I’ve been in the crypto game for a long time. Through tons of research and plenty of trial and error, I’ve developed a reasonably profitable and stable Bitcoin investing and trading strategy that I’ll share in this article.

If you want the ultimate resource on this topic, you should check out my book:

Practical Step-by-Step Guide to Creating a Successful Strategy (It’s currently 50% off, go check it out!)

The strategy consists of two parts, one active and one passive. This article will show you how I made it so that you can personalize it and make adjustments depending on your needs/goals/risk-tolerance etc.

What Is A Bitcoin Investing/Trading Strategy?

Before we can make a strategy, we need to figure out what it actually is. What is the nature of a Bitcoin strategy?

In its simplest form, a strategy tells you what steps you need to take to arrive at a specified target. You need to figure out where you want to end up and how to get there.

In other words:

You need a goal and actionable steps you can take to reach it.

What Is A Goal of a Bitcoin Investing/Trading Strategy?

To set a goal, we need to figure out what makes a strategy good:

Simply put, a good strategy produces higher returns than just holding Bitcoin consistently over a long time.

For example, if you manage to produce 100% returns in two months, but Bitcoin increased 150% in those same two months, the strategy fails as holding would be better.

Therefore, you need to outperform the Bitcoin movements through trading and earning a yield. (more on that soon).

This goal is also the right way of thinking about altcoin speculation. If you don’t produce higher returns through altcoin trading than you would have done with Bitcoin, the added risk is not justified.

Based on the section above, an appropriate goal for our strategy is to produce higher returns than you would otherwise get by just holding Bitcoin.

What Steps To Include In Your Strategy:

This is where you can get personal and customize this to fit your needs. I’ll tell you what my own steps are so that you can use them as inspiration.

As I mentioned in the introduction, I have an active and a passive component to my strategy. The active one is trading, and the passive one is lending out my BTC.

I’ll give to each one in detail in the following sections.

The Passive Part Of My Bitcoin Investing/Trading Strategy:

The BTC I passively hold I like to earn interest on. For example, one can use NEXO to earn a yield on the BTC your holding.

By holding BTC in a nexo wallet, they give you up to 8% p.a., paid daily in BTC.

8% per year might not sound like a big deal, but it is a huge deal. Here’s why:

Let’s say you have 1 BTC and that it is priced at $50,000.

This gives you $50,000 to earn a yield on.

The current rate for Bitcoin at nexo is around 8% p.a.

“Okey, so I’m earning 8% p.a on $50,000. That’s $4000 per year, right?”

No, that’s not the right way to look at it:

Remember, you earn BTC, not USD.

I truly believe that Bitcoin will reach $100,000, and that’s a 2x from $50,000.

Now, the fact that you earn BTC and not dollars means that everything you make will 2x in price as well, as long as you keep the BTC, of course, and don’t flip it to dollars immediately.

This means that you can multiply your yield by two!

In other words, the yield you receive is 8% p.a in Bitcoin, but 16% in terms of USD.

The right way to think:

You earn a yield of 8% of the price you’re going to sell your coins at.

If you think Bitcoin will reach $1,000,000 one day, then your USD interest is a 20 x 8% = 120% per year. (because one million is 20x 50 thousand)

Let’s get on to the active part of my strategy.

The Active Part Of My Bitcoin Investing/Trading Strategy:

The active part is all about trading. Swing trading, to be specific.

Swing trading is a “slow” kind of trading, where you have a perspective of up to several years when you buy/sell.

As a swing trader, I typically accumulate coins over time, intending to sell them 3-6 months later after a significant increase in value.

I do NOT try to time the day-to-day movements or even the weekly movements in price. I focus on the monthly or even yearly trends.

I’m not chasing the 10-20 percent gains with high frequency. I’m chasing the 100 – 500 percent gains infrequently.

The short term price-movements of Bitcoin are irrational and polluted by FOMO and FUD. No one can consistently predict the short term.

The long term is different. It’s much more rational and predictable. The long-term movements cancel out a lot of the short-term noise, making it easier to trade.

“Yeah, sure… But how do you do it?”

The following section is all about how I swing trade Bitcoin:

How I Swing Trade Bitcoin:

I’m a student of Mathematics and have used my knowledge of numbers and statistics to create three different models. Two of them are particularly useful for swing traders; The Risk Model and the Fair Value S2F Model.

The Risk Model:

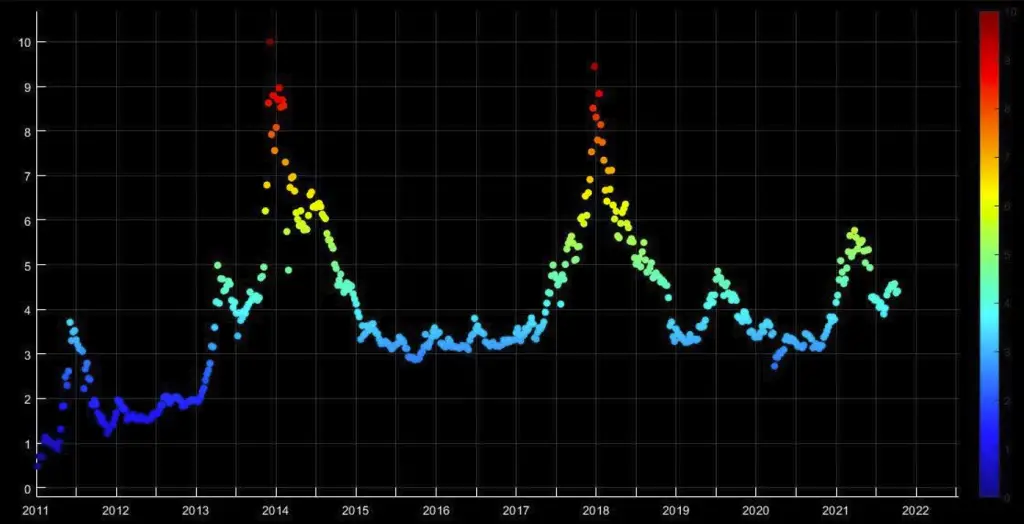

This model gives you the risk of holding Bitcoin on a scale from one to ten. The risk, in this case, means the likelihood of a huge correction in the near future.

This model is extremely useful for accumulating Bitcoin at the lowest possible average price. It tells you when you should buy a lot of Bitcoin, when you should hold it, and when you should sell it, statistically speaking.

Check it out below:

How You Should Use The Risk Model

One way of using it is to “dynamically dolla” cost average” according to the risk levels.

Let me explain:

You want to invest more when the risk level is low, and less when the risk level is high.

A practical example of a strategy using The Risk Model:

| Risk Level: | Invested Amount: |

| 1 | Invest $4000 |

| 2 | Invest $2000 |

| 3 | Invest $1000 |

| 4 | Invest $500 |

| 5 | Invest $250 |

| 6 | Hold |

| 7 | Sell 5% of your BTC |

| 8 | Sell 15% of your BTC |

| 9 | Sell 30% of your BTC |

| 10 | Sell 60% of your BTC |

To get weekly updates on this model, sign up for my premium newsletter:

The Fair Value S2F Model:

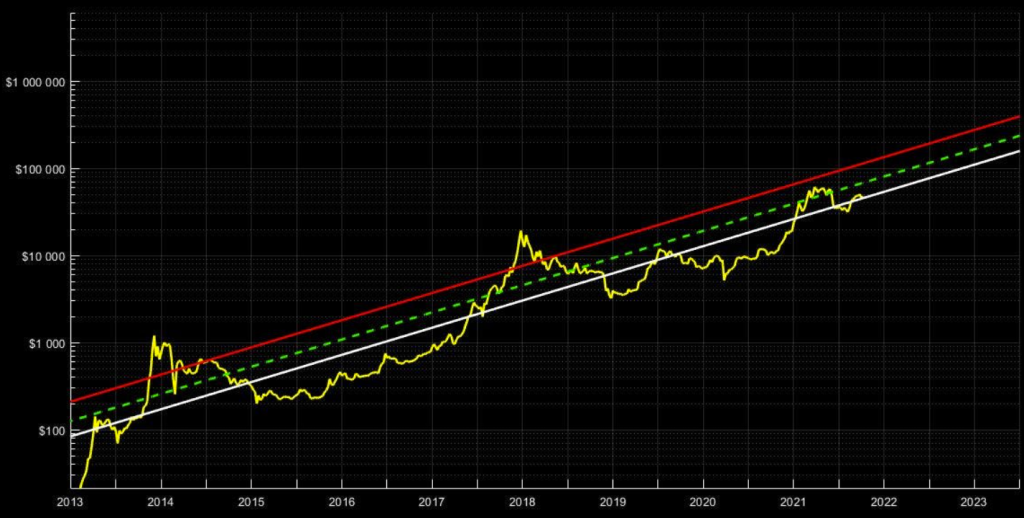

This one models the fair price of Bitcoin. The “fair price” is the price that Bitcoin “should” be at, based on a bunch of fundamental factors and a decade of historical price data.

The green dashed line is the fair value of Bitcoin:

How You Should Use The Fair Value S2F Model:

I regard Bitcoin as cheap when the price is below the white line and expensive when it’s above the red line.

Using this, the general guidelines suggested by this model is as follows:

- Buy aggressivly when Bitcoin is below the white line

- Buy moderatly when the price is between the white and the green dashed line.

- Hold or sell moderatly when the price is between the green dashed line and the red line

- Sell aggresivly when the price is above the red line.

Get Weekly Updates On My Bitcoin Models:

In my premium newsletter, I send weekly updates on all my models, together with in-depth technical analysis on Bitcoin, Ethereum, Cardano and Chainlink.

From time to time I also talk about other altcoins like SOL, AVAX, AXS, VET, and others I find interesting/promising.

You also get sneak peeks into my personal portfolio and notifications when I buy and/or sell different coins.

What Subscribers Receive Weekly:

- Updates on The Log Fit model

- Updates on The Fair Value S2F Model

- Updates on The Risk Model

- In-depth Technical Analysis on Bitcoin and Altcoins

- Sneak Peeks Into My Portfolio, and My Trading Activity

- My General Thoughts on the Market, and What I’m Doing at Each Turn

You Should Consider The Premium Newsletter If:

- You Have More Than $1000 Invested In Crypto

- You Want To Learn More About Crypto Investing

- You Want To Know What I’m Doing (I tell you when, and what, I buy and sell)

- You Want Clear Price Targets And Entry Prices

- You Want Updates On My Bitcoin Models

You Should NOT Join The premium List If:

- You’re Only Playing With Some Change, And Not Serious Money – You’re Better Off Spending The Money On Some More Crypto!

- You’re a Day Trader

- You Don’t Care About Crypto And Just Want To Get Rich Quickly

- You Prefer The Free Stuff – Totally Fine!

Most similar offers cost between $149 and $299, which is way too much for most people. After all, you need to make back the money to justify the extra spending!

For this reason, I have priced it at a fraction of that. In addition, you’ll get a FREE 30 day trial by signing up TODAY:

Using Technical Analysis In Your Bitcoin Strategy:

Other than using my Bitcoin models, I also perform technical analysis to look for buy/sell opportunities. Once again; not to time the daily or weekly moves, but to squeeze out every drop from the large moves in the Bitcoin price.

I analyze several charts, trying to figure out whether to have my capital in Bitcoin, Altcoins or in USD. The following is my top three priorities when it comes to technical analysis in my Bitcoin strategy:

Analyzing BTC/USD:

This chart just shows you the USD price per Bitcoin – “how much USD can I get per BTC I have”.

One example of the analysis I did, that saved me a lot of money, was this one:

From a newsletter in May of 2021:

Only a few days later, the price crashed down to $30K (the “wick” hit $30,066 to be precise).

Do you see how analyzing the BTC/USD chart on a long timeframe can be useful for trading Bitcoin? This crash had been building up for more than two months, and when it happened it took less than a week…

I also trade back and forth between Ethereum and Bitcoin, read this article to master it yourself:

When And Why I Trade My Bitcoin For Ethereum (and the other way too):

If you want the receive most of the technical analysis I conduct every single week and gain an insider view on my trading, click here to learn about the premium newsletter.

You can also join the free newsletter. You’ll get tons of useful analysis and guides there as well:

Analyzing The Bitcoin Dominance:

The Bitcoin dominance (BTC.D from here on) is a metric showing how much of the total crypto market lies in Bitcoin.

For example, if the total crypto market is 1.5 Trillion USD, and the BTC.D is 70%, Bitcoin’s market cap is equal to 70% of 1.5 Trillion = 1.05 Trillion.

Understanding this is key to timing what is known as Bitcoin seasons and altcoin seasons. You see, the market shifts between focusing on Bitcoin and Altcoins. Timing these seasons can be extremely profitable.

The way I use BTC.D when trading:

- When the BTC.D is high altcoins are cheap. I therefore divercify more into Altcoins than into Bitcoin

- When the BTC.D is low, Bitcoin is cheap. I therefore consentrate my capital more heavily into Bitcoin.

Basically, I do the opposite of what the market does.

BTC.D is high? Sell BTC for Altcoins.

BTC.D low? Buy BTC with Altcoins.

Example/Suggestion Of a BTC Investing/Trading Strategy:

Let’s say you have $5000 invested in BTC right now and you want to make this money grow fast! If I was you, this would be my plan of action:

- Sign up with nexo, or some similar service. I send $3350 to the nexo wallet and start passively getting a yield on my BTC.

- Then I start looking at the BTC/USD chart and the BTC.D metric. I’m checking it at least once per week to see if I can figure out the patterns. I watch other people’s analyses to get inspiration and insight. I also sign up to the free newsletter, and even the premium newsletter of Solberg Invest if I’m really serious about crypto investing.

- When I start recognizing some patterns I start making tiny trades to test my skills. I don’t trade more than 5% of my portfolio in one trade unless I really know what you’re doing.

- After a while, I make more significant trades, and my portfolio grows faster as a result. I start becoming efficient at recognizing patterns, and I’m looking at altcoin charts as well at this point. My portfolio is growing much quicker now because my trades start to make me more money.

- At some point I book profits. I know that the biggest mistake I can make is to get greedy.

In my eBook I write in great detail about how to do this, but in general, you want to book profits gradually along the way. It is often better to sell too soon than too late, trust me…

Other Ways To Trade Bitcoin:

- Day Trading. Buy and sell BTC with high frequency – multiple times per day. This requires high skill, and extreme mental resilience. NOT for beginners.

- Futures Trading. Make bets on what the future price of Ethereum will be. This is NOT for beginners either. This is mostly used by “rich people” and institutions. However, for the right people futures trading offer a lot of upsides (and risk management options).

- GBTC. You can gain exposure to Bitcoin indirectly through The Grayscales Bitcoin Trust. Buying GBTC is kind of like buying stocks, which means you can hold them in retirement accounts for tax benefits. Also, for institutions it’s often easier, legally speaking, to buy GBTC than BTC.

- Bitcoin-Correlated Securities. You can actually buy stocks that are closely correlated to the price of Bitcoin, like stocks of Bitcoin mining companies and exchanges like Coinbase.

Conclusion:

With the goal of producing higher returns than just holding would, I do the following:

- Use nexo to earn interest on 60-70 percent of my BTC every single day

- Swing trade according to the BTC/USD chart and the Bitcoin dominance (typically) with a 3-6 month perspective.

- Book profits gradually when the risk is above 7 (according to The Risk Model) and/or when the price is “expensive” according to The Fair value S2F Model.

PS: I Have a Book on Crypto Investing Strategies:

I have written an entire eBook on how to create a successful crypto investing strategy for 2021. It gives you EVERYTHING you need to know and more. I hold your hand from step one to step done, with a handwritten example showing EXACTLY what to do at every step.

Oh, and you’re getting a 50% discount!

To learn more about the book, check it out here:

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is NOT the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.