For most people, $400 isn’t life-changing money. But $400 a month, consistently, can be. Whether you’re saving for a vacation, a new car, retirement, or just to build up an emergency fund, $400 a month can be the difference between success and failure.

Let me get straight to the point:

To save $400 a month, make a monthly budget with such a surplus. First, calculate your monthly expenses. Then, your monthly income. Manipulate the expenses to the point where you’re saving $400 a month. Lastly, stick to the budget.

In the rest of the article, I’ll help you figure out how to reach $400 in monthly savings. We’ll calculate your monthly income and spending to make a budget. In addition, I’ll give you the hands-down best way to save a lot of money consistently over time.

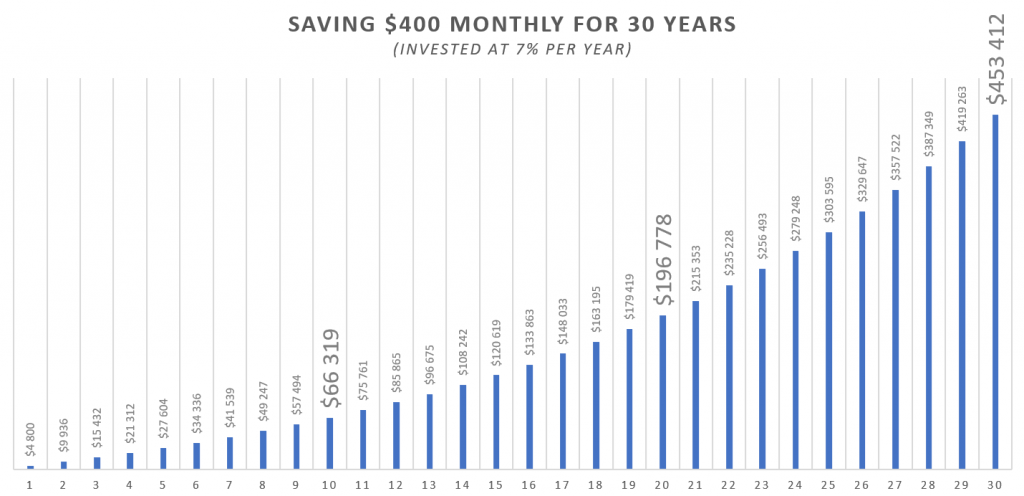

Although saving $400 is deemed trivial by some people, putting $400 a month into passive index funds for 30 years will reach the not-so-trivial sum of almost half a million dollars:

Saving money will NOT make you rich, which is why in the example above the $400/month is invested. Putting those bills to work, through investments, is the key to wealth building! When putting your money to work, saving as little as $100 a month can be powerful.

suggested reading: How Much Money Should You Save Per Day?

How To Save $400 Monthly: (in three steps)

I’ll break it down into three steps. They’re not going to be complicated, but they will probably take some work. Good things don’t come easy, I guess.

Here’s the general idea behind the steps:

- Get an overview of your current spending.

- Figure out how much money you’re making monthly.

- Make a budget with at least $400 in surplus every month.

If you’re looking for a more general guide, check out the four steps to saving lots of money fast.

Step #1: Calculate your monthly expenses

To get a decent estimation of your monthly expenses, we should take the average of the last three months. Increase the number of months to improve the accuracy of the estimation.

Here’s what you need to do:

- Get a list of the last three months’ expenses. Usually, this can be found online at your bank. If you use a lot of cash, you can probably still find out how much cash you took out of your bank account in these documents. If you, for some reason, don’t have access to such documents, you have two choices: spend three months tracking your expenses via an app, or manually saving all the receipts.

Sort all the expenses into categories (categories are called “items” from here on). Examples of “items” are “Transportation”, “Housing” and “Personal insurance”. The expenses you can’t fit into any items, you put in the item called “miscellaneous”. - Sum up all the expenses in each item to find the total expenses for each item. For example, if you had 25 different expenses of $10 each in the “Food” item, the total expenses for “Food” would be $250.

After finding the total expenses for each item, summarize all the items into a “Total expenses”. This should be how much money you’ve spent in the last three months. - Divide all the numbers from step 2 by three to get the monthly average. Since the numbers used are from three months and we’re looking for your monthly average, you need to divide them by three.

By now you should have a list of how much you spend on the different items, and how much you spend in total, on a monthly basis. This is the average of the last there months, making it a decent estimation of your actual monthly spending habits.

Personally, I like to sort the information in a table, like this:

| Item | Monthly Expenses |

|---|---|

| Housing | $1,200 |

| Transportation | $600 |

| Personal Isurance | $450 |

| Entertainment | $230 |

| Food | $450 |

| … | … |

| … | … |

| Total Expenses | $3,250 |

Before moving on to the next step, make sure that you know the following:

- How much you spend on all the different items per month (on average).

- How much you spend in total every month (on average).

If you’re a single person, and you’re spending more than $3,000 a month. Consider checking out one of these articles to get you’re living expenses down:

If you’re a family and spend more than $4,000 a month, check out one of these articles:

Step #2: Calculate your monthly income

In this case, your monthly income is all the money the average amount of money coming into your bank account in one month. This includes gifts, salary, side hustles, and everything else that brings in money.

As with my expenses, I like to log this in a table like this:

| Source | Annual Income (after tax) | Monthly Average (after tax) |

|---|---|---|

| Salary | $43,500 | $3,625 |

| Side Hustle | $7,000 | $583 |

| Money Gifts | $200 | $17 |

| … | … | … |

| … | … | … |

| Total Income | $51,000 | $4,250 |

Now, with an overview of both income and expenses, we’re in a perfect position to make a budget that’ll save us $400 a month.

Step #3 Make a monthly budget with a $400 surplus

We’re now ready for the final step, making a budget with a monthly surplus of $400. Following this budget will guarantee that you’re able to save $400 a month.

Here’s what you need to do:

- List all the expense items and their respective monthly expenses.

- Sum it up into total monthly expenses.

- List your total income.

- Make a new line called “Surplus” where you subtract your total expenses from your total income.

- Manipulate the budget to the point where your surplus is $400 or more.

- Stick to the fricking budget!!

Here’s an example:

| Item | Amount (monthly) |

|---|---|

| Housing | $1,100 |

| Transportation | $550 |

| Food | $450 |

| Personal Insurance | $400 |

| Entertainment | $200 |

| Hobbies | $75 |

| Appliances and Clothes | $50 |

| Miscellaneous | $140 |

| Total Expenses | $2,965 |

| Salary | $2,900 |

| Side hustle | $450 |

| Money gifts | $15 |

| Total Income | $3,367 |

| Surplus (Income – Expenses) | $400 |

Make something similar to that and you’ll be sure to save $400 a month consistently.

If you’re struggling to get the expenses low enough to the point of $400 in surplus, here’s the hands-down best thing you can do:

Cut down on the big “fixed” expenses in your budget:

Focusing on the big items is what makes the big impact. If you’re really trying to save more money, consider moving into a cheaper place, closer to work. This will drastically decrease your spending on housing and transportation, which probably are your two biggest expenses. In addition, the cuts will be more or less permanent, making the monthly savings consistent.

In addition, this skill can be applied to save even more by tweaking the budget to spit out a higher surplus.

Summary:

- Calculate your average monthly expenses

- Calculate your average monthly income

- Make a monthly budget and manipulate the expenses to the point of a $400 surplus.

Remember to put those bills to work! Putting $400 monthly into passive index funds for 30 years will net you roughly $450,000, given a modest 7% return per year.