(updated 08. September 2022)

I’ve researched, written about and invested in cryptocurrencies for several years. Ethereum is my next largest crypto investment, and here’s what I think about its long-term potential:

Ethereum is a great long-term investment because of its leading position in the programmable blockchain sector, its institutional acceptance and adoption, its significant upgrades and the deflationary economics of ETH.

We’ll get into every point above in more detail, but first, a quick explanation of what Ethereum is:

Ethereum is what we call a “programmable blockchain”; developers can build applications on it. Not unlike the internet hosts websites like Facebook and YouTube, Ethereum hosts applications like Uniswap and AAVE. The benefit of hosting your app on Ethereum is that the app gains the advantages of blockchain technology, like decentralization, trustlessness and privacy.

Personally, I believe Ethereum might go as high as $100,000 one day.

4 Reasons Why Ethereum Is a Good Long-Term Investment:

1. It Offers Broader Exposure to The General Crypto Market

One of the main reasons Ethereum continues to interest long-term investors is that it’s the foundation of over 50% of the entire ecosystem of applications in the crypto space.

The fact that Ethereum is the foundation of such a large part of the crypto space, means that if the crypto-space “does well”, Ethereum is likely to benefit!

Ethereum is the go-to place to launch DEFI apps and NFT projects.

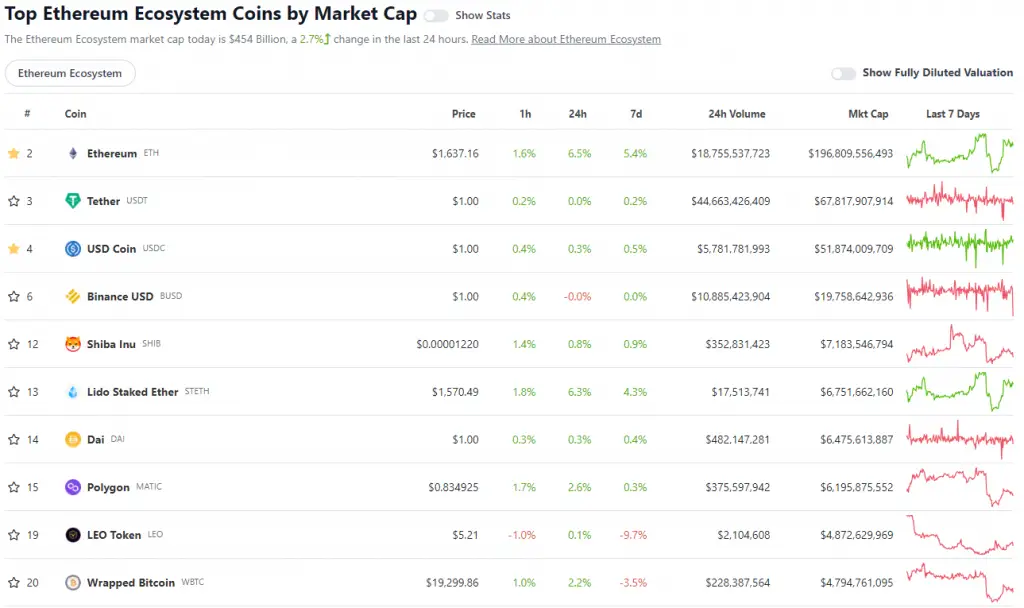

To give you an idea of how much stuff is built on Ethereum, check out the image below showing the top ten Ethereum-based projects:

The numbers on the left are the rank in terms of market cap. The top ten Ethereum-based crypto projects are all in the top 20 of all crypto projects in existence.

Given the fact that there are tens of different platforms to choose from for developers, this shows the dominance of Ethereum, and the broad exposure you’ll have by holding ETH long-term.

Oh, by the way:

I have a free newsletter you can sign up for where I send out technical analyses on Ethereum from time to time; check it out:

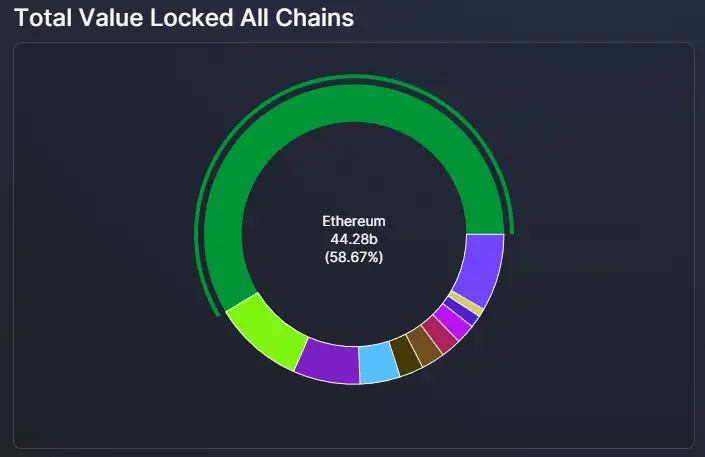

Another chart showing the dominance of Ethereum can be found at DefiLama. The chart basically shows the market share of different blockchains in the DEFI ecosystem:

As you can see, Ethereum has captured 58.67% of the total DEFI market as of 08. September 2022.

This further underscores the point I’m trying to make:

Ethereum benefits from the general adoption of cryptocurrency, because most of the crypto-space is built on Ethereum.

2. ETH is Becoming Deflationary

ETH becoming deflationary means that the supply of ETH decreases over time. Many proponents claimed that ETH will turn into ‘ultrasound’ money.

The upgrade called EIP-1559, which was part of the London hard fork (basically an Ethereum network upgrade to the consensus mechanism). Ethereum Improvement Proposal (EIP)-1559 refers to the reforms in Ethereum’s fee market mechanism implemented in July 2021.

Essentially, EIP-1559 eliminates the first-price auction model as the primary gas fee calculation. Gas fees are payments users make to compensate for the computing power needed to validate transactions on the blockchain. In the first-price auction model, users bid a specific amount to pay for their transaction to be processed, with the highest bidder winning.

With EIP-1559, there’s a discrete base fee’ for transactions, which is included in the next block. If I want to prioritize my transaction, I can add a ‘tip,’ referred to as a priority fee to pay for a faster transaction. This new model splits transaction fees into base fees and tips while burning used fees to curtail ETH inflation.

The burning of ETH, as a result of the EIP-1559 upgrade of July 2021, is what makes it potentially deflationary.

Roughly one year after the upgrade, 2 614 424 ETH has been burned. That’s not enough to make Ethereum deflationary, but the burning will accelerate with adoption, and the issuance of new coins will decrease with proof of stake. This sets Ethereum up to become deflationary.

3. Institutions Love Ethereum

Institutional investors are beginning to look at ETH as a viable store of value, and the future of cryptocurrencies. In 2020, cryptocurrency bolstered its status as an institutional asset class. Investment firms, fintech, banks, corporates, and wealth managers are accumulating heavily. This bodes well for the long-term viability of Ethereum as an investment.

Earlier in 2021, Chinese firm Meitu purchased $22.1 million worth of ETH. Meitu believes that the blockchain technology that underpins the Ethereum network can potentially disrupt existing financial industries.

There are several other examples of institutions buying Ethereum, but the most telling sign that institutions love Ethereum, it this:

The organization called “Enterprise Ethereum Alliance” (EEA) aims to “drive the use of Enterprise Ethereum and Mainnet Ethereum blockchain technology as an open-standard to empower ALL enterprises”. Its board members include J.P Morgan, Microsoft and Santander.

This is a huge reason to be long-term bullish on Ethereum.

4. ETH 2.0 Solves Ethereum’s Scaling Problems

It’s no secret that Ethereum has been expensive and slow in the past, but with ETH2.0 that changes. Ethereum, with future upgrades, will only increase in speed and scalability, get cheaper, and be more adopted over time.

ETH 2.0 refers to the transition from Ethereum’s blockchain 1.0 version to the new system. This new protocol will result in faster speeds, high security, scalability, more process efficiency, and more energy efficiency (less electricity consumption). The main upgrade that ETH 2.0 introduced is the migration from proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism.

The PoW mechanism allows the nodes (the computers running software that can verify or block transaction data) that secure the Ethereum platform to agree on the validity of information published on the network. It also thwarts economic attacks on Ethereum.

Some people believe that proof of stake will kill proof of work, but I disagree. In Bitcoin’s case, PoW is still king.

With the PoS mechanisms, users will stake their ETH to become validators on the network. Validators serve the same purpose as miners in the PoW. They create new blocks and order transactions such that all computer nodes can agree on the state of Ethereum.

The user’s stake serves to incentivize good validator behavior. For instance, I can lose a portion of my stake for failing to validate or deliberate collusion. Below are some of the ways that ETH 2.0 is going to improve Ethereum making it even better as a long-term investment option:

- Energy efficiency – users won’t have to use a lot of energy mining blocks.

- Low barrier to entry – there won’t be a need for expensive elite hardware to mine. This will make it accessible to more investors.

- Potentially more decentralization – ETH 2.0’s PoS mechanisms is likely leading to further decentralization in the Ethereum network.

- Enhanced Security – security is an essential aspect for investors. ETH 2.0 provides a stronger incentive (staked ETH) to keep the network secure.

Why Ethereum Is Winning The Long-Term Game:

I believe Ethereum will turn out on top. The so-called ‘Ethereum killers’ like Cardano and Solana will never beat Ethereum.

One of the main reasons is that Ethereum has the network effect going on for it. The network effect is the phenomenon where users derive utility or value from a service based on the number of users already using the service.

Think about it like this:

You’re about to build a new application that offers some financial services in a decentralized way – a DEFI app. Do you launch it on a chain with no users? Of course not. Do you launch it on a chain with no other apps working synergistically with yours? Of course not. You choose Ethereum for its huge user base and existing infrastructure!

The crypto-space works kind of like social media apps: There’s only value in the big ones. No matter how cool it might look, no one joins a Facebook lookalike when all their friends are on the real Facebook.

In my opinion, Ethereum’s widespread adoption and first-mover advantage will keep the platform at the forefront of decentralized finance, the NFT sector, and potential new ones that might pop up over the years.

Ethereum also has a proven track record of security and up-time, which is a huge deal for building trust and keeping its users and developers coming back.

In summary:

Ethereum will win in the long term because of the network effect. It hosts almost 80% of all applications, making it the go-to platform for developers and consequently users.

Conclusion: Ethereum is a great long-term investment

Ethereum offers broad exposure which decreases risk while simultaneously having huge upside potential due to institutional backing, technical upgrades and vast use cases. Therefore, Ethereum is a great long-term investment.

PS: None of this is financial advice. It is only my personal (and un-certified) opinion. I’m not educated as a financial advisor, I just love numbers and tech!

Grab My Free Guide – Increase Your Returns!

When investing in cryptocurrencies, there are sneaky ways to multiply your returns significantly. I’ve written about four of them and given them to you FOR FREE in this guide: