(Updated 21. September 2022)

Theta Fuel is one of the few cryptocurrencies that actually has a great use case. It is rewarded to users of the Theta Network simply for viewing videos and supporting the network of streamers/content creators. However, as a crypto investor, I’m more interested in whether or not Theta Fuel is a good investment.

Here’s the short answer:

Yes, Theta Fuel is a good investment because it has great fundamentals; the use case is good, solid tokenomics, impressive partnerships and the future potential for growth is high. In addition, the historical performance of TFUEL is great.

I’ve written about Theta Token and Theta Fuel in the past, and I think both are good investments. Check out this other article for a comparison of TFUEL and THETA: Theta Token vs Theta Fuel: Which Is The Better Investment?

In this article, I’ll look at what the future holds for Theta Fuel and if it’s a good investment.

PS:

I’ve got a free newsletter. Sign up to receive analyses and market updates every Sunday. Also, you’ll get some guides and reviews!

Fundamental Analysis Of Theta Fuel (TFUEL):

Let’s get a better understanding of what Theta Fuel is and what its function is. After all, you don’t want to invest in something that isn’t needed in the long run.

Theta Fuel is the native token to the Theta protocol. This means that the token is used to pay transaction fees and node operators for running and securing the blockchain.

TFUEL is basically like ETH for the Ethereum blockchain.

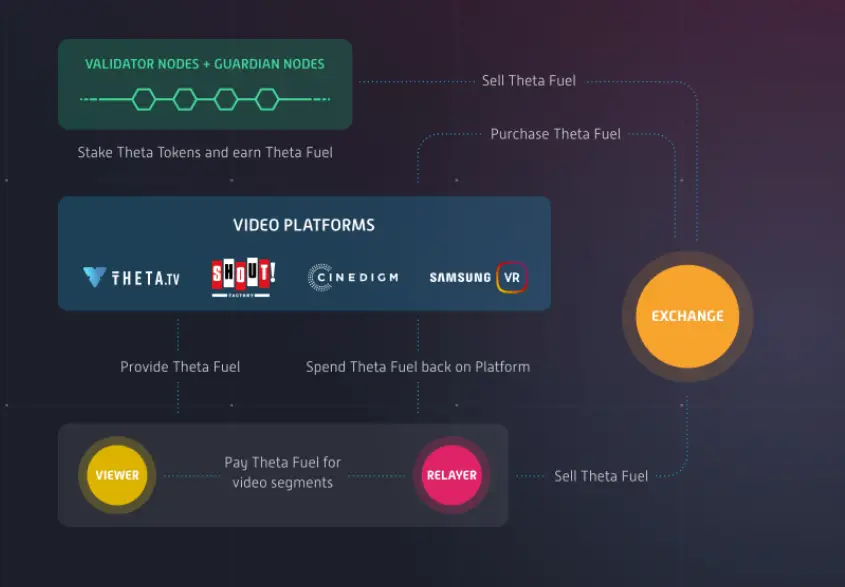

To be more specific, this is how the system works:

Nodes staking Theta Token receive Theta Fuel and sell it to exchanges. Then, video platforms (The YouTube types) purchase Theta Fuel and use it for running their platform and reward viewers who share their spare bandwidth – Kind of like seeds from the days of piratebay, except you’re paid for it and it’s legal.

This “circle of life” we see in the image above gives you a clear view of what Theta Fuel is and why it exists.

Put simply:

Theta Fuel is used to run video platforms and simultaneously reward viewers who share their spare bandwidth to lower the costs of broadcasting for the video platform. This decentralized broadcasting network is an improved business model for the platforms, and it’s paying viewers to watch their videos.

We can all agree that being paid to watch videos you will watch anyways is a fricking miracle. If you’re anything like me, you’re sacrificing countless hours of your time on YouTube.

Anyways, let’s get back to the analysis.

The Tokenomics Of Theta Fuel:

The Initial supply of Theta Fuel was 5 billion coins. That’s 5x the supply of Theta Token.

Contrary to Theta Token, the supply of Theta Fuel is not capped – it has no maximum supply.

The planned inflation rate is at 5%. However, people lose access to their tokens from time to time, effectively taking them out of circulation. For this reason, the inflation rate of Theta Fuel is probably closer to 3-4 percent per year, depending on how stupid people are.

I’m also interested in the distribution of this token. For instance, do the ten riches TFUEL holders control the majority of the supply?

A high concentration of tokens might lead to price manipulation, which is bad. Luckily, TFUEL is not concentrated in the hands of the few.

After some digging, I found the largest stakers of TFUEL:

Combined, the ten largest wallets hold less than 10% of all staked TFUEL. The total amount of TFUEL they stake is 206,058,542 coins.

The total supply is roughly 5.85 billion tokens, which means that the ten richest wallets hold about 3.52% of all TFUELs in circulation.

TFUELs concentration of 3.52% is small compared to coins like Dogecoin and Chainlink, where the top 10 wallets hold over 60% of the supply.

This is great news because it means that the tokens are well distributed, not giving any wallets control over the supply/demand balance of this token.

Another thing I love about the tokenomics of TFUEL is that over 40% of the supply is staked.

This effectively takes it out of circulation and makes the price more sensitive to increased demand. In other words, the price increases more when lots of people buy the token!

The tokenomics of Theta Fuel seems good. I wouldn’t say I like the inflation rate, but I understand its necessity to stimulate growth and adoption.

The Adoption Of Theta Fuel:

Adoption is probably the number one factor when analyzing a cryptocurrency project. Without adoption, I’m not even touching it (unless it’s a short-term trade based on hype).

Luckily, the adoption of TFUEL is connected with the adoption of the entire Theta network, which has a large degree of adoption:

Partnerships, Investors, and Stats:

Theta has a bunch of partnerships with big names like NASA and LIONSGATE. Check it out:

The fact that they’ve managed to get those guys on board means they are doing something big and that they have a lot of traction.

Check out this quote from one of Google’s top guys:

“We’re impressed by Theta’s achievements in blockchain video & data delivery. We look forward to participating as an enterprise validator, and to providing Google Cloud infrastructure in support of Theta’s long-term mission & future growth.”

— Allen Day, Google Cloud Developer advocate

Also, big names like Samsung is involved in the project:

This is also good news because influential investors = influential friends.

Think about it: If Samsung has a stake in Theta, they will 1) Help Theta succeed and 2) NOT work against them.

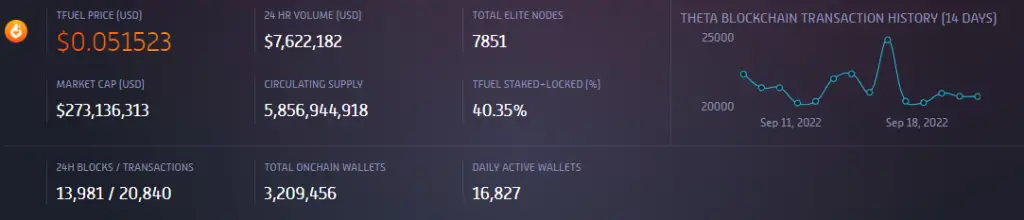

Let me also show you some stats about the activity on the Theta blockchain:

The important stats here are that 40.35% of the supply is staked, there are 3.2 million wallets in total, and 16.8 thousand are active every day.

On the right, we see that the Theta blockchain handles roughly 30 thousand transactions every day for the past 14 days. This fluctuates over time, however.

To get a more concrete view of TFUELs numbers, let’s compare them to Ethereums stats:

| Theta Blockchain | Ethereum Blockchain | |

| % of supply staked: | 40.35% | 11% |

| The total number of wallets: | 3.2 Million | 205 Million |

| Daily active wallets: | 16,800 | 700,000 |

| Transactions per day (for the last 14 days) | 21,000 | 1,000,000 |

We see that Ethereum destroys Theta in this comparison, but that’s hardly a surprise. Ethereum is way beyond anyone else in everything related to adoption. That’s one of the many reasons why Ethereum is a great long-term investment.

Nevertheless, Theta performs well and seems to have gained a fair bit of adoption. The partnerships and investors are really impressive. The fact that Samsung, NASA, and Lionsgate all thought, “Hey, this looks promising, let us join/invest with them!” is remarkable, to say the least.

The Team Behind Theta Fuel

I won’t spend a lot of time reviewing the team, but let me tell you: This team is really good!

The key players are all skilled and experienced. We’re talking PhDs, MBAs, and multiple prior successful startups.

For instance, the CTO and co-founder, Jieyi Long, have a Ph.D. in Computer Engineering, have developed multiple patented technologies, and got a Bachelor of Science (BS) in Microelectronics.

The CEO and co-founder, Mitch Liu, has co-founded Gameview Studios and Tapjoy and has a BS in Computer Science & Engineering from MIT. In addition, he has an MBA from Stanford Graduate School of Business.

It’s clear as day – These guys pack a punch!

Also, I have to mention this:

One of their advisors on the Theta team is Steve Chen, the co-founder and previous CTO of YouTube.

Having one of the key players in building YouTube help out Theta, who is competing with YouTube, is a huge advantage!

In total, there are 23 people on the team behind the Theta network, including advisors.

Does Theta Fuel Have A Future?

If you’ve read through everything above, you should know the answer to this question:

Yes, Theta Fuel has a future. It’s the native token to the Theta blockchain, which itself is rising in adoption and usage – further securing the future of Theta Fuel. As long as people want to watch videos online, there is a market for this token.

However, let’s try to look at the future growth prospects for Theta Fuel and the Theta ecosystem in general:

How Much Can Theta Fuel Increase In The Future?

Let us assume that the price of Theta Fuel will increase in parallel with the adoption of the Theta Network of decentralized broadcasters.

In 2020, YouTube had 2.3 Billion monthly active viewers. Let’s use this as a benchmark and try to do some good ol’ math.

At the time of writing, Theta has “millions of monthly active users” (source). Let’s assume that’s a solid five million.

Alright, so Theta has five million users, while YouTube has 2.3 Billion. That’s 460x the number of users.

If Theta does 1/4 of the users YouTube has, that will result in 575 million monthly users, 115 times what they have right now.

However, Theta has the potential to go way beyond what YouTube is doing…

Theta is not only a YouTube-like platform – It’s also a Twitch-like, Netflix-like, and Zoom-like platform.

In other words, the Theta platform has the potential to hijack users of YouTube, Twitch, Teams, Zoom, Netflix, HBO, Viaplay, Global News channels, etc.

They don’t even have to compete with them to get more users: If they convince, for example, Netflix to start using their platform for broadcasting (which is good for business), Theta gains millions of new users overnight, without Netflix losing anything – it’s a win-win situation!

What I’m trying to say is this:

Theta can grow to billions of users in the future by creating new streaming/video platforms or onboarding existing ones. The potential growth, in terms of price, for Theta Fuel is mind-bending.

Conclusion Of Fundamental Analysis Of TFUEL

The fundamentals of TFUEL are excellent: The use-case is solid, good tokenomics (except maybe for the inflation rate), the team behind it is great, and the future potential is crazy high.

I think this token will increase in value together with the growing user base of the Theta network, which itself seems to be growing at an accelerating rate.

All things considered, TFUEL is a good investment from a fundamental perspective.

Historical Performance Of Theta Fuel (TFUEL):

Let’s take a break from the fundamentals and look at some price charts. I’ll show you how TFUEL did in the previous bull market, and how its doing in the current bear market.

The chart below shows how TFUEL has performed since March of 2020:

In the bull market from March 2020 to November 2021, Theta fuel surged almost 100,000%. To be precise, a $1,000 investment would turn into $967,500.

In the following bear market, it crashed 92%. Your $967,500 would decrease to $77,400.

The total returns made from investing in Theta Fuel from bottom to top to bottom is 77.4x = 7,640%.

Conclusion: Yes, Theta Fuel (TFUEL) Is A Good Investment

There are four reasons why Theta Fuel is a good investment:

- Theta Fuel has a good use case.

- It has high adoption.

- The tokenomics are solid.

- The historical performance is really good.

Maximize Your Returns:

I want to give you my free guide. Get it by signing up for my newsletter: