There’s a lot of talk about Grayscale in the news. Grayscale is a gateway for institutions and rich people to gain exposure to cryptocurrencies, and the Ethereum Grayscale Trust is one of these gateways.

They have acquired almost $1.5 Billion worth of Ethereum within the last five months, but what is the Ethereum Grayscale Trust?

The Ethereum Grayscale Trust (ETHE) is a security that accredited investors can buy shares in to diversify into Ethereum, without investing in Ethereum directly. This gives them exposure to Ethereum without holding the physical coins. The trust is backed by physical Ethereum, at a ratio of 0.0104221.

Let’s look into the details, and really understand what it is, and how it affects you. We’ll also look at how they bought over 700 000 ETH in the last five months, and if it’s better to invest in their trust, or directly in Ethereum.

PS:

If you’re researching this in order to make a strategy for investing in Ethereum, you need to know this: I have written another article showing my personal Ethereum investing and trading strategy.

How Does The Ethereum Grayscale Trust Work?

The Ethereum Grayscale trust lets “accredited investors”, meaning rich people and institutional investors, gain exposure to Ethereum.

How does this work, and what does it mean?

What are you actually buying, when putting money into it?

What you get is a security, which basically means shares of a stock. This stock closely follows the price of the cryptocurrency Ethereum.

If the price of Ethereum increases, the price of your stocks should, in theory, also increases.This is because of the fact that Grayscale backs the stocks in actual Ethereum.

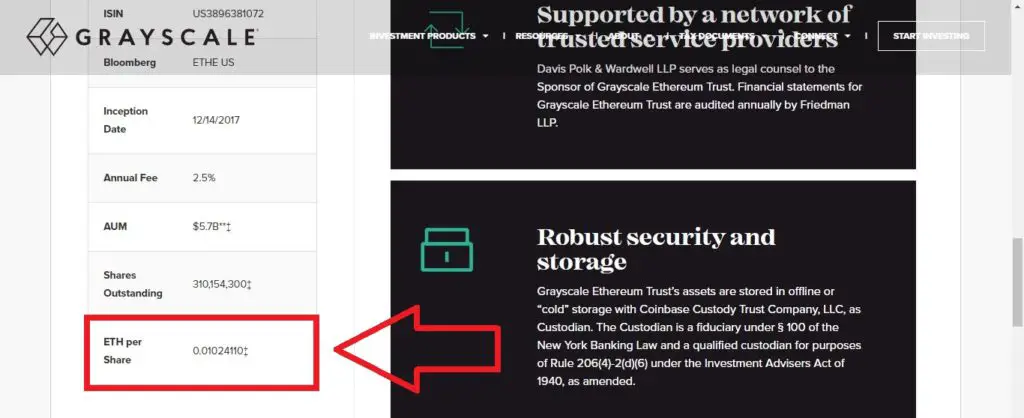

You can find the exact numbers of Ethereum they have, per share they have sold, on their website by scrolling down to this point:

This number tells us that for each share they have issued, they have bought 0.01024110 Ethereum to back them up.

For example, if you buy 1000 shares of Ethereum Grayscale Trust, they need to increase their Ethereum holdings with:

1000 * 0.01024110 ETH = 10.2311ETH.

This is what their website says about The Ethereum Grayscale Trust:

” Grayscale Ethereum Trust is solely and passively invested in Ethereum, enabling investors to gain exposure to ETH in the form of a security while avoiding the challenges of buying, storing, and safekeeping ETH directly.”

(from grayscale.com/)

Translated into English this means:

Grayscale Ethereum Trust lets you invest in Ethereum without actually investing in Ethereum. You receive shares of a security, stocks, which mimic the price of Ethereum. This way, you don’t have to handle the buying, storing, and safekeeping of actual Ethereum.

The Specifics of The Ethereum Grayscale Trust

Grayscale talks about five specific qualities on their website, let’s go through them, and translate them into English – without all the finance words:

1) Titled, Auditable ownership through a traditional investment vehicle:

What they’re saying here is that Ethereum Grayscale Trust is a traditional investment vehicle, meaning that investors can buy shares, like in a normal company, which is familiar to most investors and institutions.

The shares are titled in the investor’s name, meaning that no one can question who bought what shares, making the structure for financial and tax advisors familiar and easy to understand.

It also makes it easy to move the shares over to the beneficiary. This means that if you die, it’s easy to transfer the shares to your children, wife etc.

The fact that it’s easy to move the shares over to your beneficiary is a great point, as this is highly problematic in the world of cryptocurrencies. In the crypto market, you are your own bank, and if you die, without handing the passwords or private keys to anyone else, the crypto is lost forever.

In plain English, this section means that investing in the Ethereum Grayscale Trust in just like investing in any other security/stock.

2) Eligible for tax-advantaged accounts

This means that you can hold your shares in IRAs, Roth IRA, and other accounts where you will receive tax advantages.

This is a good argument for investing in Ethereum Grayscale Trust for people who want to expose their retirement saving to Ethereum, or other long term saving/investing.

It makes it possible to receive tax advantages on cryptocurrency investing, which is a great deal!

3) Publicly quoted

This means that their shares can be traded on stock exchanges. Investors can trade their shares, which are quoted on OTCQX, check them out here https://www.otcmarkets.com/

4) Supported by a network of trusted service providers

Under this point, they say that Davis Polk & Wardwell LLP served as legal counsel to the Sponsor of Grayscale Ethereum Trust.

This means that they have a legal counsel, Davis Polk & Wardwell LLP, which apparently is among “the premier law firms of the world”, and has been that for the last 165 years.

This is good, as the legal nature of this kind of enterprise often is complicated and confusing. The fact that they have quality legal people on their side is great.

In addition, Friedman LLP audits its financial statements, which is an accounting, tax, and business-consulting firm founded back in 1924. They have received many awards, and seem like a great partner for Grayscale to have.

5) Robust security and storage

The actual Ethereum that backs the shares is stored in cold storage, offline wallets, with Coinbase Custody Trust Company LLT as their custodian.

This basically means that Coinbase, the popular exchange, handles the storing of the Ethereum bought to back the shares. They keep the Ethereum in cold storage, which is the safest way to store cryptocurrencies.

Does the Ethereum Grayscale Trust Affect The Ethereum Price?

Yes, the Ethereum Grayscale Trust affects the Ethereum price, as their shares are backed in Ethereum – making them buy Ethereum to issue more shares.

Grayscale has actually bought a ton of Ethereum the last five months.

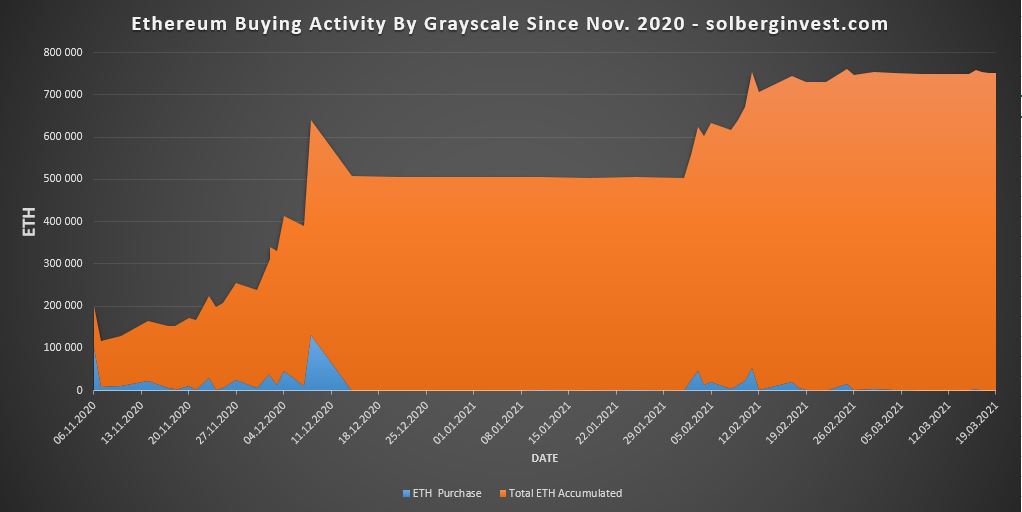

Below, you see an infographic showing their purchasing activity since November of 2020. (Data Source: bybt.com)

As you can see, they have bought over 700 000 ETH, which is close to $1.5 Billion worth of Ethereum.

This affects the price to a great degree, as this decreases the available supply on exchanges, making the Ethereum price more sensitive to regular buying pressure.

Also, it tells us that rich people and institutions are investing in Ethereum – which is a great sign. It means that institutions are not only looking at Bitcoin for investing in crypto, but Ethereum as well.

Is Ethereum Grayscale Trust a Good Investment?

To gauge whether or not the Ethereum Grayscale Trust is a good investment, we’re going to compare it to investing directly in Ethereum.

Let’s look at the historical returns of each, and figure out which has historically been the best investment:

Ethereum Grayscale Trust vs Ethereum – Historical Returns:

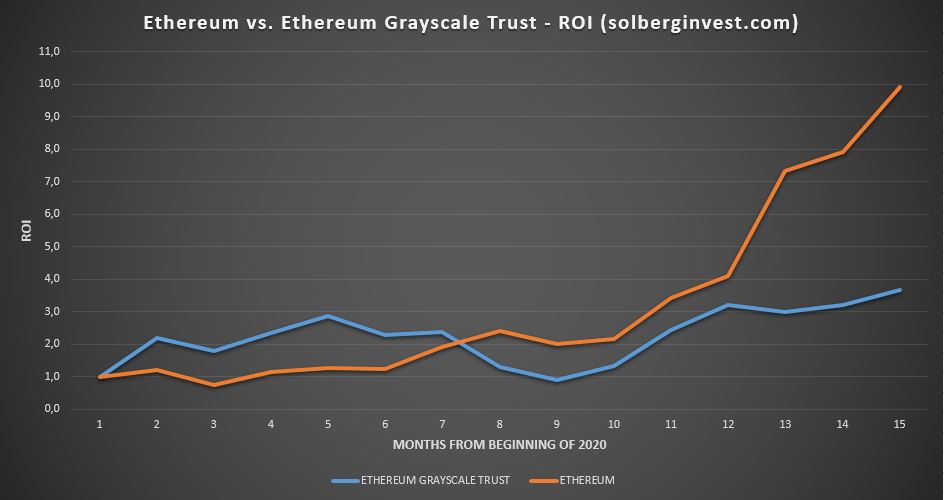

If we take a measured move going back to January 2020, we can compare the returns of Ethereum and the Ethereum Grayscale Trust, to get an idea of which has produced the best historical returns:

The Grayscale Ethereum Trust:

We see that The Ethereum Grayscale Trust has produced a return of 541% since January 2020.

Not bad, but Ethereum has done more than twice as good:

The returns of Ethereum since January 2020 has been 1240%, 2.3 times that of the Ethereum Grayscale Trust.

For the long term investors, it looks like Investing directly in Ethereum is the better option, based on historical returns.

However, for traders it seems like both Ethereum and The Ethereum Grayscale Trust are good opportunities.

There have been time periods where the Ethereum Grayscale Trust has been much more profitable to hold than Ethereum.

Let’s look at the first five months of 2020:

Ethereum January 2020 – June 2020:

Ethereum increased with 84% in the first five months of 2020.

Let us look at what the Ethereum Grayscale Trust did January 2020 – June 2020:

In the same period that Ethereum increased 84%, the Ethereum Grayscale Trust surged 979%. That’s 11.6 times as good returns – a great trading opportunity.

The conclusion of this is that Ethereum seems to be the best long-term hold, but for traders, the Ethereum Grayscale Trust provides great opportunities.

(Learn how to perform Technical analysis, read this article: How to Read Bitcoin Price Charts Like a Pro)

To make it really clear, I made another infographic showing the returns of them both, side by side:

We can see that the ROI from shares of ETHE took the lead early on, but Ethereum has left them in the dust.

Conclusion:

– The Ethereum Grayscale Trust is a security that accredited investors can buy shares of, giving institutions and rich people the chance to expose themselves to Ethereum without having to deal with buying, holding and safekeeping Ethereum themselves.

– Grayscale has to buy Ethereum to back the shares issued by the Grayscale Ethereum Trust. They have bought over 700 000 ETH, worth just under 1.5 Billion U.S. Dollars, in the period November 2020 – March 2021. This affects the price of Ethereum, as it takes away the available supply for buyers.

– For long-term investors, Ethereum seems to be the better investment. From January 2020 – March 2021, Ethereum has increased 2.3 times as much as the price of shares of Ethereum Grayscale Trust.

– However, for traders, there are opportunities, like in the first five months of 2020 where the price of shares of Ethereum Grayscale Trust increased 11.6 times as much as Ethereum.