(Updated 18. September 2022)

Investing in shitcoins is really exciting. It can be insanely profitable, as these coins can go 10x in a matter of a few hours. That being said, it’s also one of the fastest ways to go broke if you mess up.

What you need to do is to formulate a strategy before investing in shitcoins. You need to make sure you’re doing the right things and staying rational. This is hard, as emotions are amplified by the insane volatility and the wast number of scams going around.

I generally think people should stay away from shitcoins altogether, but I have created this guide for those of you who still want to dip your toes into this crazy market, even though the risks are mind-blowingly high.

You should first focus on building solid positions in bigger coins like Bitcoin, Ethereum, and Chainlink. If you need some guidance, I have written an article showing you the best way to build a large position fast in Ethereum – giving you the step-by-step guide to making huge returns with ETH: Check it out here.

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, Solana, and more. Also, I’ll give you helpful guides and reviews.

Creating A Strategy For Investing In Shitcoins

First of all, what I mean with shitcoins is this: coins with extremely low market cap and/or coins that do not necessarily have any clear use-case other than being funny.

The most obvious examples of shitcoins are meme-coins with absurd names like “Twerk Finance” and “PooCoin”.

To create a shitcoin investment strategy, you need to figure out the following:

1) Where to find new shitcoins

2) How to evaluate shitcoins

3) How to buy shitcoins

4) How much to buy

5) When to take profits

Let’s go through them one by one and create a good shitcoin investing strategy!

1) Where To Find New Shitcoins

This might seem tricky for new investors, but it’s actually fairly easy. This is what you need to do:

When searching for new shitcoins, you need to go to “shitcoin subreddits” and Facebook groups dedicated to new shitcoins and check out the projects that people are pumping.

For example, AllCryptoBets is a subreddit where you’ll find a ton of new shitcoins. When looking for FB groups, you can search “shitcoins” or “microcap altcoins” and tons of groups will pop up.

A lot of these are potentially good shitcoins to speculate on, but please be careful:

Some of these coins might be scams. You need to do some research before putting any money into them and make sure you’re comfortable with losing everything you invest.

I’ve written an article about this. Read it here for a list of subreddits I personally use when scouting for potential 100x coins.

2) How To Evaluate Shitcoins

If you find a bunch of shitcoins, how do you pick the right ones? That’s what we will figure out now.

When evaluating shitcoins, you need to know this:

The only thing that drives the price of shitcoins is the community behind it and the marketing from the developers.

With this in mind, it’s obvious that shitcoins with strong communities are more likely to do good.

A rule of thumb: Good community = Good shitcoin.

“That’s great, but how do I figure out if the community is good?”

That’s easy; you need to join it!

That’s right. Join the community and check it out firsthand. What you need to do is to join their communication channels, which usually is a telegram group.

Once you’re in the telegram group, this is what you need to look for:

1) How many people are in the telegram group? You’re usually able to check it on the top of the screen if you’re on mobile. On PC it should be in the top right corner.

2) Are the members active? If only a handful of people are sending all the messages in the chat, it’s a bad sign. You want to see a lot of traffic, as this means the community is engaged.

3) Is the community helpful? Ask some questions like “How do I buy this coin?” or “Is this coin a good buy?” and see how much effort they put into answering them.

4) Ask if there’s a plan for marketing or shilling (pumping) the coin.

Once you have done this, the next step is to check out the price chart and transactions of the coins. The most common way is to go to DEXtools and look it up.

There you’ll also see how many “holders” the coins have. This basically means how many people are actually holding the specific coin. Be sure to compare this number to the number of people in the telegram channel.

If there are many more holders than telegram members, it’s a sign that people investing in this coin aren’t contributing to the community, which is a bad sign.

To summarize, I’ll give you an example:

Researching BurnX Token: Practical Example Of Shitcoin Evaluating

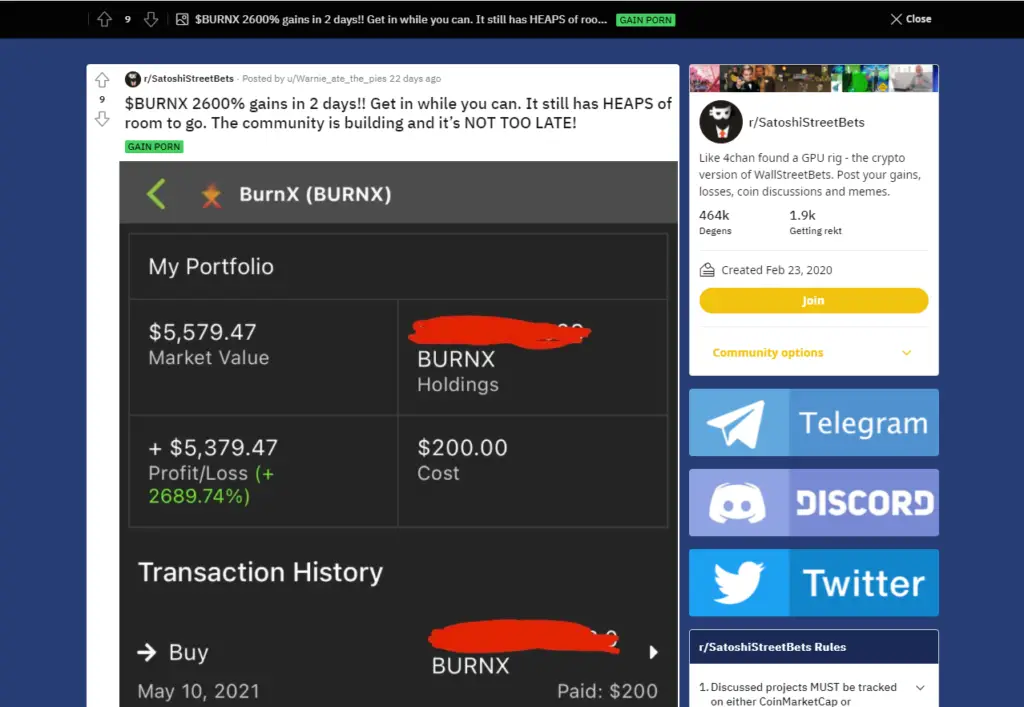

1) I went on subreddits and scanned for new potential shitcoins. I found this post:

2) To research them, I joined their Telegram channel to ask questions and check out the community.

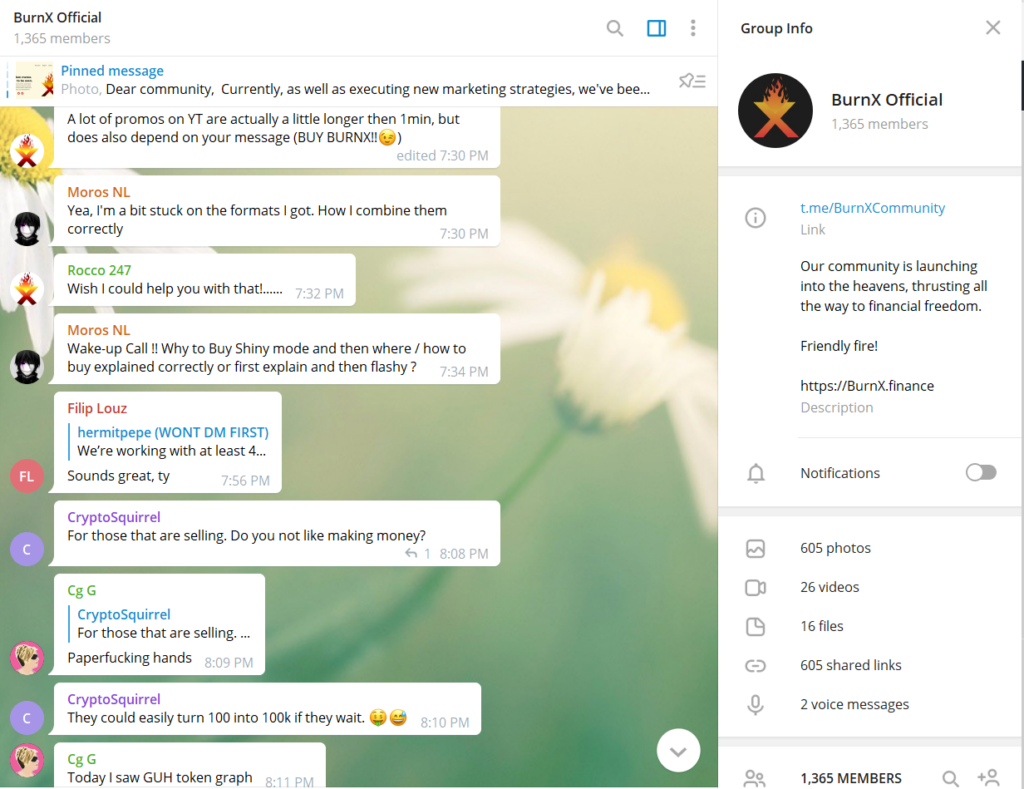

This is what it looks like on a PC:

3) Once I’m in the telegram group, I usually ask a few “dumb” questions just to get the vibe of the community. If they get annoyed by stupid questions, it’s not a coin I’m investing in.

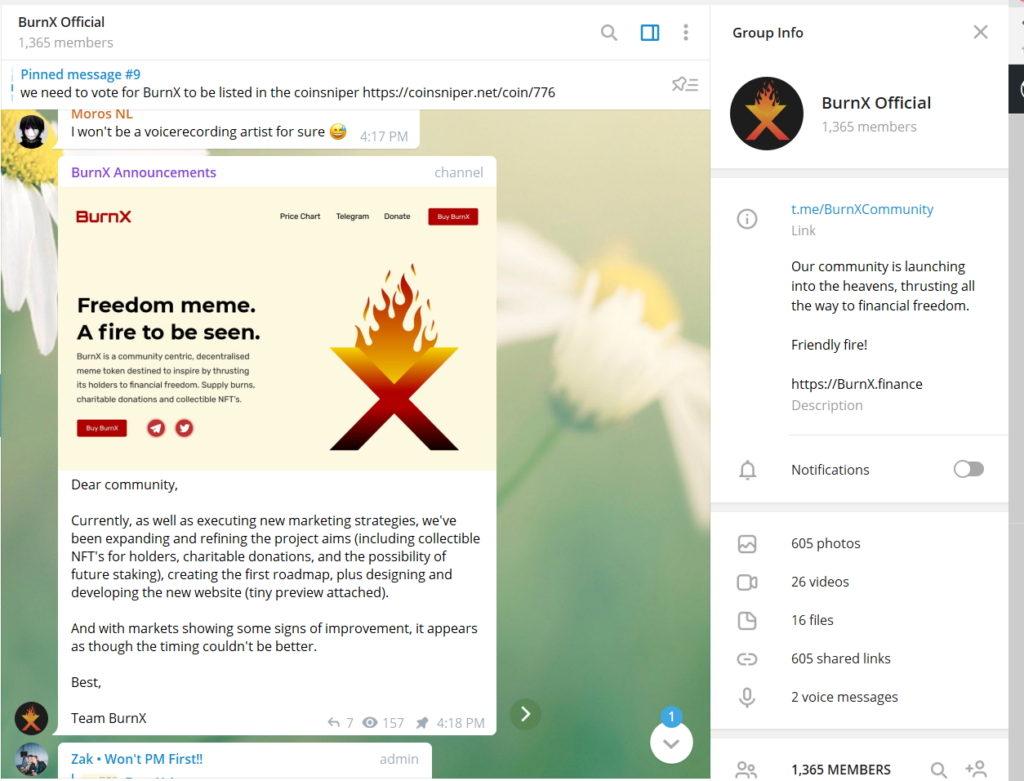

4) I look for pinned posts about marketing plans and find this:

All things considered, the community seems good. After engaging with it, there seem to be many people actively spreading the word and buying the dips.

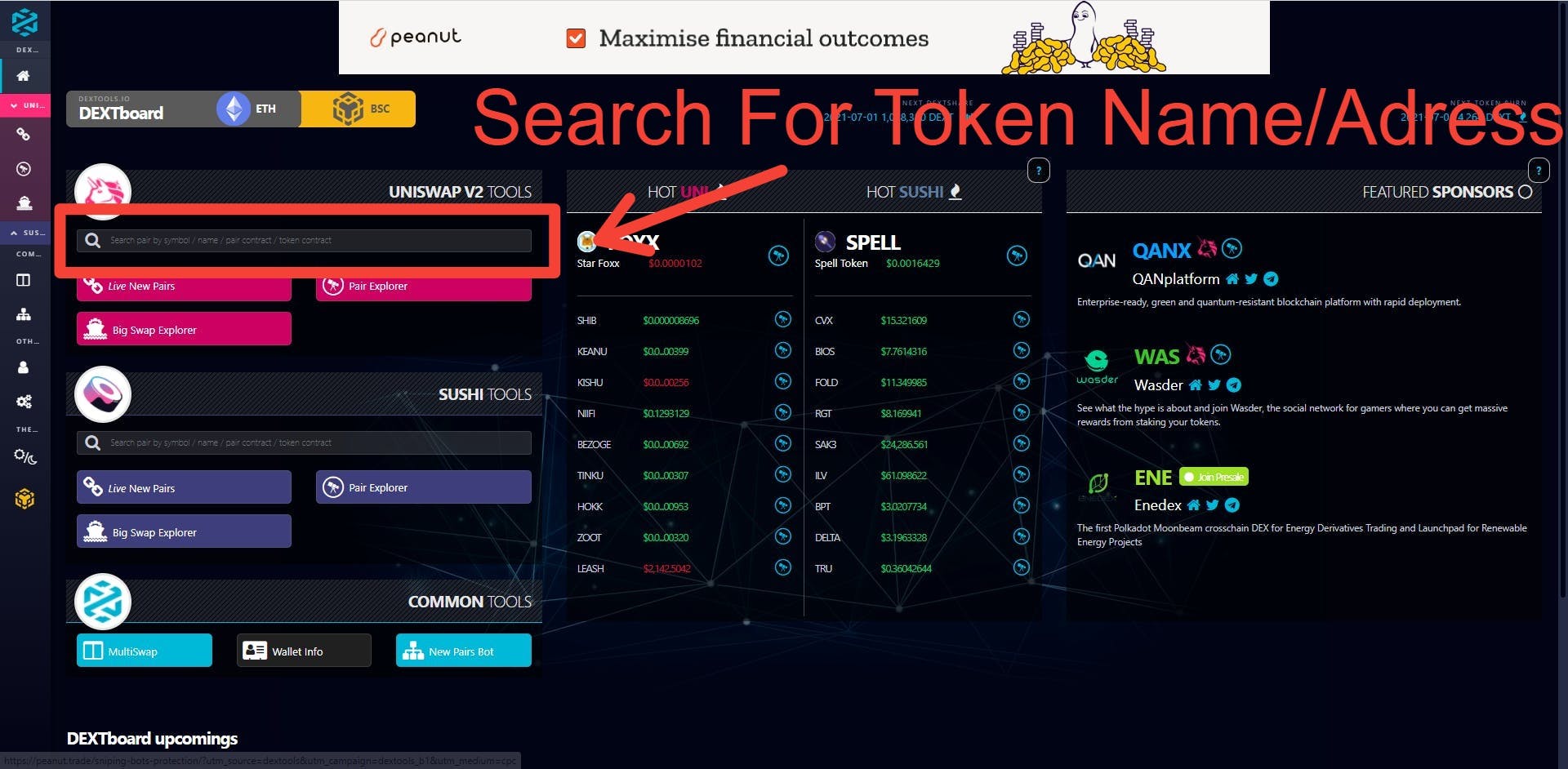

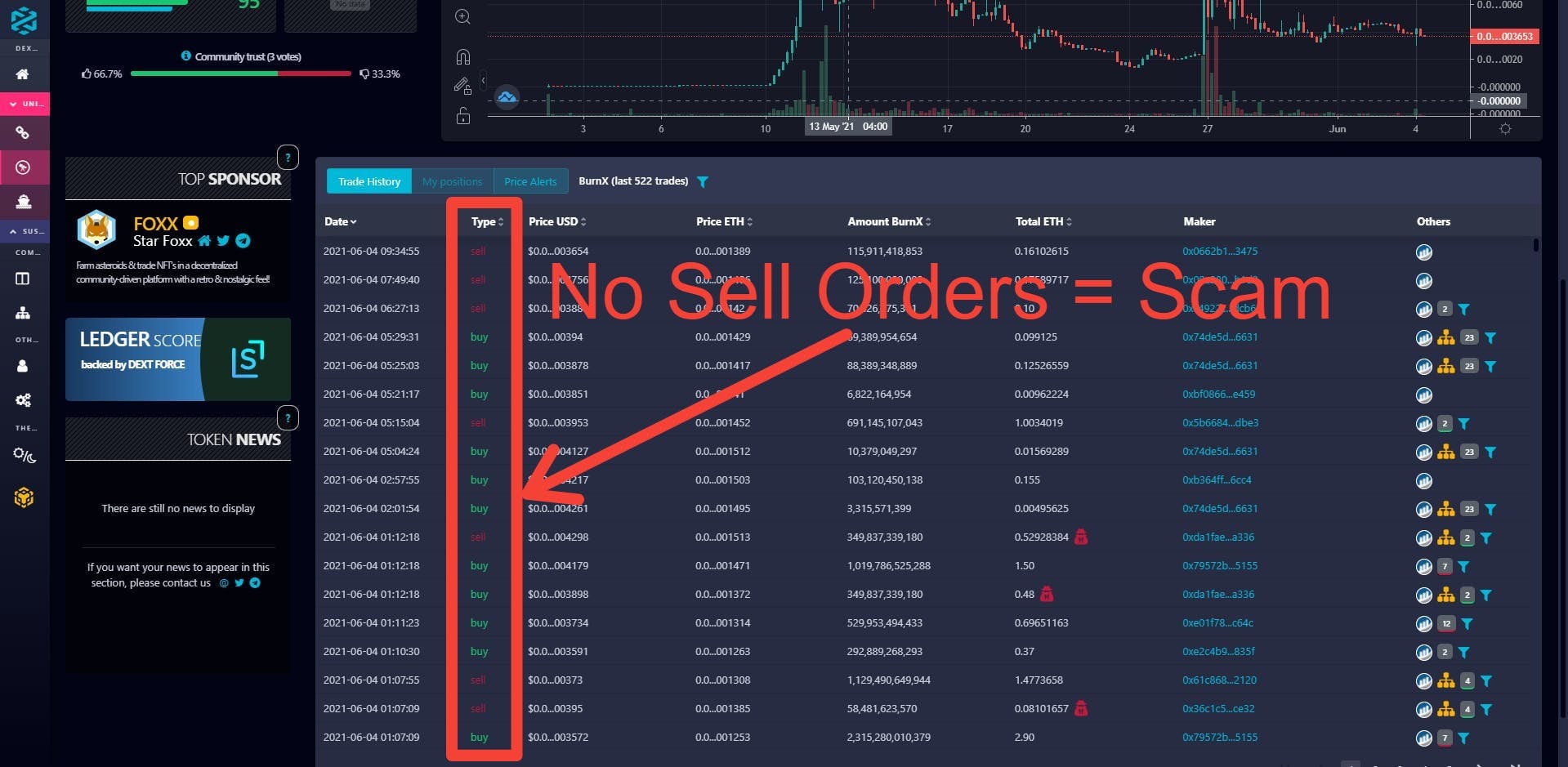

Now I’m going to check DEXtools to make sure things are looking legit:

(illustrated by images below)

First, I go to Dextools.io/app/ and search “BurnX Token”. If I couldn’t find it when searching by name, I would have to search with the “contract address”. Just ask in the telegram group if you can’t find it.

Then check out the number of holders etc. I now see that there are approximately the same number of holders as members in the telegram group, which is good.

Then I check if there are any sell orders. This is important because it might be a “honeypot scam”:

A honeypot scam is basically a project/coin you can’t sell. It’s only possible to buy. Whatever money you invest, you’ll never get back…

Scroll through the images below for further explanation:

All things considered, this coin looks good so far. What I would do now is to stick around for a few days, see how the community develops. Is it growing fast? If the number of members in the telegram channel doubles after a few days, it’s time to consider investing.

#3 How to Buy Shitcoins

How to buy a specific shitcoin depends mainly on one thing: Is it built on Ethereum or Binance Smart Chain?

If it’s built on Ethereum, you can buy it using Uniswap, the decentralized exchange for ERC-20 tokens (Ethereum-based tokens).

This is what you need to do:

1) Buy some Ethereum using an exchange like Binance, Crypto.com, or Coinbase.

2) Create a “Trust wallet” on your phone, and send the Ethereum you bought over to the trust wallet

3) Connect the wallet to Uniswap

4) Find the token on Uniswap by searching with the contract address

5) Buy the token

If you’re buying a coin built on Binance Smart Chain, you do the same thing but with Pancake Swap (or another one) instead of Uniswap.

Need more info about the Binance smart chain? Read Binances’ own article about it:

How to Get Started with Binance Smart Chain (BSC)

4) How Much Should You Buy?

This is highly dependent on your goals and personal risk tolerance. I’m not going into detail about that in this article, but if you want to read more about how to define risk tolerance and goals, read this article:

How Much Cryptocurrency Should You Buy?

Here are some general guidelines for the average investor:

| Low Risk | Medium Risk | High Risk |

| 2% Of Portfolio | 4% Of Portfolio | 6% Of portfolio |

Some people might find those percentages way too low, and that’s fine. There’s no right or wrong answer to this question.

Basically, it’s a matter of managing your risk. Shitcoins are EXTREMELY risky. They can 10x in five hours, only to crash with 90% in the next five.

For this reason, it’s generally a bad idea to have a significant portion of your portfolio invested in them. It should be used as a tool to spice things up.

Let me say that one more time:

Investing in shitcoins should be used as a tool to spice things up, not as the primary wait you make returns.

This is what I personally do:

Under normal market conditions, I don’t invest in shitcoins. However, when there’s a lot of hype and shitcoins start 10x’ing left and right, I start dipping my toes into this crazy market.

I have about 95%-98% of my portfolio in fundamentally strong projects like Bitcoin, Ethereum, and Chainlink, and I speculate with 2%-5% in different shitcoins.

I never invest more than 1% of my portfolio in any one coin. And I always take profits after 3x.

5) When to take profits

This also largely depends on your risk tolerance and goals. However, I’ll provide some general guidelines and what I personally do.

I always pull out my initial investment after 3x, no matter how bullish I am on the specific coin. This way, I’m only playing with profits.

If the coin ends up crashing to zero, I haven’t lost anything, but I also have a sizeable stack in case the coin goes to the moon.

After taking out the initial investment at 3x, I pull out 20%-30% after each 3x.

If you’re more conservative and want to decrease the risk, you can pull out 50% after each 3x, or maybe 30% after every 2x.

If you’re totally crazy and want all the risk you can get, you might just let the investment ride to the moon, taking no profits at all after pulling your initial investment out. You might have a target of 50x and sell everything at this target.

In general, however, it’s better to take profits on the way up gradually.

No matter what you’re inclined to do, make sure to formulate a plan. Here is an example:

| ROI Generated | Profit Taking |

| 3x | Initial Investment |

| 6x | 30% of the current value |

| 10x | 30% of the current value |

| 20x | 100% – Sell everything |

I can’t stress this point enough. You NEED a plan if you’re going to do this. If you fail to plan, you plan to fail…

Summary: Our Completed Strategy For Investing In Shitcoins

1) Check out subreddits like AllCryptoBets and make a list of potential shitcoins to invest in.

2) Join the telegram groups of the potential shitcoins, ask dumb questions to get the vibe of the community. Also, ask (or check pinned messages) for marketing plans and the number of people in the group. After spending a few days in the telegram groups, drop the shitcoins without a strong and growing community, and continue only with the good ones to step three:

3) Check out the remaining coins on Dextools.io/app/ and compare the number of holders to the number of people in the telegram group. If few people are in the telegram group, drop the project and move on. Also, check if there are any sell orders in case it’s a honeypot scam.

4) Figure out how much money to put into the remaining coins. In general, you shouldn’t invest more than 1% of your total crypto portfolio in any coins and a total of 6% combined, depending on your goals and risk tolerance.

5) Make a plan for when you’re going to take profits. Personally, I pull out the initial investment after 3x and 20%-30% after each 3x after that. Make sure to actually write this stuff down, as the emotional pulls of the market will throw you off at some point if you don’t.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is not the case in crypto markets.

I’ve created a free guide with 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.