(Updated 18. September 2022)

In this article, I will explain how high Cardanos transaction fees are, and how they are calculated. I’ll also give you some context about how the fees might change in the future.

Here’s the short answer:

The minimum transaction fee on Cardano is 0.16 ADA, which is $0.074. On top of that, you pay to get your transaction “prioritized” by validators. This fee depends on the network traffic. On average, a transaction on the Cardano network costs $0.2-$0.4.

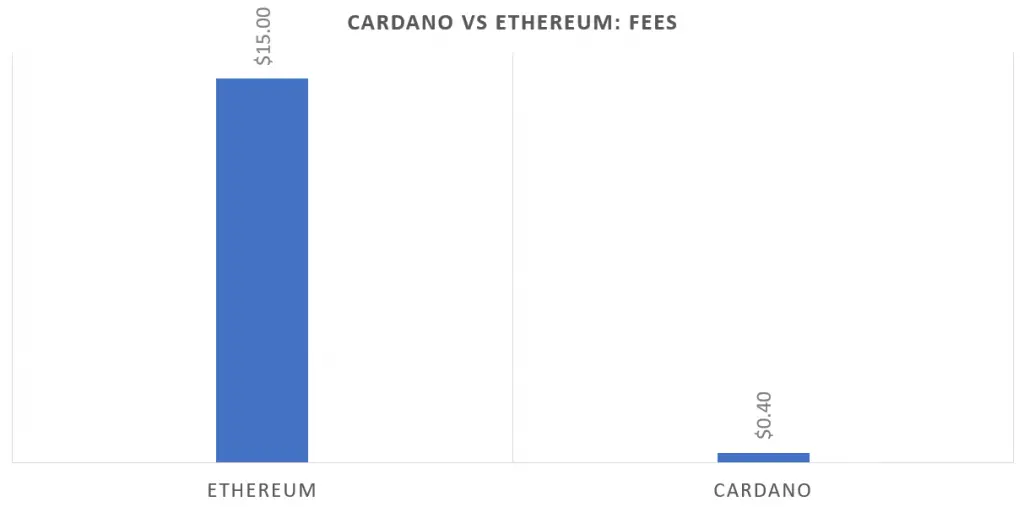

Compared to Ethereum, Cardano has 37.5-70 times lower fees. The table below illustrates this (together with some other blockchains as well):

| Blockchain | Transaction Fees |

| Cardano | 0.2 – 0.4 USD |

| Ethereum | 7 – 15 USD |

| Solana | 0.00025 USD |

| Bitcoin | 3 – 5 USD |

Below you see a chart showing the huge difference in fees between Cardano and its rival Ethereum in terms of transaction fees:

You can learn more about the inflation/deflation of ADA and the economics of Cardano in this article.

PS:

Join the free newsletter of Solberg Invest, where you get technical analyses on Bitcoin, Ethereum, Cardano, and others. Also, you’ll get some free guides and reviews. Sign up for free below:

How are Cardano transaction fees calculated?

Cardano transaction fees are actually quite simple to calculate. We just need to apply the following formula:

a + b * Tx

‘a’ is a fixed ADA amount, currently set at 0.155381 ADA

‘b’ is a fixed fee per byte of data, currently set at 0.000043946 ADA/Byte

‘tx’ is the size of the transaction as measured in Bytes

Perhaps your maths is a bit rusty and you aren’t sure what this all means. Don’t worry; let’s run through an example to demonstrate:

Let’s say we are trying to process a transaction of 210 Bytes (this is an average transaction size). As we know the other two constants, we simply need to fit this into the formula as follows:

a + b * tx

= 0.155381 ADA + 0.000043946 ADA/Byte * 210 Bytes

= 0.1646 ADA

So a transaction of 210 Bytes would cost 0.1646 ADA to process. Note that the above formula only calculates the minimum fee. Users can willingly pay higher fees if they wish to. They may do this to increase transaction speeds and reduce the chance of failed or delayed transactions.

Where do the Cardano fees go?

Cardano charges transaction fees in order to cover the cost of processing and storing the transaction. Fees also disincentivize Denial-of-Service (DDoS) attacks and improve network security. But where do the Cardano fees go and what happens after a transaction is processed? Before answering these questions, we need to explore a few technical details regarding how the Cardano chain works:

The Cardano network breaks up time into units known as slots. These slots equate to one second each. Every grouping of 432,000 slots (ie, 5 days) is known as an epoch. In any given slot, one node is randomly elected as slot leader from the existing staking pools by the proof of stake algorithm. These slot leaders perform an important role by ensuring that any transactions posted in their slot have included sufficient fees and that all transaction parameters are entered correctly. The slot leader validates the transaction and includes it in the next block in the chain.

Throughout each epoch, the aggregate fees are collected and stored in a ‘virtual pool’. At the end of the epoch, these fees are distributed to all stakers who were elected slot leaders during that epoch. As such, we can essentially summarize that Cardano fees are paid out as rewards for randomly selected slot leaders to underpin the proof-of-stake consensus mechanism.

Will Cardano fees change in the future?

Yes, it is probable that the fees will change in the future. Referring back to the fee calculation formula, you can see that constants a and b are predetermined. The network allows these to be changed in the future, and doing so will result in a new transaction fee for a transaction of a specified size.

Cardano’s developers have publically stated the below as factors they considered when determining the current values for a and b:

- Expense of a single compute Byte

- Average transaction per second

- Average transaction size

- Cost of running a full node

The answers to these questions are sure to change over time. For example, Moore’s Law suggests that computing power should double roughly every two years. This should result in cheaper memory, more transactions per second and lower node costs etc.

The beauty of the Cardano fee calculation is it is highly flexible and can respond to changing market conditions in the future.

All fees are denominated in ADA. Therefore as ADA price increases, so do transaction fees in USD terms. It is a similar dynamic that is partially to blame for Ethereum’s extremely expensive fees.

However, the flexible nature of the Cardano fees means that as ADA price increases, costs per transaction can theoretically be steadied by reducing constants a and b.

Conclusion

Cardano fees are currently extremely cheap when compared to Ethereum. The fee structure is compelling in that it secures the network, rewards stakers, and it is highly flexible and adaptable to changing conditions. For these reasons, Cardano’s fee structure is a good reason to research the network further and consider using it for its myriad potential future use-cases.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is NOT the case in crypto markets.

There ARE ways you can significantly increase ROI. I’ve created a free guide on 4 easy ways to do it.

I do all four of them myself and know for a fact that they can increase ROI by hundreds of percent.