2021 has been a breakout year for non-fungible tokens (NFT’s). From collectibles such as NBA Topshots to gaming projects such as Axie Infinity, the space has exploded in popularity. I’ve been searching for a solid investment in an NFT infrastructure project that could benefit from the sector’s expected growth over the coming years. As such, I’ve been analyzing the Enjin project in recent weeks to answer the question, ‘does Enjin have a future’?

Yes, Enjin has a promising future due to the quality and adoption of its product offerings, the extent of an existing community of users, strategic partnerships with leading brands, and inherent exposure to the rapidly growing NFT market.

In this article, I explore the fundamentals of Enjin with an aim to benchmark its current valuation and analyze its future growth potential.

What is Enjin?

Enjin was launched in 2009 by Witek Radomski and Maxim Blagov as a community-focused gaming platform, before pivoting towards an Ethereum powered NFT ecosystem after their ENJ initial coin offering in 2017.

Their stated aim is to provide a holistic platform where developers and users can mint, store and trade NFTs. There’s a current focus on gaming-related assets, though any developer can utilize the platform, meaning it has a wider scope than just gaming should new use cases for NFTs emerge.

The key functions of Enjin are defined below:

- Mint. Platform users can create NFTs with a significant degree of flexibility

- Store. NFTs (and other crypto assets) can be securely stored in the native Enjin wallet

- Trade. The platform’s marketplace conveniently facilitates the listing, marketing and sale of NFTs

- Beam. Allows developers to distribute NFTs, project information and other digital assets to their communities via QR codes

Enjin’s growth has been rapid, with over 1.1bn NFTs minted and nearly 900k assets sold on their marketplace for over 44m in ENJ tokens. High-profile strategic partnerships have been secured, such as with Microsoft’s Azure Heroes collectibles and BMW’s Vantage Program, demonstrating Enjin’s ability to convince leading brands of their value.

Suggested reading:

What is the Purpose of the ENJ Token?

ENJ is used to directly back the value of digital assets minted on the Enjin platform. The minting or purchase of assets requires the expenditure of ENJ, while these assets can also be destroyed to redeem the ENJ tokens in a process known as ‘melting’.

ENJ is tradable for fiat or other crypto assets (via exchanges such as Binance or Uniswap), meaning that Enjin minted NFTs are actually backed by real-world value.

In other words:

ENJ indirectly links rapidly growing online ecosystems like gaming marketplaces to assets that one can use in the wider world.

This is a key point to understand when assessing the value of the token and Enjin’s future growth prospects.

ENJ Tokenomics and Price History

ENJ has a circulating supply of 834 million, which at the current price of $1.15 means ENJ’s circulating market cap is $0.96 billion. ENJ has a total supply of 1 billion, which at the current price of $1.15 means ENJ’s fully diluted market cap is $1.15 billion.

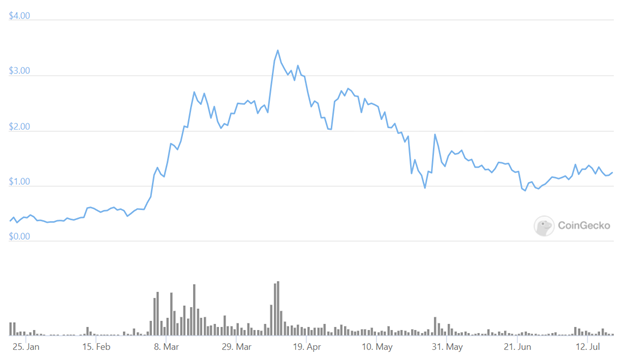

The current price is up over 6,600% from the low of $0.018 in November 2017 and down 70% from the highs of $3.94 in early April 2021.

The ENJ price history has largely followed the wider crypto macro trends, specifically those of the NFT sector, which saw significant increases in Q4 2020 and Q1 2021 before a pullback in Q2 2021.

PS:

Oskar Solberg, the owner of Solberg Invest, has a free newsletter where he sends out technical analyses on Bitcoin, Ethereum, Cardano, and others. Also, you’ll get some free guides and reviews. Sign up for free below:

Is Enjin a Good Investment For the Future?

When considering whether Enjin is a good investment, we should examine three key criteria:

- Enjin’s current market position and competition

- The growth potential of the NFT sector

- Enjin’s capacity to hold or grow market share in the coming years

Current positioning

Enjin’s early mover advantage, their well-established base of users and developers, and continued focus on new products mean they’re well-positioned within the NFT sector.

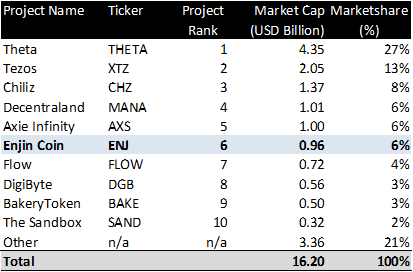

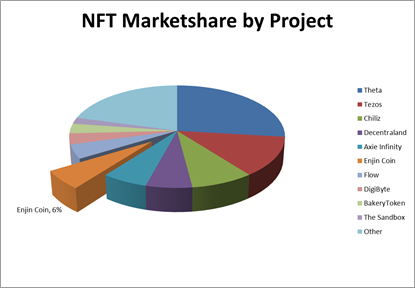

The aggregate value of NFT focused projects is $16.2 billion. Enjin fares strongly in the competitive landscape, being the 6th largest project and capturing 6% of the total market share.

NFT sector growth

As a long-term player in the NFT space, Enjin’s future is largely dependent on the sector’s growth prospects as a whole. Thankfully, the indications are that these prospects are exceptionally positive.

Nadya Ivanova, chief operating officer of BNP Paribas’ L’Atelier research firm, recently said:

“As augmented and virtual reality technology matures, normal people are going to spend more and more of their time — and therefore money — in virtual environments.”

– Nadya Ivanova

This trend towards our communication, entertainment, education, and trade occurring increasingly in the digital sphere known as the ‘Metaverse’ is a key driver in the adoption and social acceptance of digital assets and digital scarcity.

This includes mediums as diverse as visual art, music rights, in-game assets, digital proof of tangible assets, and much more.

Simply put, the NFT space is forecast to grow substantially over the coming years.

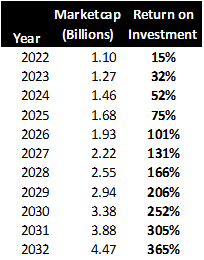

Market analysts have a wide-ranging view of the sector’s long-term growth rate. However, if we assume Enjin maintains a 6% market share and the sector grows by 15% per year (a modest assumption), the return on investment would be 15% by 2022, 131% by 2026, and a remarkable 365% by 2032.

Can Enjin increase marketshare in the future?

While impressive, the above investment returns assume Enjin maintains only a 6% share of the NFT sector. But what if they expanded their core focus from gaming into art, collectibles, music, or even novel NFT use cases?

It is quite conceivable, given their strong leadership team, existing strategic partnerships, and established userbase, that Enjin could gradually increase its market share over time.

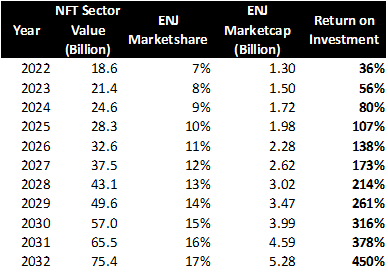

The analysis below demonstrates the investment outcomes if we assume that the NFT space grows by 15% per year and Enjin increases market share by 1% per year. This assumption significantly improves the investment outlook, with the return on investment being 36% by 2022, 173% by 2027, and 450% by 2032.

Conclusion: Yes, Enjin Has a Future

Enjin’s future appears bright for the following reasons:

- Highly functional platform, a proven usecase and community of developers and users

- Notable strategic partnerships with high profile brands

- Potential to expand core focus from gaming into a plethora of other NFT usecases

- Deep links to the NFT sector which is forecast to grow rapidly

For the above reasons, my analysis suggests the long-term investment outlook is highly favorable, and that Enjin has a bright future.

However, please exercise caution as the valuation of NFT projects correlates to those of Bitcoin and the wider crypto space. Should these markets turn bearish, it is likely ENJ will also decline.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is not the case in crypto markets.

There ARE ways you can significantly increase ROI. Oskar Solberg has created a free guide with 4 easy ways to do it.

He does all four of them and knows for a fact that they can increase ROI by hundreds of percent.