(Updated 11. September 2022)

I think the metaverse sector is one of the most promising sectors in the cryptocurrency market. Decentraland is one of the largest projects in this space, but does it have a future?

Here’s the short answer:

Yes, Decentraland has a bright future due to its exposure to the growing NFT market, novel income streams, committed community, and progressive governance model. It is one of the leading projects in its sector, and an early mover on digitized real estate, further securing its future position.

In this article, I hope to illustrate the project fundamentals to assess whether Decentraland has a future.

Get expert insights every week – Sign up for free below:

What is Decentraland?

First launched in 2015 by Ariel Meilich (project lead) and Esteban Ordano (Tech lead), Decentraland originated as an experimental grid that allocated pixels to platform users based on proof of work mining.

After an ICO in 2017, it has subsequently grown into a rich virtual world powered by Ethereum, where a community of users interact and acquire virtual land, goods and in-game services.

Land, goods and collectibles (such as avatars and wearables) are represented by non-fungible tokens (NFTs).

As a LAND (virtual land in the Decentraland metaverse) owner, you retain creative control over your assets and can monetize them in a number of ways. More on this later in the article.

Alternatively, you can sell your assets outright for the platform’s native token, MANA, or ETH if you prefer. You can therefore speculate on either the price of MANA increasing, or specific on-platform NFT’s appreciating versus MANA. You can find all kinds of different items either on Decentralands native market or on the popular Opensea.

Decentraland is a vibrant and multi-faceted platform that has fostered a strong community with features such as:

- Decentralized Autonomous Organisation (DAO) governance model, allowing the community to participate directly in the project’s oversight.

- A bespoke marketplace that allows users to list, search and transact LAND and other NFTs on-platform.

- Games, contests and social events are regularly organized to encourage greater engagement.

Decentraland is capitalizing on the growth of the Metaverse to secure high-profile partnerships with leading brands:

For example, Atari has announced that they intend to purchase a large LAND estate, to be used to house a facility where users can enjoy classic Atari games.

Other huge names that have entered Decentraland are Coca-Cola and Samsung.

Suggested reading: Decentraland vs Enjin

Decentraland Creates More Jobs – Securing Its Future:

One reason Decentraland has a future is the range of options for generating an online income it affords.

These are numerous, but the most notable options are summarised below:

- Product sales. Designers can curate selections of their work for sale as NFTs in the marketplace.

- Service provision. Developers can create and sell commissioned NFT templates and designs to other users.

- LAND leasing. LAND owners can lease the use of their assets for a fee.

- Flipping. LAND can be aggregated to create ‘parcels’ or ‘estates’ which can be flipped for profit. Similar to selling offline real estate, this can be highly profitable if you time the market correctly.

- Entry fees. If you build a particularly interesting asset (such as a park or a museum), you may be able to charge other users entry fees to explore it.

- Holding assets. There are 90,000 units of LAND, which in bull markets are rapidly growing in value.

As we have discussed their use cases and monetization above, I will focus on MANA (Decentralands native token) in the following sections.

Suggested reading: How To Buy a Parcel in Decentraland: (Step By Step)

MANA Tokenomics and Price History

Some quick facts about MANA (September 2022):

- Circulation supply: 1,813,400,000 MANA

- Max supply: 2,193,500,000 MANA

- Mana is deflationary; its supply decreases with every transaction due to a 2.5% burn voted in by the Decentraland DAO.

In terms of historical performance, MANA surged over 50,000% in the bull market of 2020 to 2022, and has crashed by almost 90% in the current bear market:

MANA’s price history and the wider NFT market have been highly correlated.

As the NFT space is new and still maturing, I expect MANA to remain correlated in the short term until investors develop the experience required to differentiate between projects of differing quality.

With Facebook’s switch over to Meta and their heavy investments in metaverse and VR development, I think that Decentraland will remain highly relevant in the coming cycle of the cryptocurrency market.

Is Decentralands MANA a Good Hold For The Future?

When considering whether Decentraland has a future, we need to place it in context versus its competitors and assess the prospects of its market.

As such, I will expand upon the following:

- Decentraland’s current market position

- Digital land as an investment class as well as Decentraland’s ability to grow market share

Current Market Positioning

Decentraland has a well-known brand and an appealing platform with a growing user base. Their ecosystem allows for a diverse and interactive experience and provides casual and professional users alike with opportunities to monetize their time in the Metaverse.

Furthermore, digital real estate is fast becoming a recognized asset class, and with its focus on land and property-related NFT’s, Decentraland is well-positioned to capitalize on this trend.

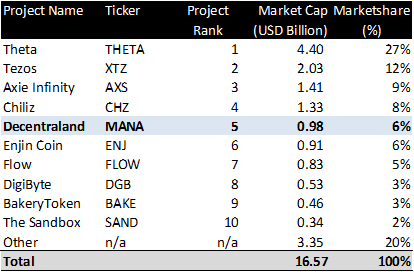

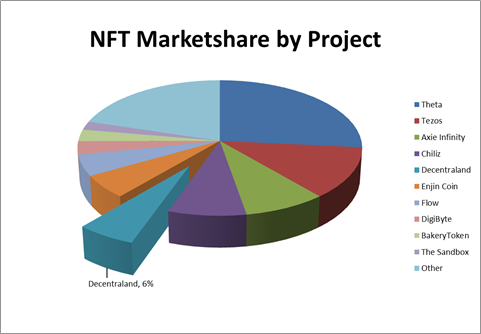

The aggregate value of NFT-focused projects is $16.57 billion at the time of writing (late 2021). Decentraland fares strongly in the competitive landscape, being the 5th largest project and capturing 6% of the total market share.

In other words:

Decentraland is well-positioned in the NFT sector, indicating that it has a bright future.

One of the competitors with a similar business model is The Sandbox. This is also an NFT-based metaverse with digital real estate and assets. If you’re researching Decentraland, you need to read this article: Decentraland vs The Sandbox: Comparison As Games & Investments

With an estimated active user base of 300,000 in January of 2022, Decentraland is more adopted and more developed than any other metaverse competitor. This further indicates that Decentraland has a central role to play in the future.

Decentraland’s Future Growth Prospects

Central to the question as to whether Decentraland has a future is the potential for digital real estate to become a legitimate asset class.

Exacerbated by Covid-led lockdowns, people are spending an increasing amount of time online, driving value to the platforms on which they interact.

This trend is picking up steam, with firms like Republic Realm currently raising capital for investment into digital land and property.

Along with Cryptovoxels and Somnium Space, Decentraland is an early mover in this space and can expect to capture a significant portion of any digital land market growth.

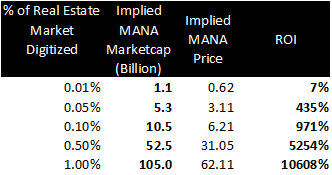

A highly conservative estimation of the global real estate market cap is $10.5 trillion. See below for the impact on MANA price assuming digital real estate grows to a range of %’s of offline real estate and that Decentraland maintains its current market share.

While this is a simplified and hypothetical exercise, the upside for Decentraland is clearly significant should the real estate market become increasingly digitized.

Suggested reading: Can Decentraland (MANA) Reach $100?

Conclusion: Yes, Decentraland Has a Future

For the following reasons, Decentraland has an exciting future:

- It is a major player in the growing digital real estate space.

- It is a diverse platform that appeals to a wide range of user profiles.

- The breadth of virtual world experiences allows developers to capitalize on any emerging trends in the NFT space.

- A strong community and DAO governance model allows the project to keep abreast of change.

While the analysis suggests a favorable outlook for the MANA token, please exercise caution. The valuation of NFT projects is correlated to those of Bitcoin and the wider crypto space. Should these markets proceed in a bearish trend, it is likely MANA will also decline in the short term.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to significantly increase your ROI.

This is not the case in crypto markets.

There ARE ways you can significantly increase ROI.

Grab this free guide with 4 easy ways to do it: