Making $100,000 a year is a huge milestone. It’s a popular target in terms of salary, and understandably so.

In this article, I’ll deep dive into:

- What lifestyle $100K/year affords for a single person and a family of four.

- How much wealth you can build.

- What luxuries you can afford.

- What people say it feels like.

Here’s the short answer to how good $100K a year is:

Yes, $100K a year is good. After taxes and expenses, the average single person will have over $3K left every month, and a family of four will likely have over $1000 a month left.

Now, this discussion is nuanced. How good a six-figure salary is depends largely on your standards and where you live. Let’s break it down!

Warning: I’m a math guy. I might throw some numbers, charts and tables at you! What I am NOT, is a financial advisor. This article is just my personal opinion. It is NOT financial advice.

Yes, $100K a Year Is Good:

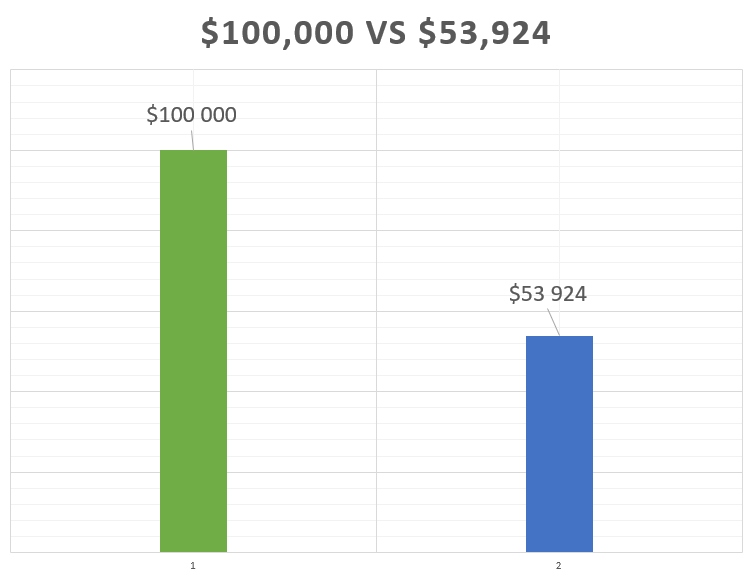

Earning $100,000 a year is great. The median salary in The U.S is $53,924, which means that earning $100,000 puts your salary 85% higher than the median.

To get a realistic picture of what kind of life you can live, and the potential wealth you can build, let’s figure out how much you’re left with after taxes and expenses when earning $100K a year:

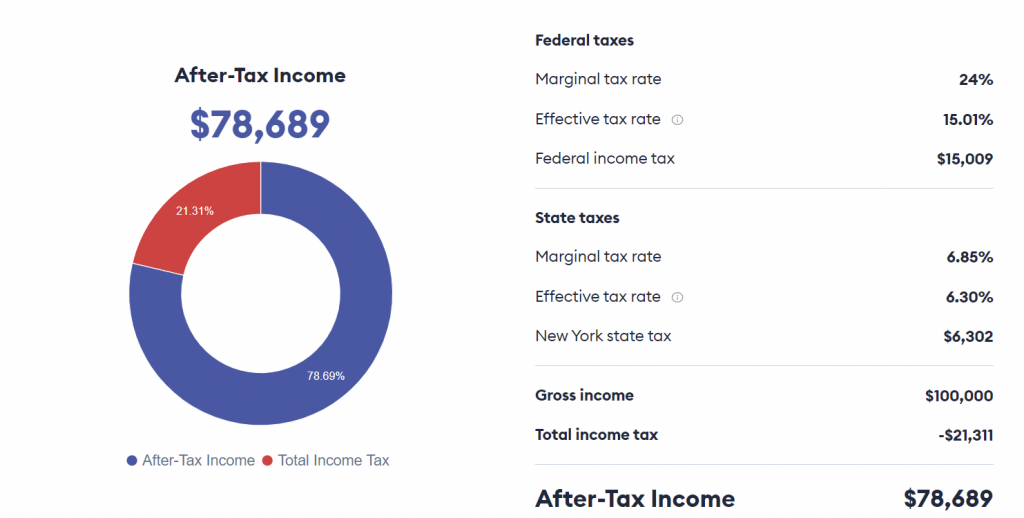

How much is left of $100,000 after taxes?

According to the tax calculator on Forbes, a single person living in New York without any deductibles would have to pay $21,311 in taxes:

As you can see, the state tax in New York is 6.3% for $100k/year earners. In other states this is different.

It ranges from California with 9.81% in state tax, to states like Texas with no state tax. If you earn $100,000 in Texas you’ll therefore only have to pay the federal tax which would be $15,009.

In other words, depending on which state you live in, earning $100K a year will net you from $75,178 in California to $84,991 in Texas.

If you live “somewhere in between” California and Texas, you’ll be left with something like $80,000. That’s the number I’ll use in the following calculations.

How much is left after expenses?

As discussed above, you’re left with roughly $80,000 after taxes. Let’s break it down to a monthly basis, and figure out what you’re left with after expenses as well:

$80,000 / 12 months = $6,666 a month.

Let’s figure out how much you’re left with after the expenses of the average American houshold.

Below you see a table showing the monthly expenses of average America, according to The U.S. Bureau of Labor Statistics:

| Item | Monthly Cost | Percentage of Budget |

|---|---|---|

| Housing (Rent or mortgage and utilities like electricity and water) | $1784 | 34.9% |

| Transportation (Car payments, gas, bus tickets, vehicle insurance etc.) | $819 | 16% |

| Food (Groceries and restaurants) | $640 | 12.3% |

| Insurance & Pensions (Personal insurance like life insurance, pension savings etc.) | $604 | 11.8% |

| Healthcare | $431 | 8.4% |

| Entertainment (Subscriptions, TV, Speakers, a new Phone etc.) | $243 | 4.7% |

| Savings | $190 | 3.7% |

| Apparel and Services | $120 | 2.3% |

| Education | $106 | 2.2% |

| Miscellaneous | $76 | 1.6% |

| Personal care | $54 | 1.2% |

| Other | $44 | 0.9% |

| TOTAL | $5,111 | 100% |

As you see, the average American household spends $5,111 every month. However, $190 of that is saved and roughly $500 goes to pension savings.

In addition, these expenses are estimated for each household. This means that it’s generally a family that has expenses like the ones above.

If we assume that your expenses are 80% of the ones above, and cut away savings and pension from the mix, you’re spending $3,500 a month.

As we’ll see later in this article, the assumed $3,500 a month in expenses is highly realistic.

For a single person, monthly expenses range somewhere between $1,700 and $4,200 depending on where you live. Check out the tables under the heading “Your lifestyle depends on where you live:” to see an overview of 20 different cities for both single people and families of four (click here to go there now).

Given our assumptions and estimates, with a monthly salary of $6,666 you’re left with $3,166 after tax and expenses, if you live the average life of an American worker.

To be clear, I think you can live on less than $3,500 a month. You can read more about that in these two articles:

You can do a lot with over $3K left over every month. Let’s for fun see what happens if you save it all, 50% of it, or 25% of it:

Wealth Building With $100K a Year Salary:

It’s essential to save and invest, especially in times of inflation (like we’re having now).

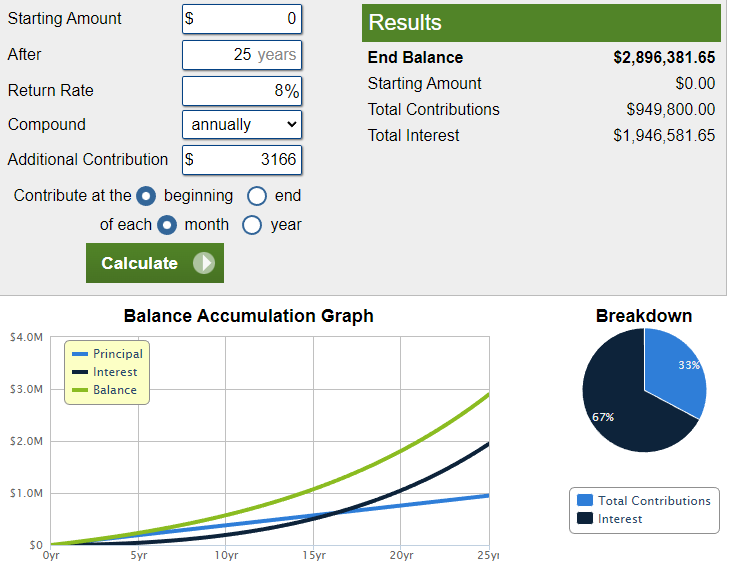

As discussed above, assuming you’ve got $3166 left over after tax and expenses is reasonable. How much will you accumulate over time?

If you’re 40 years old, you’ll likely retire in roughly 25 years. Let us, therefore, use 25 years as our time frame.

Suggested reading: Is Saving 20% Of Your Income Enough?

We’ll look at three different scenarios: Saving everything, saving half of it, and saving 25% of it.

Assumptions/rules for this thought experiment:

- You invest it all in index funds with an annual average return of 8%.

- You actually manage to save that much EVERY SINGLE MONTH for 25 years

- We do not adjust for inflation

- We do not think about taxes

These assumptions/rules make it somewhat unrealistic. You will most likely not be able to copy the following results. However, it will give you an idea of what’s possible if you stay consistent:

Scenario #1: Saving all of it: $3166/month

- You’ll almost have three million dollars after 25 years.

- Almost two of the three million will be due to interest/return on capital.

- You’ll be a millionaire within year 15.

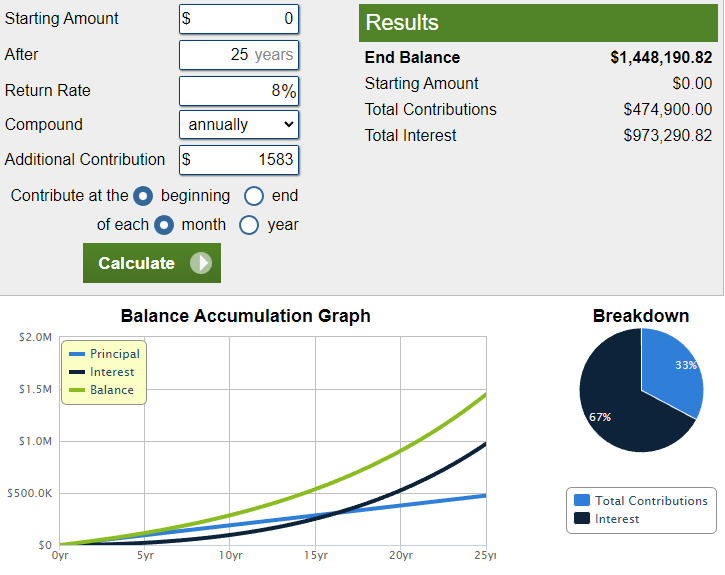

Scenario #2: Saving half of it: $1583/month

- You’ll almost have 1.5 million dollars after 25 years.

- Almost one million will be due to interest/return on capital.

- You’ll be a millionaire within year 22.

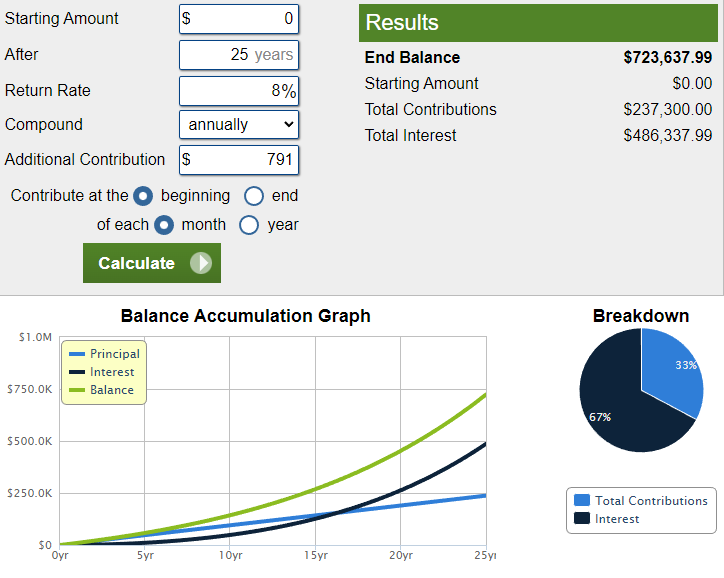

Scenario #3: Saving 25% of it: $791/month

- You’ll almost have $750,000 after 25 years.

- Almost half a million dollars will be due to interest/return on capital.

- You will NOT become a millionaire within 25 years.

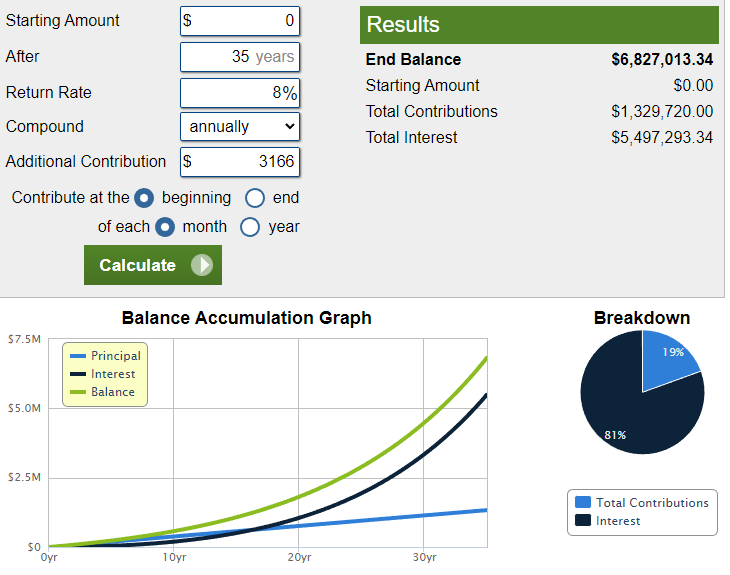

What if you’re 30 years old and save $3166 until you retire?

Being 30, you’ve got roughly 35 years to build wealth. Let’s see how much saving $3,166 every month for 35 years turns into:

- You have almost seven million dollars after 35 years.

- 4/5 of the money (roughly $5,5 million) comes from interest/return on capital.

- In year 36 you’ll get $440,000 in returns. If you stop saving after 35 years, you’ll continue to earn more than 4x of your salary of $100,000 in returns from the stock market.

If you somehow manage to land a job with a $100K yearly salary in your twenties, the numbers are even crazier…

There are other ways to invest than in index funds. For example, some dividend stocks are great for retirement investing. In this article, you can learn about four of them.

Or, you can choose to go with cryptocurrencies. Even though they are highly volatile and risky, I think the “blue-chips” like Bitcoin and Ethereum are great long-term investments.

In fact, Bitcoin might reach $1,000,000 sooner than you think, and Ethereum could skyrocket to $100K.

If you live frugally, you can invest even more. To get an idea of how cheap you can live (and still be comfortable), check out this article: Yes, You Can Live On $2,000 A Month! Here’s How & Where:

What YOU Can Expect From A $100K Salary: (Singel & Family of 4)

In the next couple of sections, I will give you the chance you figure out how a $100K a year salary might affect YOUR finances. Apart from that, a free salary calculator will help you to calculate your salary package in different parameters like hourly, daily, weekly and more.

I’ll give you specific, location-dependent median expenses and estimated taxes to figure out how much YOU are left with every single month.

Let’s break it down!

Your lifestyle depends on where you live:

To “guestimate” your lifestyle when earning $100,000 a year, we first need to figure out the location-dependent expenses.

In terms of living expenses and rent, living in a city like New York differs vastly from living in a city like Tulsa.

Below is a table I put together showing the costs of living and the median rent for a single person and a family of four in different places in The United States:

| Location | Single Person | Family of Four | Median Rent |

|---|---|---|---|

| New York, NY | $1,393 | $5,134 | $2,800 |

| San Francisco, CA | $1,351 | $4,979 | $2,492 |

| Oakland, CA | $1,274 | $4,697 | $2,156 |

| Washington, DC | $1,184 | $4,363 | $1,929 |

| Boston, MA | $1,177 | $4,338 | $2,091 |

| Pittsburgh, PA | $1,125 | $4,148 | $1,053 |

| Nashville, TN | $1,107 | $4,081 | $1,659 |

| San Diego, CA | $1,105 | $4,079 | $2,013 |

| Miami, FL | $1,104 | $4,076 | $1,982 |

| Chicago, IL | $1,078 | $3,973 | $1,533 |

| Philadelphia, PA | $1,071 | $3,948 | $1,359 |

| Los Angeles, CA | $1,069 | $3,942 | $1,975 |

| Dallas, TX | $1,039 | $3,829 | $1,457 |

| Atlanta, GA | $1,021 | $3,773 | $1,344 |

| Las Vegas, NV | $992 | $3,659 | $1,138 |

| Orlando, FL | $973 | $3,588 | $1,391 |

| Austin, TX | $966 | $3,562 | $1,702 |

| Huston, TX | $930 | $3,429 | $1,233 |

| Tulsa, OK | $895 | $3,301 | $814 |

Alright, now let’s figure out how much you, as a person/family earning $100,000 a year have left in each of the places above, while also taking state tax into consideration:

| Location | Monthly Average Taxes: (Federal + State) | Expenses: (Single, Family) | Left After Expenses & Tax: (Single, Family) |

|---|---|---|---|

| New York, NY | $1,760 | $4,193, $7,934 | $2,380, -$1,361 |

| San Francisco, CA | $2,068 | $3,843, $7,471 | $2,422, -$1,206 |

| Oakland, CA | $2,068 | $3,403, $6,853 | $2,862, -$588 |

| Washington, DC | $1,888 | $3,113, $6,292 | $3,332, $153 |

| Boston, MA | $1,649 | $3,268, $6,429 | $3,416, $255 |

| Pittsburgh, PA | $1,506 | $2,178, $5,201 | $4,649, $1,626 |

| Nashville, TN | $1,250 | $2,766, $5,740 | $4,317, $1,343 |

| San Diego, CA | $2,068 | $3,118, $6,092 | $3,147, $173 |

| Miami, FL | $1,250 | $3,086, $6,058 | $3,997, $1,025 |

| Chicago, IL | $1,653 | $2,611, $5,506 | $4,069, $1,174 |

| Philadephia, PA | $1,506 | $2,430, $5,307 | $4,397, $1,520 |

| Los Angeles, CA | $2,068 | $3,044, $5,917 | $3,221, $348 |

| Dallas, TX | $1,250 | $2,496, $5,286 | $4,039, $1,797 |

| Atlanta, GA | $1,694 | $2,365, $5,117 | $4,274, $1,522 |

| Las Vegas, NV | $1,250 | $2,130, $4,797 | $4,953, $2,286 |

| Orlando, FL | $1,250 | $2,364, $4,979 | $4,719, $2,104 |

| Austin, TX | $1,250 | $2,668, $5,264 | $4,415, $1,819 |

| Huston, TX | $1,250 | $2,163, $4,762 | $4,920, $2,321 |

| Tulsa, OK | $1,635 | $1,709, $4,115 | $4,989, $2,583 |

| AVERAGE: | $1,594 | $2,834, $5,743 | $3,992, $994 |

Observations based on the table above:

- After taxes and expenses, how much is left of the $100K yearly salary hugely depend on where you live. Moving from New York to Tulsa could save a single person $2,609 a month, and a family of four $3,944 a month.

- For a family of 4 living in New York, San Francisco or Oakland, $100K a year is (more often than not) too little to live on.

- San Diego is the most expensive city a family of four can survive on $100K a year with median spending and rent.

- Huston, TX is the third best place to live for a single person earning $100K a year, economically speaking.

- On average, a single person living a “normal life” earning $100K yearly, has $3,992 left over every month.

- On average, a family of four living a “normal life” earning $100K yearly, has $994 left over every month.

How much can you travel while earning $100k a year?

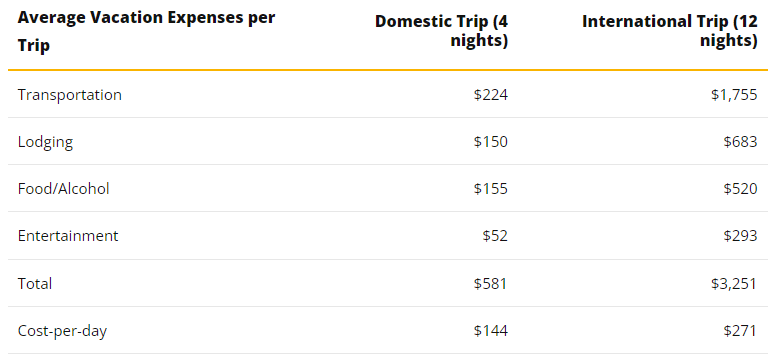

According to ValuePenguin, these are the average costs of traveling:

As a single person living in cities other than New York, San Francisco or Oakland, you could in theory travel internationally for more than two weeks every month.

This would be impossible, of course, as you would need to be at work, but it gives perspective on just how much traveling you can afford.

The correct way of thinking about it is: Every month you save enough to have the option to travel for more than two weeks.

If you actually did save that money for, let’s say three years, you could travel for roughly one and a half years.

As a family of four, you can also afford to travel a lot, unless you live in the cities mentioned above.

If the daily cost of traveling internationally is $271, you can figure out how much you can afford to travel like this:

First, look at how much is left of your $100K a year salary depending on your location in the table above.

Then you just divide that number by $271.

The answer is the number of days you in theory can travel.

For example, if my family and I live in Nashville and have $1,343 left over every month, we can travel $1,343 / $271 = 4.95 days per month.

Multiplying that number by 12 gives you the yearly amount, which might be a better way to look at it. After all, a few long trips are easier to combine with work, and life in general, than lots of shorter ones.

What luxuries can you afford with $100K a year?

There are many ways to blow the leftover money on “fun stuff”. Here are a few:

- Rent a celebrity – Yes, you can actually rent celebrities. Why not spend a few thousand bucks on getting 50 Cent to swing by your birthday party? You can find them on this website.

- Buy a motorcycle – According to Cardo, a motorcycle usually costs somewhere between $4,000 and $6,000 for new riders. Unleash yourself and give the “biker-life” a shot – You finally have an excuse to rock the leather jacket!

- Buy a luxury bed – A luxury bed might be just what you need. You’ll sleep better, and therefore, live better. They can cost upwards of $3,000. (source)

- Home theater – According to Audio Advice, you can get a home theater designed and installed for $10,000 and up to $50,000, depending on the desired quality and size. For a single person, you’ll need to save at least three months. A family needs to save roughly one year, at minimum.

- An engagement ring – With all the leftover money from earning $100K a year, you can go “all out” and find the perfect ring. Surprise your future wife and give her something to brag to her friends about!

- Hire a personal chef – For roughly $2K a month, you’ll have a professional chef preparing all your meals. Bon appetite!

There are a gazillion ways to spend the leftover money. I don’t really think you’ll need any help with that…

What $100K/Year Earners Say About It:

Let’s look inside the minds of people earning $100k a year!

I’ll begin this section with a couple of quotes from a series of interviews done by Thought Catalog:

I guess the big difference for me is that when I was in college if my laptop broke I couldn’t really afford to get a new one without calling home. Now if my shit breaks I probably have enough money sitting in my account to go get a new mac without even thinking twice, whether I need to upgrade or not.

– Jacob 32, (source)

That’s the dream, right? When “shit breaks” you just “buy some new shit”!

I loved this one:

I don’t have to do my own laundry or clean my own apartment!

– Seth, 37 (source)

Another person, giving a dimmer view on the $100K dream, said the following:

I still somehow never have any money. Making more money means buying more things means less money at the end of the month.

– David, 34 (source)

Suggested reading: Is Saving $1000 Per Month Good? (Where You’ll Be In The Future)

After digging around on Reddit and a few other forums, I found some other people’s thoughts on how much $100k a year really is.

The following three quotes are from the subreddit r/FinancialPlanning:

$100K is a lot to me. I make near $140k and save/invest over half of it. My coworker makes the same and his family struggles. They do like to live the fancy life. I used to feel bad for him, but now I don’t. He only got himself to blame for not putting a stop to the crazy spending.

– Flagstaff2017

So if you are responsible with your money you will be more than comfortable with $100K.

Yes, $100,000 a year is a lot of money. If $100k a year isn’t enough for someone, their problem isn’t income. Their problem is out-of-control spending.

– Varathien

… no it’s not that much money, but it’s enough that you won’t live like poor people.

– bun_stop_looking

You will find that making more money gives you tons of freedom in your life, money doesn’t buy happiness, but it can enable you to be happy. I would leave the option open to make more than that.

At another forum, an anonymous called “hmmmmmm” said this:

100k p/a probably puts you in the top 0.1% of the worlds earners. If you can’t live comfortably off that you’re a greedy a mofo.

– hmmmmmm

After reading through a bunch of these, the main point of most people seems to be the following:

$100K a year affords a luxurious lifestyle, depending on where you live. You can blow hundreds on “fun stuff” every month and still save more than enough to ensure your retirement.

Suggested reading: Is Saving $500 Per Month Good? (Where You’ll Be In The Future)

Conclusion: For Most People $100K A Year Is Great!

For any single person, $100K a year is great (almost) regardless of location. You’ll be able to cover the “median lifestyle” with $3,000 – $4,000 to spare after tax! This will enable you to buy a nice car, an above-average house/apartment, travel as much as you want or just buy a whole lot of toys if that’s what you’re into.

$100K a year is also good for a family of 4. As long as you don’t live in New York, San Francisco or Oakland, you”re likely to have $1,000 to spare every month. You’ll be able to travel internationally every year, have a decent car and go eat out every once in a while. You will not be able to live like royals, but you’ll have more freedoms than most other families.

Thank you for reading. Sharing it would mean everything!

– Oskar