Cardano and Solana have made commendable gains in the year 2021. I have been analyzing both of these projects for quite a while now, and I will be comparing Cardano vs Solana and discuss their similarities and differences. Also, I will try to elaborate on which coin has a higher profit potential for the future.

Cardano is better than Solana for long-term holding due to the lower risk. However, Solana is the best coin to trade as the volatility is higher.

Now let’s dive into the basics of both projects and drive a solid conclusion based on the similarities and differences of these Solana and Cardano.

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, Solana, and more. Also, I’ll give you helpful guides and reviews.

Get expert insights every week – Sign up for free below:

What are Cardano and Solana?

Cardano is essentially designed as a scalable and more sustainable platform to run smart contracts, to improve on traditional blockchains like Ethereum.

The platforms allow the development of decentralized applications. The smart contract feature of Cardano is rolling out in mid-September by the name of Alonzo Hard Fork upgrade.

This upgrade will allow users to employ smart contracts on the network, and it will surely boost the platform’s effectiveness.

Therefore, it is another step towards Cardano’s promise of providing an energy-efficient, scalable, and secure blockchain platform.

Due to the high performance of the Cardano platform, its native coin ADA is also performing incredibly well in the market.

Solana is primarily aimed at solving the scalability issue in the blockchain community without sacrificing decentralization and security.

It aims to be a fast and more effective network than Ethereum, Cardano, and all the other blockchains out there.

Today, Solana can support 50,000 transactions per second while making new blocks every 400 milliseconds through 200 validating nodes.

The transaction fees of using the Solana blockchain are roughly 60 thousand times lower than Ethereum… I’ve written an article about how this is possible; check it out here.

The native token of the Solana network goes by the name of SOL. It has a maximum supply of 489 million and has several use cases.

How are Cardano and Solana similar?

- Marketplaces. You can buy, sell, trade, and stake both of these cryptocurrencies on reliable cryptocurrency exchanges around the world.

- Programmable blockchains. They are both blockchains built to host decentralized appliactions.

- Decentralized and Scalable. Both of these projects address the issue of scalability and decentralization in the crypto realm.

- Ethereum Killers. Both Cardano and Solana are termed Ethereum Killers.

- Staking. Both Sol and ADA can be staked.

How are Cardano and Solana different?

- Market Capitalization. Cardano sits at the third spot in the list of most valuable crypto in terms of market capitalization whereas Solana is at number ten.

- Smart Contracts. Cardano is soon getting the upgrade for smart contracts, however, Solana already has them.

- Consensus Mechanism. Cardano runs on proof of stake, while Solana utalizes proof of history to reach consensus.

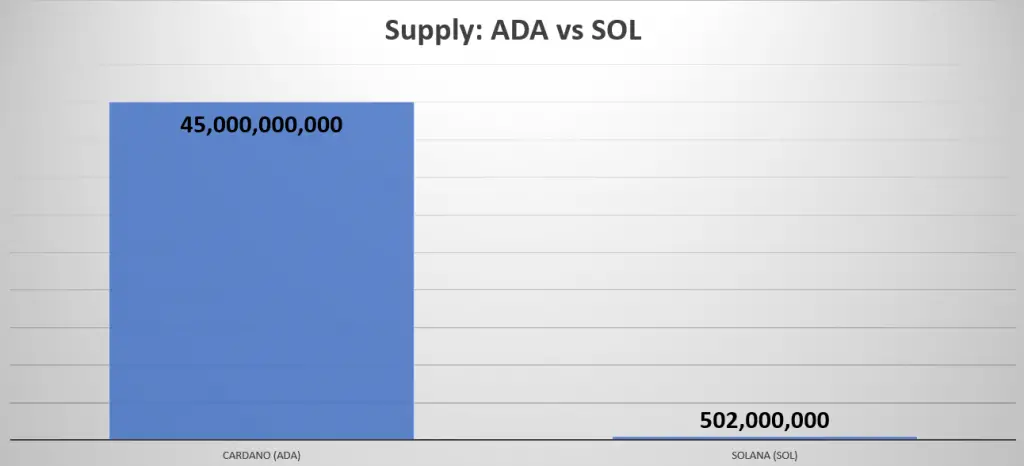

- Supply. ADA has a huge supply while SOL is relativly scarce in comparison.

You should also check out:

Avalanche (AVAX) vs Solana (SOL): Which Is The Better Investment?

Cosmos (ATOM) vs Solana (SOL): Which Is The Better Investment?

Tokenomics and Price History Of ADA and SOL:

- The supply of ADA is much higher than the supply of SOL, logically making the price of ADA lower than that of SOL:

Such a high difference in supply makes the price per token differ greatly as well. This is why we see Solana priced closer to three digits and Cardano barely breaking a few bucks.

Cardano spreads its total value across many more coins, is a good way to think about it.

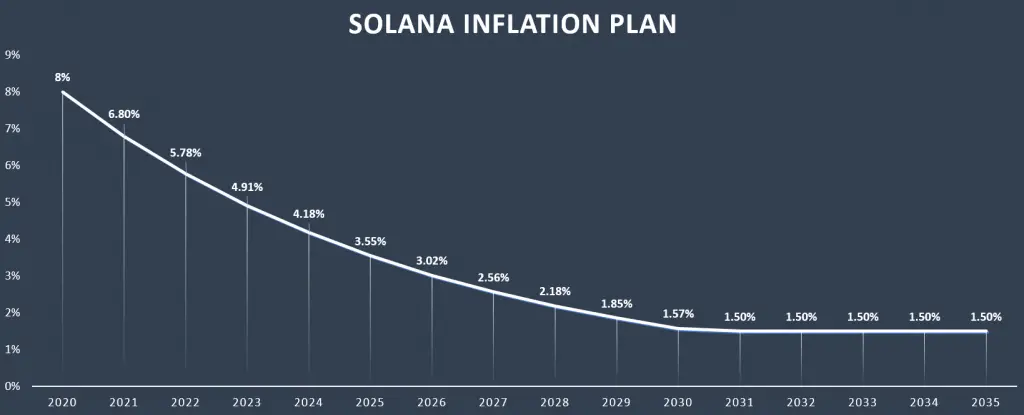

- The planned Inflation is higher for Solana, starting out at 8% in 2021. Below you’ll see the planned inflation for both projects:

I’ve written about both of these projects more in-depth in the following articles:

Is Cardano Deflationary? The Tokenomics Of ADA

A higher inflation rate is good for stimulating adoption and growth in the short term. However, it acts as a downward pressure on the price, which is bad for token holders.

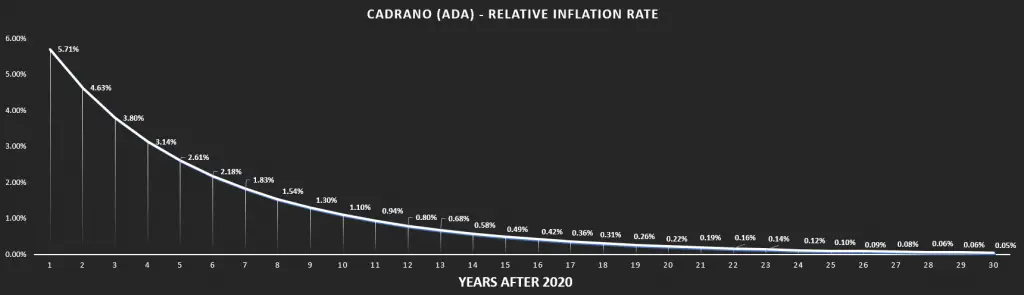

The target inflation rate of Solana is 1.5% per year. The inflation of ADA will continue to decrease for a few decades and eventually become deflationary – the circulating supply will decrease over time.

Below you see the long term inflation plan for Cardano:

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, etc. Also, I’ll give you helpful guides and reviews.

Get expert insights every week – Sign up for free below:

Cardano vs Solana Price Outlook

As mentioned, there is a major price difference between Cardano and Solana. This is mainly triggered because of their respective supply. The supply of SOL is significantly less than that of ADA, contributing to the price of SOL being higher.

However, both of these coins have shown significant signs of correlation in the recent past. They have upscaled and downgraded at an equal pace at times. However, the ETH 2.0 update is expected to impact the worth of both Cardano and Solana positively. Currently, Solana is eyeing the triple-digit mark, and Cardano is looking to topple its all-time high.

The Alonzo upgrade of Cardano is anticipated to give the desired boost for Cardano, so it can push above its weights and grow by a great margin. This could increase the ‘edge’ of Cardano over Solana.

Solana having the lowest market cap, have a higher chance of yielding outsized returns. However, it is also riskier.

Personally, I would hold Cardano for the long term and swing-trade Solana.

Swing trading the lower market cap coins and holding the large ones is a great strategy for most people.

Suggested reading:

Can Cardano (ADA) Reach $1,000?

Can Solana Reach 1000 Dollars?

Conclusion: Cardano is better

In conclusion, I can say that both of these projects are very strong with a bright future ahead. With new upgrades rolling out soon, Cardano has the ability to grow as a project and as a crypto token as well. Because of its headstart, Cardano has a higher chance of success, and thus, it should be the first choice for investors. However, Solana offers a great chance for more active investors and traders.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is NOT the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.