(Updated 18. September 2022)

Solana’s main advantages are low transaction fees and high scalability. But exactly how low are Soloana’s transaction fees? And why are they so low?

Let me get straight to the point:

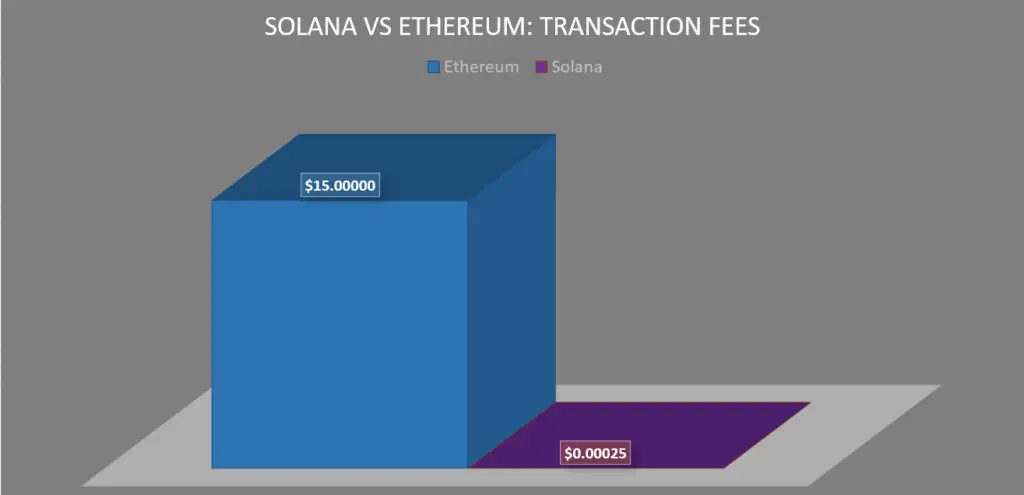

Solana fees are on average $0.00025 per transaction. The fees are set by the competition for block space, which increases when the traffic on the blockchain increases.

Solanas transaction fees are 60 thousand times lower than Ethereum’s. This is because of the high scalability of Solana compared to Ethereum.

Below you see a chart visually showing the difference:

Does this mean Ethereum is dead? Not at all. I still think Ethereum is a better “overall” blockchain than Solana. Read more about why Ethereum is the king in this article.

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, and others. Also, you’ll get some free guides and reviews. Sign up for free below:

Why Solana’s Transaction Fees Are So Cheap:

The reason for high transaction fees is too many transactions in too little time. In other words, it’s a scaling issue.

If a Blockchain can do 10 transactions per second (TPS), and 5000 people try to transact the same second, the fees will shoot up, as the competition for “block-space” increases.

“Ehhh, what…?”

It’s complicated, but here is the “skinny” explanation:

When you send crypto to someone, the transaction has to be placed in a “block”. This block is basically a bundle of transactions.

After a specified time interval, which depends on which blockchain you’re transacting over, the block gets added to the chain. The chain is basically a public database, or a ledger, where all transactions are logged.

Once the block that your transaction lies within gets added to the chain, your transaction is complete.

Here’s the thing: A block can only carry a limited number of transactions!

If the block gets filled up, you have to wait for the block to be added to the chain and hope there’s room for you on the next one.

“Okay, but what decides which transactions get to ride in the block?”

Whoever pays the highest transaction fee!

Transaction fees are the price you pay to gain a spot in the next block, which completes the transaction by adding it to the chain and making it official.

Therefore, there are two factors in the equation that decides the transaction fees: The time it takes to create new blocks, and the number of transactions that fit in one single block.

If blocks are created frequently, and tons of transactions can fit into each of them, the competition to get a spot in them will be low, resulting in low transaction fees.

To learn more about how the blockchain works, read this article:

What is Blockchain Technology?

Great, now it’s time to look at these two factors for each Solana and Ethereum and try to predict the future transaction fees:

The Transaction Fees Of Solana Compared To Ethereum

Below you see a table showing the two factors mentioned above for Solana and Ethereum so that you can see how much better Solana is:

| Solana | Ethereum | |

| Block Time (time to create new blocks) | 0.4 Sec | 13 Sec |

| Block Size (number of transactions per block) | 20 000 Transactions | 70 Transactions |

| Fees (per transaction) | $0.00025 | $15 |

From the table above we see that Solana has superior block time and block size, which is why Solana has drastically lower transaction fees than Ethereum.

With stats like that Solana is able, in theory, to scale all the way up to 50 000 TPS without much trouble. That’s about the same as VISA is capable of. (source: bitcoin.com)

In addition, Solana claims to be able to double its scalability every two years – increasing exponentially intact with developments in CPU technology.

If Solana is able to keep scaling, the fees will remain as low as they are today. Actually, they may even decrease, as competition for block space decreases even more.

In Ethereum’s case, it’s no wonder why the fees shoot up when usage goes up. The scaling of the Ethereum m blockchain is terrible, leading to high competition for block space.

However, this will change once ETH 2.0 fully rolls out.

ETH 2.0 will eventually scale the Ethereum blockchain all the way up to millions of transactions per second, leading to much lower fees and way faster transactions.

To summarize:

Solana has roughly 60 thousand times lower transaction fees than Ethereum at the moment because it scales way better and has lower traffic. However, when Ethereum 2.0 gets fully rolled out, the fees will be practically the same – both extremely low.

Do You Invest In Crypto?

I’ve created a FREE guide on how to increase ROI (Return on investment). This metric is the most important factor when it comes to investing.

When investing in traditional markets like stocks and bonds, there’s not too much you can do to significantly increase your ROI.

This is not the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide with 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.