Between 2016 and 2018, there were debates in the bitcoin community regarding certain technical parameters. These disagreements led to deep ideological divisions. Ultimately, several new networks were deployed to compete with the Bitcoin blockchain. Many find these Bitcoin ‘forks’ confusing, so today, I’ll do a deep-dive on Bitcoin SV and determine if Bitcoin SV is a good investment.

No, Bitcoin SV is not a good investment. This network has serious security flaws and fails as a store-of-value. Stablecoins also outcompete it as a medium-of-exchange. Bitcoin SV has no relevant use-case or special attributes, making it unattractive to investors.

Historical Performance of Bitcoin SV

Bitcoin SV originated as a fork of another Bitcoin fork, Bitcoin Cash (BCH), and the network and BSV token was deployed in November 2018.

The launch initially appeared successful, and by January 1st 2019 BSV had appreciated 98% against Bitcoin (BTC).

However, as illustrated below, BSV has performed very poorly against both BTC and Ether (ETH) since the start of 2019.

Ever since a very short-lived price pump in January 2020, the BSV price has declined almost constantly in BTC and ETH terms:

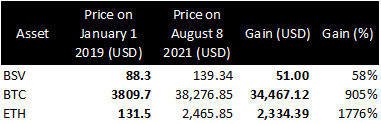

Below you see BSV’s performance since January 2019 compared to BTC and ETH in the same time period:

BSV has performed modestly in USD terms. The price has increased from $88.3 in January 2019 to $139.3 in August 2021. While this 58% jump sounds impressive, you must place these gains in context:

The two-year period in question has been very bullish for most asset classes, from crypto to stocks and real estate.

For example, even the S&P500 index is up 82% over this time. Given the higher risk involved in crypto, BSV has certainly underperformed.

We must also consider opportunity cost. This refers to how best we maximize the returns from our limited investment capital.

For example, if you allocated some of your crypto portfolio to BSV in January 2019, you would have gained 58%. However, had that same capital been allocated to BTC or ETH, you would have gained 905% or 1,776%, respectively. Investing in BSV, therefore, resulted in a significant opportunity cost to your portfolio.

To conclude, BSV has historically performed very poorly relative to other crypto assets and other asset classes. Even though the risk and potential reward of investing in stocks is drastically lower, The S&P500 has outperformed BSV since 2019.

PS:

Join the free newsletter of Solberg Invest, where you get technical analyses on Bitcoin, Ethereum, Cardano, and others. Also, you’ll get some free guides and reviews. Sign up for free below:

Does Bitcoin SV Have a Future?

As it was designed to improve upon bitcoin’s functionality, the question as to whether BSV has a future largely depends on whether it succeeds against this goal. Bitcoin’s main use cases are as a store-of-value and medium-of-exchange. I’ll therefore review how BSV performs against these use cases.

Store-of-value

Store-of-value assets are those that can be expected to retain their purchasing power over time. This usually requires the asset to be storable, retrievable and exchangeable in the future. While BSV has retained its USD purchasing power since inception, it has also been trending down in USD terms since early 2020.

BSV’s security is also highly questionable:

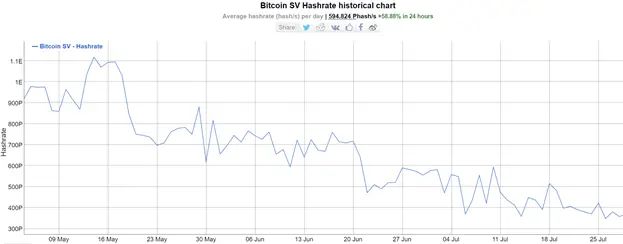

An attack on the network can result in users losing some or all of their funds. As such, poor security impacts the ‘retrievable’ requirement of a store-of-value. By monitoring ‘hash rate, a measure of energy expended by miners to protect the network, we can assess security trends over time. The lower the hash rate, the less expensive it is for an attacker to gain control of the network.

You can see below that the BSV hash rate, and consequently its security, is clearly declining:

In August 2021, the network suffered a 51% attack. This is where an attacker tries to gain control of the network by controlling the majority (i.e. 51%) of the hash rate. The network suffered other similar attacks in 2021.

Similarly, the network experienced a ‘double-spend’. Essentially, this means a user spent the same BSV tokens twice. Many exchanges temporarily ceased trading for BSV and the price declined during these attacks.

In my opinion, BSV’s declining price and poor security record mean it fails as a store-of-value. It has experienced several 51% attacks, and the network has experienced a ‘double spend’. This is not acceptable for a store of value.

In another article, I compare all the biggest “Bitcoins” in a battle as mediums of exchange and store of value; read it here to see how BSV performers compared to BTC, BCH and BTG.

Medium-of-exchange

The main purpose of increasing block size was to improve the efficiency of the network. In terms of improving the speed and costs of transactions, this has been a significant success.

Larger blocks result in more transactions being record in each block. This means the speed and cost of each transaction on BSV are a fraction of Bitcoin’s.

To this extent, you could argue that BSV has succeeded as a medium of exchange.

However, competition for blockchain-based value transfer has increased markedly in recent years. Most notably, the rise of stablecoins means that users can transfer value in a decentralized and secure manner without being exposed to the price volatility of the crypto market.

Centralized USDC and USDT are the most prominent stablecoins, and these alone have a combined market cap of over 80 billion. Decentralized options such as UST and Frax are becoming more common.

In my opinion, stablecoins undermine BSV’s medium-of-exchange use case. Stablecoins are more suitable for being used as exchange mediums due to their stable price and even better scalability and fee structure.

Should you buy Bitcoin SV?

We have established above that BSV is struggling to achieve its goal of being a scalable Bitcoin solution. However, there are other intangible factors to consider when deciding whether to buy BSV.

As BSV is a fork and direct rival of Bitcoin, we need to compare the two networks.

Network effect (how networks gain value in a non-linear fashion as they gain new participants) generates a strong economic moat. Bitcoin’s network effect is currently far stronger than BSV’s.

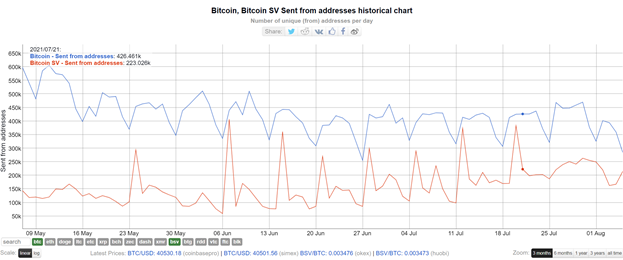

Bitcoin has more users, more active wallets, and is stronger in most other metrics of the network effect.

As an example, see the chart below demonstrating daily active addresses. Bitcoin has had more active addresses every day over the last three months, despite the higher cost of bitcoin transactions.

While BSV currently has far cheaper transactions than Bitcoin, this may not be the case for long. Bitcoin developers continue to work on the Lightning Network. This is a scaling solution for Bitcoin that promises faster and cheaper transactions.

If the Lightning Network rolls out as planned, it will diminish the advantages BSV currently has over Bitcoin.

BSV also suffers from a poor reputation in the crypto-space:

Craig Wright leads the project. This Australian businessman claims to be Satoshi Nakamoto (the inventor of Bitcoin). Wright has pursued legal action against many Bitcoin developers and investors.

Many in the crypto-space dispute these claims, which have resulted in negative sentiment against his projects. The poor public image of its leaders may therefore reduce BSV’s investment potential.

Suggested reading:

Conclusion: No, Bitcoin SV Is Not A Good Investment

For the following reasons, I believe it fails as an investment and as a product:

- A history of price underperformance compared to rivals

- Inferior security and frequent attacks means it fails as a store-of-value

- Stablecoins outcompete BSV as a medium-of-exchange

- It has poor network effect compared to bitcoin

- Bitcoin L2 scaling solutions further threaten BSV’s current medium-of-exchange advantages over Bitcoin

- Poor reputation of the project may hamper its future price potential

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is NOT the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.