The cryptocurrency market has exploded, with coins going 100x left and right. Algorand performed excellent in 2021, but is Algorand a good investment in 2022?

Yes, Algorand is a good investment in 2022. It’s one of the most promising blockchain projects in terms of technology and use cases. In addition, there are a number of real-world projects using the Algorand blockchain, increasing its value. But, Bitcoin and Ethereum are better.

Let’s break it down, and analyze Algorand as an investment in 2022:

The Economics of Algorands Coin – ALGO

The ALGO cryptocurrency, which is what you buy to invest in algorand, has a high circulating supply, forcing the price per coin to be low. (Read more about the Algorand supply mechanics and inflation here)

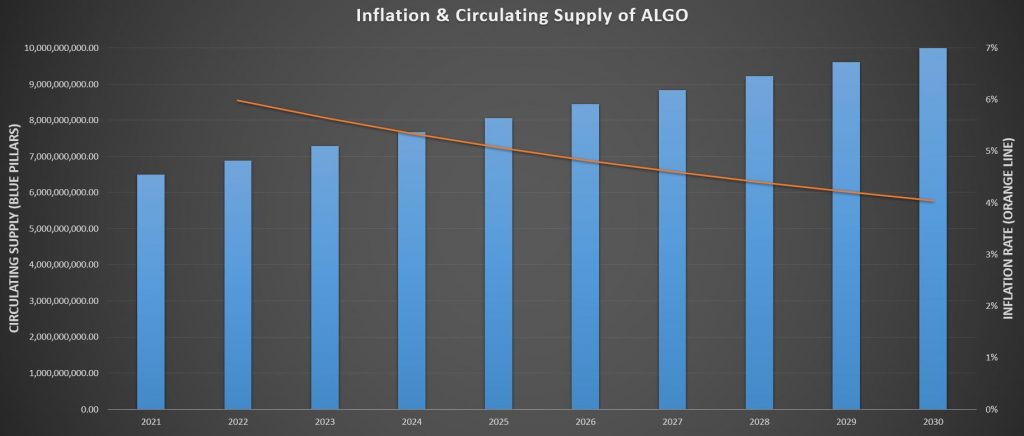

The current circulating supply of ALGO is roughly 6.5 billion coins, which is a lot:

This naturally causes the price per coin to be low, compared to other projects like Ethereum.

What’s more important to understand is the rate of inflation that ALGO will experience.

Algorand will have a relatively normal inflation rate between 5% and 6% annually in the next 5 years or so. After 2030 inflation will end as all the coins will be in circulation.

They plan to distribute an average of 388 million coins per year until 2030.

Just like the U.S. Dollar is devalued by money printing, this drives the price down, which is bad for investors.

Take a look at the future inflation rate of the ALGO below.

The orange line is the inflation rate, with values at the right vertical axis. The blue pillars are the circulating supply each year, with values at the left vertical axis:

The inflation rate in 2022 will be around 6%. This means that the circulating supply of ALGO will increase by 6%.

Remember, the way to calculate the price of ALGO is to divide the market cap by the circulating supply.

If the supply increases, the price has to decrease.

As investors, it’s important to look at fundamental factors like the inflation rate and the supply mechanics of ALGO.

It’s easy to look at the inflation and think: “Why the heck are they suppressing the price with 6% per year!? Are they working against me!?”

No, they are not “working against you”. There is a reason for the issuing of new coins, creating inflation, and it’s good.

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, Algorand, and more. Also, I’ll give you helpful guides and reviews.

Get expert insights every week – Sign up for free below:

Is Algorand a Bad Investment Due to its Inflation Rate?

Inflation is generally bad for the value of an asset. However, it’s not that simple. We have to look at why Alorand has chosen this type of distribution for their coins before concluding anything.

In fact, ALGO’s inflation can be used as an argument for investing in Algorand in 2022.

Hear me out:

The high inflation rate means that a lot of new coins are being distributed. These tokens are being used as incentives for developers and ALGO stakers.

No inflation means no incentive to stake your ALGO (because there can be no rewards) and no incentive to “build stuff” on Algorand.

If Algorand manages to attract a lot of developers and business, as well as stakers, the high inflation rate makes the blockchain more secure (due to more stakers) and the ALGO coins more valuable (due to more adoption).

In other words, inflation is good for business, which again is good for the value of the ALGO coins.

So far, this strategy seems to work well. They have a lot of traction when it comes to bringing business and stakers to the Algorand ecosystem:

The Algorand Ecosystem:

The ecosystem built around and on top of Algorand is a huge upside for ALGO investors.

This is basically how it works; more projects built on algorand = increased ALGO price.

Well, that’s good news – Algorand has tons of projects built on it, as well as projects in the pipeline.

This is taken from the Algorand website:

I would like to mention one use case that I really like:

Marshall Islands’ Sovereign Digital Currency Will Be Based on Algorand

Even though the Republic of the Marshall Islands only has a population of 55 000, it’s a big deal that they’re building their national currency on the Algorand blockchain.

If they do it successfully, other countries might follow – increasing to the value of ALGO a lot.

Technical Analysis on Algorand as an Investment for 2022

Let’s look at the price charts, and see what they tell us about the possible outcomes for Algornad this year.

I like to keep things simple when performing technical analysis on cryptocurrencies. If you’re unfamiliar with basic technical analysis, read this article: Bitcoin Technical Analysis: How to Read Bitcoin Price Charts Like a Pro

We’re going to look at algorand priced in USD, BTC and ETH. This way, we get a few different perspectives and a more complete understanding of the price moves of the cryptocurrency.

ALGO / USD Analysis:

I’m writing this right after a huge correction/crash. We’ve found support on the yellow line, in the $0.8-$0.85 range.

If this line breaks, the next support is likely to be right above the $0.5 level – red line.

If the support we’re at right now breaks, we’re likely to reach $0.5, which is a 39% drop.

The upside potential is hard to tell at the moment.

Let’s move on to ALGO / BTC:

ALGO / BTC Analysis:

This chart tells us that ALGO is trending sideways relative to Bitcoin. This might change of course, but generally speaking, it has been the case for almost two years now.

In other words:

Over time ALGO is not outperforming Bitcoin significantly, which makes the added risk of holding ALGO instead of BTC unjustified.

Let’s take a look at the ALGO / ETH chart:

ALGO / ETH Analysis:

This chart just looks bearish… ALGO is trending down relative to ETH.

Remember, this chart shows the ratio of ALGO / ETH. Even though this is trending down, the USD price of ALGO might go up.

This chart only tells us that ETH is outperforming ALGO, not that ALGO is decreasing in terms of USD.

You need to ask yourself an important question:

Can I justify the increased risk of holding this altcoin instead of holding the altcoin – Ethereum?

In this case, the answer is a clinging NO. It’s clearly trending down against ETH, making it impossible to justify its place in your portfolio.

To conclude our technical analysis of Algorand:

I’m going to be honest; in 2022 I would rather invest in Ethereum or Bitcoin. The increased risk of holding ALGO can’t be justified as its trending down against ETH.

The only way to justify holding ALGO, in my opinion, is to trade the swings against BTC within the yellow trend channel we located above.

Even though the technical analysis is far from optimal, the Algorand it self is super strong. Let’s look more at Algorands fundamentals:

The Team Behind Algorand

When analyzing a potential cryptocurrency investment, it’s important to take a look at the team behind it.

We’ll look at the three leadership positions, Founder, CEO and COO:

Founder: Silvio Micali

This guy has been a key figure in the development of modern cryptography and has been a faculty member at MIT since the 80’s.

In addition, he has received a bunch of awards, including the Turing award and the Gödel Prize.

In other words:

Silvio Micali, the founder of Algornad, is super smart, and knows basically everything about cryptography.

CEO: Steve Kokinos

Steve Kokinos has founded and run several successful businesses in the past.

The most recent is FuZe, which has over 700 employees and serves over 1500 enterprise customers.

What you need to know:

Steve Kokinos, the CEO of Algorand, has a lot of experience and know-how when it comes to running successful businesses.

COO: W. Sean Ford

W. Sean Ford is responsible for product management, engineering, marketing and global community development.

He came from LogMeIn, where he was responsible for global marketing strategy, product marketing, eCommerce, communications, brand leadership, and demand generation.

He has a ton of prior experience in leadership positions, including CMO and COO of Zmags, and as vice-president of Global Business Unit (GBU) marketing at Oracle.

In other words:

W. Sean Ford, the COO of Algorand, knows his way around the business world, with tons of experience from several companies. He knows how to do his job.

Algorand Team Conclusion:

The leadership of Algorand is top-notch from both a tech and business standpoint. This is a rare combination, as most cryptocurrency teams are either heavily focused on technology or business. This is good for Algorand investors.

Should You Invest in Algorand in 2022?

After looking at several different ways of analyzing Algorand as a potential investment in 2022, this is what I have to conclude with:

Algorand is a good investment in 2022, due to its superior technology, a large ecosystem of partners and wast number of use cases. However, it’s not better than Bitcoin or Ethereum.

Therefore, cryptocurrency investors should consider investing their capital in Ethereum or Bitcoin before investing in Algorand.

For an in-depth look at the technology behind Algorand, read this article:

How Algorand Solves “The Blockchain Trilemma”

Are You Investing in Crypto?

Download my free guide, and sign up to my newsletter.

There you’ll receive updates on Bitcoin, Ethereum, Chainlink and ADA; including both technical and fundamental analyses, as well as general market updates.

By signing up, you’ll also learn:

- How to read price charts like a pro (technical analysis for beginners)

- How to calculate exactly how much crypto you should have

- How to earn passive income with cryptocurrencies

- The number one mistake crypto investors make