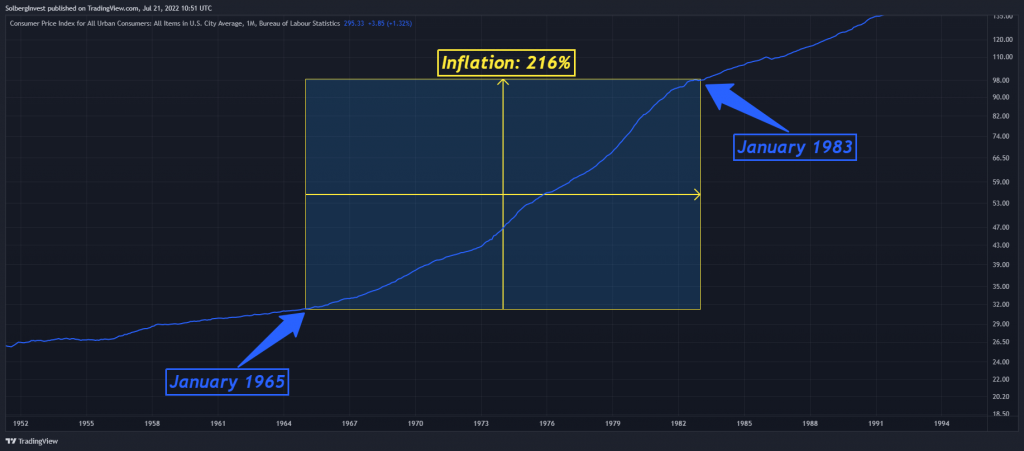

Let’s look at historical data and compare investing and saving from the mid 60s, through the 70s and early 80s – a time of high inflation:

Inflation from January 1965 – January 1983: 216%

Once again we’re using the “Consumer Price Index For All Urban Consumers (CPI-U)”, as it best fits most people. (source)

216% inflation is insane. Think about it; that’s more than a tripling of prices. (200% = 3x). If you used to spend $230 on a dinner out with your family in 1965, the same dinner would cost almost $730 in 1983!

Basically, every dollar in 1983 is worth less than 1/3 of every dollar in 1965.

Below you see what the S&P 500 did in this time of high inflation:

We can clearly see that The S&P 500 increased, but not nearly enough to beat inflation.

The “real” return of investing in the S&P 500 from 1965 to 1983 is roughly -50%. Here’s the math:

$100 invested in 1965 turned into $167 in 1983. Since inflation has cut the value of every U.S. Dollar in less than one third, the “1965-value of 167 1983-dollars” is less than one third of $167, which is roughly $50. Therefore, the factor of growth is 50/100 = 0.5. The return is therefore 0.5 – 1 = -0.5 = -50%.

Now, why the heck would anyone argue that a negative return of 50% is desirable over a 20+ year timeframe?

Because the alternative is even worse!

Saving money from 1965 to 1983 had a real return of -70%. Every dollar you had would be worth less than one third of its original value.

It’s clear then, historically speaking, that investing is the better choice during times of high inflation – even if the investment does not outpace inflation.

The next question you should ask yourself is: What to invest in…

Yes, You Should Invest During Inflation

I’m not a financial advisor, but investing during inflation seems the better choice. Personally, I will continue stacking BTC, Mutual funds, and paying my mortgage. I will do what I can to keep up or beat inflation. I choose to invest through it.

Suggested reading: Is Saving $2000 Per Month Good?