Solana has been one of my best-performing investments of 2021. Its tech is awesome, the adoption is ramping up, and institutions are investing. However, after the crazy price increase of 2021, is Solana a good investment in 2022?

Yes, Solana is a good investment in 2022 because of the growing ecosystem of applications, the strategic partnerships, the institutional adoption, the solid token economics.

The better question is whether or not Solana is a better investment than Ethereum or Bitcoin. After all, you need to be able to justify the added risk of holding SOL instead of ETH or BTC.

I think that Solana has the potential to reach $1000. However, just because it has the potential to do it does not mean it will.

Let’s dive into everything you need to know to make a data-based decision on whether or not you’re going to invest in Solana!

Fundamental Analysis of Solana as an Investment for 2022:

Let’s go through some of the fundamental aspects of this project first. I’ll look at the economics of the SOL token, the technology behind Solana and the adoption.

The Tokenmoics Of Solanas Token – SOL

Analyzing the supply mechanics is important for figuring out if Solana is a good investment, or not.

(The numbers used below are taken from coinmarketcap.com and docs.solana.com/inflation)

Solana has a circulating supply of 315 000 000 SOL, which means that 315 million SOL are floating around on the open market, in smart contracts, or locked in staking.

However, the total supply is over 500 million. This means that there will be a circulating supply of almost 500 million SOL at some point in the future.

“Sure, but why should I care?”

Because the price of SOL is a function of market cap divided by circulating supply!

It then logically follows that if the circulating supply doubles, the price per SOL is cut in half.

I figured out how Solana plans to distribute their tokens and their planned inflation rate (how fast the supply grows).

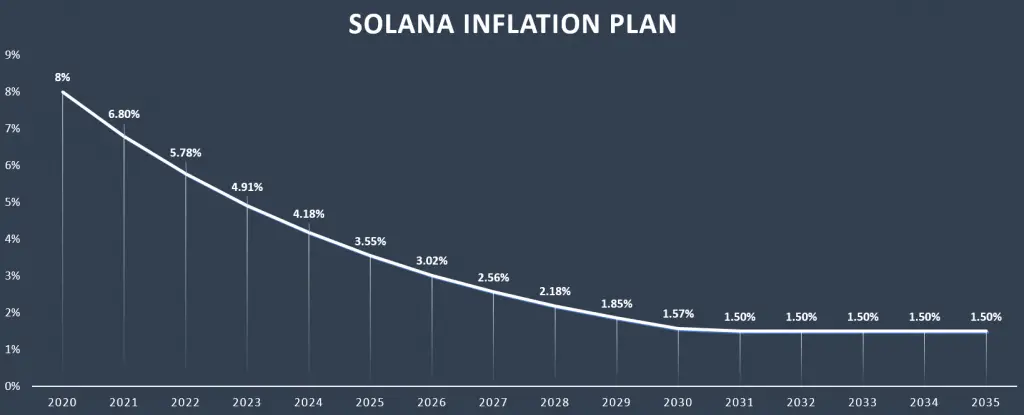

– Initial Inflation Rate: 8% (Inflation in 2020)

– Dis-inflation Rate: −15% (The change in inflation every year)

– Long-term Inflation Rate: 1.5% (The inflation after 5-10 years)

This means that the inflation of 2020 was 8%, which lead to downward pressure on the price at 8%. However, this downward pressure decreases by 15% every year, leading to a decreasing inflation rate over time. After a decade or so, the target inflation rate is 1.5%:

This is a reasonable inflation rate. It’s a bit high initially, which might scare off some people. After all, SOL’s marketcap has to increase 8% just to break even.

However, it’s important to ask why the inflation of SOL is set to 8%. Or even why there is inflation in the first place!

It’s simple, really…

It’s to incentivize staking and developing to get the ball rolling.

The target of 1.5% per year is perfect for Solana. This keeps the staking lucrative without having a large downward pressure on the price.

In summary, the tokenomics and an exponentially decreasing inflation rate make Solana a good investment, at least in the long term.

Join my newsletter:

The Solana Blockchain (Technology Review)

The blockchain, Solana, is super fast and highly scalable. With basically instant transactions and scalability of up to 50,000 transactions per second, Solana leaves Ethereum and the others in the dust.

Check out the comparison of a few different blockchains below:

| Solana | XRP | Ethereum | |

| TPS (transactions per second) | 50 000 | 1500 | 7-15 |

| Transaction Speed (block time) | 0.4 Sec | 5 Sec | 15 Sec |

| Transaction Fees | $0.00025 | $0.0034163 | $15 |

As I’ve written in earlier articles, Solana has roughly 60 thousand times as low fees as Ethereum.

Solana is also 40 times as fast, and 5000 times more scalable.

Why then, is Ethereum worth so much more? It seems like Solana should be the leading blockchain, not Ethereum.

However, there’s one weakness with Solana, which is a dealbreaker for many people – lack of decentralization.

To function properly, The Solana Blockchain relies on a central agent – The Solana Foundation.

According to “Cardanofeed.com“, this is a big problem:

… The Solana Foundation is the only entity developing core nodes on the blockchain. This means Solana has a central point of control that reduces the network’s overall decentralization. In comparison, several core node developers are building on Ethereum, among them Go Ethereum, OpenEthereum, Nevermind, and Besu.

…

When comparing Solana to other Layer 1 chains, the amount of tokens held by insiders is high. Ethereum and Cardano both distributed around 80% of their tokens through a public sale, with insiders holding between 15 and 17% of the total supply. However, Solana’s token distribution looks more similar to Binance Coin’s, which also has around 50% of its tokens held by insiders and is frequently criticized for its lack of decentralization.

https://cardanofeed.com/how-decentralized-is-solana-11526.html

There are even more factors contributing to the centralization of Solana, like extreme requirements for running a validator node – thousands of bucks for the hardware, one SOL per day in “voting fees”, electricity, etc.

I guess this is the price to pay for achieving speed and scalability…

It’s also important to know that Solana is early in its development. It seems to “go down” every now and then failing to validate transactions, which the “Solana-people” excuse by saying it still is in Beta.

Solana Adoption:

At the time of writing this (end of January 2022), the Solana ecosystem consists of roughly 1300 projects.

These projects include everything from DeFi applications like Lending/borrowing apps and Decentralized exchanges, and all other things like social media apps and meme coins.

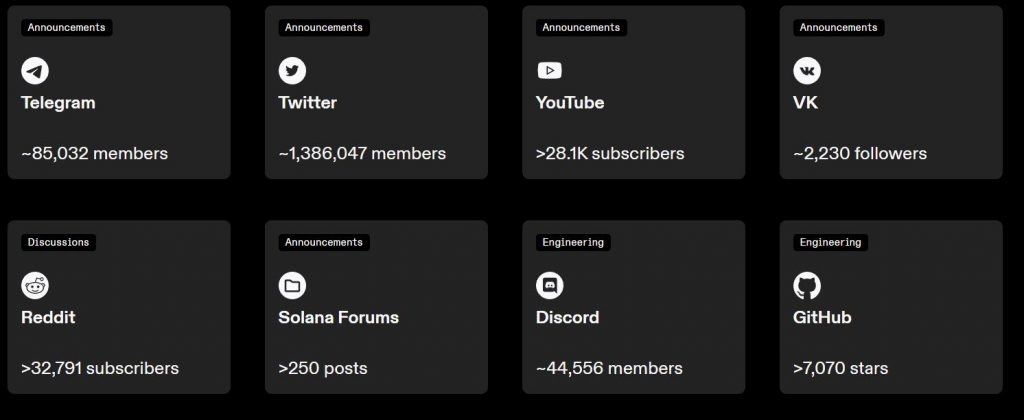

Other than that, Solana has garnered a huge social media following:

To give you some perspective, Ethereum’s twitter profile has 2.1 million followers, and Bitcoin has 4.4 million followers.

The marco-legend Raoul Pal said this about Solana:

“It’s kind of like everybody wanted Cardano to happen is actually happening to Solano right now. It doesn’t mean Cardano doesn’t over time, but Solana looks like it’s going to win this cycle. It wasn’t the standout coin that becomes a major.”

Raoul Pal

There’s a lot of institutional interest in this project as well. Just to mention two instances:

- Galaxy Digital has launched a Solana fund offering institutional investors exposure to the price action of SOL (source)

- According to Bllomberg: “In June [of 2021], Solana Labs, a developer of decentralized finance projects, raised $314.2 million from investors, including venture capital firm Andreessen Horowitz and Bankman-Fried’s Alameda Research.” (source)

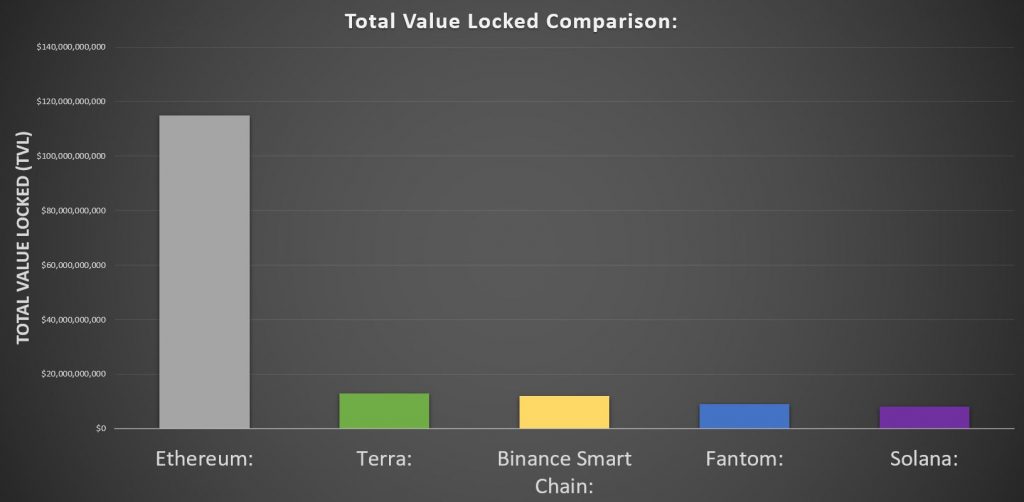

Another thing you need to look at is the “total value locked” (TVL) compared to other chains like Ethereum or The Binance Smart Chain:

TVL is basically the amount of value locked in contracts/applications across all applications on a given chain.

For example, if you want to earn interest on your ETH you can “lock it up” in a DEFI app on the Ethereum blockchain. The ETH you deposit into the app will then be counted on the TVL on Ethereum.

Below you find a graph showing the TVL on a few different chains, as of Q1 2022:

Solana is not as big as the others in terms of TVL. However, this will change in the future, and Solana might start creeping up on Ethereum and the others in the coming months/years.

The Team Behind Solana:

The Solana team consists mostly of high-quality engineers. These people often have experience from huge companies like Qualcomm, Apple, Google, Dropbox and Microsoft.

The CEO and Co-founder: Anatoly Yakovenko

This guy is the CEO of Solana, and the one who first got the core idea that Solana is built upon – proof of history.

He has tons of experience in relevant fields. The following is taken directly from his Linkedin profile:

- Dropbox: He focused on distributed systems and compression. He worked there for 6 months.

- Mesosphere: Now known as D2iQ. Essentially built a distributed operating system. Position lasted 10 months.

- Qualcomm: Senior Staff Engineer Manager, 2015 to 2016, Senior Staff Engineer, 2012 to 2015, Staff Engineer, 2008 – 2012, Senior Engineer, 2006 – 2009

This guy is without a doubt a smart man, with the right talents to build and organize the Solana blockchain in an effective manner. However, it does not seem like the guy has tons of leadership experience, which might turn some people off. Nevertheless, his been CEO for over 4 years now, and Solana is doing great – He must be doing something right!

The CTO and Co-founder: Greg Fitzgerald

This guy is the CET of Solana, and the one who’s responsible for the architecture of the Solana blockchain. He’s the guy who figured how the “how” of the Solana blockchain.

Although he didn’t have a Linkin profile, I found some information about him over at Crunchbase:

Greg is the principal architect and CTO of Solana. Greg has explored the full landscape of embedded systems. He created a bidirectional RPC bridge between C and Lua for the BREW operating system, helped launch the ARM backend for the LLVM compiler toolchain, and published a variety of open source projects including a streaming LLVM optimizer in

Haskell, license analysis tooling in Python, and a reactive web framework in TypeScript. If you have time to burn, ask him “Why Rust?” We dare you.

https://www.crunchbase.com/person/greg-fitzgerald-0210

To be 100% honest, I don’t understand half of the words used in the quote above. However, What I do understand is this: Greg Fitzgerald knows a lot about developing software and birthing tech-stuff. This makes him a good CTO, in theory.

The COO and Co-founder: Raj Gokal

This guy is the COO of Solana, and the guy who oversees the day-to-day stuff. He is second in command, next to the CEO.

Like the CEO, this guy has tons of experience. The following is taken directly from his Linkedin profile, but also from his personal website:

- General Catalyst: He worked there for 8 years as an investor.

- Sano: He co-founded Sano which was later bought by One Drop, which is a major company in the “mental health tech” industy.

- Omada Health: As Director of Product he help scale the project.

Raj Gokal also traveled the world while consulting on the side. After a year of traveling, he met with Anatoly Yakovenko (the CEO) in 2017 and was pitched the initial idea of Solana over a cup of coffee.

On his website, he ends with this:

Since then, we’ve shipped a lightning-fast distributed ledger technology for mission-critical decentralized applications. The architecture works. We’re thrilled, and now are working on building an ecosystem and business around this tech.

– Raj Gokal

Technical Analysis on Solana as Investment for 2022

As well as looking at the USD chart of Solana, I’ll take a look at Solana compared to Ethereum and Bitcoin. This gives you the full picture and an indication of whether or not Solana is a better investment than ETH and BTC in 2022.

SOL/USD Analysis:

The chart below shows the USD price of SOL. As I’m writing this in the middle of a huge correction, SOL is currently down 66%.

We’re not seeing any signs of reversal yet, and I expect it to test $50-$55 if it keeps falling.

If a test of $50-$55 is successful, and SOL finds long-term support (a few weeks minimum) in this range, we might get a reversal and begin a new bullish parabolic phase for Solana.

This chart paints a short-term bearish picture, but might indicate a bright long-term future. It’s often harsh correction like this one that kicks off the next parabolic run.

SOL/BTC Analysis:

This chart will show the ratio of SOL and BTC. If the chart goes up it means that Solana outperforms Bitcoin. If it goes down it means that Solana underperformed Bitcoin.

This chart might go both ways. If we continue dropping, I think a 50% correction from here is possible (worst case).

However, if we find support in this current range, we might begin going back up to the previous ATH – a 70% surge:

It’s hard to tell where this chart is going to go in the long term, but it shows you where the SOL/BTC ratio lies at the moment.

SOL/ETH Analysis:

This chart will show the ratio of SOL and ETH. If the chart goes up it means that Solana outperforms Ethereum. If it goes down it means that Solana underperformed Ethereum.

This one is speculative, but interesting nonetheless. 2022 might hold the third “Solana wave”:

There are no “hard numbers” in this speculation, only a general prediction of Solana vastly outperforming Ethereum.

If you want more analysis like this, I broadcast it on a weekly basis in my newsletter!

Get expert insights every week – Sign up for free below:

Conclusion: Yes, Solana Is a Good Investment in 2022

Solana is a good investment because:

1) the growing ecosystem

2) the strategic partnerships

3) the institutional interest

4) the solid tokenomics

5) the bullish technical analysis, predicting it will outperform Ethereum in 2022.

As always, all of this is just my opinion. It is not financial advice.

Grab My Free Guide – Increase Your Returns!

When investing in cryptocurrencies, there are sneaky ways to significantly multiply your returns. I’ve written about four of them and given them to you FOR FREE in this guide: