When the likes of Citibank and JP Morgan predict Bitcoin prices from $150 000 up to almost $400 000 within a few years, it makes you wonder:

What is the maximum potential for Bitcoin in terms of price?

Here’s the short answer:

The maximum realistic potential price of Bitcoin is approximately $5 million. The absolute maximum potential is $60 million. The reason behind this enormous valuation is that Bitcoin might swallow the bond market – currently worth $100 Trillion.

I’ll walk you through why and explain the “roadmap” of Bitcoin as it matures as a store of value.

In this article, I argue for Bitcoin as the ultimate store of value and best global reserve currency, however, this is not a price prediction.

This is a thought experiment where I try to figure out the maximum potential of Bitcoin and if it’s a realistic outcome. Unfortunately, I do not know the future.

Bitcoin 2021-2026: Taking over Gold

Bitcoin is now a recognized store of value, competing with Gold. In recent years, we’ve seen an increasing number of institutional investors moving their capital from Gold ETF’s, and physical Gold, over to Bitcoin.

According to J.P. Morgan, this trend is just getting started. (Source: Bloomberg)

We also have predictions from the likes of Citibank of over $300,000 per coin, based on the belief that Bitcoin will overthrow Gold as the ultimate store of value. (Source: Forbes)

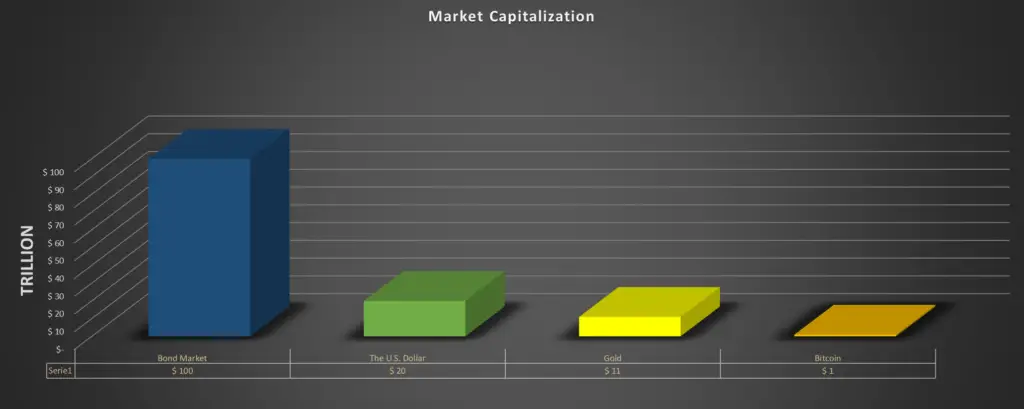

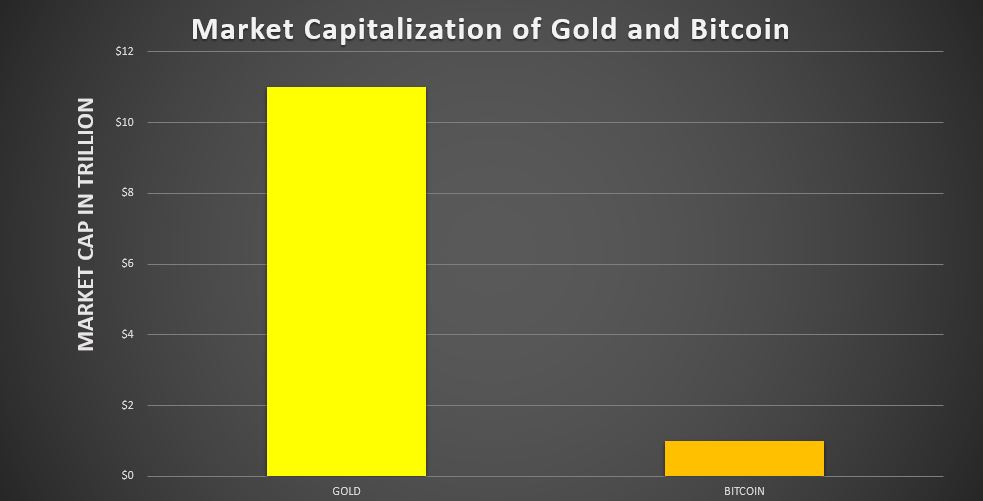

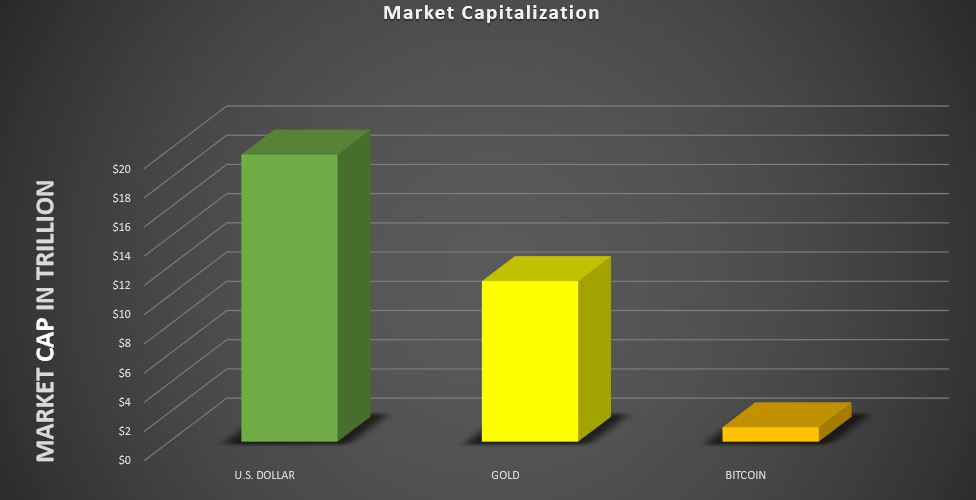

Gold, at the time of writing, has a market cap of over $11 Trillion, while Bitcoin is resting at a modest $1 Trillion (in 2021).

If Bitcoin successfully hijacks the capital currently invested in Gold, the Bitcoin price would reach roughly $350,000.

Remember, it’s not just some random guy on the internet with a tinfoil hat who’s predicted this. These predictions come from J.P Morgan, Citibank and Bloomberg.

Even Blackrock has talked about Bitcoin overtaking Gold. (Source: Forbes)

Although many thought Bitcoin would overthrow Gold in 2021/2022, it is more likely to happen in the current cycle. The peak of the current cycle will probably be in 2025.

“Why 2025?”

Because Bitcoin will have another halving in 2024, leading to a new exponential price increase due to a doubling in stock to flow.

Bitcoin 2030-2035: Taking Over The U.S. Dollar

The U.S Dollar is failing. I’ve written a 5000-word article on this topic, but I’ll give you the short version here:

Why the U.S. Dollar will fail:

Basically, the economy works like this: Your spending is someone else’s earning.

If you spend more money, someone else earns more money.

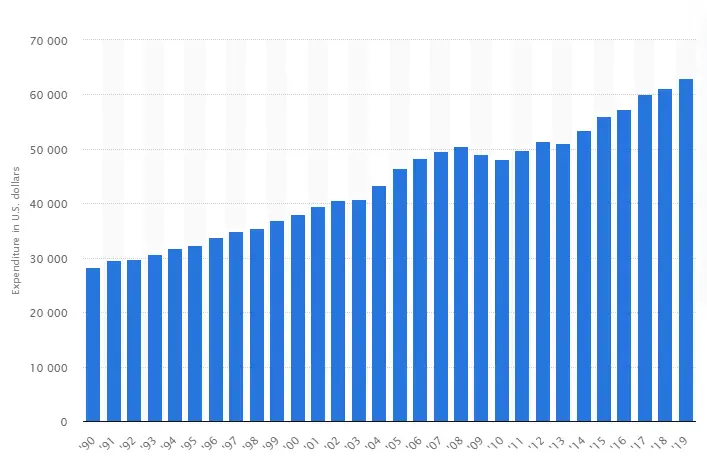

Since 1990, the median spending per U.S Citizen has roughly doubled.

Below you see the median spending of U.S. Citizens from 1990 to 2019:

As you can see, the spending/earning of U.S. Citizens have increased by over 100% in the last 30 years.

Credit and other forms of borrowed money work like steroids to the economy. It artificially increases the spending power of an individual or institution.

This artificial increase in spending leads to an increase in earnings for other people, boosting the economy.

The increased earnings lead to even more credit, as you can loan more when you earn more.

This leads to a blown-up economy where spending and earnings are artificially increased by credit, making the economy balloon into a huge bubble.

Let’s look at some concrete numbers:

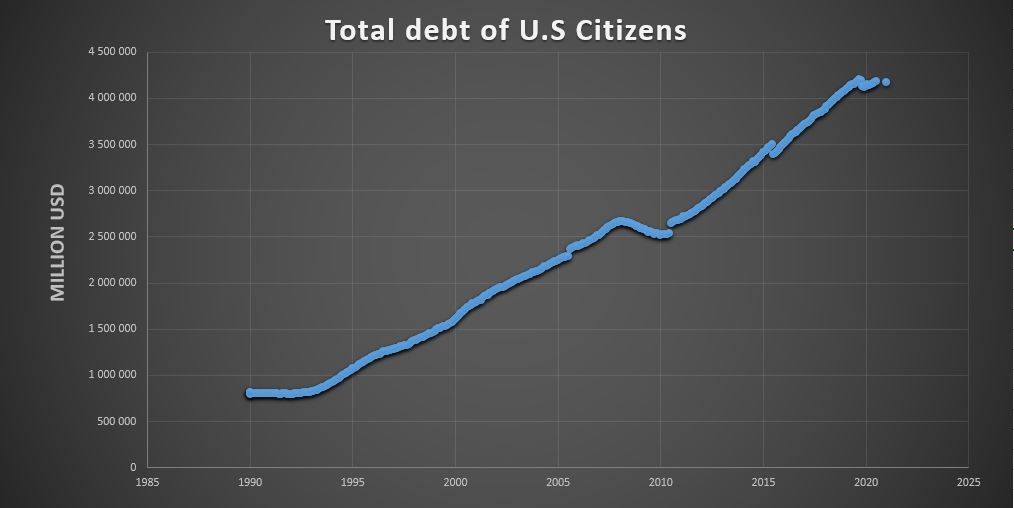

At the same time as the median spending has increased by roughly 100%, the debt of U.S. Citizens has increased by over 400% (5.24x):

After adjusting for population growth, the debt per citizen has increased 2.62 times faster than the income/spending.

“Why should I care about this…?”

People, in general, are over-leveraged with debt relative to earnings.

Also, a large part of the spending of U.S Citizens is financed by debt.

“Well, why is this a problem?”

If the interest rates increase, and credit is less available, the spending power of U.S. Citizens will decrease a lot.

“… and what then?”

Remember, your spending is someone else’s earnings. If U.S. Citizens start spending less money, businesses and institutions will start earning less.

These businesses, too, are generally financed on debt, making it hard to survive a decrease in their earnings, forcing them to fire employees or take out even more credit.

Firing employees will decrease the spending of U.S. Citizens even more, so the best option in general for the economy is for struggling businesses to take out short-term loans to get them through the rough times.

This leads to even more debt.

Every time that the economy dips, more debt is accrued.

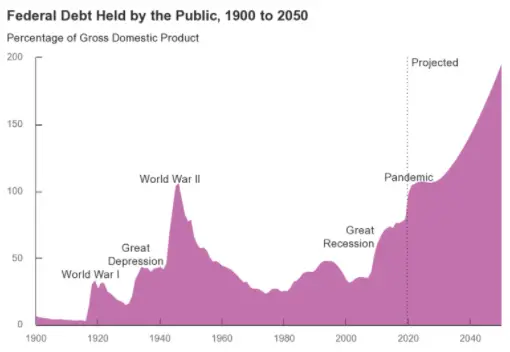

Look at the debt relative to GDP projections made by the Congressional Budget Office:

That projection is not very optimistic regarding the “soundness” of the economy.

The United States will be buried in debt for the next 30 years because it can’t afford to pay it back (paying it back would decrease spending, leading to an economic crash).

It’s important to remember that taking on debt is good for short-term growth, which is why they choose to do it, but it’s guaranteed to fail in the long term.

The end result of this strategy, taking on debt to fight the inevitable economic downturn, will end in disaster.

Read the great words of Jeff Booth from his book “The Price of Tomorrow”:

A day will come, probably sooner than later, when we realize that the only thing driving our economy is the explosion of debt … Once bond holder determine that governments have little ability to repay or service the debt … the interest rates will rise, [making it harder for the government to keep the economy floating].

Sure, governments can monetize and make their currencies worth less [to make it easier to pay the debt], but as other central banks [does the same] the strategy becomes irrelevant.

… this strategy has only one endgame: 1) higher inequality 2) people losing hope in the system due to not being able to make ends meet 3) more polarization 4) a rise of leaders that use the polarization to create “us versus them” narratives to consolidate power 5) commonplace revolutions and war.

[The short-term solution of taking on even more debt] in the end, is a dissolution.

Jeff Booth

Bitcoin might emerge as the replacement of The U.S. Dollar. If the debt explosion continues and the money printer keeps going, it seems inevitable.

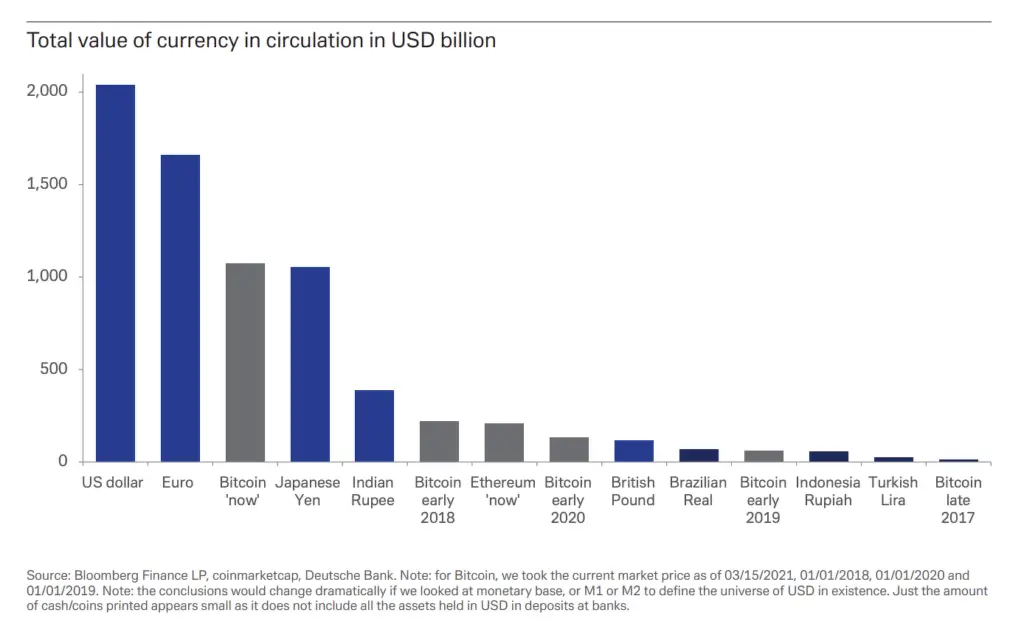

Below you see Bitcoin’s value compared with the largest fiat currencies in the world. All the gray pillars are Bitcoin at different times in the past.

It’s catching up quickly: (now = 2021)

Below you see a visual presentation of the difference in market cap between Bitcoin, Gold and the U.S. Dollar.

This includes more than just the actual USD circulation; it’s the M2 I’ve used in this calculation:

If Bitcoin manages to swallow the market cap of The U.S. Dollar, it will reach a price of over one million USD.

“When will this happen?”

It is estimated that by 2030, Bitcoin will have a market cap of over $20 Trillion due to its stock-to-flow and adoption level.

However, it’s impossible to know and far from certain that it will happen or when it will happen.

Nevertheless, if the money printing and debt accruing continues, it’s not unreasonable to assume that Bitcoin might replace The U.S. Dollar at some point in the future.

Bitcoin 2040-2050: Taking Over The Bond Market

Let us first look at how the bond market essentially works and then how Bitcoin might swallow this market too.

How the bond market works

Let’s say that the government needs 10 million dollars to fund a new project. One way they can raise it is to issue a bond worth 10 million, and sell it to investors:

When governments create this bond, they essentially just create a piece of paper and say it’s worth $10,000,000. This paper also says that whoever holds this paper will receive a yield of 3% of the $10,000,000 for the next 10 years, and then the government will buy it back from you for the same price you paid for it.

The investor that buys the bond has to give the government 10 million USD and receives the newly created piece of paper (the bond). Holding this bond, the investor receives a 3% yield on the ten million he/she paid for it for the next 10 years. After ten years, he gets the ten million dollars he paid for it back.

In other words:

Bonds are created by governments, companies, or institutions to raise money. Bonds are essentially debts that investors buy to receive a yield.

Bonds issued by the government are called T-bonds (treasury bonds). These are “guaranteed” by the government to be paid back.

As long as you trust that the government is able to pay you back, T-bonds are considered “risk-free”.

However, the debt of the U.S. Government is exploding, growing at an exponential rate. They can not keep this up forever. They will bury themselves in debt.

The only solution, if they reach a point where they’re unable to pay investors back and keep up with the interest payments, is to be “bailed out” by the FED:

In order to keep their head above water, they will be forced to print more money.

Printing money devalues the dollar and causes inflation.

If they keep printing money to pay off their debt, inflation rates will eventually be higher than the bond yields, making them less attractive to investors.

Think about it; if the inflation rate is at 10%, and a bond yields 3%, your purchasing power decreases by 7% per year – you’re losing money!

At this point, there are no rational players left to buy bonds. Why would you buy something that is guaranteed to decrease your purchasing power?

All of this money has to go somewhere…

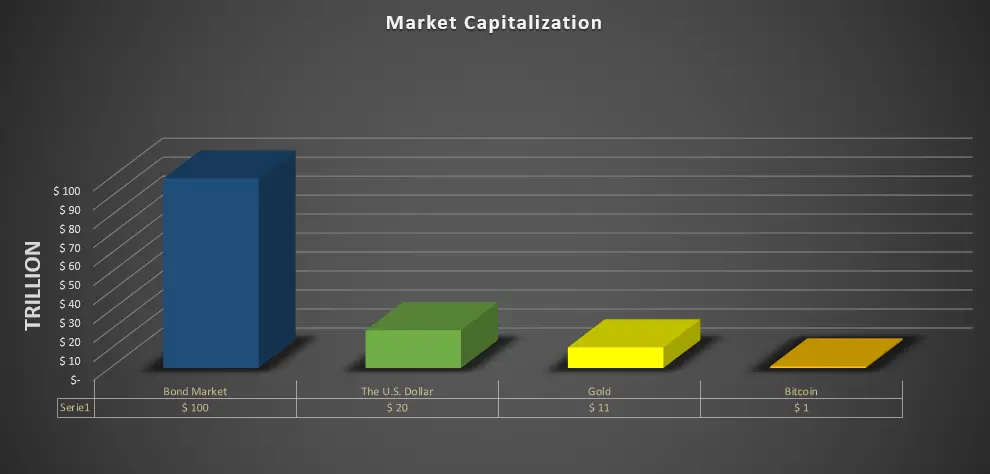

At the time of writing, the bond market is at a valuation of $100,000,000,000,000. That is one hundred trillion U.S. Dollars.

Do you think these investors will keep their capital invested in something guaranteed to lose purchasing power?

Rational investors will look for alternative investments to save them from the high inflation rates and devaluation of the U.S. Dollar.

The $100 Trillion will float into other markets with a proven track record of beating inflation.

My best guess is that the majority will choose Bitcoin.

The reason behind this is that Bitcoin has absolute scarcity (limited supply) and a pre-programmed, unchangeable monetary policy.

The monetary policy of the FED can change tomorrow. They might decide to print 10 Trillion next week. That’s bad for long-term bondholders, as it increases the inflation rate and decreases the chance of their bonds being profitable.

They need an asset with predictability, transparency, and a predetermined inflation rate.

Bitcoin offers this. The inflation rate of Bitcoin is halved every four years.

If you want to learn more about one of the mechanisms that give Bitcoin its fundamental value, check out this article: How the Bitcoin Halving Affects the Price of Bitcoin.

Well then… What would happen to the Bitcoin price if it swallowed the bond market?

The Realistic Maximum Potential of Bitcoin:

If Bitcoin actually swallows Gold, The U.S Dollar, and eventually the bond market, the market capitalization of Bitcoin will be over $100 Trillion USD.

Technically, it doesn’t make sense to price Bitcoin in USD at this point as Bitcoin will be the “standard” to price stuff in … but let’s ignore that.

Below you see a visual representation of the market valuation of Bitcoin, Gold, The U.S. Dollar, and the bond market:

We can calculate the price Bitcoin will reach by dividing the market valuation by the supply. The supply of Bitcoin is predictable, as it’s predetermined in the code.

The rate at which new Bitcoin is issued is halved every four years, making the inflation rate of Bitcoin exponentially decreasing.

However, let’s just go with the maximum supply, the hard cap of Bitcoin at 21 million BTC, to keep it conservative:

$100 000 000 000 000 / 21 000 000 BTC = $4 761 905/BTC

In other words:

If Bitcoin reaches the current market capitalization of the bond market, one hundred trillion USD, the Bitcoin price will reach over $4 750 000 per BTC.

The Absolute Maximum Potential of Bitcoin

Some argue that the maximum potential of Bitcoin is even higher than $4 750 000.

Some people speculate that Bitcoin will swallow all of the money in the world, including bond markets, real estate, the stock market, the forex market, and the futures market.

Financial expert estimate that this number is somewhere between 630 and 1200 trillion USD (source: The Sun)

Let’s run the numbers on both ends of the scale and calculate the absolute maximum potential of Bitcoin:

Higher end:

$1200 Trillion / 21 000 000 BTC = $57 142 857/BTC

That’s almost 60 million dollars per Bitcoin.

Lower end:

$630 Trillion / 21 000 000 BTC = $30 000 000/BTC

At the lower end of estimations, we get a 30 million dollar Bitcoin price.

Final Thoughts

Bitcoin reaching almost 60 million dollars is not realistic. It’s possible, but extremely unlikely.

The same goes for $30 million, however, this is a tiny bit more realistic.

The only way I can see $30 million as a possible outcome is if the dollar is devalued to such an extent that $30 million is worth something like $5-$10 million in today’s valuation of USD.

The $4 750 000 is realistic and my best guess as to what the maximum potential of Bitcoin is.

Please, do not read this as a price prediction. I’m not saying that Bitcoin will reach $4 750 000.

What I’m saying is this:

If Bitcoin were to reach its full potential as a reliable store of value, central banks keep printing money at the current rate, and governments keep accruing debt at an exponential rate, Bitcoin might swallow Gold, The U.S. Dollar and the bond market, and reach a price of $4 750 000.

Do You Invest in Bitcoin?

Download my free guide to increase your ROI.

When you download the free guide, you’ll be signed up to my newsletter.