Many people want to travel the world or have some travel goals, but very few people actually manage to save enough to fulfill their goals. On the other hand, some people actually manage to travel the world without saving for years. So, should you first save money or skip the wait and travel worldwide?

While savings always comes first, you don’t have to postpone your travel goals either. When saving for travel, you should put traveling as your major goal and cut down on luxuries, reduce unnecessary expenses and create a realistic budget that’s adjusted for your travel goals.

Of course, your income will affect how often you travel or where you can travel but having a modest income shouldn’t hold you back from fulfilling your travel goals. In this article, I’ll outline how to save for travel without compromising your lifestyle in a major way.

How To Save Money for Travel

Before saving money for travel, you’ll have to change how you view savings. If you want to travel soon, you’ll have to bring more drastic changes in your lifestyle. This doesn’t mean that you have to start living like a tramp! In fact, saving for short and medium-term goals is easier than you may think.

Here are some realistic ways to save money for travel:

Start With the Biggest Expense

Before you can start saving money, you’ll have to know exactly where your earnings go. By accounting for each penny, you’ll have a more realistic picture of what you can cut down on. You’ve probably heard the advice that you should always start with your most difficult task whenever you’re working. The same logic applies to making a savings plan.

Make a list of all your monthly expenses. Include everything from how much you spend eating out to every small snack. You don’t have to be exact with many of the smaller expenses, but you should have a mostly accurate estimate.

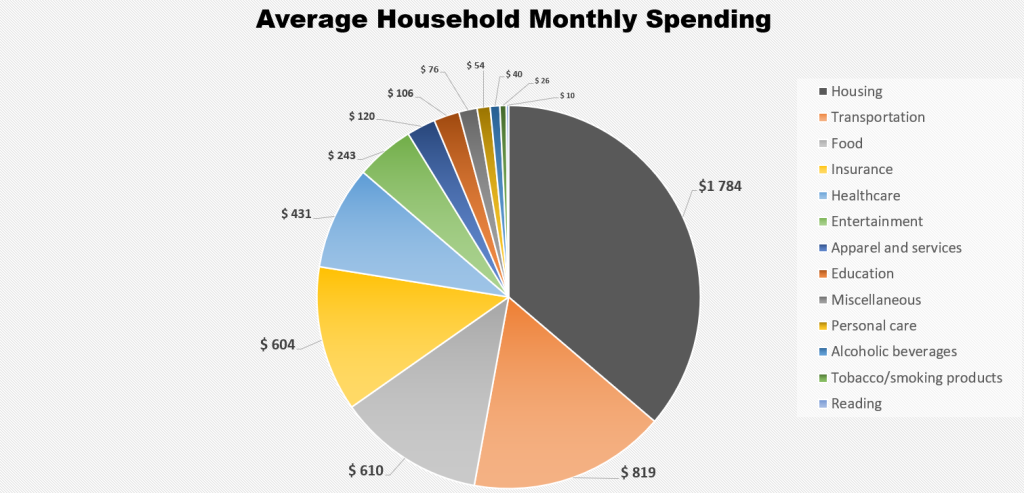

To give you an idea of what “average people” spend their money on, check out this chart I made using data from U.S. BUREAU OF LABOR STATISTICS:

Now, list the top 3-5 expenses that take up most of your money. It could be payments on a home or student loan, utility bills, or your commute expense. Now, start brainstorming alternatives to these expenses.

If your home loan or commute expenses are more, consider shifting to a cheaper place closer to work. While this may seem like a drastic step, it’s actually going to save you more than many other budgeting options combined.

You can cut down on restaurant meals all you want, but your total monthly bill spent on these meals won’t even be a fraction of your home loan payments. As with everything else in life, you’ll have to ask yourself whether sacrificing a spacious home is worth a yearly international trip. If you live for experiences, this is an easy choice to make.

Of course, you often won’t be able to cut down your biggest expense. There’s no substitute for student loan payments, and you can’t compromise on things like school fees, health expenses, or retirement savings. If these are your biggest expenses, skip them and move to the next one.

If you’re looking for the best ways to save more money, you should read this article: The 4 Steps To Save A Lot Of Money Fast

Why You Shouldn’t Offset Retirement Savings for Travel

Most people think that they have to dig into their regular savings for travel, but this is risky. Savings for retirement, a child’s college fund, or other essentials are uncompromisable expenses. Your savings plan should only cut down on non-essential expenses, so you don’t feel regret later on in life.

In the end, it comes down to your mindset. Avoid the “either-or” mindset and realize that you can live a normal life and travel extensively so long as you stick to a manageable budget.

Save on Utility Bills

For most people, utility bills are large expenses. However, this is something that you have full control over. By implementing energy and water-saving habits, you can easily cut your utility expenses by 50% or more.

But where do you start?

Like when planning any savings strategy, always look at what uses the most energy in your home. In most cases, home heating and cooling costs will make up most of your utility bills. If you live in an area with extreme summer or winter temperatures, cutting down on heating or cooling costs can be challenging, but it’s not impossible.

Some effective ways to cut down on home heating and cooling costs include:

Invest in Better Insulation Systems

This may include changing the roof insulation, replacing your house’s windows with better double-glazed ones, and other methods to improve your house’s natural insulation. While this will cost more than other methods initially, you’ll save more on energy bills in the long run.

Invest in Smart Technology

Smart appliances, lights, and other technology can help you drastically reduce your energy bills. Smart lights come with timers and sensors that help you reduce electricity wastage. Smart appliances are also more energy efficient and come with significant energy savings.

Invest in an Energy-Friendly Home Design

Changing your home design doesn’t have to include rebuilding your house! Small changes like installing heavy curtains and carpets in the winter, using sunroofs to allow more natural light in rooms, or planting trees and shrubs around your house can significantly improve its natural cooling and heating systems.

There are countless other ways of saving on your energy bills, but you’ll need to make these habits permanent if you want to save money in the long run. Considering that switching from incandescent to LED lights can save you around $200 a year – that’s around 2-4 days of expenses if you’re traveling in a South Asian country!

Cut Down on Expensive Commuting

Once you’ve got the major expenses out of the way, you can focus on other seemingly necessary but still significant expenses. Commute expenses fall in this category, and you’ll be surprised at how much you can save by switching to different forms of commute.

Always have public transport as your priority method of transport if it’s feasible. Apart from cost savings, public transport gives you more free time to read a good book, listen to a podcast or do activities you can’t do while driving.

If you’re using a car that’s a fuel guzzler, try to go for a more efficient hybrid option instead. A recent study showed that you could save $154-$435 monthly by using ride-sharing and public transport. In a few months, you’ll have enough for a yearly trip!

Reduce Subscription Expenses

In an age where subscription services drain money from your bank account without you giving them much thought, cutting down on unnecessary subscriptions can give you significant savings. The worst thing about subscription services is that they are paid for automatically, which is why you won’t think twice after paying for the initial subscription.

But how do you choose which subscriptions are necessary and which you can live without?

It’s quite easy, actually. Simply make a list of all your current subscriptions that cost money. Group these subscriptions into similar categories and eliminate ones that already have an alternative.

For example, if you have 2-3 streaming subscriptions, you can eliminate 1-2 of them without compromising your lifestyle.

Save on Food Expenses

Saving on food doesn’t mean you have to start rationing, but you’ll have to cut down on meals at fancy restaurants or junk food in general. While you can still treat yourself to an occasional fancy meal, you’ll have to cut down on the number of times you eat at such restaurants.

The average American household spends around $600 a month on food. Of this, they spend $198 on dining and takeaways. Simply cutting down your dining expenses in half could save you up to $1200 a year!

Saving for traveling suddenly seems much easier, doesn’t it?

Monitor Your Shopping Habits

I’ve kept the most important savings method for last. Even if you’re not a fan of expensive branded clothes, shoes, or watches, you probably spend a significant amount on unnecessary items “in the moment.” And many people reject these purchases later on.

One way to cut down on unwanted purchases is to make a list before you go shopping. This applies to both online and physical shopping. Making a list allows you to shop according to your needs and budget. If you want to buy a luxury item, make sure you add it to your list before buying it.

This way, you’ll think twice before buying items you don’t need or don’t have the budget for. You’ll also end up with more cash in your travel savings account!

Final Thoughts

Traveling around the world may be one of your life goals, but you’ll need a savings plan to make these goals a reality. Remember, if you view saving as an action, you’ll save for a while and then soon revert to old spending habits.

However, if you view savings as a habit and make it part of your lifestyle, you’ll have enough to meet your travel goals sooner than you realize.