Saving money is important. Securing your financial future has rarely been more necessary. Inflation is sky high, and there’s turmoil in the geopolitical landscape. That being said, is saving $1,500 a month a good amount?

Yes, saving $1,500 a good. It is roughly 6.5 times better than the average monthly saving of Americans. Given an average 7% return per year, saving 1500 dollars per month for 30 years will end up being $1,750,000.

I use saving and investing synonymously in this article and assume you put your money into an index fund. Well, at least after you’ve built up a safety net of three to six months of expenses.

Oh, and I suggest reading another article I wrote: how much you should save every year.

Let’s break it down, and get into the details!

Yes, Saving $1,500 a Month Is Good

First of all, saving $1,500 a month is an incredible achievement. If you’re doing it, then great job! If not, I’ll give you some pointers later in the article, showing how YOU can get there.

According to Market Watch, the median amount saved up in The U.S. is $5,300. (source)

If you save $1,500 monthly for four months, you’ll save up more money than the median balance of savings accounts in The U.S.

In one year, you’ll have $18,000, which is more than 3x the median savings of Americans.

Other facts that shine a light on the “goodness” of saving $1,500/month:

- 18% of Americans saved $0 in 2021.

- 48% saved less than $5,000 in 2021.

As you can see, saving $1,500 is way better than most Americans do. In these inflationary and uncertain times, that is a huge deal.

Some people say you shouldn’t save money during inflation because the money decreases in value. I disagree; there are great reasons to save during inflation.

Ok, so saving $1,500 a month is better than the average American. But exactly how much better is it?

Let’s compare saving $1,500 a month to the average monthly savings of Americans.

How Much The Average American Saves:

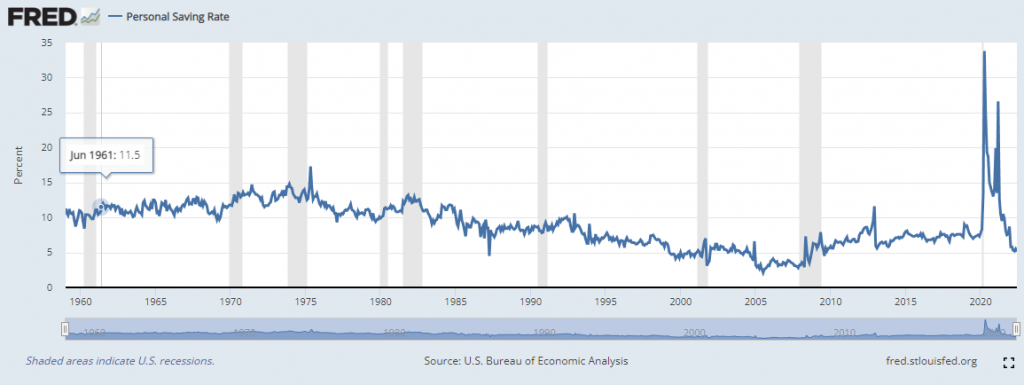

According to the U.S. Bureau of Economic Analysis, the average savings rate is roughly 5% at the time of writing:

And yes, this also includes investments in stuff like stocks and real estate.

With the average savings rate, we just need the median salary to get an idea of what the “normal” savings per month is.

According to Indeed, the median salary of American workers is $53,924. (source)

That’s an average monthly salary of $4,493.

So, an American with a median salary saving at the average savings rate would therefore save:

$4,493 * 0.05 = $225.

From this, we can say that saving $225 per month is “average”.

To be fair, we’re not using the strict definition of “average”. It is more of an estimated median monthly saving.

Obviously, $1,500 is way better than $225. But let’s see just how much better it is:

Saving $1,500 vs The Monthly Average:

Some quick stats to kick off the comparison:

- Saving $1,500 is 566% better than the average American.

- You save more in two months than the average guy saves in a year.

- While the average monthly saving is 5% of the median salary, saving $1,500 per month equals 33% of the median salary.

What’s more interesting is to see what happens if you consistently save it for years and years.

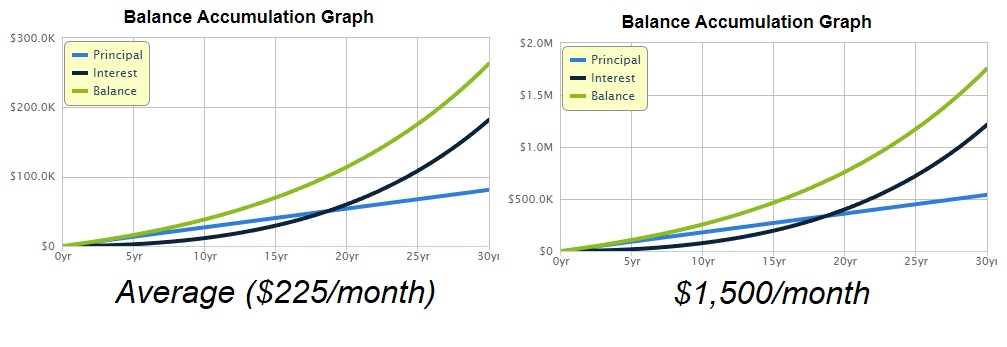

The graph below shows just how much more investing $1,500 a month turns into vs investing the average of $225:

As you can see, $1,500 a month turns into roughly $1,75 million in 30 years. The average saving of $225 per month doesn’t even break above $300K.

How To Save $1,500 A Month:

When talking to people about saving money, especially when the numbers creep over one thousand bucks a month, the usually say the same:

“fifteen hundred bucks is WAY too much to put away monthly!”

“Sure, I can do it every once in a while, but not consistently over many years!”

I get why people say that, and I used to do it to. In some sense, it is actually true. If you’re not saving $1,500 now, and got nothing left at the end of the month, how can it be possible to increase it?

Most people think that it’s all about cutting down on the “small stuff” like the Netflix subscription or the occasional Starbucks coffee. This couldn’t be further from the truth…

I’m about to give you the number one key to mastering your finances. At least it was for me.

Do NOT worry about the small, variable expenses. Focus on the big, fixed expenses.

This is key for two reasons:

You make significant progress by cutting down on the big stuff, and cutting on fixed expenses makes it easy to save every month consistently.

To reach your goal of saving $1,500 a month, here’s what you need to do:

- Cut down housing expenses. Housing is by far the biggest expense for most people. If you can cut down on this one, you’ll be able to save a lot more money every month. For example, if you spend $1500 per month on housing, but you’re able to cut that down by 33%, you’ve already got $500 per month!

- Cut down on commute-related expenses. This is often the second largest expense people have. If you can cut this one down, you’re left with a big chunk of money to save every month.

Pro tip: Move closer to work, in a cheaper house/apartment.

This move cuts down on your housing expenses and makes getting to work cheaper and faster. It saves you both money and time, making it easy to save $1000 a month!

If you need more on saving more money, check out this article: Can’t Save Money Because of Bills? Here’s What I Did

Of course, the difficulty of saving $1000/month depends on your salary.

Individuals earning $100K/year have several thousand left over every month after taxes and expenses. Read more about what it’s like to earn $100K in this article: Is $100K a Year Good? (For Single People and Families of 4)

Anyways, my point is this:

If you can cut down on the big things like housing and commuting expenses, you’ll save $1000 a month in no time. The best part is that you can keep spending money on small luxuries like Netflix and Starbucks.

In addition, the saving will be consistent because you cut down on “fixed expenses”.

Another Way To Save $1,500 a Month:

instead of cutting down on expenses, you can increase your earnings.

This often takes more time and work, but can have a huge impact on your finances.

There are many ways to do it, and I’m sure you’ve looked into it at some point already.

Most articles I can find suggest stuff like answering surveys or freelancing as a writer on Upwork. Most of the suggestions out there are pure BS, and a terrible waste of time.

The only three things that have worked for me, are the following:

- Ask for a raise – simply asking for a higher salary, after gaining some leverage, of course, might work. This only works if you’ve been at the same company for a while, and if you’re actually providing value to the business. If you haven’t got the leverage to ask for a raise yet, make a 6-month plan and go for it!

- Get a second job – This is a time-consuming, but safe way to make more money. You can get a part-time job working evenings at a store, as a cab driver, online, or whatever you can find. Working an extra 30-50 hours a month might result in $400-$800 extra money every month.

- Start a small business on the side – I’ve tried a few, but this current website is the best one by far. Starting a blog about one of your hobbies or interests is a great way to make more money. The best part about it is that once it’s built, it’s basically 100% passive income!

If you consider starting a small online business to make more money, you should definitely watch the video below. It gives you an idea of how to do it, how long it takes, and how much you can expect to make:

Conclusion: Yes, It’s Good (And Realistic)

Saving $1,500 a month is more than six times better than the average American, and will in 30 years turn into $1,750,000 if invested in index funds with 7% returns per year.

Saving that much money is hard, but not impossible. The key is to cut down on the big fixed expenses like housing and transportation. In addition, you can increase your income to make it even easier (or save even more! )

Suggested reading: