These days there’s a lot of hype around alternative layer one solutions like Solana and Avalanche. New crypto investors often feel like Ethereum is outdated, and that the tech is “old and slow”.

After all, Ethereum is roughly 60,000 more expensive to transact on compared to Solana, and it’s 40 times slower.

Nevertheless, I would argue that Ethereum is a great investment in 2022. In this article, I’ll tell you why, and try to show the reason behind Ethereum’s high valuation.

The short answer to “Is Ethereum a good investment in 2022” is this:

Yes, Ethereum is a good investment in 2022. We are seeing institutional adoption accelerating, expecting huge technological upgrades, the TVL is over 10 times as high as the closest competitor and the Ethereum ecosystem is miles ahead of other blockchains.

PS: There are ways to squeeze even more out of Ethereum than just holding it. I have written an article about my personal Ethereum investing and trading strategy showing how to make higher returns.

Let’s get into why Ethereum is a good investment and my largest altcoin position in the cryptocurrency market:

Why Ethereum is a Good Investment in 2022:

First of all, let’s establish what Ethereum and other layer one solutions like Solana and Cardano are, and what they are trying to achieve:

Ethereum is what we call a “programmable blockchain.” This means that programmers can make changes to the platform and make new applications. The Ethereum blockchain is often compared to “the internet” as it lets you build things on it and use it to store information.

The same is true for Solana, Cardano, Avalanche and all the other layer one solutions.

Basically, Ethereum and the other layer one solutions try to build a sandbox for developers to play around in and build awesome applications that people and businesses want to use.

For example, the popular DEFI application Uniswap is built on Ethereum. This means that all transactions done in the Uniswap application are in fact run on the Ethereum blockchain.

The more applications that are built on a given blockchain, and the more people that use these applications, the higher the value of the native token to that blockchain will be (in theory).

For example, if more people use applications built on the Ethereum blockchain, ETH will in theory increase in demand and therefore value.

Basically, the more a blockchain is being adopted/used, the more valuable the native coin gets. Got it?

Now, let’s look at the adoption of the different blockchains:

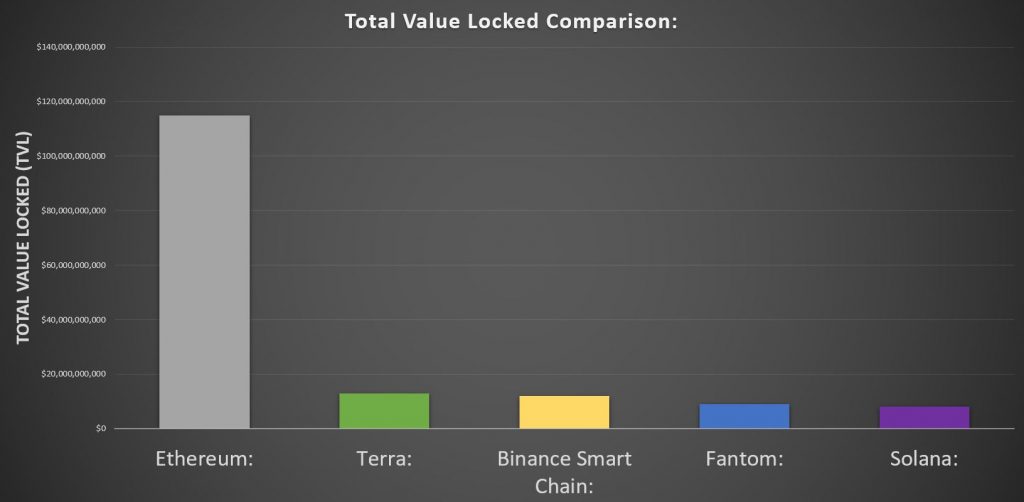

TVL Ethereum vs Competition:

TVL means “total value locked”, which means the amount of money locked in DEFI apps and such.

TVL is basically a number telling you how much money is floating around in the DEFI ecosystem of a given blockchain.

Oh, and this is important: High TVL – good. Low TVL – bad.

Below you find a chart showing the difference in TVL of some of the largest blockchains:

Do you see how much more money flows around on the Ethereum blockchain?

The TVL on Ethereum is almost 10 times higher compared to all its competitors.

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, Solana, and more. Also, I’ll give you helpful guides and reviews.

Get expert insights every week – Sign up for free below:

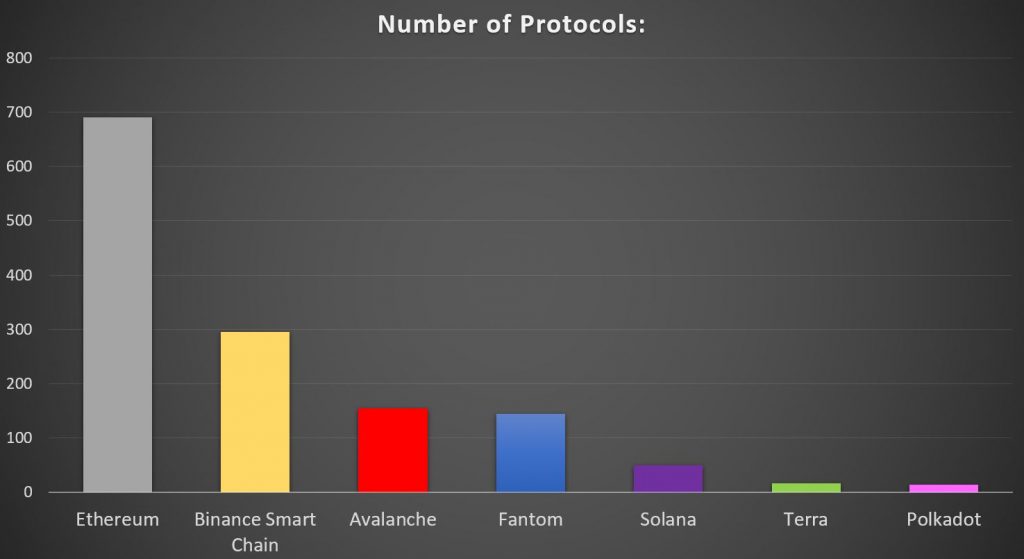

Number of application on Ethereum vs competition:

Another way to get an idea of the adoption of a given blockchain is to look at the number of applications built on top of it.

The number of “protocols” is the right way to say it, but let’s just stick with applications cuz it’s easier…

Below you’ll see a chart showing the number of applications built on some of the different blockchains:

Once again, Ethereum is leading by miles. BSC (Binance smart chain) got almost half as many, but the applications on BSC are known to be “fishy”, and lots of them are not serious projects. (At least at the time of writing! It might change)

The point is that Ethereum is miles ahead of its competition, just like it is in terms of TVL as well.

Now, remember how more applications and users leads to a more valuable native token/coin…?

At this point it should be obvious why Ethereum is “the prince of crypto” (Bitcoin is the king), and also that Ethereum is the safest bet if you’re investing in layer one solutions – It’s got all the users and protocols!

Suggested reading:

Why Ethereum Will Continue to Dominate in 2022:

By now you understand that Ethereum dominates the “programmable blockchain” sector (layer ones). It has way more applications and much higher TVL.

However, will this continue to be the case?

If this is to change in the near future, Ethereum will most definitely not be a good investment in 2022…

Well, here’s the thing: Ethereum has the network effect on its side!

Think about it:

The applications on the Ethereum network all feed off each other in a synergistic manner. If one protocol increases its userbase, other applications on the same network benefit!

- For a developer choosing which network he’s going to build his new application on, he will pick the one where the likelihood of people adopting his app is highest. In most cases, that’s Ethereum!

- It’s also normal to need to integrate a bunch of other application into your application to make it work properly. Ethereum has the most applications, which makes it the best network to build on due to the large range of different applications you can integrate into yours!

- Ethereum is time-tested, and people trust it. Projects based on BSC or other platforms are much less trusted. BSC in particular. This makes users prefer Ethereum based applications, which makes developers pick Ethereum as their platform. This makes Ethereum even more trustworthy, which creates an upwards spiral.

I’m sure there’s much more to add to that list, but you get the point – In 2022, Ethereum is a good investment because its got the network effect working for it.

Institutions are Investing (a lot) in Ethereum:

Watch the actions of rich people and institutions, not their words, and you’ll see that they’re all scooping up the ETH that retail investors like you and me are panic-selling every time the market dips.

I’ll give you a picture of how much ETH these guys are buying. Let’s begin with Grayscale:

Grayscale manages over 7 billion USD worth of ETH:

Grayscale has an Ethereum Trust, which allows people to get exposure to ETH without actually buying it directly.

One can buy some stock in Grayscale Ethereum Trust, which gives you a claim to a certain amount of ETH indirectly.

This is great for institutions that are prohibited by regulations and such to get exposure to Ethereums price action.

It’s also good for pension savers, as you can hold the stock in a retirement account (I think).

Here’s the number of USD worth of ETH Grayscale is handling at the moment:

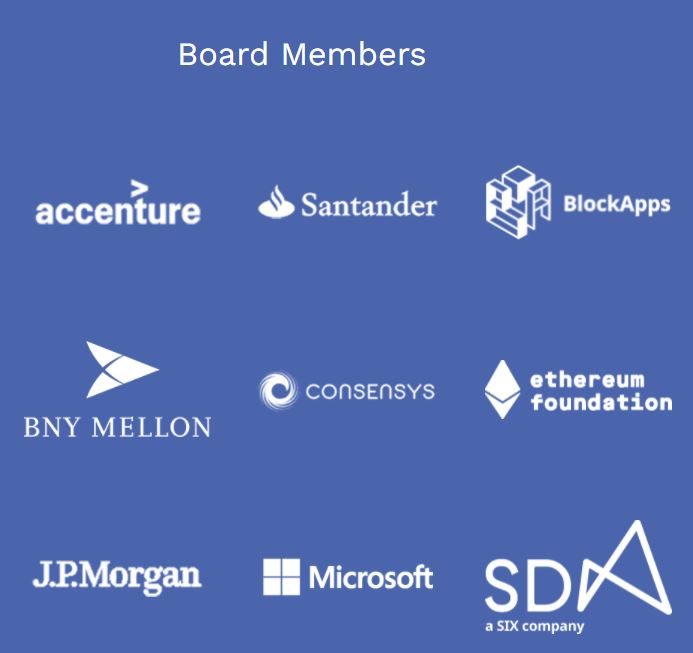

Enterprise Ethereum Alliance

Also, you should take a look at “Enterprise Ethereum Alliance” (EEA) – Institutions (200+) that work together to further Ethereum development and create new projects on its blockchain.

The board members of EEA include big names like these:

The fact that names like J.P.Morgan, Microsoft, and Santander are interested in Ethereum makes our case even stronger – Ethereum is a good investment for 2022 (and beyond).

Other big-name members in EEA:

- FedEx Corporate Services, Inc (postal service)

- Ernst and Young (Famous investment bank)

- The Bank of New York Mellon (Huge bank)

- Standard Chartered Bank (Huge bank)

- Sberbank of Russia (One of the largest banks in the world, based in Russia)

The list goes on… Check them out here if you want to see for yourself:

EEA MEMBERS

All of these guys are interested in the success of Ethereum. If that is anything other than bullish I don’t know what is!

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, Solana, and more. Also, I’ll give you helpful guides and reviews.

Get expert insights every week – Sign up for free below:

Ethereum 2.0 Is Coming in 2022:

Ethereum is currently slow and expensive to use. It’s got some major issues on the scaling front. Here’s why:

The Current Problem With Etherem:

At the moment, Ethereum can handle between 7-15 transactions per second. This is really slow compared to other chains like Solana which can handle up to 50,000 transactions per second.

The high traffic, combined with the low scalability, makes the transactions fees on Ethereum high. The reason is this:

Fees are like a ticket into the block that miners will add to the chain of already approved blocks. Only a certain amount of transactions fit into the given block.

All the transactions in the block will go through with a few minutes, while the ones that didn’t get a spot in the block have to wait for the next opportunity to get into a block.

The way to get your transaction into a block is to pay a transaction fee. If there’s more competition for “blockspace”, the fees naturally get higher (supply vs demand).

Every 14 seconds a block is added to the chain, and each block can fit roughly 70 transactions.

Now, think about all the things that are built on Ethereum – all the NFT stuff, all the DEFI stuff, all the Metaverses.

All of the transactions happening on these projects are competing about spots in the blocks on the Ethereum blockchain. This makes the fees EXTREMLY high when the hype is high.

Personally, I paid over $300 for a single trade on Uniswap in Q1 of 2021 – insane…

Ethereum 2.0 Will Fix This in 2022:

The solution to high fees and slow transactions due to low scalability will (probably) come in 2022.

Ethereum will switch over to proof of stake instead of proof of work, and utilize a bunch of technical stuff like network sharding to improve the scalability.

Basically, this is what Ethereum 2.0 will do:

- Scale Ethereum up from 7-15 all the wat up to 100,000 transaction per second

- Reduce the fee of transating on Ethereum from $15-$300 down to practically speaking nothing.

- Allow Ethereum holders to “stake” ETH to earn a yield.

I hope you understand how crazy bullish that list is…

ETH Might Turn Deflationary in 2022:

You know how inflation is lowering the value of FIAT currencies like The U.S. Dollar?

ETH is likely to experience the opposite of that – deflation – in 2022, here’s why:

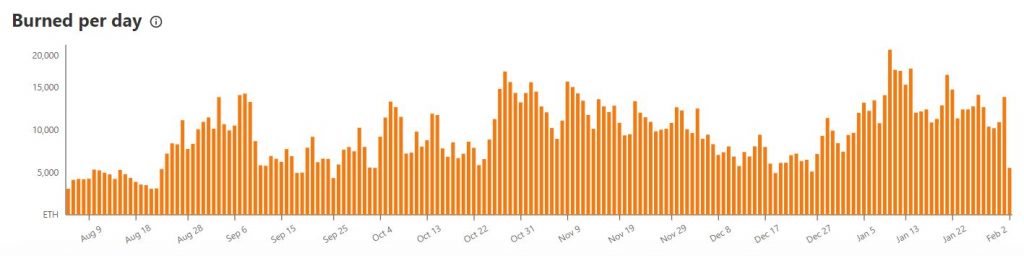

In August of 2021, a network upgrade was uploaded to Ethereum – EIP-1559. This upgrade made some changes to the transaction fees on Ethereum:

Instead of miners receiving the majority of the transaction fee, a lot of the fees are now being burned (basically deleted from existence).

This burning mechanism is acting as deflationary pressure and increases with the number of transactions on the Ethereum blockchain.

Below you see a chart showing the amount of burned ETH per day since August of 2021:

That’s a lot of burning!

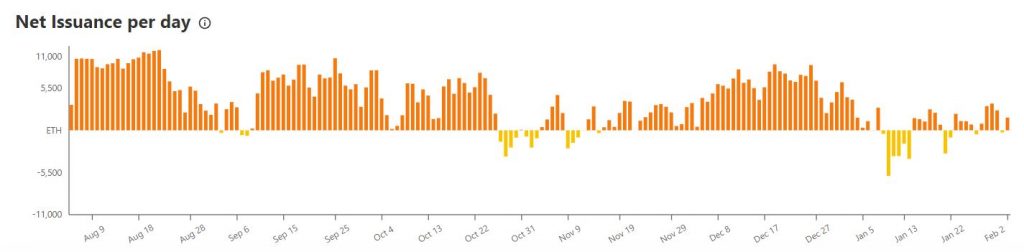

Now, the chart below this sentence is showing the “net issuance” per day, which basically equals the inflation/deflation per day:

Notice that some of the days are colored yellow. These days the net issuance was negative.

This means that more ETH was taken out of circulation through burning that was put into it by mining!

That’s deflation right there – acting as an upwards pressure on the price over the long term.

Now, do you think there will be less activity/traffic on Ethereum in 2022, or more?

If you, like me, think there’ll be more, ETH might actually turn deflationary in 2022… Bullish!

Is Investing in Ethereum too Risky in 2022?

This is a good question, and I’ll give you a good answer. But first of all, you need to understand this:

There are two types of risks when investing in cryptocurrencies: Systemic risk and idiosyncratic risk.

The systemic risk is the risk of investing in the cryptocurrency market in general. The risk that the whole market dumps.

This risk follows any cryptocurrency investment, not just Ethereum.

Because Bitcoin is the market mover and the king of crypto, the systemic risk of investing in cryptocurrency is equal to the risk of investing in Bitcoin.

The idiosyncratic risk is the risk that Ethereum fails, regardless of what the market does.

This is the risk of the Ethereum blockchain being compromised, competitors like Cardano or Binance Smart Chain catching up, or implementing an upgrade unsuccessfully – making the blockchain obsolete.

In my opinion, the biggest risk of investing in Ethereum is the risk of competitors catching up. The risk of the blockchain being hacked, or failing at some point, is extremely low.

Notice, however, that the idiosyncratic risk of investing in Ethereum is mostly a symptom of their success.

The risk of competitors catching up exists because Ethereum has the lead. For this reason, the idiosyncratic risk of investing in Ethereum is relatively low, in my opinion.

Conclusion on the risk of investing in Ethereum:

Investing in Ethereum carries the idiosyncratic risk of Ethereum failing, or being outcompeted, plus the systemic risk which is equal to the risk of investing in Bitcoin. In other words, it’s like investing in Bitcoin, but with some extra points of failure.

In my opinion, the systemic risk of cryptocurrencies is high, and the idiosyncratic risk of investing in Ethereum is relatively low.

Therefore, investing in Ethereum is “high-risk” compared to investing in assets in other markets, like the stock market of real estate, but the risk is relatively low compared to other cryptocurrencies.

Other Use-Cases for Ethereum in 2022:

There are more ways to use Ethereum than just “building applications”. In this section I’ll tell you about a three of them:

Governments Can Use Ethereum

Did you know that the Ethereum blockchain can be used as an immutable “log”? This has use-cases far beyond just the login of financial transactions. For example, governments can write laws on the Ethereum blockchain!

We have already seen interest from some governments to write their laws on the Ethereum blockchain. Brazil is one of them.

Also, they have shown interest in storing information about who owns land/real estate on the Ethereum blockchain.

This is REALLY helpful in countries that struggle with corruption and general bad record keeping.

There is an unlimited number of possible use cases for Ethereum by Governments, but these two are the major cases we’ve already seen interest in.

Banks Already Use Ethereum

Here’s one example of how banks already use Ethereum:

The European Investment Bank (EIB), the investment bank owned by the EU Member States, has announced the issuance of the organization’s first-ever digital bond built on a public blockchain. The bond was issued using Ethereum and the issuance invoked $121 million two-year bonds placed with key market investors.

Jamie Redman (Bitcoin.com)

That’s right; a bank has issued a bond on the Ethereum blockchain!

I hope you understand just how crazy bullish that is for Ethereum as an investment.

This was back in 2021, and banks are only loving Ethereum more and more.

Know this:

The bond market is a $100 Trillion market. Suppose Ethereum becomes the go-to marketplace for bond issuing; that is a huge deal for Ethereum.

Tokenized Real Estate On Ethereum

Real estate is traditionally a “high ticket” investment, meaning that you need a lot of money to get started. Ethereum changes this:

Suppose you have a property that’s 10 000 square feet big worth $1 million. Suddenly you need some cash, but you don’t want to sell the property yet. What you can do is tokenize the property.

This is how: You create an ERC-20 token (token on the Ethereum blockchain) which derives its value from the property. For instance, you can create 10 000 tokens, one per square foot, and value them at $1 million / 10 000 = $100 each.

Then you can sell 2000 tokens to investors and keep 8000 of them for yourself.

This way, you keep 80% of the property while other investors own 20% of it.

If it’s a rental apartment, the rent can be paid in Ethereum directly into a smart contract which automatically pays out the appropriate percentage of the rental income to the owners.

“How far away is this?”

It’s already here!

Last week, a friend of mine actually talked to a Norwegian billionaire real estate guy looking to tokenize some of his properties.

Also, check out this article about Reinno, a company that just launched its platform with over 200 million dollars worth of real estate tokenized.

How Much Should I Invest in Ethereum?

How much Ethereum you should buy, is closely related to whether or not Ethereum is a good investment.

After all, the better Ethereum seems the more you want of it, right?

I’ve been giving this a lot of thought, as this is a hard question to answer. It’s highly dependent on the risk you’re willing to take, as well as your goals.

However, I have made some general suggestions for “average Joe” who want a quick answer:

• 50% of your portfolio should be kept in Bitcoin.

• Ethereum should be the largest altcoin in your portfolio.

• Individual Mid-caps should not be more than 15% of your total portfolio.

• Keep the total small-cap and highly speculative coins below 10% of your total portfolio.

Mid-caps and small-caps refer to medium and small-sized coins, measured by market cap.

If you’re a beginner, I suggest you stick with the rules listed above. (not financial advice)

However, if you’ve got some experience and know what you’re doing, there’s nothing wrong with investing more than 50% of your portfolio into altcoins.

I do have an article you can read to get deeper into this:

How Much Cryptocurrency Should You Buy?

Ethereum is a good investment, which is why there’s nothing wrong with keeping 20%-25% of your portfolio in Ethereum.

Concluion: Ethereum is a Good Investment in 2022

Given the reasons listed below, I’ll conclude with a loud “yes” – Ethereum is a good investment in 2022!

- Institutional adoption is ramping up

- ETH 2.0 is getting close

- The TVL is over 10 times as high as the closest competitor

- Ethereum hosts over twice as many protocols as the closest competitor.

- ETH might become a deflationary asset in 2022.

- All of the points above work synergistically in a network effect kind of way to make Ethereum even better.

Do You Invest in Cryptocurrency?

Download my free guide to increase your ROI!

I’ll teach you four FREE ways you can get more bang for your buck: