(Updated 17. September 2022)

ADA, the native cryptocurrency of the Cardano blockchain, is an exciting crypto with a strong following. In this article, I’ll look into the economics of this token and figure out if Cardano is deflationary or not.

Here’s the short answer:

Cardano is not deflationary, but it will be in 2030 and beyond. At the moment, the inflation rate is 4.72%. However, the inflation rate decreases exponentially over time and will be 0.9% in 2030. Assuming 1% of the supply is lost yearly due to human error, Cardano will be deflationary in 2030 and beyond.

Let us get deeper into the economics of ADA and figure out how the supply will change in the future.

The Circulating and Max Supply Of ADA:

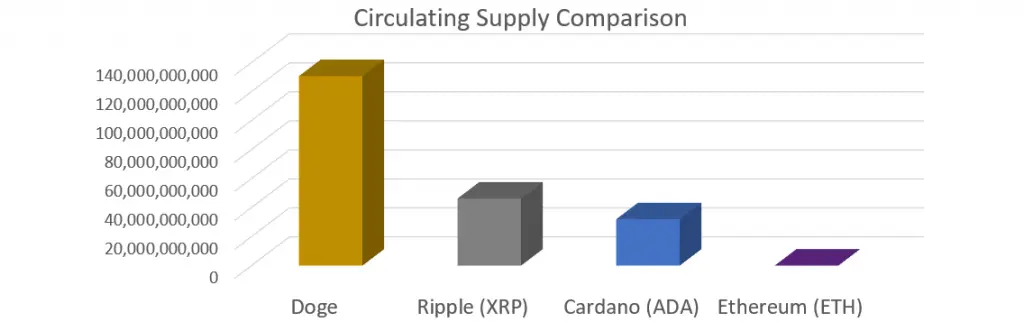

First of all, Cardano has a circulating supply of 33.8 Billion ADA and a max supply of 45 Billion. That’s approximately 2000x the supply of Bitcoin, and the main reason behind the “low price” of ADA compared to other coins like Bitcoin and Ethereum.

To illustrate, I made this chart showing the difference in supply between a few coins:

Notice how the coins with high supply are priced low. For example, Doge, XRP, and ADA are priced relatively low, while ETH is priced in the thousands of dollars.

This is why Cardano will never reach $1000: Price per token = Market Capitalization / Circulating Supply.

From this equation, we see that a high supply leads to a low price. Also, if the supply increases, the price decreases. This is why inflation/deflation matters.

About 75% of the coins are in circulation, while the rest is waiting to be released.

The way the remaining 25% of the supply is released will decide the inflation/deflation mechanics of Cardano and affect the price of ADA.

Let’s get into the details, and try to figure out how the inflation/deflation will change over time:

PS:

I have a free newsletter where I send out technical analyses on Bitcoin, Ethereum, Cardano, Solana, and more. Also, I’ll give you helpful guides and reviews.

The 2 Types of Inflation for Cardano (ADA):

In this section, we will do some good ol’ math to estimate the true inflation rate of ADA.

For simplicity, I’ll define “inflation rate” like this:

“Number of coins taken from the locked supply into the circulating supply (including treasury), as a percentage of the number of coins already in the circulating supply, per year.”

It’s also helpful to distinguish between absolute and relative inflation:

Absolute inflation is the number of coins added to the circulating supply every year.

Relative inflation is the percentage these new coins make out of the total circulating supply.

Basically, we’re trying to figure out the number of coins taken from the reserves per year and calculate the ratio between that number and the circulating supply.

The Long Term Inflation/Deflation Of Cardano (ADA):

The absolute inflation of Cardano depends on 2 things:

- The percentage of the circulating supply that is currently staked.

- The number of coins in the reserve. The reserve is just the ADA not currently in circulation (Max supply – circulating supply).

Here are the rules governing the inflation rate, simplified a bit of course:

- At any time, no more than 0.3% of the reserve ADA will be released every Epoch (5 days)

- The released ADA equals 0.3% multiplied by the percentage of the circulating supply of ADA being staked.

About 71% of the circulating ADA is currently being staked (source), and the reserve holds about 11.2 Billion ADA (source).

This gives us everything we need to calculate the absolute inflation rate:

0.3% * 0.71 * 11.2 Billion ADA = 23 856 000 ADA Every Epoch (5 days)

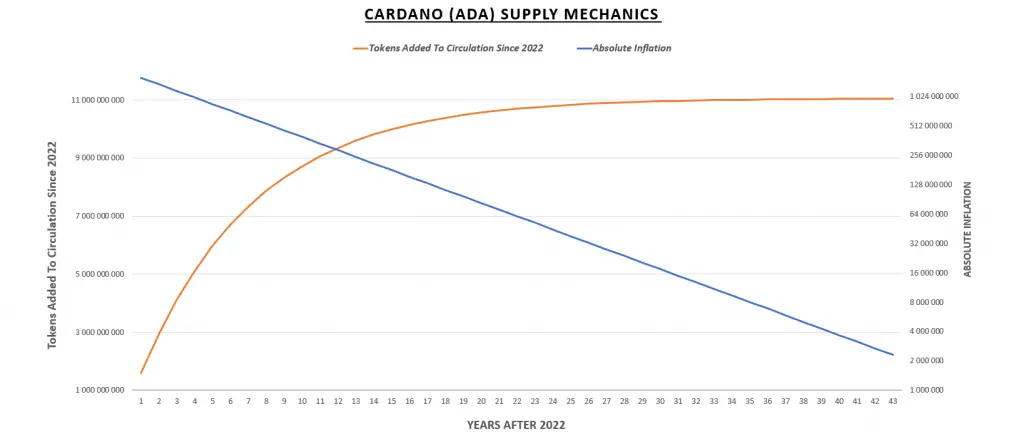

After messing around with the numbers in Excel, I made a chart showing the absolute inflation together with the total number of ADA added to the circulating supply x years after 2022:

Observations based on the chart above:

- Given the rules above, the reserve will never be empty, and there will technically always be some inflation. However, the absolute inflation converges to zero at an exponential rate (slower and slower).

- It is likely that at some point in the future people will lose more ADA in faulty transactions, forgetting private keys, etc., than the absolute inflation is adding ADA to the supply, effectively making Cardano deflationary.

- The long-term value of ADA will probably be more stable after the high inflation in the first decade. Likely, it will increase in value over time as it becomes more scarce/hard to make/earn.

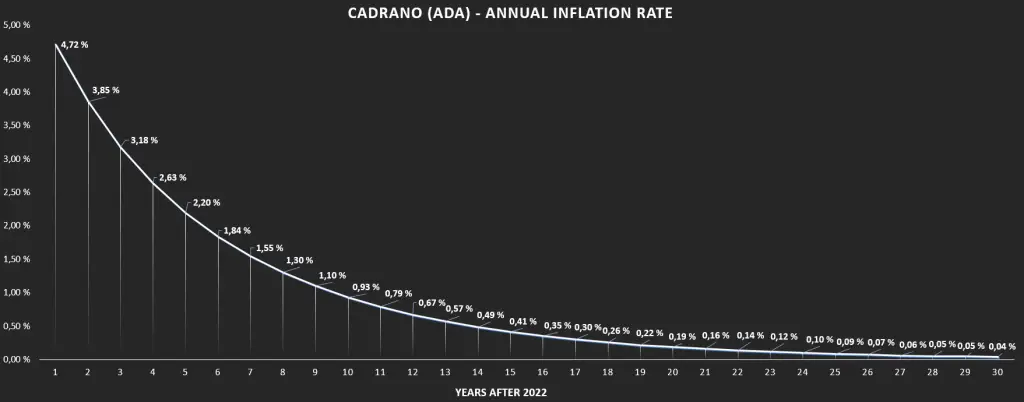

To get the inflation in relative terms, i.e., as a percent of the circulating supply, I’ve made this chart showing how it evolves for the next 30 years:

It starts at 4.72% in 2023. After five years it’s 2.2%. After a decade, it’s 0.93%. After 30 years, the inflation is 0.04%.

The inflation rate of Cardano converges to zero. It decreases exponentially, but will never actually hit zero.

This looks like the inflation rate of Bitcoin, which is also decreasing exponentially. The inflation rate is more choppy in Bitcoins case, due to the halvings every four years, but it’s built on the same principle.

This is a key quality of “hard money”, and I really like the planned inflation for the ADA.

Read more about how the halving of Bitcoin affects the price of Bitcoin here to learn how important inflation actually is.

Suggested reading: Why is Algorand so cheap?

Conclusion: No, Cardano Is Not Deflationary, But It Will Be

There’s currently an inflation rate of 4.72% per year, but it’s decreasing exponentially. It is reasonable to assume that 1% of the supply is lost annually due to human error, which gives us deflation after 10 years.

In other words:

Cardano is not deflationary yet. At the moment, the supply inflates at a rate of 4.72 percent per year. However, the inflation rate decreases exponentially over time and will be less than 1% per year in 10 years. Assuming 1% of the supply is lost yearly due to human error, Cardano will be deflationary in 2030 and beyond.

Read this article to learn more about the fees of Cardano and how they fluctuate.

Do You Invest In Crypto?

When investing in traditional markets like stocks and bonds, there’s not too much you can do to increase your ROI significantly.

This is not the case in crypto markets.

There ARE ways you can significantly increase ROI.

Grab this free guide with 4 easy ways to do it: